Why Understanding Order Types is the First Step to Smarter Trading

You may think ordering any type of trading order from a broker is similar to sitting down to eat at a restaurant. You can simply walk up to the counter at the restaurant and say "I will take any burger you have ready right now" (that's a market order), or you can say " I want this premium burger, but only if I get it for less than $15 and I'm willing to wait" (this is sort of like a limit order). Your restaurant experience hinges on how you place your order, and the trading experience is no different.

A trading order is simply an order you give your broker to let him know how, when and at what price you want to buy or sell an asset. Similarly, you can put on a market order to buy a forex pair like EUR/USD or buy a CFD on a commodity or buy a stock on the NYSE, but these orders are your primary tool for taking control of risk and for timing your market entry and exit.

Let's imagine two traders observing the same intense swing in the market. Sarah is a novice trader so she panics and presses "buy now" at market price. On the other hand, James is a professional trader and had already created several conditional orders that triggered when the price he preferred had been reached. I wonder who did better?

Order types are not just different ways to enter trades: these are your control mechanisms in unpredictable markets. They enable you to trade when you are asleep, they save you from emotional trades, and they help you execute your trading plan when fear and greed move in.

The amazing part about these order types is that no matter what market you are trading, there is a way to control your entry on the chaos. The same principles learned trading forex during volatile London sessions will also serve you well trading technology stocks during earnings season, and CFDs on crude oil during a geopolitical event.

