Introduction

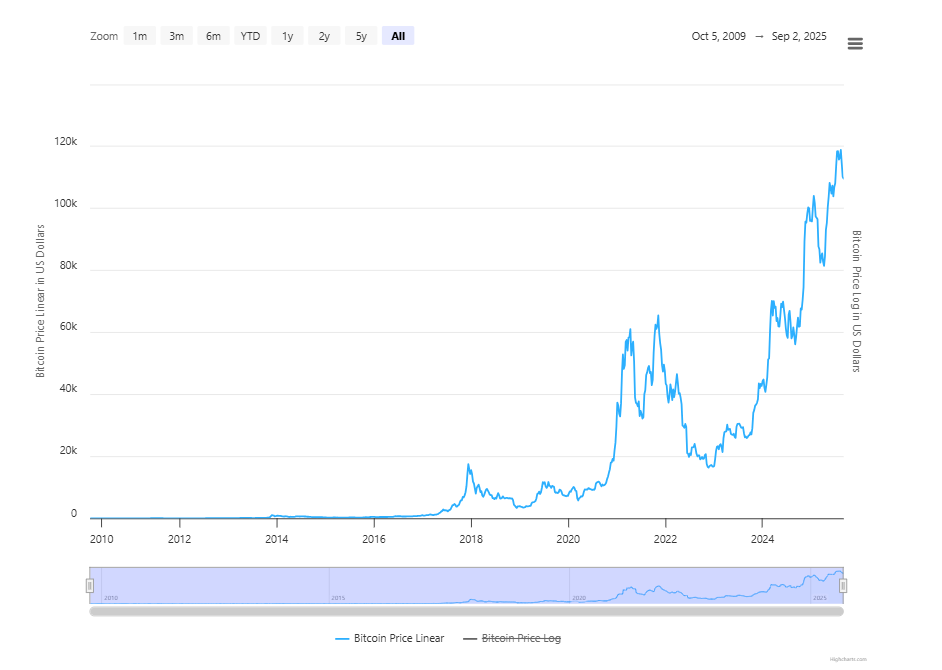

Crypto has gone from internet curiosity to one of the biggest financial stories of our time. Just look at Bitcoin. It started around a few cents and and today, it has skyrocketed to over $108,000. People who threw in just a few dollars early on ended up sitting on life-changing money. If you had saved and bought Bitcoin for $100 back then, today you’d be looking at hundreds of thousands of dollars.

There are a few ways people approach crypto investing:

-

Short-term trading (in and out within hours or days)

-

Mid-term trading (holding for weeks or months)

-

Long-term holding (hanging on for years, sometimes decades).

In this guide, we’ll focus on the third one: Long-term Crypto investment. Long-term holders don’t worry about every little dip. They HODL (Hold On for Dear Life) because they believe the future value will be worth it. For many, Bitcoin has become “digital gold,” a potential hedge against inflation. And it’s not just individuals. Big names like MicroStrategy have stacked billions worth of Bitcoin investment, and Tesla also grabbed $1.5 billion back in 2021. These kinds of moves say a lot about the value of cryptocurrencies.

What Is Long-Term Crypto Investment?

A long-term crypto investment means buying a cryptocurrency and holding it for years (often 5–10 years or more) with the expectation that its value will grow. Long-term investors focus on a coin’s fundamentals (like technology, scarcity, and adoption) and are prepared to hold through volatility as part of their overall crypto investment strategy.

-

Short-term trading: tries to time market ups and downs (high risk, high stress).

-

Long-term investing: holds for years, believing crypto’s core value will outpace inflation and other assets.

Think of it like planting a tree. You water and care for it, and after years, you harvest fruit. Similarly, a crypto holder “plants” a coin today and waits years for gains. Seasoned investors compare it to Bitcoin value investing or buy-and-hold stock investing. HODLers stay calm during crashes, understanding that daily price noise shouldn’t scare long-term conviction.

