Introduction: Understanding CFD Spread, What It Is and Why It Matters

Have you ever thought about why two different traders might cite two slightly different prices for the same market? The answer is the CFD spread, and understanding the CFD spread could be the difference between trading profitability and watching your profits disappear to hidden costs.

The CFD spread is the difference between the buying price (ask) and selling price (bid) of any financial instrument you are looking to trade. In other words, it is the transaction cost that is built into each and every trade you make. While this gap in price may appear trivial, it can contribute to your trading profits in ways you had not considered.

To illustrate this, we can simply look at two examples. In professional trading terminology, if the EUR/USD has a bid price of 1.1000 and an ask price of 1.1002, the spread is 2 pips. In everyday terms, if you were buying some shoes that were listed for $50, but you had to pay $50.50 to complete the checkout, the additional $0.50 is the spread you are paying to conduct the transaction.

The spread is not simply an arbitrary fess. It reflects many factors of market conditions, liquidity, and the cost of conducting business in the financial markets. More importantly to you, it is a predictable cost that you can use in your trading strategy to make more informed trading decisions.

As we go through this guide, we will examine what spreads actually mean, what types of spreads you will encounter, what influences spreads, and most importantly, how to reduce the effect that spreads have on their trading performance. After reading this guide you will know how to use this information to improve trading performance.

Understanding spreads is the first step to becoming a better value and potential trader. Let's explore some more detail about this important concept.

Definition and Fundamental Concept of CFD Spread - Know the Basics

The CFD spread is quite simple in terms of definition, and it is written as: Spreads = Ask price - Bid price. But this formula is more than just basic math in relation to your trading plan. The spread is a transactional cost and is crucial in defining how you will choose your entry and exit points.

Your trade will begin with a negative P&L of the spread amount, because of the spread amount. In general, this means the trade has to move in your favor by at least the spread amount before you will break-even. Knowing this core principle can explain why some trading models perform better than others.

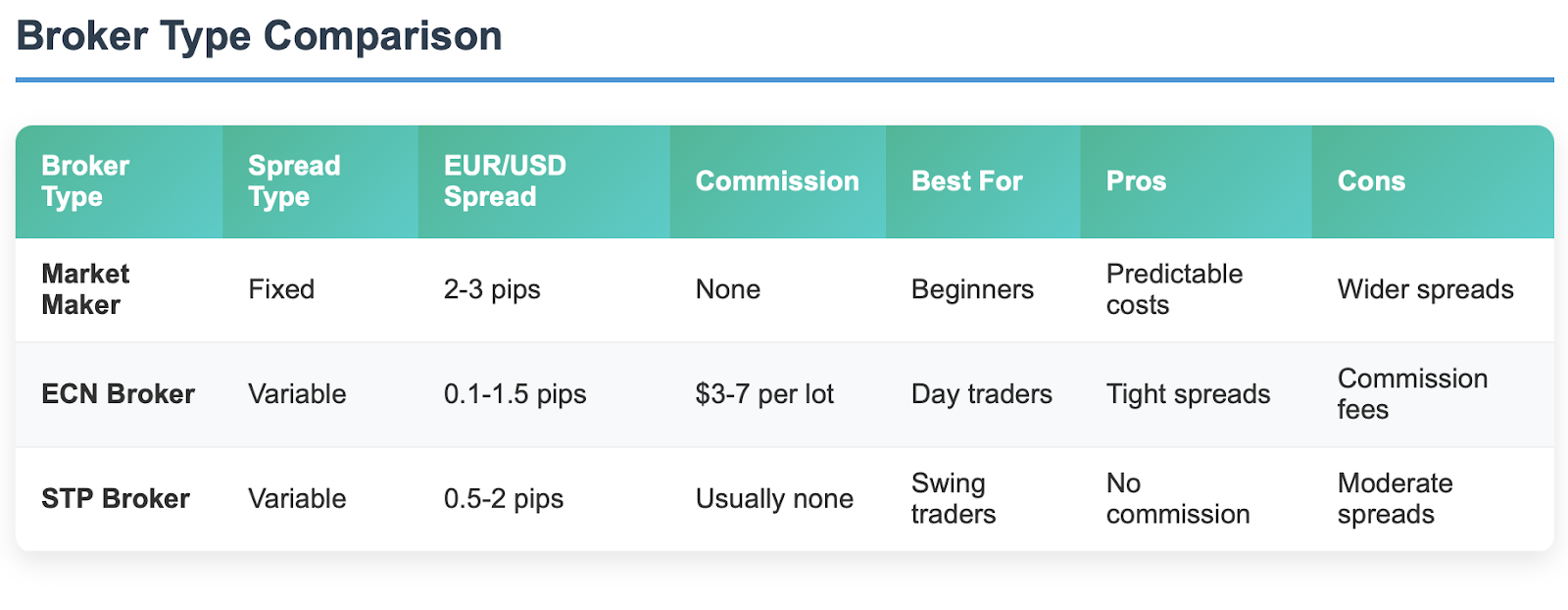

CFD spreads come in two varieties: fixed and floating (or variable). A fixed spread will not change with the market - it is as if you pay a shipping fee the same, 24/7. A floating spread will change, based on volatility and liquidity in the market - kind of like surge pricing with a ride-sharing service.