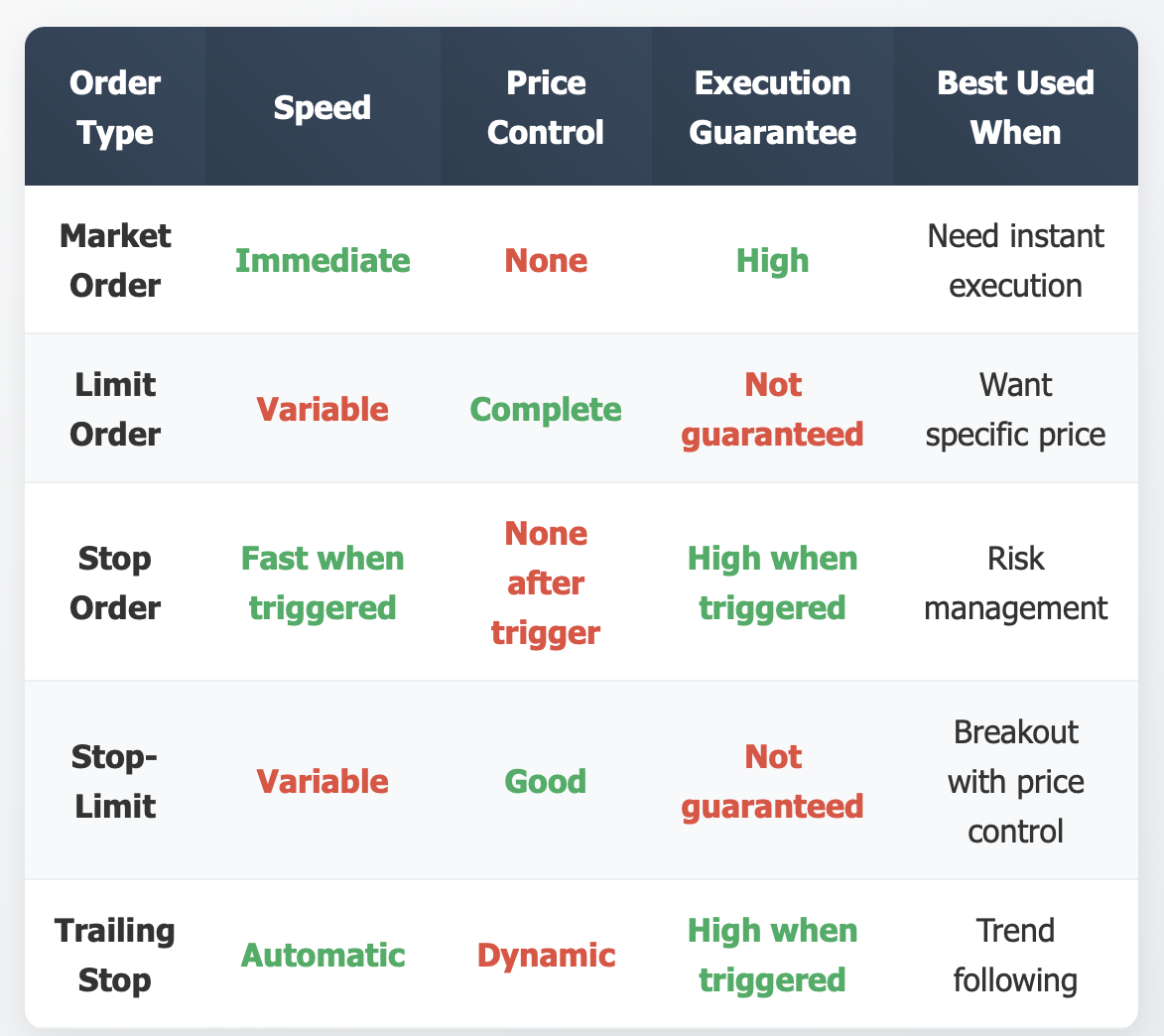

Market Orders: Quickest Way to Enter the Market

A market order is the closest trading equivalent of "I want it now, whatever the price." When you submit a market order, you are instructing your broker to fill your trade immediately at the best price available in the market.

Imagine that you are watching EUR/USD at the announcement of a major ECB news. The EUR/USD pair is trading at 1.0850, and suddenly there is some very positive news that breaks. You want to attack and get into the trade because you feel that euro is going to explode, so you enter a market buy order. Within a couple of seconds (or possibly milliseconds depending on your broker), your position gets filled. You may get filled at 1.0851 or 1.0849 and possibly even 1.0855 if the market is moving that quickly, but at least you got in the trade.

This speed is great, however execution speed comes with a downside. This downside is called slippage. Let's say you are trying to buy 100,000 units of EUR/USD at 1.0850, but the market only has 50,000 units to fill at that price. Your broker will fill your first 50,000 at 1.0850 and then your remaining 50,000 at the next best price maybe 1.0851. You have your full position as you wanted, but an average price that is slightly different.

If you're a novice trader, market orders are usually the easiest option to grasp. It is essentially like urgent clicking "buy now," when using Amazon. It's a natural progression and simple process. However, there are times when market orders can be used, and experienced traders learn to use them strategically. Generally, experienced traders will use a market order when volatility is high, and the priority is speed, rather than the exact price.

Market orders allow you to have one assurance, and that is filled execution. If there is some liquidity in the market (and there is always liquidity for major pairs and stocks), your order is filled. The negative side, is you lose control of your entry price when you do not wave this through the markets, particularly when it is fast moving and thin.

You should use market orders when you require to enter or exit a position quickly, you are trading in highly liquid markets, or the price movement you are getting is more important than saving just a few pips or cents on your entry.

Limit Orders: Pick Your Entry price

If market orders mean "I don't care what I pay", limit orders represent an auction-type process by which you set your maximum price. A limit order allows you to specify precisely the price you want to execute your trade at, and you will only receive execution if the market can reach your specified price.

There's two kinds of limit orders. A buy limit order defines the maximum price you're willing to pay for an asset. For example, if the price of Tesla stock is currently at $200 and you believe it's overpriced but would be willing to buy it at $180, you could place a buy limit order at $180, and your order will be live until you either get shares once Tesla drops to $180 or you cancel the order yourself.

A sell limit order does the opposite - this is the minimum amount you're willing to accept to sell something you already own. For instance, if you bought Bitcoin at $25,000 and want to take profits when it topped $35,000, you would set a sell limit order for $35,000. If the price of Bitcoin reaches your sell limit order, your position will automatically close at your target price.

Professional traders love limit orders to catch retracements. Here's an example; GBP/USD is currently in an uptrend at 1.2500, and an experienced trader might place a buy limit order at 1.2450 for the retrace to continue up. Instead of watching charts all day, they can let an order do it for them.

If you are a beginner, think of limit orders as waiting for your favorite sneakers to go on a clearance sale. You are looking to buy them at a specific price, and you are willing to wait for that price. Sure, you may miss out if they never get to that price, however, when they do get to that price, you get what you wanted at your planned price.

The main benefit of a limit order is pricing, you are never going to pay a penny more (or receive a single cent less) than what you wanted to pay. The downside, is your order may never get filled, typically in an up or down trending market where the price just moves away from your limit level.

Limit orders can be very advantageous when you're trying to plan entries at some technical level, if you are trying to take your profits at specific planned target prices or if you just don't want to chase prices in a volatile market.

