Introduction

Have you ever wondered why some traders manage to make money even when the markets are in free fall, while others watch their account equity disappear? Market cycle direction is the key to understanding why.

In trading, the bearish market cycle means that prices fall over time. A bear market is the opposite of a bull market, which is defined by prices going higher. When prices are falling, the market is almost always dominated by pessimism, and selling pressure overwhelms buying enthusiasm.

Let's say Bitcoin fell from a price of $35,000 to a price of $28,000 over a few weeks. That would be a textbook example of a bear market trend. But savvy CFD traders can profit from this price action by shorting it when it begins to fall. To put this into a context you can understand, imagine you are watching the price of your favourite video game online marketplace item fall from $100 to $80. The downward movement embodies the same concept.

Bearish market understanding is not just an academic exercise; it is one of the most important lessons for anyone who is serious about CFD trading, Forex Trading or trading any type of financial market. When you can recognise and trade these patterns, the potential to profit from falling prices no longer presents a formidable challenge.

This guide will cover everything you need to know about bearish markets. We will look at things such as the defining characteristics of bearish markets, the causes of bearish markets, trading strategies you can follow, the psychological challenges you will face, and real-world examples to wrap it all together.

Definition and Characteristics of a Bearish Market

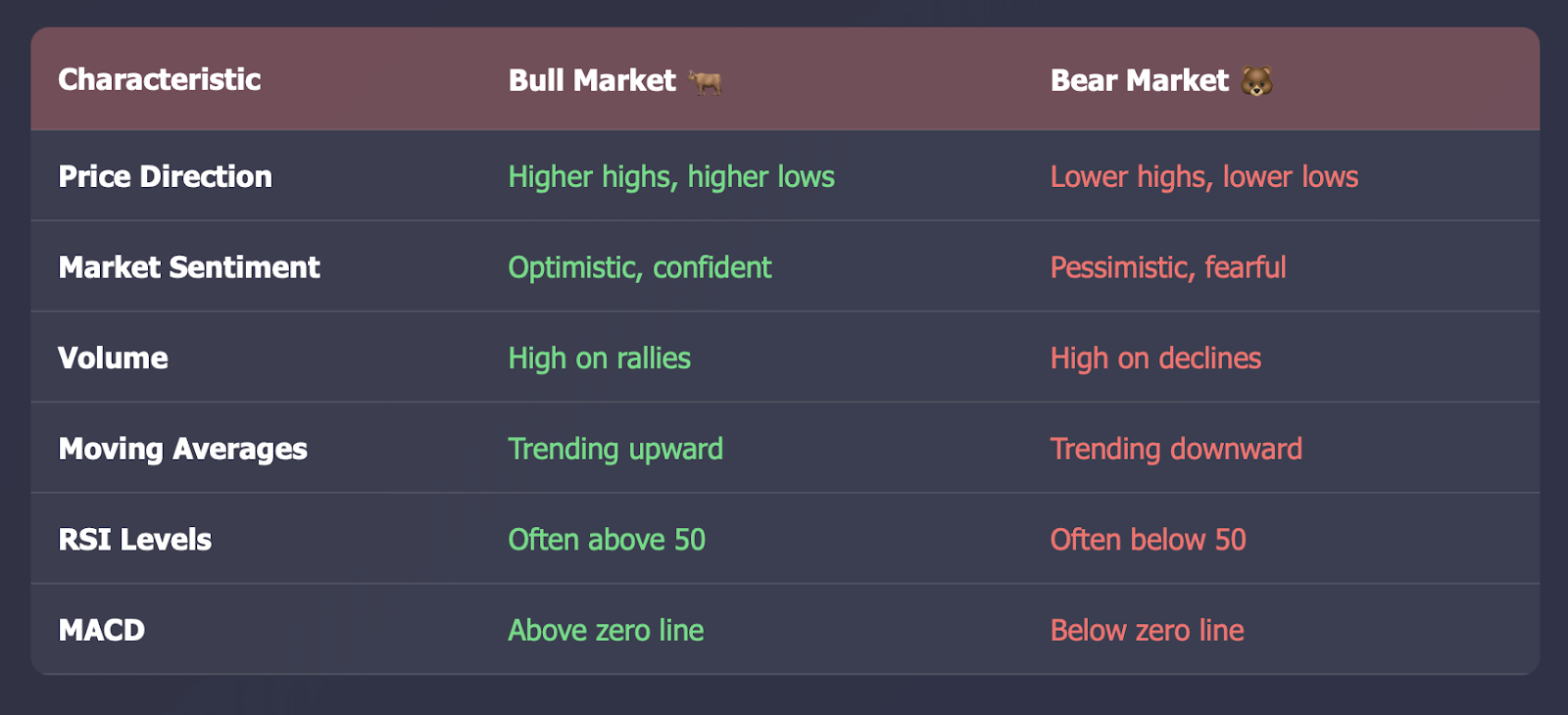

When it comes to bearish markets, there is one thing that is absolute: prices move lower. With a bunch of lower highs and lower lows. They also have other qualities besides just the move-in price.