This is where it can get interesting for the trader. Fixed spreads give you certainty - you will pay exactly the same for each trade. If your broker has a fixed spread of 2 pips on EUR/USD, you will have the same cost from each position whether the market is calm or in chaos during major news events. This will give you greater confidence to calculate your trading costs easily up front.

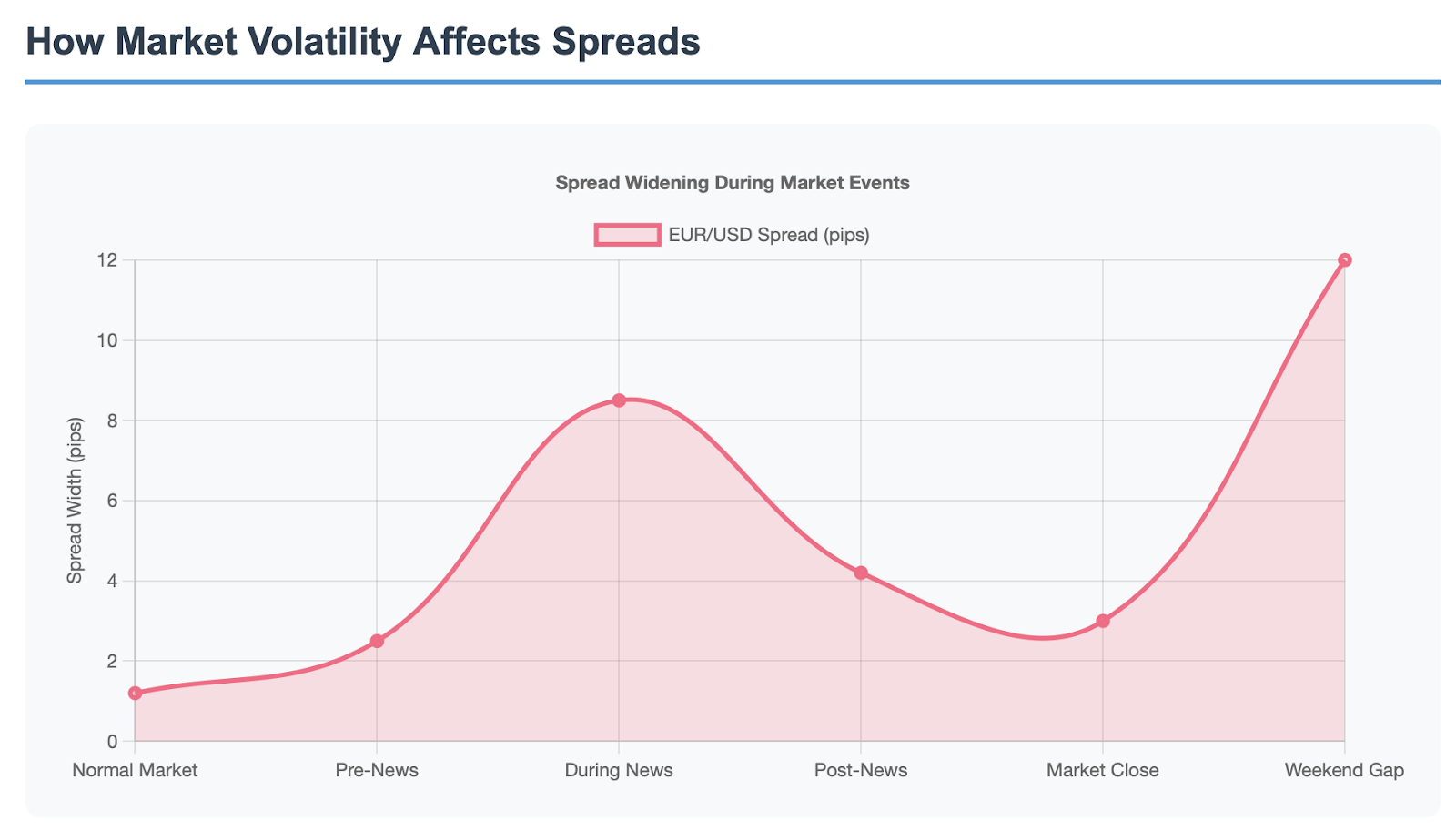

Floating spreads can be a double edged sword. In a normal market, they can often be lower than fixed spreads (potentially as low as 1 pip), giving you better entry and exit prices for your trade. But in a period of high volatility, floating spreads can widen considerably (to 5 or more pips). This obscures the trading costs when your bank is at stake in a volatile market setting.

The interplay between spreads, liquidity and volatility is very interesting. Instruments that have high liquidity (i.e. major currency pairs) have tighter spreads typically speaking because there are more willing counterparties in the market. Conversely, low liquidity instruments are faced with widening spreads since the fewer market participants will incur a higher cost for the market maker to provide a quote to them.