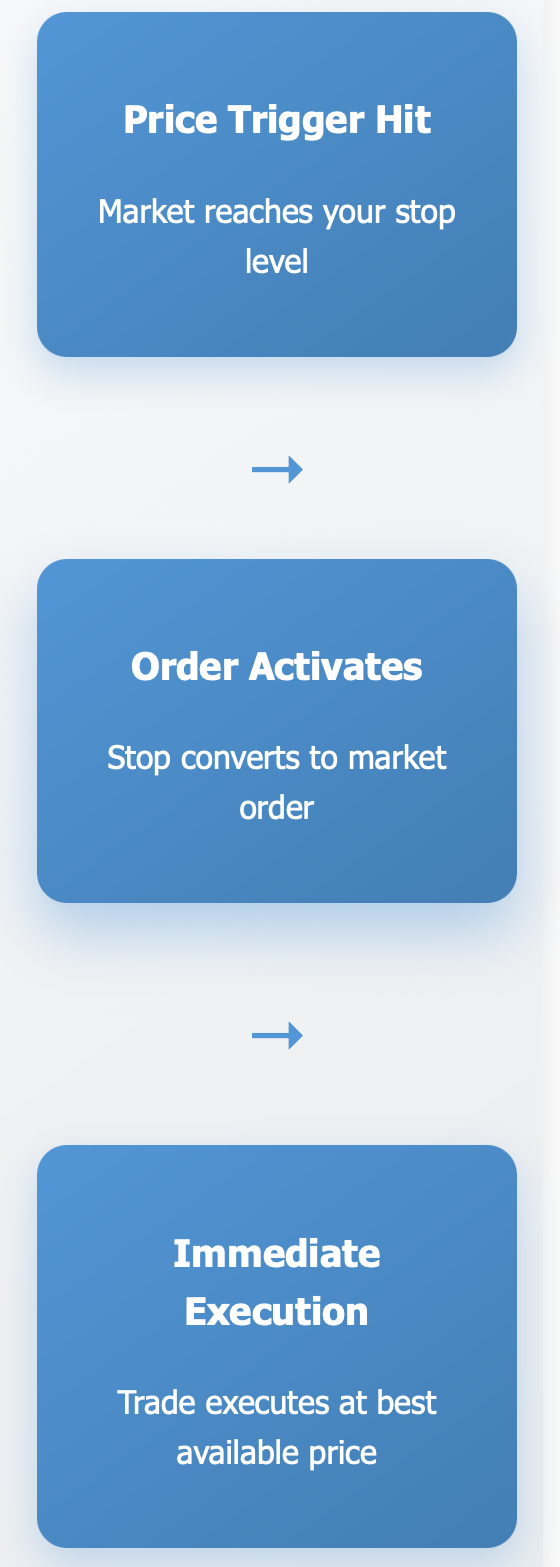

Stop Orders: Protecting Yourself with Triggers

Stop orders are like smart alarm clocks, they only go off when something specific happens in the market. Limit orders are executed only when prices go in your favor. Stop orders "trigger" when prices are moving against you (to protect you) or for when the price "breaks out" of important levels (for momentum trades).

A buy stop order is like a buy limit order, in that it is above the current market price and triggers a buy when the current market price reaches that level. It sounds a bit strange at first, but we use buy stops as breakout traders.

If you wanted to trade gold above $2000 and having the current market price was $1950, you could place a buy stop order at $2001, with the expectation that your order only gets activated if price breaks out above $2000.

A sell stop order is like a sell limit order, in that it is below the current price and gets triggered once current price reaches that level. Sell stop orders serve as a foundation for stop-loss orders. For example, if you owned Apple stock at a price of $150, and you could only afford to lose $10. In this case, you would place a sell stop at $140. If Apple came down to $140, then your stop would trigger to sell your position and limit your loss to $10.

Think of stop orders as relatively similar to your alarm clock. An alarm clock only rings after 7 AM AND when it's raining. A stop order can only trigger under certain market scenarios.

Here's a professional example. A forex trader goes long EUR/USD at 1.0800 and expects the pair to rally. The trader places a sell stop at 1.0750 to limit any downside risk. They also place a buy stop at 1.0900 in case the pair continues the breakout to add to their position. The stops allow the trader to manage risks and profit from momentum without having to stare at their charts all day.

The beauty of stop orders is they are automated. They turn your trade rules into automated actions. The challenge is stops can trip during temporary price spikes (referred to as stop hunting) or on price gaps, which can cause the stop to execute at a worse price than expected.

Stop orders are paramount to risk management, breakout strategies, and any scenario that you want the market to "prove" a move before pulling the trigger.

Stop-limit orders: A way to manage risk while still being price specific

A stop-limit order functions like having a very smart assistant, where you say "only act under these conditions, however when you act, please only act given my exact conditions about price." Stop-limit orders contain the trigger mechanism of a stop order with the price control of limit orders.

Here is how stop-limit orders function. You determine 2 prices, the first being the stop price (the trigger), the second being the limit price (the maximum you're willing to pay, or minimum you're willing to take). When the market reaches the stop price, your order is activated, but only as a limit order at the limit price you specified (as opposed to a market order).