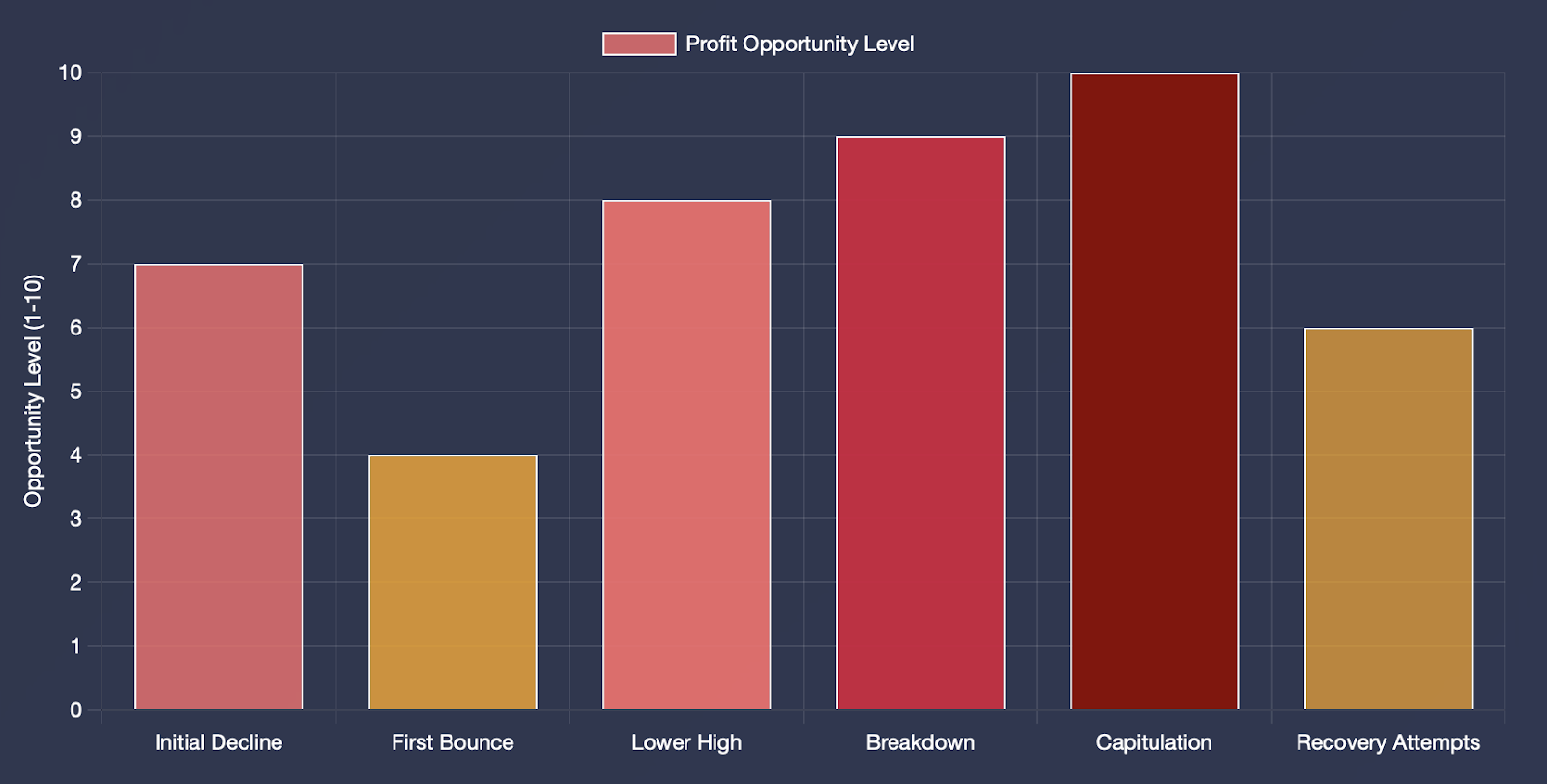

The first key feature of a bearish market is the decline in price. Bearish markets are not just random price moves that come down for a short time and then back up. A bearish market reflects sustained downward pressure. At some point, the market changes sentiment to pessimistic, and the number of market participants who expect further declines begins to grow. Price movement has different volumes depending on what part of the bear market you are in. Usually, in the very early and very late stages, the volume is either going to go way up, like panic selling, or retreat to nothing while participants wait on the sidelines.