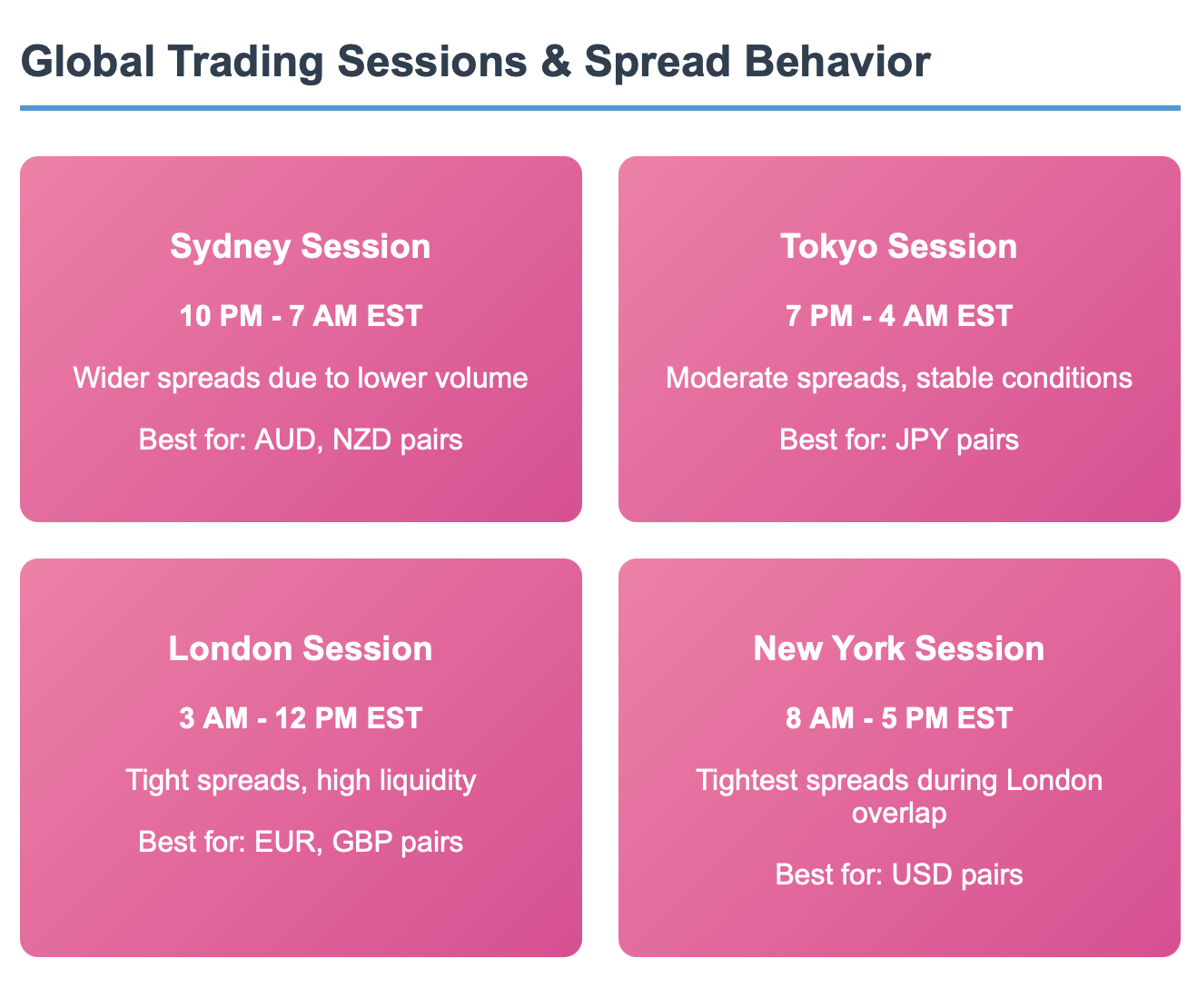

Volume is important now as well. As we observed, sometimes optimal trading occurs when trading volume is higher, especially when multiple markets are open at the same time. You will typically see better spreads when overall trading volume is higher, such as the peak time of day; noon in London. Conversely, during less comparative trading volume time, such as the time between the New York close and Sydney open, spreads can widen.