Going back to our Bitcoin example from earlier, say Bitcoin is trading at $28,000 and you only want to buy Bitcoin if it exceeds $30,000, but also only if you will pay a maximum of $30,200. You could set up a buy stop-limit order with a stop price of $30,000 and a limit price of $30,200.

Provided that Bitcoin passes $30,000 in price increases to $30,200, there will be an order trigger stop-limit mechanism where, you will only be buying shares if there are any at $30,200 or better price (less than $30,200).

This gives you more control than a normal stop order. However, you now have the risk of your order not executing. If Bitcoin gaps up from $29,800 all the way to $30,500, your stop activates at $30,000, however since the market is then trading above your limit of $30,200, your order remains unfilled while Bitcoin runs away from you.

Think of it like booking online concert tickets. At 10 AM, when the tickets go on sale (that's the stop price), your alert goes off notifying you, but you will only buy the ticket if the price is under $100 (that's the limit). If the tickets open at $150, you are not buying anything, even though you were ready to buy the ticket.

Stop-limit orders are the preferred method of professional traders when they want to take part in a breakout but still want the protection against catastrophic slippage in price. Furthermore, stop-limit orders are very helpful in markets that are less liquid or when news is breaking fast and regular stop orders are executing at horrendous prices.

The choice is clear: greater control over execution price, but lower assurances the order will actually be executed when triggered.

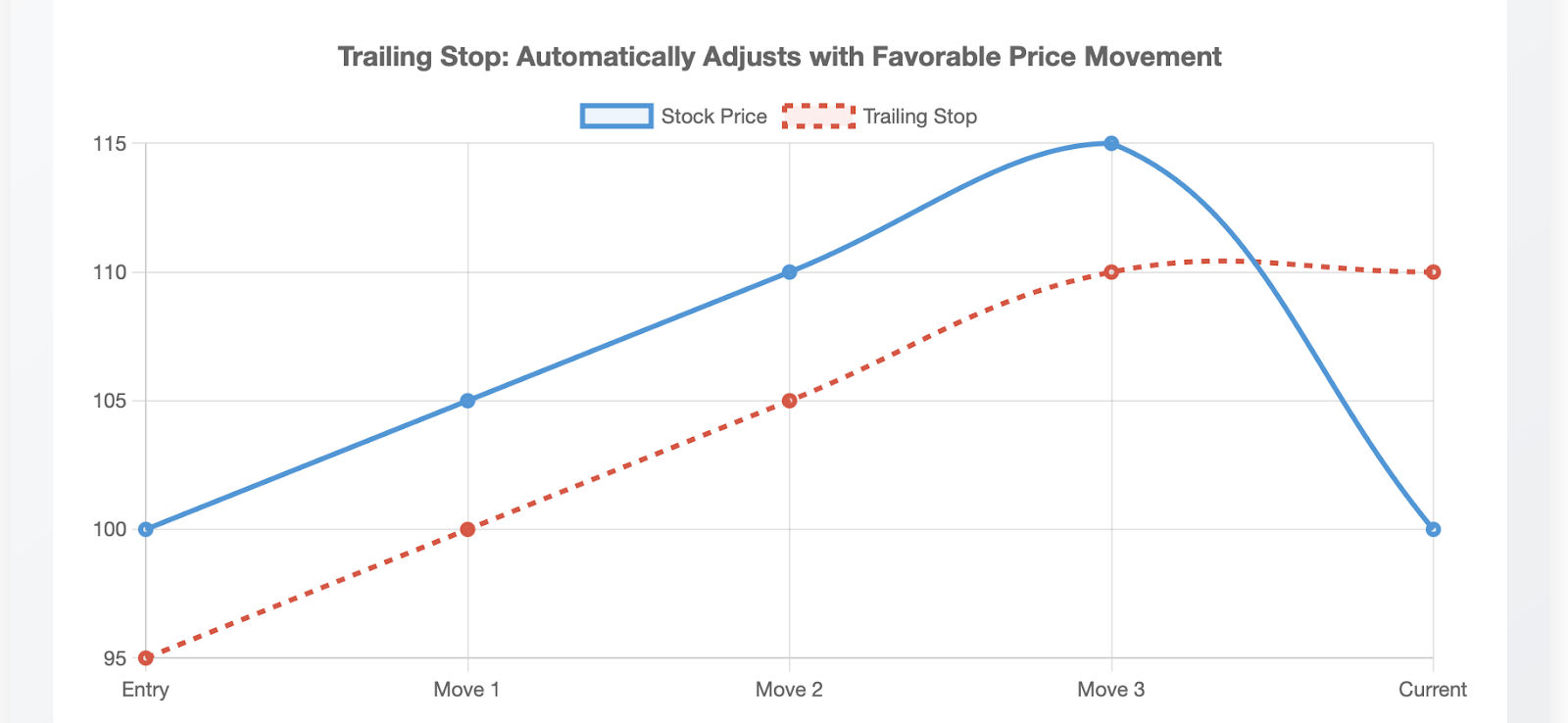

Trailing Stop Orders: Protecting Your Profit Ability When the Market Moves

You can think of a trailing stop as a safety net, adjusted to wherever you go on your profit ladder. Regular stop orders are one price level. Trailing stops adjust depending on how far the market moves in your favor.