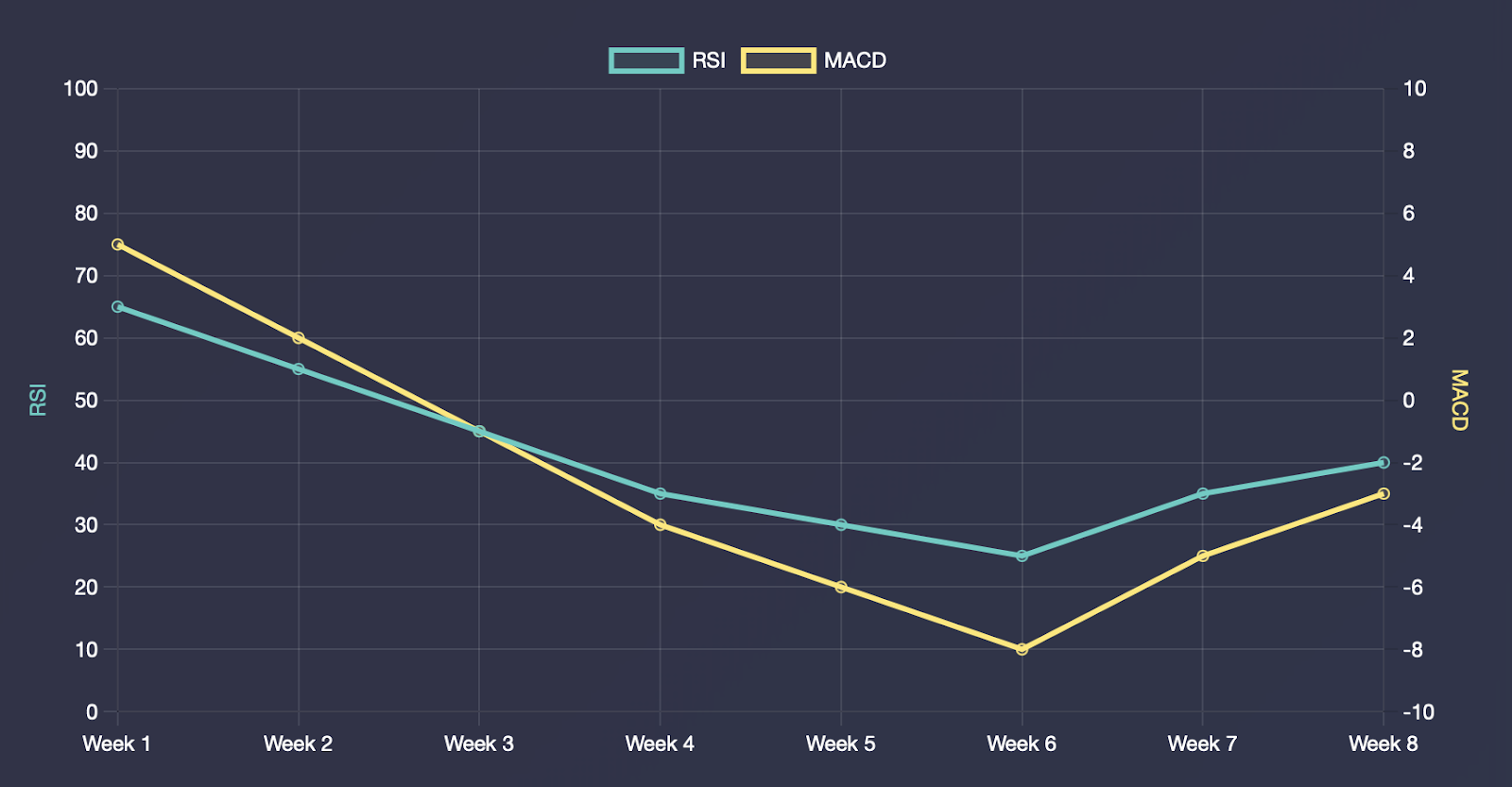

To get some insight into these conditions, we want to look at technical indicators. Moving averages will be trending downward. The Relative Strength Index (RSI) will likely remain under 50, indicating weak momentum. The moving average convergence divergence (MACD) will show bearish signals with lines crossing below zero.

Here’s a professional example: When Bitcoin went from $40,000 to $30,000, the moving averages were sloped downwards, and MACD was declining. These technical signals did not just confirm the bearish price action but helped to affirm the overall bearish sentiment.

Think back to that video game item again; if the price of that item goes from $100 to $70 and your friends start questioning if they want to buy it because they expect it will continue to drop, you would clearly see the sentiment - and the market psychology - lean toward bearish.

While price direction is the most notable and easy difference between bullish and bearish markets, it is not the only difference. Bull markets create optimism and attract new buyers while bear markets create fear and incite selling behaviour. Technical analysis indicators also behave differently; bullish market indicators will trend upward while bearish market indicators will trend downward.

To summarise, a bearish market exhibits price declines, negative sentiment, and confirming technical indicators. A single day of declining price does not create a bear market, just like a single sunny day does not mean summer has arrived.

Bearish Market Causes

Bearish markets do not happen by chance. Usually, there are specific triggers that create the imbalance between buyers and sellers.

The imbalance of supply and demand provides context. The market is creating selling pressure that is overwhelming the amount of buying interest, which will lead to declining prices - the question is whether that will happen quickly or gradually, depending on the specific causes of bear market sentiment.

Bear markets are often driven by macroeconomic factors. Rising interest rates mean higher costs of borrowing and can lower economic growth. Inflation is a significant detractor of purchasing power and corporate profits. GDP slowdowns are a clear signal of weak economic growth and poor future investor returns.

Bearish factors can stem from policy shifts and events alike. Central banks often trigger selling when they announce an unexpected increase in interest rates or the tightening of monetary policy. Government regulations can also create unease in markets, particularly in crypto markets where regulation is still being formed or executed. Furthermore, geopolitical events like wars and trade disputes can impact exposure to particular assets and shake investors' confidence in the broader economy.

Technical factors are important too. If prices move below key support levels, selling gets triggered, as stop-losses get hit and technical traders sell when other technical traders sell.

