Understanding Cash Settlement in CFD Trading

Have you ever wondered how some investors derive profit from trading CFDs and derivatives without possession of the underlying asset? The answer lies in the fundamental nature of cash settlement.

Cash settlement is, as the name implies, a settlement of cash and not a physical delivery of the underlying asset. So when the underlying asset is traded cash settlement allows you to trade without regard for handling, storing, and managing the physical asset.

Consider this example: If you are trading a CAD gold CFD and you make a profit, you will not receive actual gold bars delivered to your front door. Rather, it goes into your trading account's cash balance for your profit. And whether you trade for a living or you are just a beginner on a simulated account, you will get 10 cash equivalent with a CAD gold CFD.

It is clear how easy cash settlement is versus dealing with physical delivery. A traditional transaction of a commodity involved finding a warehouse to store, transporting (which needed to be insured) to and, dealing with the quality of the physical asset. Cash settlement eliminates those complicated efficiencies and creates accessible and efficient markets for all.

As a beginner, if hypothetically, for the sake of educational training, you buy one share of Apple stock CFD at $150 and sell it at $160, your platform banking clears your account with the $10 not any individual stock certificate or see a paper trail, just cash entry.

This mechanism is not just convenient, it's the foundation of modern CFD and derivatives trading, facilitating the highly liquid, fast-paced markets we have come to enjoy.

What Cash Settlement Actually Is

Cash settlement refers to the final exchange of funds based on the difference between the price you opened and closed your trade for, without a physical asset ever changing hands. This is a standard practice for CFD trades referencing stocks, indices, commodities, etc.

