Introduction

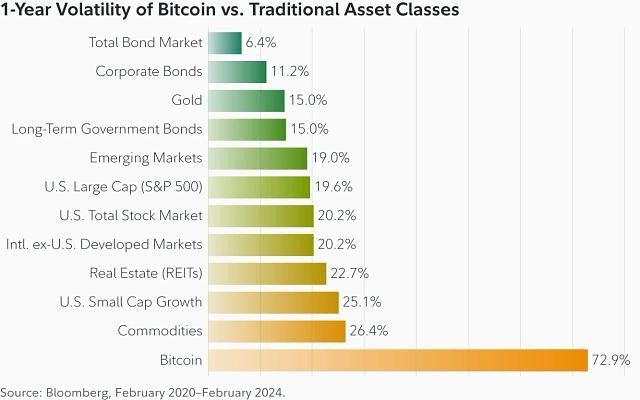

Crypto markets are known for their wild ups and downs. Bitcoin’s annualised volatility in early 2025 was around 52%, compared to just 15.5% for gold. That means prices can skyrocket one week and crash the next. Traders are also swayed by irrational

behaviour, global news, and even random tweets. Traditional methods like technical analysis or fundamental analysis often fail in such fast-moving markets.

This is where big data analysis comes in. It takes huge amounts of information, which can include prices, on-chain transactions, news, and even Twitter chatter, and processes it in real time. Quant funds already use cryptocurrency prediction models to monitor wallet flows and forecast short-term Bitcoin price changes. For example, Glassnode’s data science team used machine learning on blockchain data to build a “Sharpe Signal” for Bitcoin, finding on-chain signals that systematically predict price moves.

You can think of it like studying for an exam. A student who only reads one textbook risks missing questions. But one who checks past papers, online notes, and discussions is better prepared. That’s how big data gives investors an edge in spotting crypto market trends.

In short, big data is already important today. It’s not something to be learned about in the future. Instead, it has become a core tool for crypto investors today.

Where Does All That Crypto Data Come From?

Crypto produces data 24/7, and analysts split it into four big sources:

-

On-chain data: Direct from the blockchain. Transaction volumes, wallet addresses, whale transfers, and UTXOs (unspent coins). Analysts use this to measure holder sentiment. For example, Glassnode studies the UTXO realised price to see when long-term holders are in profit.

-

Market data: Prices, volumes, liquidity. Platforms like CoinMarketCap track this. A sudden spike in trading volume often signals an upcoming trend.

-

Social and sentiment data: Twitter, Reddit, Telegram, Discord. Santiment and Glassnode monitor this to create crypto sentiment analysis scores. Like hashtags trending on Twitter. If everyone’s talking about Ethereum, that matters.

-

Macro data: Interest rates, stock indexes, or the US Dollar Index. Research shows Bitcoin often moves opposite to the dollar index. In March 2020, when COVID hit, Bitcoin crashed nearly 39% in a single month, shocking prediction models.

Professional traders combine all these. For beginners, even tracking one or two cryptocurrency data sources, like the Fear & Greed Index plus on-chain wallet counts, can help.

How Big Data Actually Predicts Crypto Market Trends

Now, let’s talk about how this data is turned into predictions. It boils down to a few key techniques:

-

Pattern recognition: Computers crunch historical data to find recurring patterns. AI/ML detect recurring signals in prices and blockchain activity. Glassnode’s ML models found that short-term holder SOPR (spent output profit ratio) often predicts Bitcoin rallies.

-

Sentiment analysis: This uses natural language processing to judge the “mood” of the market from text. NLP scans millions of posts to measure fear vs greed. Hedge funds used this to ride Dogecoin rallies after Musk’s tweets.

-

Predictive models: Once you have data and features, you train a model: supply it with historical inputs and historical output, and let it learn. These models then take today’s data and predict tomorrow’s price or trend. One XGBoost model using stablecoin flows predicted Ethereum volatility with high accuracy.

-

Real-time monitoring: Big data in crypto means automation. Bots and algorithms continuously scan news wires and social feeds for key words or sudden spikes in discussion. If a big tweet drops, they react before most humans.

It’s like noticing all your classmates study math more than history before exams. You can guess the math paper is coming. The same goes for crypto. If big wallets accumulate BTC and Twitter goes bullish, a pump is likely.

Forecasts are always probabilistic, not fortune telling. They increase odds but never guarantee wins. The bottom line here is that crypto market prediction isn’t magic. It’s a probability. With big data modelling and crypto predictive analytics, the odds get better.

Big Data vs Traditional Analysis

Let’s compare big data with old school methods:

-

Technical analysis (TA): This is chart-reading. It is good for spotting patterns, but in crypto, false signals are common. Charts alone can’t explain Elon Musk’s tweets.

-

Fundamental analysis (FA): Helps long-term value calls, but can’t predict short-term shocks. For example, Tesla’s fundamentals didn’t predict Musk tweeting to drop Bitcoin. On May 12, 2021, Musk suddenly tweeted Tesla would stop accepting Bitcoin – Bitcoin’s price then dropped over 12% in hours.