An illustrative example to consider was Bitcoin's decline in 2022. As global interest rates rose, riskier assets were reconsidered or avoided, causing a mass public sell-off. Adding additional uncertainty, regulatory pressure from multiple countries compounded the problem.

And on top of this, when Bitcoin's price progressed to below $30,000, a technical breakdown confirmed the bearish sentiment, resulting in additional selling pressure and a lasting bear market environment.

A simpler illustration might be watching your collectable card trade from $50 to $35, as the game company announced they were printing more cards (essentially increasing supply), while also fewer players were joining the game (decreasing demand).

Identifying the causes for bear market conditions allows traders to predict bear markets and act accordingly. Not every market move can be predicted, but being aware of red flags gives you an advantage.

Trading Strategies in a Bear Market

Bear markets can offer profit opportunities if they are approached properly. The trick is to adjust your trading strategy from fighting against the trend to going with the trend, which is falling prices.

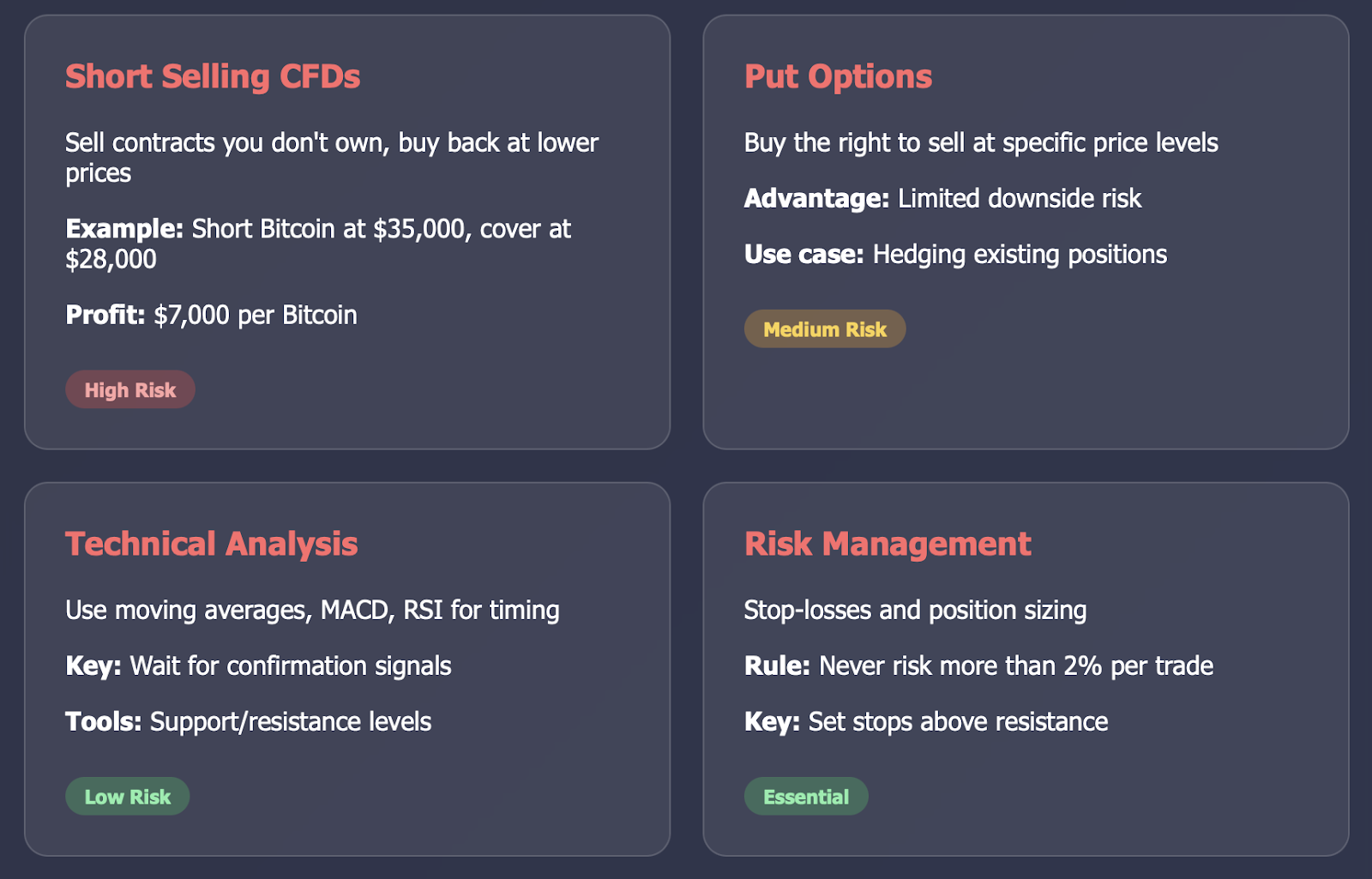

The most direct way to trade while the market is bearish is to short sell CFDs. You are essentially betting that a contract's price will fall eventually by selling contracts you do not own and then buying them back at a lower price. For example, if Bitcoin were on its way to $30,000 and you short-sold CFDs, a 10% decline would provide a 10% profit for you.

You can look at it this way: If you borrowed an item worth $100 in a video game, sold it for $100 (but never paid for it, of course). When the market fell, you bought it back for $80, and you made $20. Selling a CFD short does the same thing, but with financial contracts.

Another method to profit in a bear market is by using put options. Put options are an additional way to profit from falling prices, or as a hedge against falling prices. Put options give you the right to sell at a specific price, while they will gain value as the market declines.

Using proper stop-loss and take-profit levels is important in bear markets. Set stop-losses close to resistance levels where prices may bounce. Use take-profit placing based on technical support levels or established risk-reward ratios.

Technical analysis will be your best friend. Downward-moving price averages can indicate entry and exit points. MACD can be used for bearish momentum when the crossover works below zero. Generally speaking, RSI levels below 30 can indicate oversold conditions and possibly present short-term bounces.