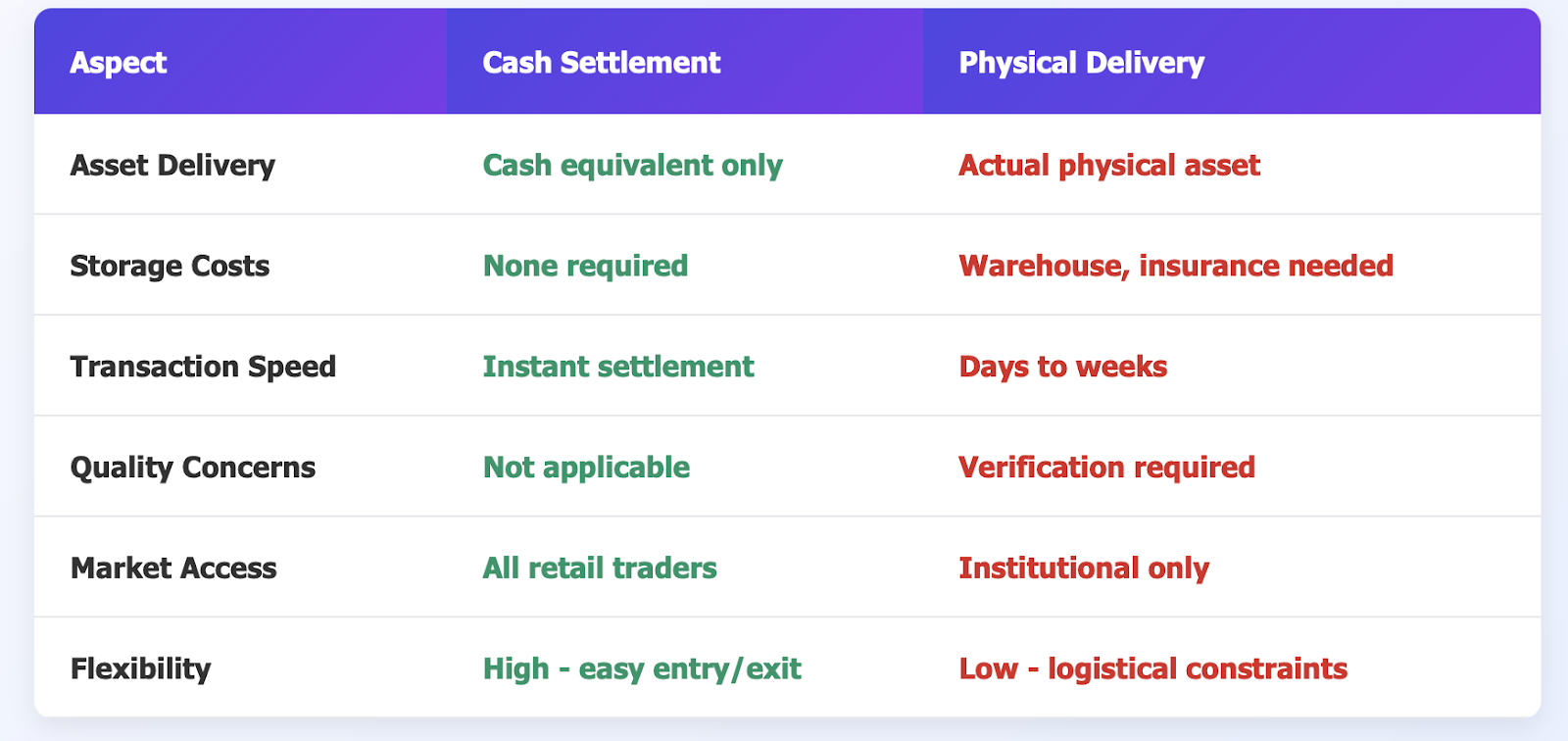

To contrast the difference with physical delivery is obvious; with physical delivery, the trader actually receives (or must provide) the underlying asset, such as receiving or providing 1,000 barrels of oil or 100 ounces of gold. Cash settlements completely eliminate the need for the physical asset, and focus purely on the profit or loss incurred from price fluctuations.

The benefits are significant; trading expenses collapse, because we do not need to buy storage, transport the physical commodity, or verify quality. You now have tremendous flexibility moving in and out of positions, without the logistics issues that come with holding a physical asset, and the associated issues.

Think about an example from a professional trader. A trader shorts an S&P 500 CFD expecting the S&P 500 to go down. The S&P 500 goes down, and they close their position for a profit of $500. The trader never received or provided any of the 500 underlying stocks.

For novice investors, the method is even more seamless. A student on a demo platform simply buys a Bitcoin CFD. When the price of Bitcoin increases, the platform automatically calculates and credits the cash difference to their account in their base currency.

This is how cash settlement leads to efficient price discovery and market access without the traditional constraints that limited markets to institutions with extensive infrastructure.

How Cash Settlement Has Evolved

Financial markets didn't always function in this way. Early futures markets operated mainly on a physical delivery model - traders that bought wheat futures actually expected trucks full of grain.

Cash settlement evolved as these markets became more sophisticated, and market participants recognized that they wanted price exposure without the hassle of handling actual physical assets. Cash settlement began in earnest when stock index futures became popular: delivering hundreds of individual stocks to settle would be a mess.

The move to electronic trading platforms led to increased automation, and with automated systems and algorithmic trading making cash settlement desirable, it became a strictly necessary requirement for any semblance

of a fast-paced, large-volume market.

Currently, cash settlement provides a way of doing business in all asset classes. It started with stock index futures, evolved to commodity futures, and eventually made its way to retail traders through the adoption of CFDs.