-

Big data: Combines TA + FA + sentiment + macro in real time. That’s why it works better in fast-moving markets.

Traditional analysis is like checking one subject’s grade to see if you passed school. Big data vs technical analysis is like checking all subjects, study habits, and mood swings at once.

When Elon Musk tweeted about Bitcoin (adding #bitcoin to his bio), Bitcoin jumped around 14% that day. Traditional analysts didn’t see it coming (Elon’s a wildcard). But algorithms scanning Musk’s tweets would catch that spike in sentiment immediately.

Use all three crypto analysis methods together. Classic tools give structure, but crypto prediction tools like Glassnode or Santiment add depth.

The Hidden Risks of Big Data in Crypto

Up to this point, big data sounds great, but beware, as it is not perfect, and there is a dark side to it as well. Risks include:

-

Data quality: Not all data is honest. There’s a lot of fake noise in crypto. Wash trading inflates exchange volumes. Fake news can trick sentiment bots.

-

Overfitting: This is a classic ML risk. A model might learn patterns that were true in the past data but fail in new conditions.

-

Black swans: Sudden, unpredictable events can blow away big data models. For example, COVID-19 in 2020 caused Bitcoin to crash 39% despite predictions.

-

Costs: Big data is not free. Collecting and storing terabytes of data, running heavy ML algorithms, needing GPUs – it can be expensive and technically demanding.

Think of it like using last year's question paper to guess the exam questions this year. It can be helpful, sure, but if the teacher changes everything, you are stuck.

So, yes, big data helps. But don’t forget risk management. Always plan for crypto market uncertainty because big data risks are real, and crypto prediction challenges are not going anywhere.

Step-by-Step Guide to Using Big Data

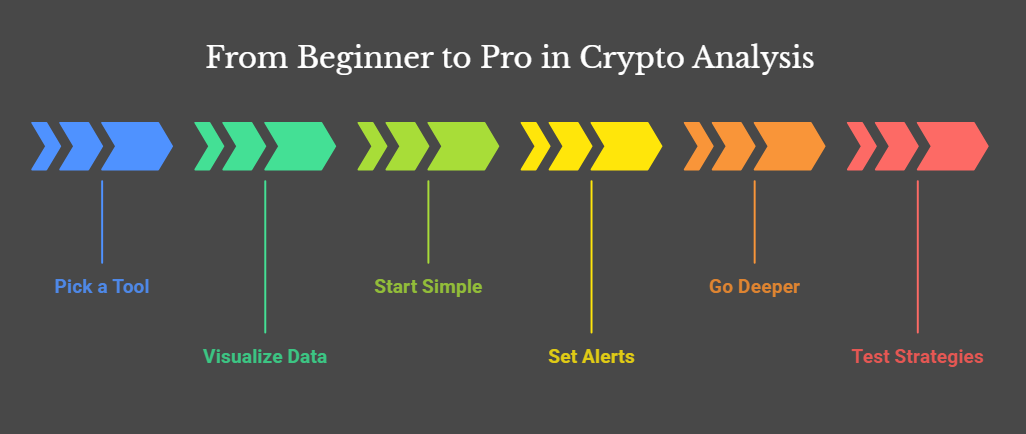

Here’s how you can start today:

-

Pick a tool: Start simple. Popular platforms like Glassnode (on-chain), Santiment (social), and CryptoQuant (exchange flows) offer dashboards and charts. Begin by browsing their charts on Bitcoin or Ethereum.

-

Visualise data: Don’t stare at numbers. Use charts and graphs. You can also use Google Sheets or Python (Matplotlib, Plotly) to plot data. Plot BTC price vs exchange inflows, for example.

-

Start simple: As a beginner, track the Crypto Fear & Greed Index. Even Google Trends for “Bitcoin price” is useful.

-

Set alerts: Many services let you set simple alerts. CryptoQuant lets you get notified when whales move coins.

-

Go deeper: To really harness big data, consider learning Python and its libraries. Learn Python + ML (TensorFlow, Scikit-learn) for advanced models.

-

Test strategies: Try paper trading with signals before risking real money.

Professional traders already use ML to predict Ethereum volatility. Beginners can just start with the indexes. Like a high schooler starting with trending searches before learning complex math.

This way, you move step by step into big data for beginners, using crypto prediction tools and eventually real crypto big data analysis.

Conclusion: The Future of Big Data in Crypto

Big data already makes crypto investing faster and smarter. It doesn’t erase risk, but it improves decision-making. With AI, predictive accuracy is improving even more. Experts expect institutions to soon rely on AI-driven analytics 24/7 to predict liquidity and trends.

The message is clear. Crypto big data is not an option anymore. It’s carving up the future of crypto investing as we speak. And as AI + blockchain converge, big data prediction will only get stronger.

Want to get started? Visit BTCdana to explore data-driven insights, trading tools, and guides for both beginners and pros.