Introduction: Why Quote Currency Matters

Upon first reviewing forex trading, you'll notice something strange: currencies always come in pairs. You never actually buy "euros" or "dollars" in isolation. You're always exchanging one currency for another. This pairing concept underpins the entire forex market and all it takes to understand it is recognizing what a quote currency is.

Think about it like this: you go down to your local supermarket to buy a soda. The soda is clearly what you want (let's call that the "base"), but your local currency is what you pay (the "quote"). If you want a soda, but you never know the price in your local currency, you won't know if you have to spend too much or a little for it. The same logic applies to forex pairs.

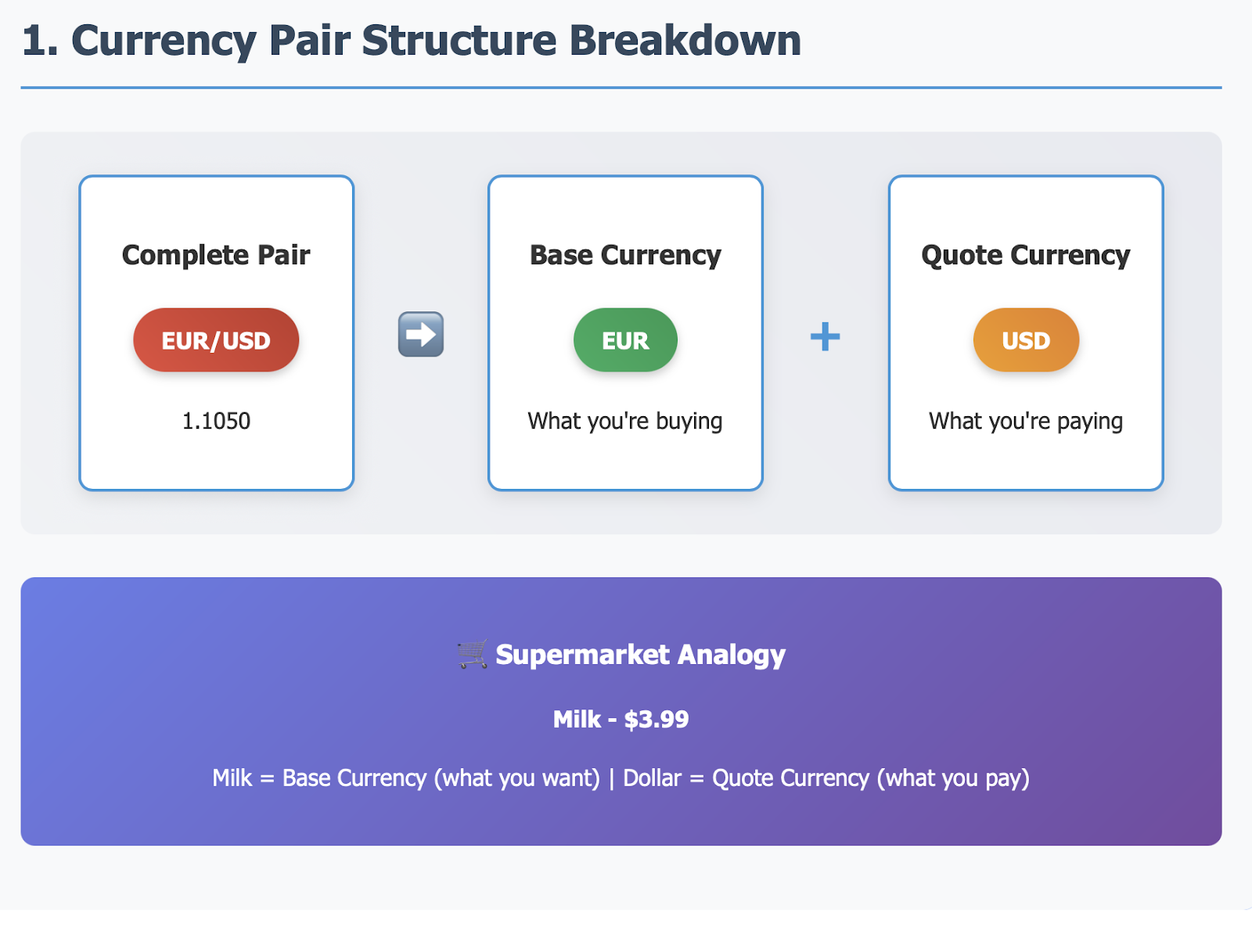

All currency pairs consist of two currencies: a base currency (which is the first currency) and a quote currency (the second currency). In EUR/USD, EUR is the base currency and USD is the quote currency. The quote currency tells you how many US dollars it takes to buy one euro. If we didn't have a quote currency, there would be no way to measure value, or even make trading decisions.

The quote currency is more than a technicality, it is the underpinning that makes forex trading possible. If you are looking at, EUR/USD, GBP/JPY or any other market, the quote currency tells you the "price" of the base currency. Understand this and you have taken your first true step to being knowledgeable about forex trading.

History & Background of Quote Currency

The paired currency system we use today did not happen overnight. It has developed over years of international monetary policy & the need for global trade. With each of that history we can start to understand why we quote currencies as we do.