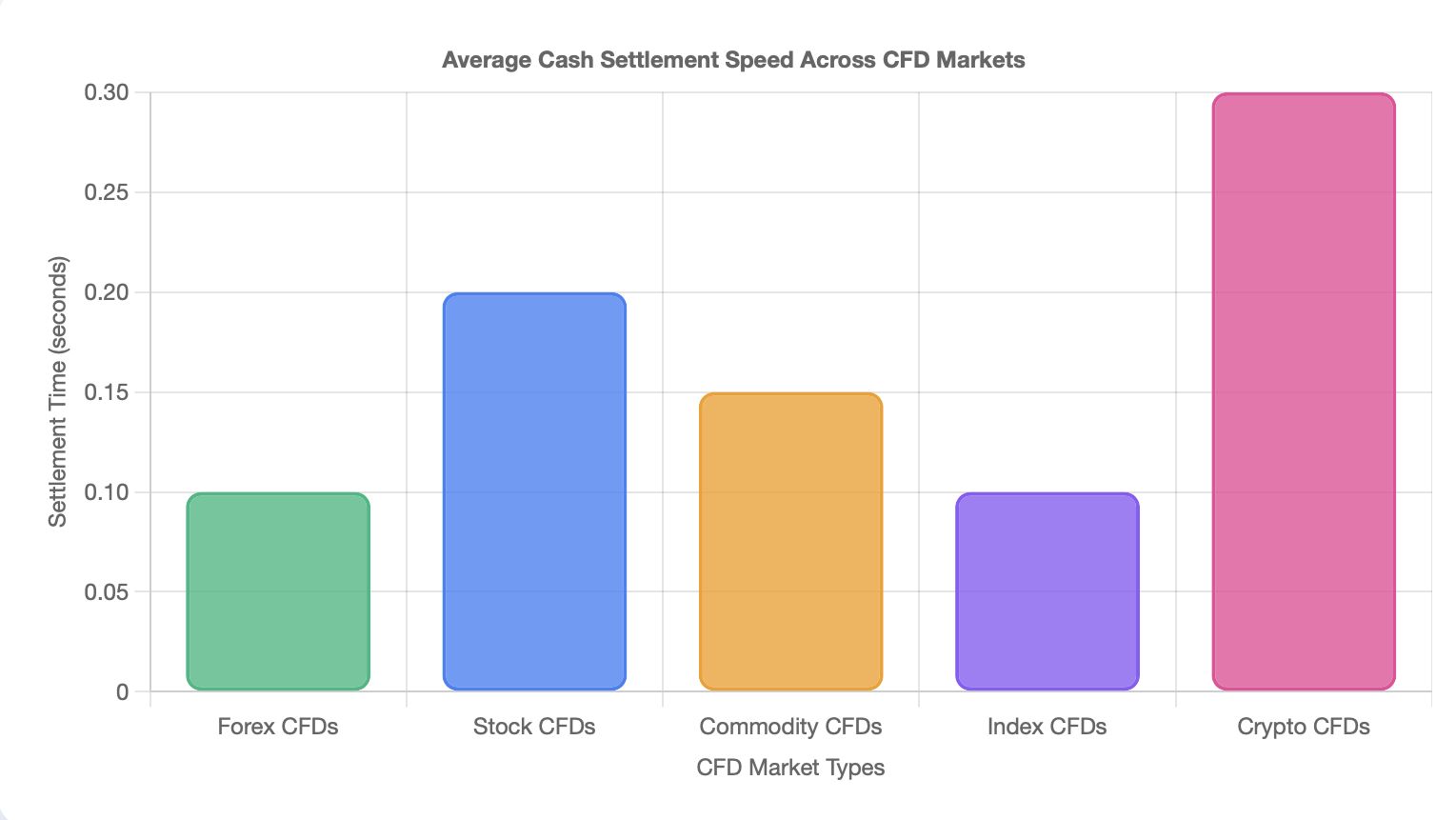

The advancement of technology has been critical and supports efficient processes. Real-time price feeds, instant settlement systems, and automated clearing, have made cash settlement system efficient, reliable, and, ultimately, transparent. What demanded armies of clerks and the necessary infrastructure only years ago now happens in milliseconds through a digital framing.

The S&P 500 futures contract, which was introduced with cash settlement in 1982, proved that a market could operate in a fully efficient manner without a physical product. In another example, gold futures also embraced cash settlement by realizing that almost all the traders simply wanted cash rather than the burden of holding physical precious metals.

This historical arc of the cash settlement is not indicative of some new and novel financial engineering, rather it is none other proven and trailing approach to "settlement" that emerged out of acknowledged market-merits.