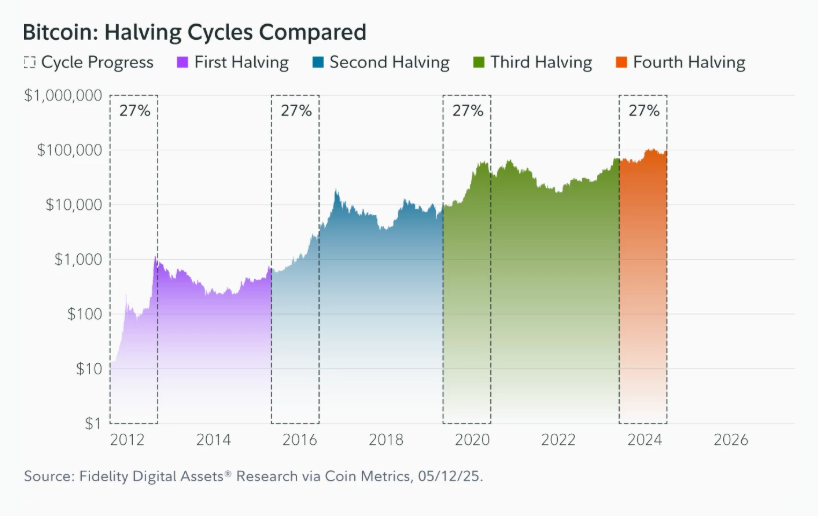

Patience is everything here. Prices can go up and down like a rollercoaster, but if you zoom out, the trend for major coins like Bitcoin value has been upward. Early Bitcoin holders who didn’t sell during the 2010–2013 dips became millionaires years later.

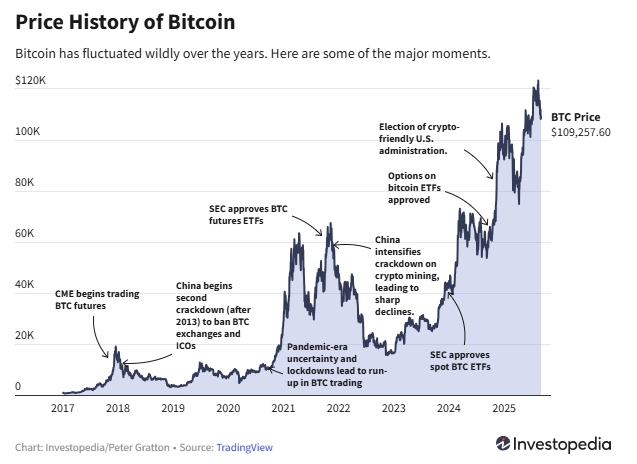

Historical Performance of Crypto as a Long-Term Asset

Cryptocurrency markets have been extremely volatile in the short term, but the long-term investment returns have been very fruitful. Bitcoin and Ethereum have each seen several ups and downs. For instance, Bitcoin’s major bull runs occurred around 2013, 2017, and 2021. After reaching $1,000 in 2013, it fell back, then shot to nearly $20,000 by the end of 2017. Similarly, after the 2017 peak, it plunged (under $4,000 in 2018) and then rallied to an all-time high of around $69,000 in late 2021 and in 2025, it reached an all-time high of $109,000.

This roller-coaster pattern repeats roughly every 4 years, driven by Bitcoin’s halving events (when mining rewards are cut in half). Each halving reduces the new supply. For example, one year after the 2024 halving, Bitcoin’s price was up 31%.

Despite wild swings, the 10–15 year returns for crypto have dwarfed traditional assets. Compared to other assets in the last decade:

-

Bitcoin went from cents to more than $100,000

-

Gold grew slowly (around 120% in 10 years).

-

Stocks like the S&P 500 had steady gains (around 250% in 10 years).

The Core Logic Behind Long-Term Crypto Investment

Several fundamental factors drive their belief in crypto’s future value:

-

Fixed Supply: Bitcoin’s supply is capped at 21 million coins. This scarcity has been a key reason behind its growth, as seen in the Bitcoin historical price trend, which reflects how limited supply has supported long-term demand.

-

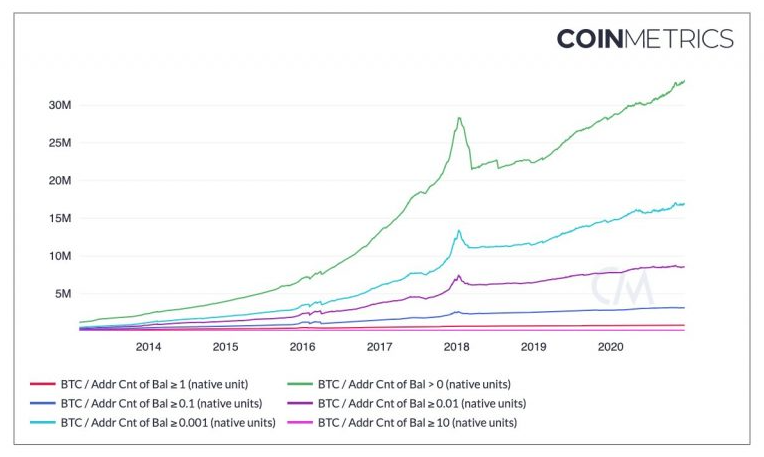

Growing Demand & Network Effects: The more people use crypto, the more valuable it becomes. As crypto usage grows, demand rises. For example, Visa and PayPal now allow merchants to buy, hold and sell crypto directly, which adds to adoption and supports stronger long-term investment returns.