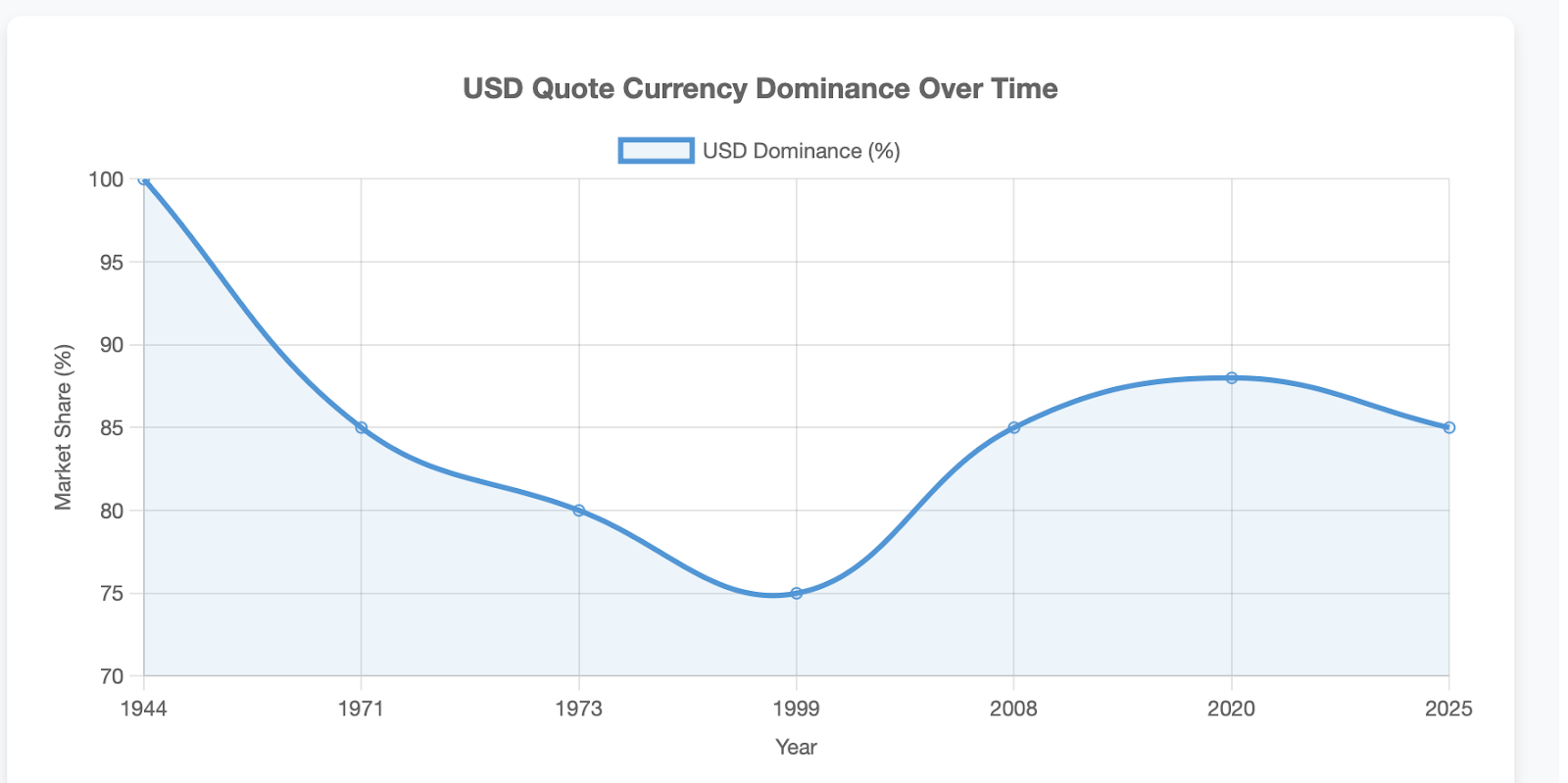

In the time of the Gold Standard, most currencies were gold- backed. This gave us a common reference point, although it was inflexible and often impractical for daily trading. When Bretton Woods was established in 1944, the US dollar became the world’s reserve currency and all other currencies essentially pegged to the dollar, this was an important point for the dollar’s hegemony in global finance.

After the collapse of Bretton Woods and with countries allowing currency fluctuations, a need for a standard format for quoting rates based on currency pairings was required. Since accepting currencies in trade almost always occurs with the exchange of one currency for another, the paired currency system has developed naturally.

The role of the US dollar became more pronounced with the petrodollar system. The agreement of oil-producing countries where oil was priced in dollar terms established the USD as the world's primary quote currency. Currently, an estimated 88% of all forex transactions have the USD on one side of the trade. This historical dominance is why pairs with the USD are more liquid and the most widely traded currency pairs. The EUR/USD pair alone comprises approximately 24% of the total volume of forex trading. The quote currency system mirrors real-world relationships, developed over decades of international trade and finance.

Definition of Quote Currency

The quote currency is the second currency in any forex pair and displays the "price" you pay for the base currency. For example, EUR/USD = 1.10, means that one euro costs 1.10 US dollars. In this example, the USD is your quote currency because it is telling you the price.

To illustrate this example even further, let's say you bought a burger for 15 Mexican pesos. The burger is your base currency and what you wanted and the peso is your quote currency and what you paid.

This idea is clearer when you think about real currency exchanges. If you're traveling from Europe to Japan, you'll first check EUR/JPY rates. Let's assume that EUR/JPY = 130. In this case, for every euro you exchanged, you would get 130 Japanese yen. The yen is the quote currency because you can see the price of one euro in yen.

The quote currency is always on the right side of the slash. In GBP/USD, the USD is the quote currency. In AUD/CAD, the CAD is the quote currency. This way of presenting currency always follows a standard convention, which will enable you to pretty much understand any currency pair once you have the core structure down.

Types of Quote Currencies

One important distinction to make: the quote currency affirms what you are actually buying or selling in a trade. When you "buy" EUR/USD, you are buying euros while simultaneously selling dollars. Your quote currency (USD) is what you are relinquishing in exchange for your base currency (EUR).