How Cash Settlement Actually Works

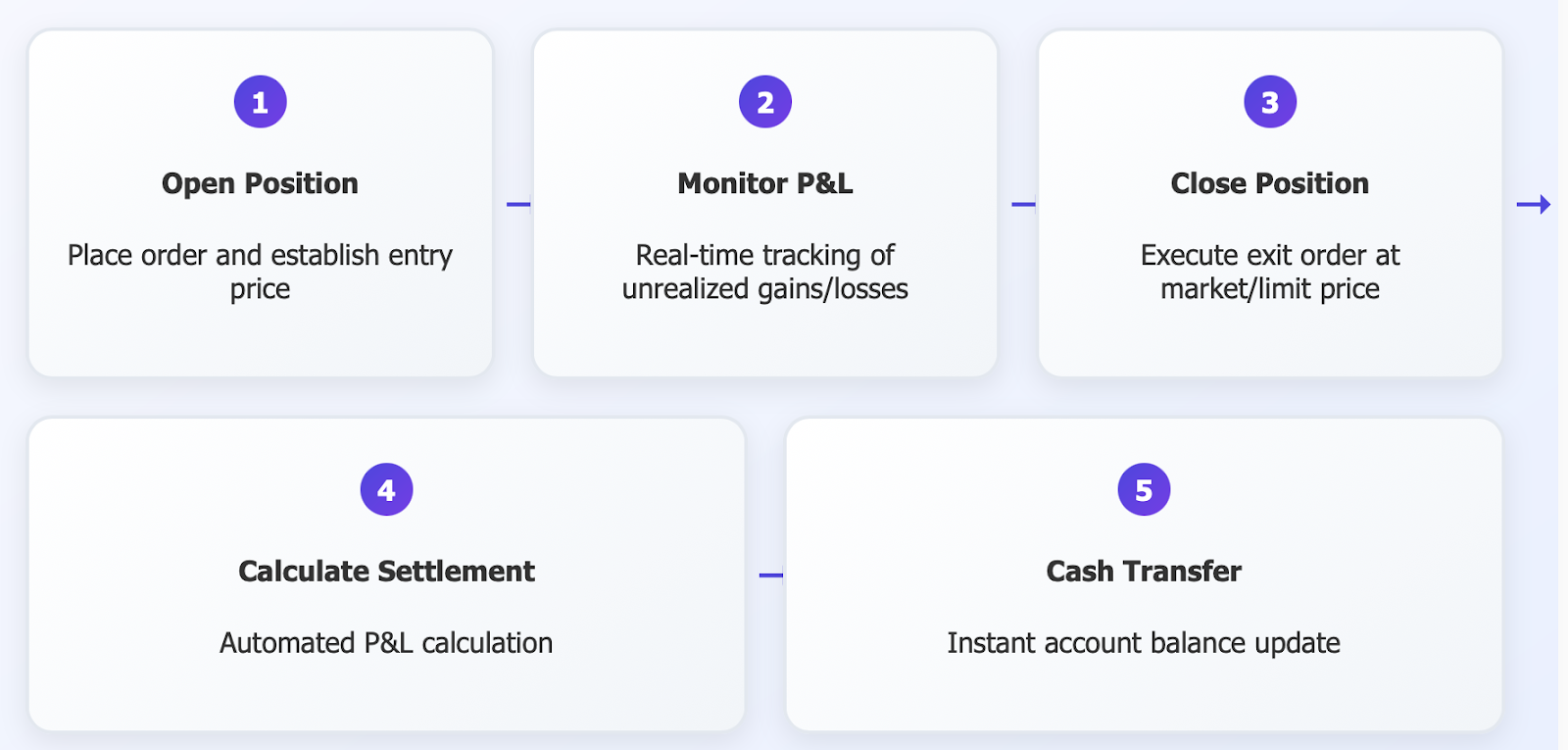

Cash settlement in the context of a CFD trading process follows a basic sequence in a largely unseen progression.

To begin, you are placing an order and are opening a position. Your broker records your price and "position-size". As the markets move, so too does your unrealized profit or loss - which is updated in real-time. When the position closes or expires, you trigger the price to cash settlement calculation.

The computations are straightforward: (Settlement Price - Entry Price) × Contract Size = Your Cash Result.

If you're long and the price goes up, you have cash in your account; if you're short and the price goes down, you have cash in your account. If you're on the wrong side of the move, cash leaves your account.

Let's work through a specific example. An investor purchases a CFD on oil at $70 per barrel, anticipating rising energy prices. If the oil goes up to $75, and he subsequently closes his position, his cash result is computed as follows: ($75 - $70) × contract size = $5 cash profit for each unit.

For newcomers, this process is the same but typically uses smaller amounts. For instance, a student buys a CFD on Apple stock at $150 and subsequently sells at $160. The trading platform automatically calculates the difference of $10 and has cash added to their account, and they did not need to add it together.

Modern trading platforms allow users to avoid all of this complexity automatically. Margin calculations, overnight fees, currency conversions, and final settlement happen without any manual action required. The only thing the user needs to do is to glance at their account to determine what their results were without having to sort through endless technicalities.

Typically, the settlement is instantaneous upon the closing of a position during market hours. If a position is carried through to expiration, settlement will occur at a specified time as measured against the official closing price.

This automation and transparency create one of the most significant benefits of CFD trading via cash settlement: you always know where you are financially.