Here’s how it works. Let's say you are long a stock at $100. You put a trailing stop in at $5 below the market. When you put that in, the stop becomes $95. If the stock goes to $110, the trailing stop becomes $105. If the stock goes to $120, the trailing stop becomes $115.

The trailing stop only moves in your favor: as long as the stock continues to move in your favor, the stop moves only up. If the stock drops from $120 to $115, your stop would remain at $115 and will still trigger, locking in a bulk of your profit.

Let's imagine you are a professional gold trader. You go long at $1900 with a trailing stop in at 50 pips below the current price. As gold climbs to $1950, the trailing stop moves up to $1900 (breakeven). At $2000, the stop is at $1950. If gold does a sudden reversal and drops to $1950, the trailing stop triggers a block very profitable $50 profit instead of potentially giving up the entire profit from $1900!

Firstly, if you picture playing a video game where the safety checkpoint is constantly moving forward as you advance through the game, trading utilizing trailing stops is like this at some level. You're never going back any further than your last checkpoint should you make a mistake later in many cases.

Trailing stops essentially remove one of the greatest psychological challenges in trading - deciding when to take profits. They allow you to ride winning trades without having to face the constant and ongoing decision of whether to take a profit or not, you literally can set them and forget them and allow the market to decide when your winning run is over.

The major benefit is protection from profit taking without having to constantly be monitoring. You don't need to guess the perfect price point to exit, the trailing stop will automatically trail the market price as long as the trend remains in your favour.

The main downside is that with trailing stops, there are potential for profit taking during normal market pullbacks that can also cut your trade short. The performance of trailing stops is always best in trending markets and can be frustrating in choppy, sideways market conditions.

Most trading platforms allow you to set trailing stops as either fixed dollar amounts or percent amounts, depending on the amount of volatility of the asset analyzed. A trailing stop of $1 could work on a $20 stock, however you'd want to have it a much larger amount for a $200 stock.