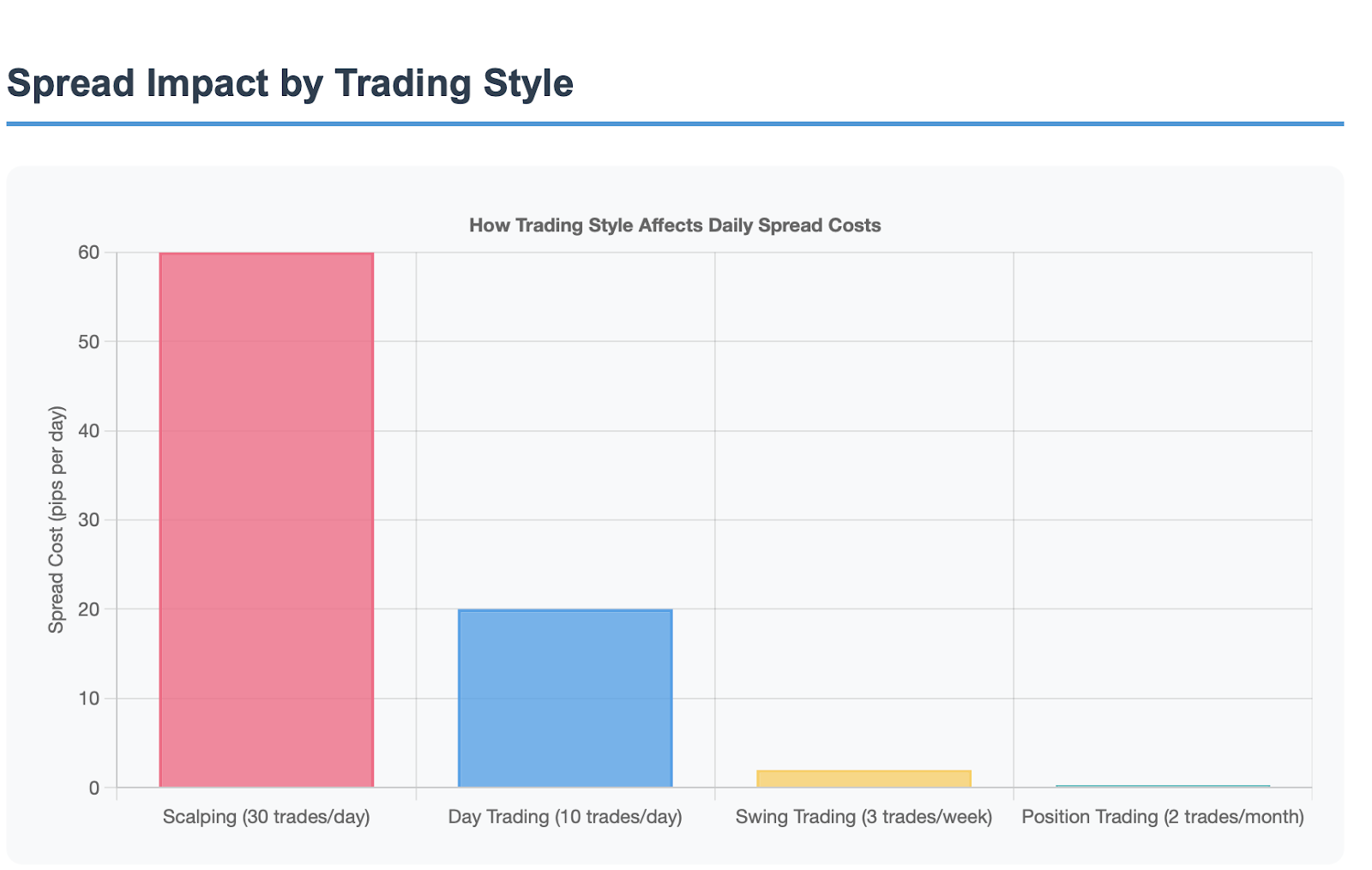

It is very important to note, this is not only theory, it is real and it will have a direct impact on your profitability. A day trader executing 10 trades with a 2-pip spread will incur 20 pips in costs relative to the spread. If that same day trader is able to execute the same trades at 1.5-pips spreads, then he or she will save 5 pips a day and while that is not huge for one day, multiply that into one week, one month and then one year.

Just remember, a spread is more than just a number on your screen. A spread is the cost of market access, the liquidity cost, and a major determinant of whether your trading strategy will be profitable in practice.

History and Evolution of CFD Spread

The idea of bid-ask spreads did not start with modern CFD trading; it can be traced back to the very beginning of financial markets. Knowing this history, however, helps us to understand why spreads exist, and how spreads have evolved into the complex pricing mechanisms we see today.

When stock and futures trading were in their infancy, buyers and sellers connected through telephone conversations with human market makers. These traders were physically present in one central location, and they priced stock by literally yelling prices across the trading floor or quoting prices over a telephone line. The spread was essentially their profit margin, but it also compensated them for the risk of holding their inventory. At the time, spreads could be much wider (sometimes notably wider) because the entire system was dependent on humans serving as market intermediaries.

The advent of electronic trading was completely transformative for the nature of spreads. By removing intermediaries, all quotes were visible, standardized, and open to anyone with a computer connection. This transparency resulted in competition among market makers, which consequently forced spreads tighter and to traders' advantage.

The forex market went through the most transformative of improvements. In the late 20th century currency trading, large banks controlled the market and could quote spreads in the 5-10 pip range or even larger on larger forex pairs. The introduction of electronic communication networks (ECNs) and retail forex platforms in the early 2000's diminished this spread significantly.

CFDs had a similar journey. The early CFD platform providers typically charged higher spreads because the technology and competition was not fully developed. As electronic trading matured and additional providers entered the field, spreads became increasingly competitive.

They eventually evolved to today's high-frequency trading environment where instantaneous prices can be quoted electronically, while spreads adjust thousands of times per second, responding to the market. The advancement in technology should typically benefit traders as it has led to tighter spreads and overall better execution although it can also lead to quick widenings in spreads depending on market events and conditions.

During the transition from manual trading to automated high-frequency trading we can see how spreads generally have become more efficient, and more advantageous for retail traders. The days one would call a broker and simply ask what spread they would give you - are long gone. Instead now we have a competitive marketplace to review spreads amongst hundreds of brokers in real time.

This historical context is important to take from, as we note that spreads provide a legitimate and proven design function in the marketplace. Rather than being a current scheme to extract fees from traders through the spread, spreads have traditionally been part of the market design, in many of its forms throughout history in financial markets.