Benefits and risks you must understand

Cash settlement has benefits but also comes with risks, something that smart traders appreciate and manage.

The benefits are immense. You do not have to deal with physical asset costs: storage, insurance, transportation, or quality issues. Liquidity increases significantly as cash settlement is always faster than arranging for physical delivery. The whole trading process becomes streamlined, and you can concentrate on market analysis rather than logistics.

Cash settlement enables strategies that with physical delivery are not - you can easily short-sell an asset, trade fractional positions, and you can jump from market to market quickly. High-frequency trading, and algorithmic strategies, are reliant entirely on cash settlement as an efficient process.

The risks are equally important to understand. Whenever there is market volatility, cash settlement immediately translates into realized gains or losses in your account. You cannot wait out volatility, nor will you have some grace period, as you would if you sold a physical asset.

The impact of leverage greatly magnifies these effects. A relatively small price move in a leveraged CFD position can provide large cash impact, whether positive or negative. Experienced professional traders understand this and position themselves accordingly.

Let’s think through this situation: an investor has a leveraged position on the EUR/USD CFD. Currency markets move quickly, and because they are cash settled, each movement from one pip to another in their platform will move their account balance up or down, instantly.

This allows the investor to accumulate large profits from a relatively small price change, but also large losses, quickly, when a trade moves against them.

For new traders, the effect is pronounced even in small positions. A student who is trading a Bitcoin CFD on a demo platform sees their cash balance change with every price tick. While the amounts may not be very large, the point about market risk is still very real; their cash balance goes up and down, rapidly.

To clarify, cash settlement does not create risk, it just creates immediacy and transparency in the existing risk.

Examples in the Real World in Action

There is nothing like a real-world example or examples to help understand the nuances of the concepts and the calculations.