Risk management starts to become indispensable in a bear market where volatility is common and often wide-ranging. Use proper risk management and do not risk money or amounts that you cannot afford to lose on one trade. Stay away from maximum leverage because of the unpredictability of a bear market, where sharp upward and downward bounces can occur quickly.

Position sizing is critical as well. Understand that you should be venturing into a new mindset with shorting the market because of your previous long strategies in bull markets. Consider starting with smaller positions to acclimate to new market nuances. You can always add to winning positions.

Finally, bear market trades can require a completely different style of thinking compared to trades in a bull market. Rather than seeing the optimism of growth, you are benefiting from pessimism and decline!

Psychology and Discipline in a Bear Market

Often, the single biggest obstacle to trading successfully in a bear market comes from within. The mind has a funny way of sabotaging profitable trading decisions, and instinct can often get in the way of the right decision.

Bear market psychology favours fear. Many traders fear shorting markets, even when ample visible downtrends are forming. Many have no plan on how to engage with this feeling of "unlimited losses" (even though CFD positions can be managed with stops). Only for the self-enforced limits in their minds to stop them from cashing in on such obvious opportunities to benefit.

While greed presents a different issue in bear markets. Some traders exited their profitable short positions too early, fearing the market was going to bounce back, only for their targets to be achieved. Others will continue to hold on to losing long positions in the hope of gaining back some of their losses.

Hesitating in bear markets is the death of profit. If you are contemplating whether it is a real trend or not, you are most likely too late, and the largest portion of the move will have already passed you by. Professional traders often say - the first cut is the deepest, but as it's also the cheapest, it is the best option!

If you consider an example of a bitcoin pair that breaks below support at $32,000, we could see clear bearish signals. A hesitant trader would find that they would be waiting for extended confirmation while the price suddenly falls below $28,000 before they actually plot a trade. As explained, waiting costs them $4,000 per bitcoin!