CFD Spread Across Markets and Trading Styles: How Spread Varies Globally

The impact of spreads on your trading performance varies dramatically depending on your chosen trading style and market focus. Understanding these differences helps you align your approach with the most cost-effective strategies for your situation.

Day trading represents the most spread-sensitive trading style. When you're making multiple trades within a single session, often holding positions for just minutes or hours, every pip counts. A day trader opening and closing 10 EUR/USD positions with a 2-pip spread pays 20 pips in transaction costs – before considering any other fees. If the same trader finds execution with 1.5-pip spreads, they save 5 pips daily, potentially hundreds of pips monthly.

Consider this like buying and selling snacks throughout the day. If you're constantly buying at $1.02 and can only sell at $1.00, those small differences add up quickly when you're making multiple transactions. Day traders need to focus on the tightest possible spreads and high-liquidity instruments to maintain profitability.

High-frequency trading takes this concept to the extreme. These strategies depend on capturing tiny price movements, making spread costs absolutely critical. A strategy that targets 0.5-pip movements becomes impossible with a 2-pip spread, but might be profitable with a 0.3-pip spread.

Swing trading offers more flexibility with spread costs. When you're holding positions for several days to weeks, a 2-5 pip spread becomes less significant compared to the larger price movements you're targeting. A swing trader aiming for 50-100 pip movements can absorb higher spread costs while still maintaining profitability.

Think of swing trading like buying game credits over a weekend sale period. The small price difference at purchase matters less when you're planning to hold and use those credits over an extended period. The key is ensuring your profit targets significantly exceed your spread costs.

Position trading represents the most spread-tolerant approach. When holding positions for weeks, months, or even years, the initial spread cost becomes a tiny fraction of your overall trade. A position trader targeting 500-1000 pip movements on major trends can work with wider spreads without significantly impacting returns.

This resembles saving money to buy expensive electronics. The small difference in purchase price matters less when you're making a major, long-term investment. Position traders can focus more on overall market analysis and less on finding the absolute tightest spreads.

Different markets also present varying spread characteristics. Major forex pairs (EUR/USD, GBP/USD, USD/JPY) typically offer the tightest spreads due to high liquidity and competition among market makers. Minor pairs and exotic currencies face wider spreads because of lower trading volumes and reduced market maker competition.

Stock indices like the S&P 500 or NASDAQ often provide competitive spreads during market hours but may widen during overnight sessions. Commodity CFDs can show significant spread variations based on the underlying market conditions and storage costs associated with physical commodities.

The key insight is matching your trading style with appropriate markets and spread expectations. Day traders should focus on major pairs during peak hours, while position traders can afford to explore opportunities in less liquid instruments where fundamental analysis might provide greater edges despite higher spread costs.

Factors Affecting CFD Spread and Why Prices Differ

Several interconnected factors determine the spreads you'll encounter, and understanding these variables helps you predict costs and optimize your trading timing.

Market liquidity stands as the primary driver of spread width. High-liquidity markets feature numerous buyers and sellers, creating competition that naturally drives spreads tighter. The EUR/USD pair, as the world's most traded currency pair, consistently offers some of the tightest spreads available. Compare this to an emerging market currency pair with limited trading volume, where spreads can be 5-10 times wider.

This principle works like popular versus rare collectibles. Popular sneakers with high demand and supply have smaller price differences between buying and selling prices. Rare, specialty items face wider spreads because fewer people are actively trading them, making it more expensive for dealers to provide quotes.

Volatility creates a dynamic relationship with spreads. During calm market periods, spreads typically remain stable and tight. But when major economic news breaks or unexpected events occur, spreads often widen rapidly. Market makers increase spreads during volatile periods to protect themselves from rapid price changes that could result in losses.

For example, EUR/USD might trade with a 1.5-pip spread during normal conditions but widen to 4-5 pips immediately following a surprise central bank announcement. This volatility-spread relationship means you'll often face higher transaction costs precisely when you might want to trade the most – during exciting market movements.

Trading hours significantly influence spread behavior. During peak trading sessions when major financial centers overlap (like the London-New York overlap from 8 AM to 12 PM EST), increased activity typically results in tighter spreads. Conversely, during quiet periods like the gap between the New York close and Sydney open, reduced participation leads to wider spreads.

This creates opportunities for savvy traders who can time their activities around these predictable patterns. Trading major pairs during peak hours often provides better execution costs, while off-hours trading might require accepting wider spreads as the cost of convenience.

Broker policies add another layer to spread determination. Some brokers offer fixed spreads as a service feature, absorbing volatility-related spread fluctuations themselves. Others provide variable spreads that more closely reflect real-time market conditions. Each approach has advantages – fixed spreads offer predictable costs, while variable spreads might provide better pricing during calm periods.

Additionally, some brokers operate different business models that affect spreads. Market makers might offer competitive spreads but trade against their clients, while ECN/STP brokers pass through institutional spreads plus a small markup. Understanding your broker's model helps explain the spreads you encounter.

Economic events and news releases create predictable spread patterns. Major announcements like employment reports, central bank decisions, or geopolitical developments typically cause temporary spread widening as market makers adjust to increased uncertainty and volatility.