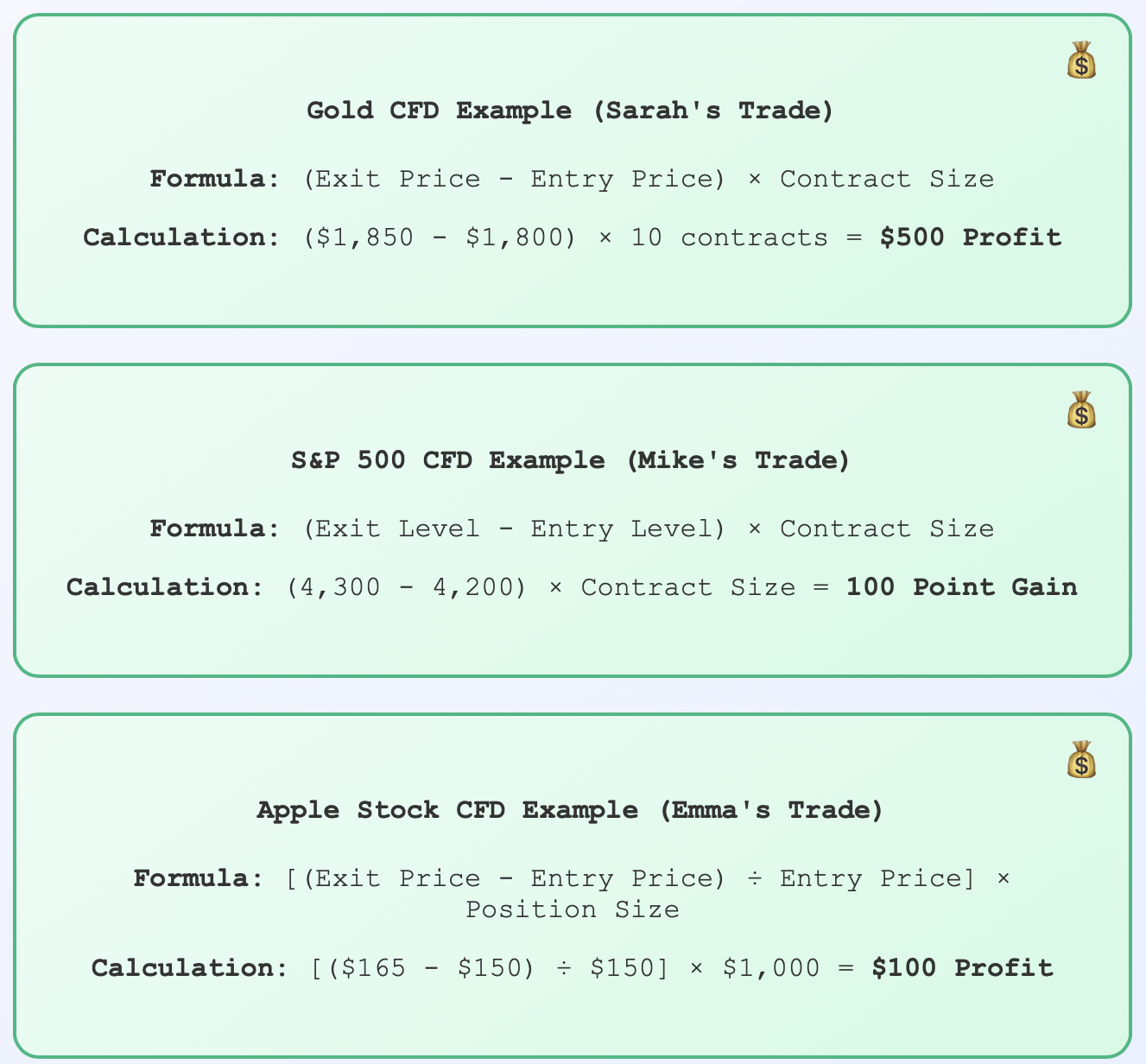

Case 1: Gold CFD Trading Sarah, a seasoned trader, is going long on gold CFDs priced at $1,800 per ounce in an amount of 10 contracts. Due to economic turmoil, gold rises to $1,850. When she closes her position, her cash settlement is: ($1,850 - $1,800) × 10 contracts = $500 profit, which is automatically deposited into her account. No gold bullion delivered, no storage fees incurred – simply cash accounting.

Case 2: S&P 500 Index CFD Mike wants to gain exposure to U.S. stocks but does not want to buy individual shares. He buys S&P 500 CFDs when the index is at 4,200, and over the subsequent weeks, the market rallies to 4,300. His cash settlement is: (4,300 - 4,200) × contract size = profit on a 100-point increase, completely paid entirely in cash. He gained broad exposure to the market but never owned hundreds of individual stocks.

Case 3: Beginner's First Trade Emma, using a practice account, buys $1,000 worth of Apple CFDs when the stock is at $150. Apple reported better-than-expected earnings, and the stock rose to $165. Therefore, the gain on her position is: ($165 - $150)/$150 × $1,000 = $100. The practice account deposited the cash difference into her account – a real-world lesson in how the markets work.

Each of these examples illustrates how cash settlement reduces operational issues while still keeping full exposure to price changes. The math is transparent, the outcome is immediate, and every trade feels the same whether you’re trading for thousands or millions.

The simplicity is beautiful. Cash settlement fully demystifies the process, regardless of the underlying asset, whether precious metals, stock indices or individual.

Making Cash Settlement Work for You

Cash settlement has revolutionized CFD trading to provide a low friction method to participate in global markets. It offers the accuracy of financial markets with banking casualness.

The benefits are elementary: lower costs, more liquidity, straightforward processes, and instantaneous transparency. Cash settlement offers full market exposure without the friction of physical asset operation.

Intelligent traders see the benefits and liabilities of cash settlement. Cash settlement means cash profits or losses are instant and real with capital risk of non-delivery of physical assets during cash settlements. Cash settlements remove hiding behind physical assets or with deferred delivery timelines.

Risk management is necessary because cash happens in real-time. Position sizing, stop-losses, and diversification are not simply smart guides, they are necessary for the immediacy of risk in cash settlement.

The process works the same way for beginners trading on a demo platform and professionals trading multi-million dollar accounts. The principles don’t change: understand your exposure, manage your risk, and leave the operational details of settlement to cash.

Whether you're interested in commodities, currencies, indices or individual shares, cash settlement provides a standardized and cost-effective way to participate in these markets. Cash settlement is not just a perk of trading in modern times - it is what makes trading in modern times possible!

Are you ready to experience the advantages of cash settlement in CFD trading? BTCDana offers a full solution for you to explore the relevant markets with clear, efficient and automatic settlement processes. Join the thousands of traders that have reveled in the advantages of efficient cash settled trading as a feature of their documentary.