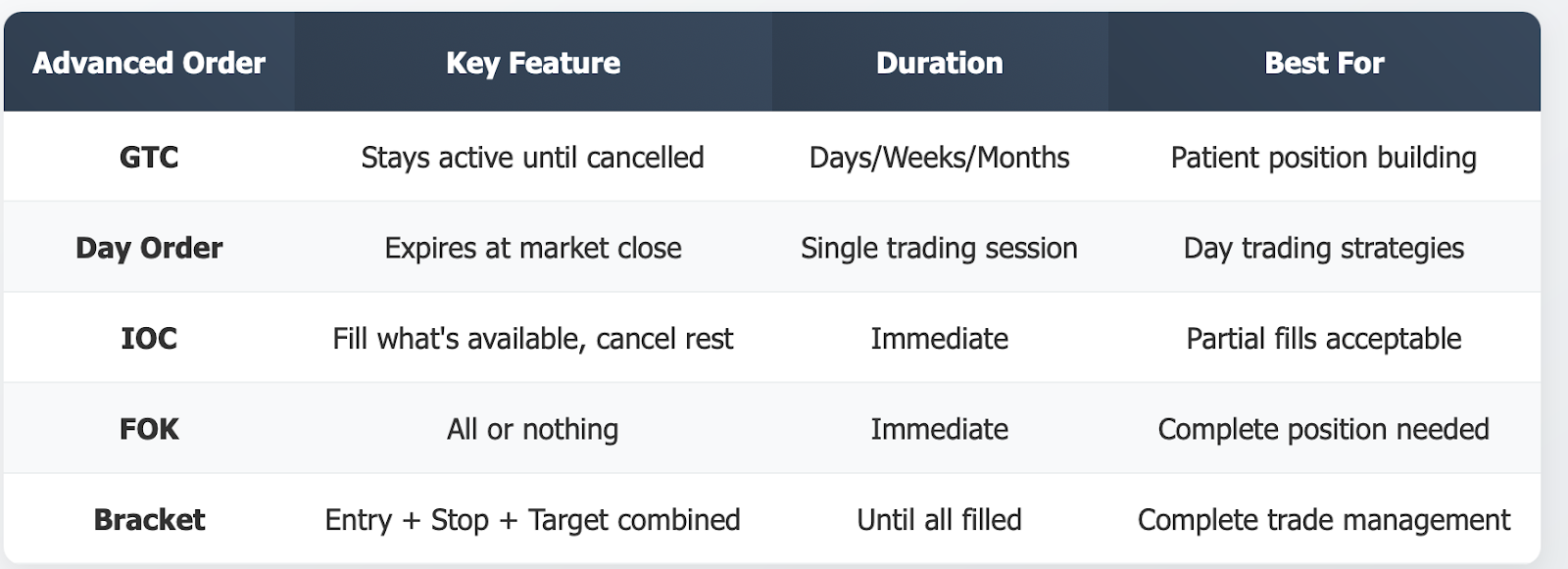

Advanced Order Types: Moving Up the Order Food Chain

Now that you've conquered the standard order types, there are a lot of advanced order types that can bring you additional precision and efficiency to your trading toolbox. They are not better than standard orders, but they do solve different problems that active traders face.

Good Till Canceled (GTC) orders will remain active until you cancel them manually or they execute. GTC orders can remain in the system for days, weeks or months - while day orders automatically cancel at the end of the day when the market closes.

GTC orders are ideal for long position traders looking to buy solid companies during the next major price dip, whenever that may occur. Just remember that GTC orders live forever and to review them from time to time, as the truly forgettable GTC orders can turn into surprises orders for many traders months later when they forgot the GTC order was still active.

Day Orders expire automatically when the trading session ends, which is why day orders are perfect when attempting to get an executed price during the active hours of the market - but ideally without having that order hanging into the evening market session overnight. Day traders love them, as they save a trader, an accidental overnight position.

Immediate or Cancel (IOC) Orders execute as much as possible as soon as possible and cancel the rest. For example, you want to buy 1,000 shares of stock A at $50. However, when you place your IOC order, only 300 shares are available to be bought at that price. An IOC order would buy 300 shares and cancel 700 shares. An IOC order is basically saying "give me what you can right now, but don't make me wait for the rest."

Fill or Kill (FOK) Orders is the all-or-nothing choice. Your entire order must be executed immediately and completely, or your order is cancelled without any partial fills. Think of it as an "all-or-nothing shopping deal." If the store cannot give you all five of whatever you wanted at the sale price, why take any of them?

All or None (AON) Orders are similar to FOK Orders, but they are less strict on timing. Your order must be executed in full when it is possible to execute your order, but the order can wait in the system until enough shares can be offered. AON orders are useful when you need to establish a specific position size and partial fills would blow up all your planning and lead to misguided trading strategy.

Bracket Orders are the utility players of order types. Bracket orders allow for a primary entry order, and pre-set stop-loss and take-profit orders together. A swing trader is able to place a bracket order to buy XYZ stock at $50, and set a stop-loss order at $45 and take-profit target order at $60. Once the entry is filled at $50, both exit orders are activated automatically.

Advanced orders provide increased flexibility and can be an automation to more complex strategies. They are however for traders that have particular situations to fulfill and/or specific tasks to accomplish that cannot be performed with just basic orders. Do not feel compelled or pressured to utilize them until you have advanced past your trading fundamentals, and you have identified specific situations in which an advanced order will be helpful.