Regional factors also play a role. Currency pairs involving currencies from countries experiencing political or economic instability often face persistently wider spreads. Market makers price in the additional risk of holding these positions, passing those costs to traders through increased spreads.

The interconnection of these factors means spread prediction becomes part art, part science. Experienced traders learn to anticipate spread behavior based on upcoming events, trading session overlaps, and historical patterns, allowing them to time their activities for optimal execution costs.

How to Optimize and Minimize CFD Spread Costs – Practical Strategies

Reducing your overall cost of spread is much more than simply finding the lowest price broker; it's about developing a strategy that takes into account factors such as market selection, timing, execution style, and the platform on which you plan to trade to minimize the total cost of trading overall. Here are some methods you can trust to reduce your spread costs.

Select instruments to trade in highly liquid markets. For example, if you consider highly liquid currency pairs, consider the major forex pairs EUR/USD, GBP/USD, and USD/JPY. These major markets have lower costs due to construct constant volume. Even if you prefer to trade an exotic pair or a special market, consider if the additional cost of the spread is worth being able to trade that opportunity.

This is analogous to going to a great restaurant rather than searching for a hidden gem; while you may find hidden gems in restaurants, the better choice is where they are busy, at least in terms of service and price. The additional trades in the major markets create lower spreads into your pocket.

Trade during the heavy volume trading times. Timing of the trades makes a difference to the cost associated with spread. Quite simply during the time frame of heavy volume as a trader, you will have constant narrow spreads in market movement. Peak trading hours are during the London-New York markets (8 AM to 12 PM EST) which make for a narrower spread in USD or EUR based markets and also during peak hour in Asia provide better spread in JPY markets and during the London session have better spreads in GBP instruments.

When possible, plan your trading sessions around these natural rhythms in the market. Even if your method doesn’t require you to trade immediately, waiting for peak liquidity in a market session can contribute to sizeable savings over time. For example, if a trader just saved 0.5 pips on each trade by exchanging on the market at a different time, the trader has saved 50 pips over 100 trades – which influences profitability.

Consider ECN (Electronic Communication Network) or STP (Straight Through Processing) brokers as they may be better spread conditions. They usually pass the institutional spreads on with a small markup due to the market being liquid, and therefore, prices typically vary from a certain point, thus being tighter than the fixed spreads at the same time, which is typically customary.

You may pay a dollar amount commission per trade, however, the total cost (spread plus commission) will usually be smaller than trading based on wide, fixed spreads.

Position sizes should be managed based on your experience to avoid complications with slippage as well as spreads widening. Large orders can and will directly affect the prices in the market temporarily – thus increasing the net effects of transaction costs. If you plan on trading outside of a trading plan or strategy and you plan on trading size, decide ahead of time how much to trade during the entry process instead of one sizable trade, or use limit orders to define your entry prices.

Think of it like you're trying to buy a ticket for a concert. When you buy one or two tickets, you're most likely to get the price as displayed or close. If you try to buy 50 tickets at once, you may end up in the higher section or have extra fees. This is the best way to break up any larger positions into smaller ones.

Along the lines of larger positions broken into smaller positions, use limit orders instead of market orders when you can. Market orders execute the trade at current market value immediately but incur slippage, especially during wildly volatile markets. Limit orders allow you to set your max price you want and may provide better price executions during normal market periods.

While limit orders will execute price, it does present the risk of non-execution. Limit orders may or may not execute if the market does not trade at your mark. However, executing include worse, market prices execution, particularly during volatile periods, when traders might be speculating to trade at a spread or dispersion of liquidity.

You want to try to have a research approach to comparing your prices from various brokers. You will want to consider, execution quality, platform stability, and any other fees that could be part of your total trading cost. A broker with an ultra-tight spread on a surface level may provide poor execution quality during volatile market conditions in addition to keeping you at higher price executions.

Utilizing separate brokers for different trading methods also has its advantages. One broker might have tight spreads that works great when you are scalping day trading major pairs. Another broker might have excellent pricing for exotic currencies on multi-day type trades. Though this may add to the complexity of managing accounts, you could potentially lower costs across different trading strategies.

You should also stay on top of your actual spread costs over time. Record the spreads you pay based on times of day, market conditions, and instruments used. Monitoring these costs will help find patterns and adjustments to the types of trades you are placing.

Some traders might see that certain currency pairs or market conditions are getting either better or worse executions than what is expected. This assessment of trading pairs or market impact will be beneficial in related to how you adjust mile strategy to keep costs as low as possible.

The goal is not necessarily to track down the lowest spread possible, but to identify and use forex opportunities that best align with the strategy your style of trading will entail. Of course, sometimes the cost of slightly better execution, or minor changes to a platform provide healtier profitability at a consequence of paying slightly higher spreads.

Common Mistakes in CFD Spread Management

Even seasoned traders sometimes fall into expected traps while trading spreads. Understanding those traps allows you to avoid expensive mistakes that can unravel perfectly good strategies.

The most expensive mistake is to ignore spread costs entirely. In many cases, traders become overly focused on market analysis and strategy development, while treating spreads like notional costs. Forgetting about spreads can turn what was an effective strategy into an unprofitable trade - perhaps even at a high frequency.