For the novices out there, think of watching that video game item go from $100 to $90, then to $85, you should absolutely sell; however, you want to hold (and hope) for the price to recover. At some point, you know you need to act, but now you have acted too late, and your item is worth $70.

So now it's about remaining disciplined. Before entering into a position, you need to have a trading plan in place. Before you enter an order, have your entry price, stop loss price, and price targets established.

If you remain disciplined, you will stick to your plan and not allow your emotions to supersede your rules.

Maintain a trading diary where you record both your decisions and emotions. You can keep track of the times you allowed fear or greed to play a major role in your decision. This practice informs your awareness of the trading decisions you make, and the cause and effect of how your emotional state at the time contributed to the decisions you made.

Automation allows you to remain more disciplined. If you can set a stop loss or a take profit order, this keeps you from contradicting logic with emotion in the heat of the moment.

Real-World Case Studies of Bearish Markets

Let's consider a couple of real-world examples of bearish markets to see how these principles are put into practice.

Case Study 1: Bitcoin Bear Market 2022

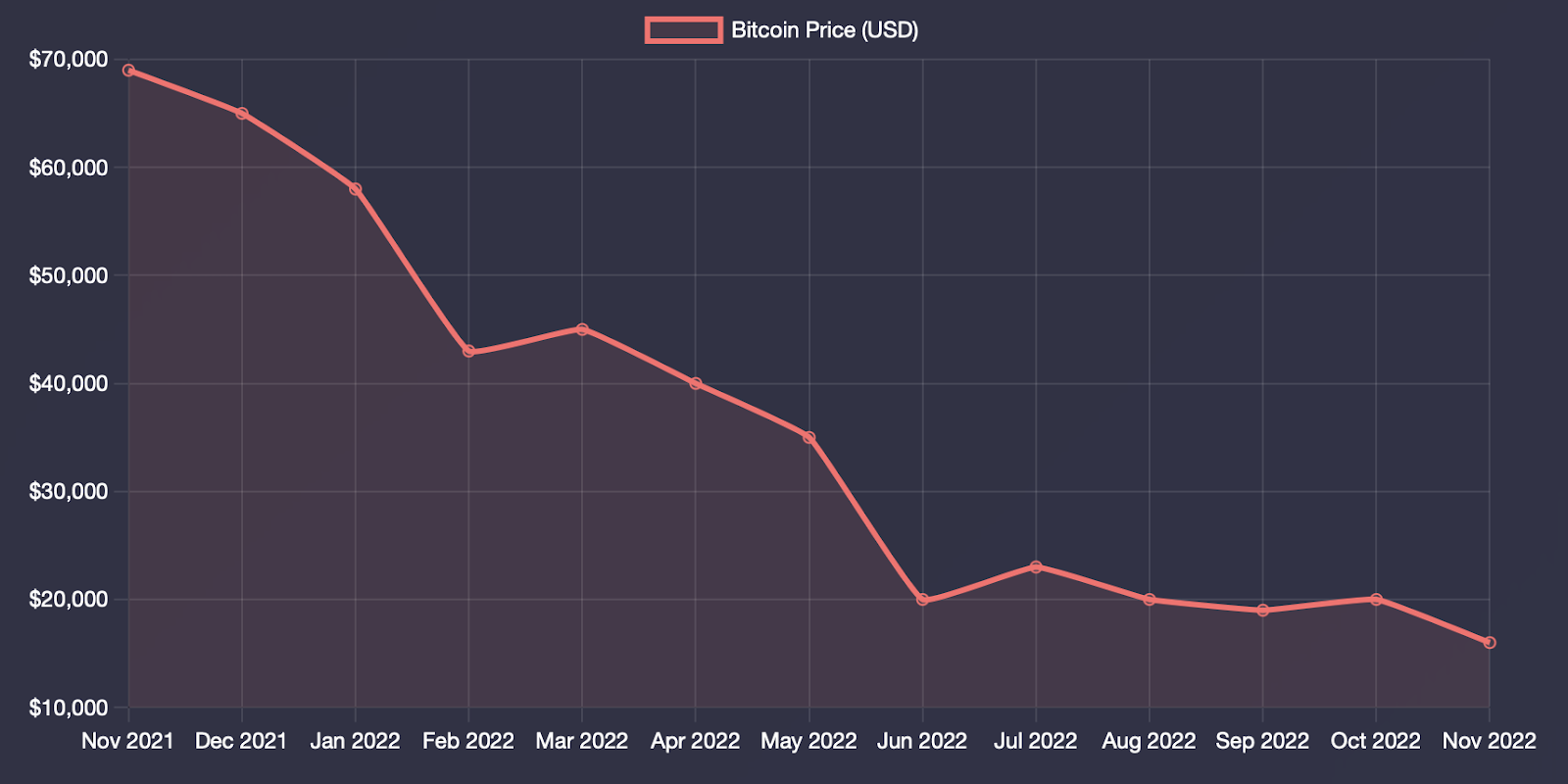

Bitcoin fell from about $69,000 in late 2021 down to below $16,000 in 2022, which allowed for multiple short-selling opportunities. The discerning CFD trader who identified the breakdown below $50,000 could have greatly benefited from this.

The narrative was established: increasing rates were diminishing risk assets’ attractiveness, regulators were applying pressure from different corners of the world, and technical aspects that we monitor were breaking down repeatedly. Opportunities to be short Canada CFDs with stops above $52,000 and profit targets near $40,000 would have created wonderful profits for traders.

Managing risk was important, as Bitcoin was bouncing fast and violently while it was falling. People who controlled their position sizing and were not too greedy were able to ride out the swings and ultimately ended up profitable.

Case Study 2: Tech Stock Correction

The 2022 tech stock drop is yet another example. There were going to be declines in companies like Netflix, Meta (Facebook), and Tesla, with growth stock valuations taking a hit from rising rates that sent them down. CFD traders could easily take advantage of this move while using manageable risk by having stop losses in place.