Choosing the Right Order Type: Practical advice for Traders

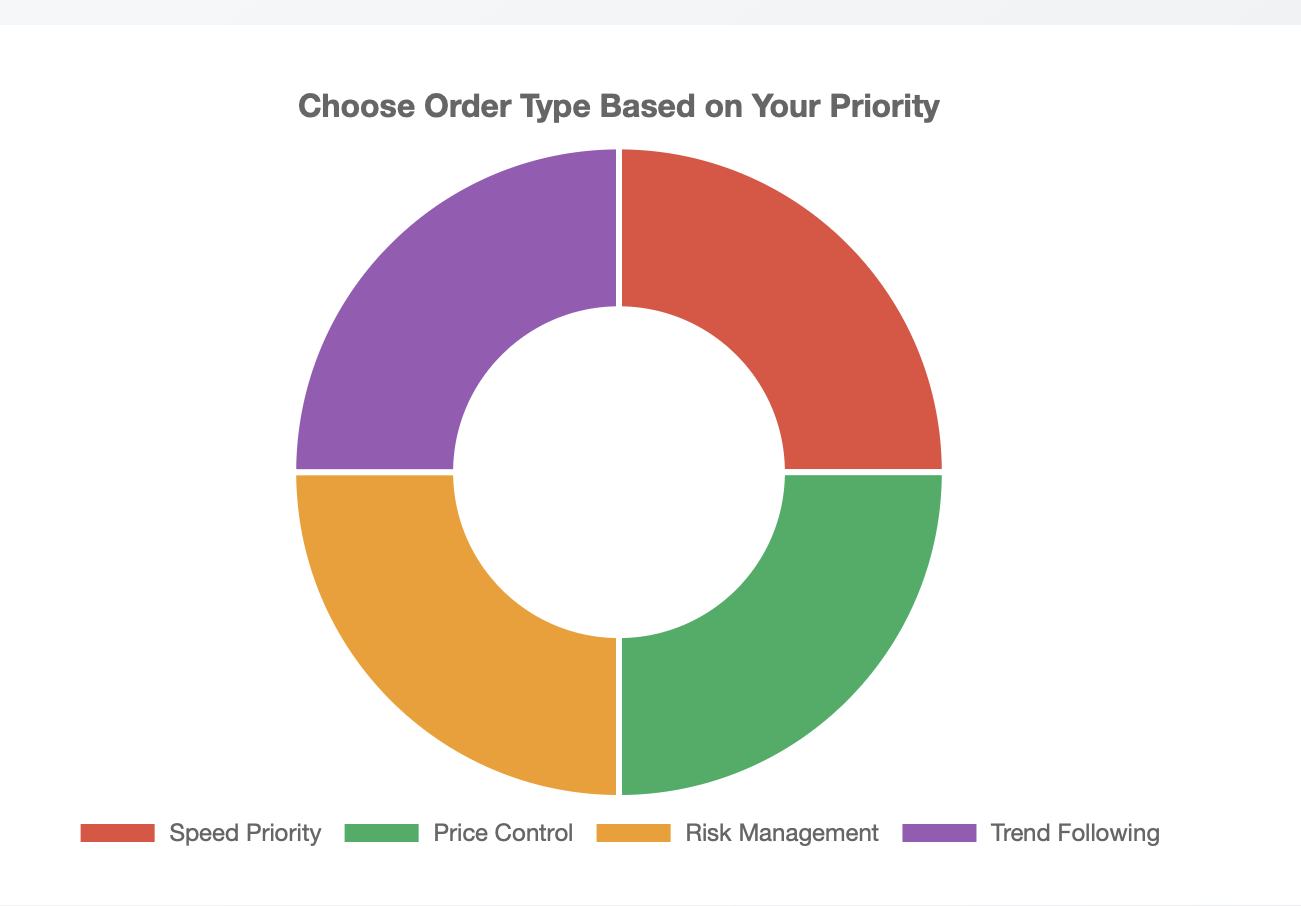

Choosing an order type is not about the "best order type" but rather about picking your tool based on the specifics of the situation and your objectives. Here is how to conceptualize the decision process.