-

Technology & Innovation: DeFi, Web3, digital payments, and now even AI are using blockchain. All these new technology trends push demand for cryptocurrencies higher and influence crypto market cycles over time.

Imagine limited-edition sneakers. If only 100 pairs exist, and demand grows, their value skyrockets. Bitcoin works similarly: with a known finite supply and increasing demand, many expect its price to rise long-term.

Why Crypto Is Suitable for Long-Term Investment

There are several specific reasons crypto can be a compelling long-term holding compared to other assets:

-

Scarcity: Bitcoin is often called digital gold. Its total supply is fixed. In other words, Bitcoin inherits the idea of gold’s scarcity but with digital convenience, as it is easier to store and transfer.

-

Inflation Hedge: Many investors treat crypto as a hedge. During periods of high inflation, crypto’s fixed supply can preserve wealth. For example, El Salvador made Bitcoin legal tender in 2021 to protect its economy against dollar inflation. This supports the idea of a Bitcoin inflation hedge in uncertain economies.

-

Technology & Use Cases: The crypto ecosystem keeps adding real-world uses. Ethereum’s ability to run smart contracts has led to booming sectors like decentralized finance (DeFi) and NFTs. As these technologies mature, holders of these platforms’ tokens may benefit, making Ethereum investment increasingly attractive.

-

Institutional & Regulatory Recognition: Big players are warming up to crypto. Some countries are planning digital currencies too (CBDCs). The broader acceptance by institutions, exchanges, and even some governments suggests crypto is maturing and adding strong long-term investment value.

In summary, crypto combines scarcity and innovation in one package. Limited supply, digital nature, and integration into modern finance make it suitable for long-term holding.

Crypto vs Traditional Assets

How does crypto stack up against familiar investments?

-

Bitcoin vs Gold: Scarce and a good hedge, but Bitcoin is easier to store and transfer. Importantly, Bitcoin’s historical returns have far outpaced gold’s.

-

Crypto vs Stocks: Stocks depend on a company’s profits, dividends, and growth. Crypto is backed by adoption and network value. Stocks are steady, crypto can be explosive.

-

Crypto vs Real Estate: Real estate is tangible but highly illiquid and localized. Crypto is 100% digital and trades globally, 24/7. Land or buildings offer stable rents, but crypto can offer much higher returns.

It’s like game money vs. physical game cards. The digital coins are easier to send and trade than cards, but both can hold value.

Compared to all traditional assets, crypto’s liquidity and innovation stand out. And no other asset class ties together new tech trends (AI, blockchain, DeFi) with finance, which strengthens the case for crypto vs traditional investment in today’s markets.

Risks and Mindset of Long-Term Crypto Investment

Before we get too excited, let’s be clear. Crypto is risky. Even long-term holders have to deal with some tough challenges.

-

Price Volatility: Crypto prices can swing dramatically. For example, Bitcoin fell about 84% from late 2017 ($20k) to late 2018 ($3k). However, Bitcoin has matured structurally, so short-term price moves matter less than long-term trends.

-

Regulation: Governments are still figuring out crypto rules. Some countries embrace it, while others ban it. Sudden regulatory crackdowns can spook markets.

-

Technical Risks: If you lose your wallet key, your money is gone forever. Hacks on exchanges also happen.

-

Psychological Challenges: Crypto markets can trigger FOMO during rallies and panic during crashes. It takes discipline to stick to a long-term plan.

In short, combine strong research with the emotional resilience to hold through storms.