Take for example a day trader who has identified a solid trading strategy that produces an average of 15 pips a day. If the day trader is executing round trips at a 3 pip spread and trading 3 trades each day, the day trader is really spending 9 pips in round trip costs. Now the net profit for the day trader is only 6 pips, or a 60% reduction in potential profitability!

It's like planning a road trip based on average miles per gallon and forgetting to include the costs of tolls – the tolls don't seem like a lot individually, but they can really affect your budget. Spread transaction costs are no different when you trade.

Another common mistake is examining spreads in isolation, ignoring many other factors around executing trades. Some brokers claim they have ultra-tight spreads, but then whenever the markets move quickly, they are slow to execute your trade, will requote your trade often, or will cause a noticeable delay in their platform. Each of these things can be a hidden cost or hidden negative value that cancels out the spread savings you thought you were getting.

This is similar to how some shopping discounters might offer products at amazing percentages off of retail, but then the shipping costs, the return policy, or even the quality of the merchandise is in question. The savings displayed in a headline might be impressive, but in reality, the total cost of ownership could end up being much more than the other alternatives that have higher prices but better terms.

Trading in high volatility periods, without adjusting for the spread expansion is yet another frequent error. Many traders consider major news or market volatility as a time to trade, without considering the spread will likely expand as a result - which in some cases may vary widely from normal spread levels.

For example, a trader might plan to scalp the EUR/USD around a Fed announcement expecting their normal spread of 1.5-pips. But then the spread might expand to 4-5 pips due to volatility. In that case the planned 3-pips of profit becomes impossible to achieve. Even if they end up getting the same market movement they expected, the expanded spreads will likely eat up the entire value of their anticipated profit.

Engaging in overtrading because of tight trading spreads is a subtle but very costly trap. Some traders will be likely to increase their trading frequency when they discover trading platforms with attractive spreads, because they believe the lower transaction costs allow them to be relatively more active in the market. It seldom works out well; more trades mean more opportunities for loss, and the burden of trading frequently is a challenge in itself that degrades effectiveness as well as quality of decision-making, particularly at some point along the frequency continuum of trading.

Consider someone going to a restaurant with cheap appetizers. It is easy to begin ordering multiple appetizers because they seem cheap. On an individual basis, they may seem reasonable, but if you order too many, the total price will be higher than simply ordering a regular priced centerpiece with none or just a couple of appetizers. Trading more often in tighter spreads can end up being more expensive in total and even produce better chances for larger loss exposures.

Not identifying different spread conditions across market sessions produces mixed performance. A trader may have a strategy that works really well while spreads are tight, but doesn't function as well during a wide spread market situation; however, they tend not adapt their methodology to the wider spread condition.

Position sizing mistakes exacerbate the spread influence. When a trader takes a position too large for their available account size, then it increases all trading costs to the medication of a higher percentage of available capital. Trading with a spread and risking 10% of one's capital on that trade, the spread is likely to cost more relative to trading the same size of position with a 2% at risk with the same trade spread.

Neglecting the harmony of the timeframe and the spread impact can be damaging to your trading strategy. Scalping strategies can tolerate a very small spread, whereas swing trading strategies can tolerate larger spreads. Sometimes traders apply short-term strategy spread amounts to longer-term strategies, or vice versa.

The solution is to determine your strategy's spread parameters in advance. You should know precisely how much spread costs can be absorbed by your approach while remaining profitable. Also consider several market conditions - adjustments to your trading schedule, or the choice of instruments may be necessary.

Doing so avoids implementing an unsuccessful strategy which would result in disruptive and unanticipated loss due to the spread. This duty will help maintain your trading style and performance, irrespective of the trading conditions.

Real-World CFD Spread Case Studies

Analysing actual trading qualifiers is one way of converting accountability into real world profit / loss scenarios. The practical case studies will show optimizing spreads in various fashion, or else costly mistakes, lessons and knowledge experience revisions.

Case Study 1: Professional EUR/USD Day Trading

Sarah, a professional day trader, primarily worked EUR/USD scalping, selecting trades in the London-New York overlap. Sarah was able to identify a pattern baseda strategy that targeted 4-5 pip movement with 70% win rate. Her initial broker offered a very competitive spread of 2.5 pips and when she would compare her performance they showed unacceptable results.

Over the course of 100 trades, Sarah's approach yielded 450 pips in gross profit (90 winning trades × 5 pip average), however, she incurred a combined spread cost of 250 pips (100 trades × 2.5 pip). At a net of only 200 pips, her spread cost accounted for 56% of her theoretical profit.

After reviewing options, Sarah moved to an ECN broker with an average spread of 0.8 pips and $4 commission per round trip. Her spread costs were reduced to 80 pips for a set of 100 trades, with commissions generating around 40 pip equivalents. Therefore, her total transaction costs were 120 pips, which provided her with a net profit of 330 pips, which are 65% more in actual profitability.

The lesson is that for high-frequency traders, improving spreads can greatly enhance performance. Sarah's better execution costs nearly doubled her net profitability without altering her strategy.