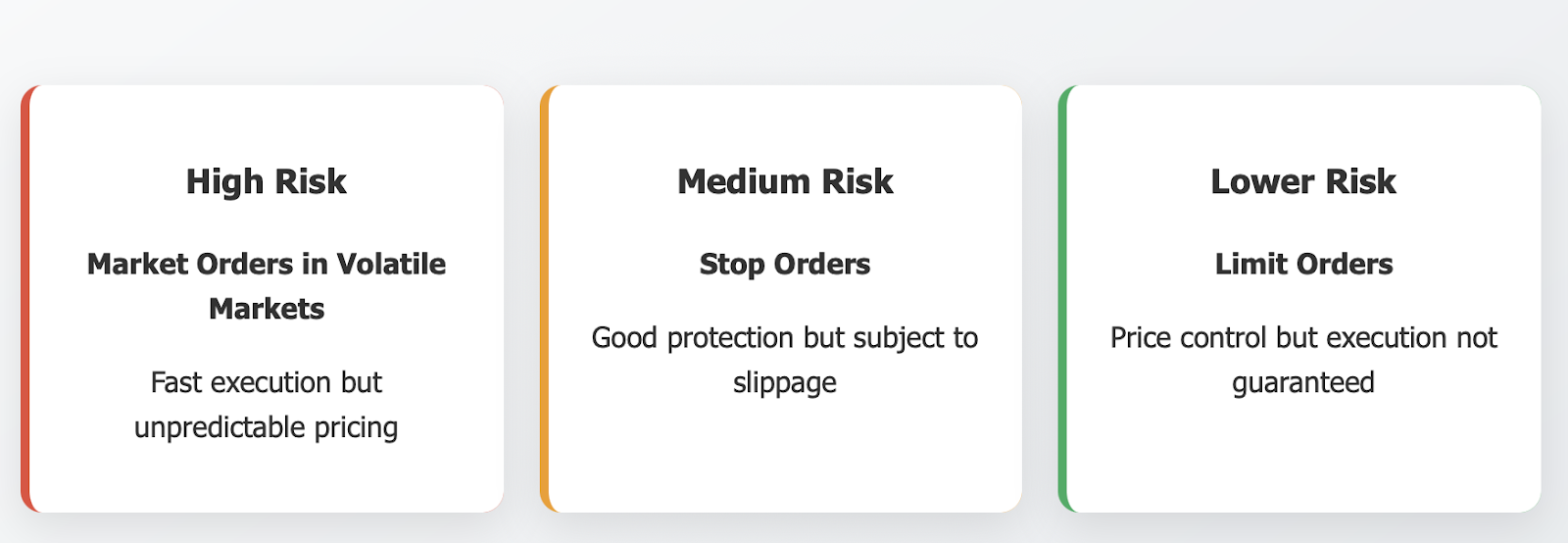

Speed vs. Control Trade-off: Market orders are the best choice when you need immediate execution and price action is more important than a few pips or cents. For trades with a price level that you want to hit and you can be patient (or miss out entirely), limit orders allow you to control your price better.

Market Conditions Matter: Markets that are volatile and moving quickly (for example, strong news events) may not have limit orders filled, and you could miss price improvements. Markets that are quiet and in a range may produce worse prices using market orders when you could have just waited a couple of minutes for a limit order.

Your Trading Style: Scalpers and news traders rely on market orders as they must consider speed. Swing traders and position traders are focused on entries based on technical levels and consider limit orders to be a better option for controlling price. Trend traders love trailing stops so they can let profits run.

Common Beginner Errors: New traders use market orders because they seem easier, then wonder why their entries are worse than anticipated after they fill. They will also set their stops way too tight and get shaken out of good trades on normal volatility. Start with wider stops than you think you need and focus in as you get more skilled.

Fast Decision Process: Ask Yourself:

-

Do I need to make the trade now, or can I wait for a better price?

-

Do I worry more about missing the trade or getting a bad price?

-

Is this a liquid market, and I don't expect the order size to be an issue?

-

Do I have a clear plan for taking profit as well as cutting losses?

Risk Management Comes First: No order type is going to save you from bad risk management. With market orders, limit orders, or complex bracket orders, you should always know your maximum loss before you ever enter a trade.

The best traders will use different order types for different uses. They may use market orders for quick scalps, limit orders for methodical entry, and stop orders for protection or trailing stops for radical trades. Flexibility and situational awareness is more important than being convinced of one preferred order type.

Start simple, and become proficient with market or limit orders first, and then add order types as necessary in your trading.

Conclusion:

Knowing order types is not only about becoming a more proficient trader. It can also become a way to manage one's complete destiny in the trading world. The difference between using a market order versus a limit order inherently is a small difference in every single trade; but over hundreds or thousands of trades, the proper order use will spell the difference between consistent profitability and perpetual losses.

Every successful trader in the spectrum of day traders betting on pip movements and scalping the forex market during the London session to longer term buy-and-hold investors planning to grow their stock portfolios with cash flow (with dividends) relies on the use of order types to implement their trades and their strategies, while managing their risk.

The order types, representing two-dimensional buttons to press in your trading platform, also serve as a three-dimensional evolution of trading. Order types are an expression of your ideas for trading and turning those ideas into actual market life.

With time and commitment, as you grow from indiscriminately pressing both buy and sell buttons, to strategically thinking through order types of trade, represents another step in the development of your trading. You will no longer be so reactive to movements in the market. You will be more proactive in the sense of how you want to engage with the market.

As you're learning to trade, first, take the time to truly understand market orders (trades executed immediately) and limit orders (trades at the price you want, cool). Next, you can add stop orders for protection (exit protects you from big loss), and then begin to play with other advanced types of orders (stop-limit, AON, etc.) as your trading strategy gets more complex.

The most important point is to practice first; practice with demo accounts first. Most brokers have paper trading features where you can practice as many different order types as you'd like without trading your real money.

And, remember that the goal of this is not to use all the order types available to you - the goal is to use the right order type for each unique situation. This means knowing the basics, knowing where the trade-offs are, and letting your trading strategy take you to the right order type.

The market will always be there, full of opportunities. You are simply engaging it on your terms, and you're choosing which tools are right for whatever situation you've encountered. Order types are among your most important trading tools; make sure you learn them, and they'll serve you in all of your trading endeavors.

Ready to put your order type knowledge into practice? Join thousands of traders who've discovered the power of precise order execution on BTCDana.com.

Start with our risk-free demo account and experience the difference professional-grade order types make in your trading results.