Crypto Portfolio Strategy for Long-Term Investors

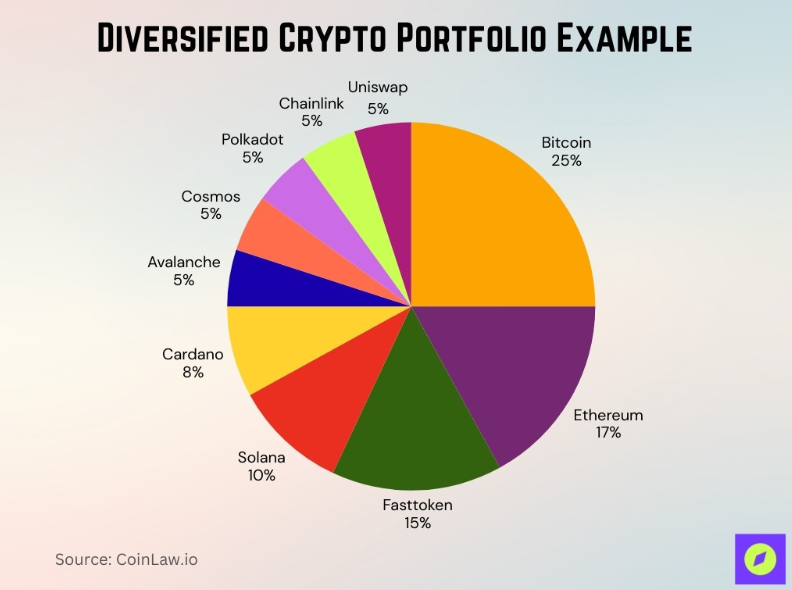

Building a long-term crypto portfolio involves balancing risk and opportunity. Here are some common approaches:

-

Major coins first: Most long-term investors focus mainly on Bitcoin (BTC) and Ethereum (ETH). They are the most established and widely used.

-

Conservative approach: 80% BTC/ETH + 20% cash or stablecoins.

-

Aggressive approach: 50% BTC/ETH + 50% altcoins.

The idea is simple. Make sure your core is strong, then take smaller bets on newer coins.

Another strategy is Dollar-Cost Averaging (DCA). This means investing the same amount every week or month, no matter the price. It removes the stress of trying to “time the market.” Beginners usually find DCA the easiest and safest way to build a position over time.

In practice, many long-term holders use DCA for major coins and an occasional lump sum for extra savings. Think of saving part of your allowance every week. After 5–10 years, it adds up, and sometimes the value even grows if you’ve invested wisely.

Step-by-Step Guide for Long-Term Crypto Investment

If you’re a beginner ready to get started, here are the simple steps:

-

Choose a Reliable Exchange: Start with a well-known crypto exchange or app that supports your country (examples: Coinbase, Binance, Kraken, or a local regulated platform).

-

Start Small (1–5% of Your Capital): When beginning, only use a small portion of your total savings for crypto. This lets you learn without risking too much.

-

Set Long-Term Goals (5–10 years): Decide your horizon. This mindset helps you endure volatility. You might chart out financial goals and earmark crypto as part of that long-term plan.

-

Use Secure Storage: Once you buy crypto, plan how to store it. For small amounts, leaving crypto on an exchange is convenient but riskier (exchanges can be hacked). For larger holdings, transfer your coins to a cold wallet (hardware wallet or paper wallet) where you alone hold the keys.

-

Research and Stay Informed: Learn basics about crypto (blockchain, wallets, major coins). Follow reputable news (CoinDesk, official blogs, etc.) to stay updated.

By following these steps, you’ll be following a prudent strategy. Over long horizons, consistency and security matter more than trying to buy/sell at perfect moments.

Future Outlook of Long-Term Crypto Investment

Looking ahead 5–10 years, several trends suggest why long-term crypto investing remains relevant:

-

Wider Adoption: More countries and companies are exploring crypto and blockchain. Already, 130+ nations are studying or launching central bank digital currencies (CBDCs) as digital versions of their fiat.

-

Web3 and Technology Growth: The crypto/Web3 ecosystem is still in early stages. We may see new breakthroughs: decentralized finance (loans, insurance on blockchain), tokenized assets (real estate and stocks on-chain), NFT-based ownership, and AI-driven crypto tools.

-

Inflation and Macro Factors: With global money printing and inflation pressures, some investors will continue to view crypto as an alternative store of value. If large economies (like the US) face currency devaluation or debt issues, Bitcoin and other deflationary tokens might attract capital.

-

Expert Predictions: Some analysts envision dramatic growth. For example, ARK’s Bitcoin model projects a base case of around $710,000 per BTC by 2030 (based on broad adoption assumptions). Others forecast even higher. These are just models with many assumptions, but they underscore the potential scale of crypto’s future.

That said, nothing is guaranteed. Always base decisions on updated research. But many experts agree: cryptocurrency will likely be part of the financial system’s future.

Conclusion

In summary, Long-term crypto investment is not about chasing quick wins. It’s about believing in the future of digital money and being patient enough to hold through the ups and downs.

To recap:

-

Crypto like Bitcoin and Ethereum have shown massive growth over the past decade, with many investors confident in Bitcoin's future value.

-

Their scarcity and adoption make them strong candidates for long-term investment.

-

Risks are real, but manageable with the right mindset.

-

A simple portfolio strategy and DCA can make it easy even for beginners, especially when following a clear digital asset investment guide.

If you’re ready to start your journey, explore BTCDana’s platform where you can learn, practice, and invest safely. Build your habits now, and let the future growth of digital assets work for you.