Case Study 2: Gold CFD Volatility Trading:

Mike attempted to trade gold CFD breakouts against major economic announcements. The strategy was to quickly enter a position soon after a news release, aiming for movements of 20-30 pips. After back testing on historical data, the strategy looked promising.

During live trading, Mike found that gold spreads tended to widen from 3 pips to 8-12 pips during high-impact news releases. This provided for a 10-pip cost to enter the market as he had anticipated entering at market price. Several opportunities to trade successfully based on price action alone were losses because of the widening of the spread.

After reviewing his results, Mike changed his strategy. He began to transition to limit orders before news releases with a price to accommodate a widening spread. He also began focusing on the few minutes after the news had been released and during the second set of candles when the spread started to normalize itself but there was still some volatility.

This adjustment greatly improved his results. By not trading the worst periods of spread widening, he was still able to capture moves off volatility while not detracting from the potential profitability of his strategy.

Case Study 3: Beginner Multi-Pair Trading

Jennifer, a new trader, was drawn to a broker advertising "spreads from 0.1 pips," and decided she would trade multiple currency pairs in order to diversify. She focused on EUR/USD, GBP/JPY, AUD/CAD, and some exotic pairs, typically completing 2-3 trades each day on various instruments.

After two months, Jennifer's account had a negligible loss, even with multiple profitable trades. Her analysis determined that while all of the major pairs like EUR/USD, would often provide narrow spreads when the market was optimal, her exotic pair trades had spreads of 5 to 15 pips. In fact, diversification increased her cumulative transaction costs significantly. Jennifer also traded outside of major market hours because she worked, and the spreads were wider on even the major pairs.

Her average spread cost, per trade, was nearly 6 pips and she was hoping for 1 to 2 pips. Jennifer reviewed her plan and narrowed it down exclusively to EUR/USD and GBP/USD when she could trade. Soon thereafter, she migrated to a broker with fixed spreads that were consistent with her trading plan, too. This narrow focus cut her average spread cost by over half, while maintaining her diversification by deploying different trading strategies on these two instruments.

Comparative Analysis: Strategy Refinement versus Spread Optimization

A comparative analysis of these cases gives us key lessons regarding spread management priorities. In Sarah's situation, we see how spread optimization can scale an already profitable strategy. In Mike's experience, we learned how to account for changing spread behavior as part of strategy development. Jennifer's story is about the idea that spread costs could limit otherwise good diversification strategies.

The common thread among these cases is the idea that spread management works best when it is integrated into a complete strategy cycle, instead of being considered as an afterthought. Successful traders will incorporate spread costs into their strategy design, will test their strategy approach, by applying their ideas under varying spread conditions, and will regularly assess the performance impact to expected transaction costs.

These real-world examples illustrate that spread management is not simply looking for the cheapest broker. Successful traders do not consider spread management separately from their approach, rather they see it as a task as part of trading when they are trading in the markets.

Conclusion and Practical Tips - Improve Your Profitability Management Spreads

Management of spreads or understanding the impacts of spreads are perhaps one of the most straight forward paths to improving your profitability with CFD trading. Spread optimization not only requires gut feelings of predicting market direction or perfect entry timing, but provides you with clear and tangible, applicable results.

Our findings indicate that spreads are not merely unavoidable costs, but manageable elements that successful traders account for as part of their strategy. Whether day trading major currency pairs or swing trading other indices, the principles are the same: understand your costs, refine your approach, and factor spreads into your results.

Your spread management strategy should align with your trading style and market focus. Day traders should seek a tight spread and trade liquid instruments during active times of day. While swing traders can tolerate a wider spread, they should still account for that cost in their profit target. Position traders have the most flexibility, but they too should not ignore spread cost efficiency.

The practical next steps are simple—determine the average spread you have incurred on your current trades/positions. Find brokers/platforms with better spreads for your specific trading method. Explore various timing strategies in order to take advantage of natural spread patterns that emerge throughout global trading hours.

Use actual metrics to monitor your progress. Look at your average spread cost per trade, per day, and per month. Start comparing your spread costs to your gross profits to understand how your transaction costs affect your outcomes. Using relevant metrics takes the guessing out of your decision-making process, and it can help you make purposeful decisions when selecting brokers and refining your strategy.

It is important to understand that the lowest-spread brokers don’t necessarily have the best overall trading environment (costs). When analyzing a broker's trading costs, remember to incorporate quality of execution, reliability of the platform, and add-on fees, along with the spread. Paying a few pips (or points) more in spread trading with fewer unchecked add-on costs resolves in better overall trading services in net results (benefits).

Most critically, maintain your spread management continually in your trading experience as opposed to a one-time trait. Market conditions change, brokers change, and your approach to trading will develop over time. Periodic assessments of your not through alternative brokers will assure that your spread-management strategies meet your trading needs and opportunity.

Lastly, while traders who have consistent profits might be identified by their attention to details, as spread management, is an example of those details. By building this foundation for a lifetime of trading success, you are actively compounding your profits from across your entire trading standpoint over time.

Are you ready to put your spread management expertise to use? Join BTCDana today and take advantage of competitive spreads across all major currency pairs, indices, and commodities.

Our advanced trading platform has the tools and transparency you need to manage your trading costs and maximize your profit potential. Open your account today and start trading with confidence.