The key to success in this instance was being able to acknowledge the change in market fundamentals rather than seeing the price drop as just another pullback. Traders who did not nuance their trading strategies to acknowledge that we switched to a bearish environment were the traders who kept buying into every price drop in risk assets.

Case Study 3: Beginner-Friendly Example

Finally, let’s return to the video game item example we discussed previously. You could consider game items that originally were worth about $100, and now, because of updates in the game, they are suddenly worth less. The early sellers at around $95 made a good profit, and the people who were going to wait to sell at $70 are not going to make any profit at all.

The lesson can be applied to financial markets. Oftentimes, recognising that a trend has already become bearish, even if you do not know if there will be continuation, is a safer approach than wishing for a trend to reverse when it may be too late.

These examples all have similar themes: recognising that you are already in a bearish condition, implementing sound risk management, and developing the discipline to follow through when you are triggered (and not hoping for reversals).

Conclusion & Action Steps

Bearish markets can have as much risk, but also have as much opportunity. Success in a bearish market is about understanding what its characteristics are, why they happen, and employing the appropriate strategies with sound risk management.

The take-home points are simple. Learn how to recognise bearish market signals via technical analysis and sentiment. Learn short selling and risk management. Finally, learn to develop the psychological discipline to trade against your natural optimism.

Bear markets present a formidable test for all traders’ skill and emotional discipline. Those who properly prepare can profit, while others with little preparation will struggle. There are many opportunities and great strategies, but success will be dictated by your ability to execute these properly over time.

When developing your trading skills, never forget that markets cycle between bullish and bearish. What feels difficult in today's bear market will likely be an opportunity in the bull market. Traders with the ability to trade both directions have a distinct advantage over those only trained to profit from rising prices.

Want to learn how to trade in a bearish market? Then open your account at btcdana.com today and get immediate access to real professional CFD trading tools and strategies that will enable you to make a profit in any market situation. Don't get surprised by the decline in price levels, when you can turn your falling prices into an opportunity!