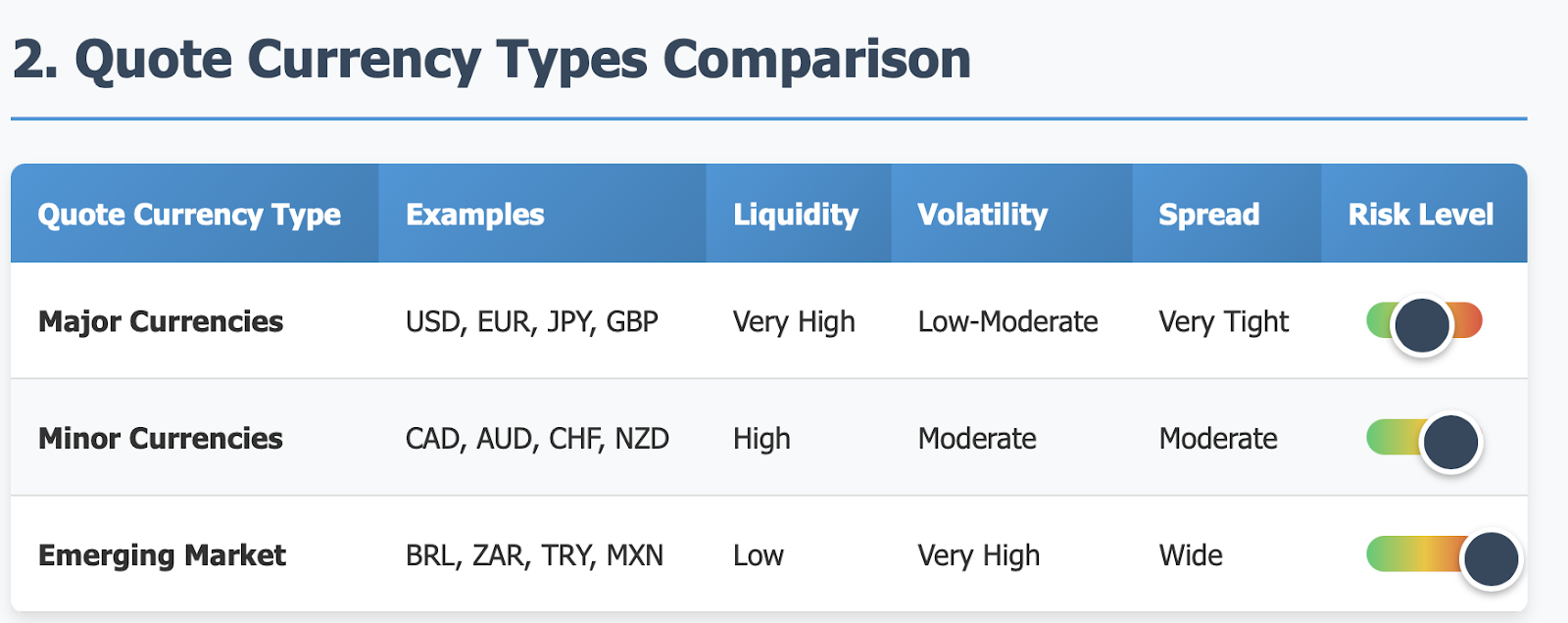

There are types of quote currencies. Not all quote currencies are the same. The forex market groups currencies to be equivalent in some way, which provides an array of behaviors and character all currencies have.

Major currencies are the foundation of forex trading. These currency pairs include US Dollars (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Swiss Franc (CHF), Australian Dollars (AUD), and Canadian Dollar (CAD). When the currency appears as the quote currency, they usually give you high liquidity and price movements that are fairly uniform.

It will be no surprise that USD is the predominant quote currency. USD appears in about 88% of all trades. After USD, EUR is the next most popular quote currency followed by JPY and GBP respectively. Major currencies have the advantage of deep liquidity, good spread and constant market action. By trading either EUR/USD or GBP/USD I have given you the two most liquid markets in the world.

Emerging Market Currencies tell a different story. Chinese Yuan (CNY), Indian Rupee (INR), Brazilian Real (BRL), South African Rand (ZAR) and Mexican Peso (MXN) can also be quote currencies; however; there are more companions. Emerging market currencies have much more volatility and wider spreads than the major currencies.

With an emerging market currency as a quote currency you have added risk. Factors such as political instability, economic policy decisions and swings in commodity prices can all cause huge movements. You have the potential for this simply by trading EUR/TRY (Turkish Lira) or USD/BRL, where the added volatility potential is not present from trading these major pairs.

The selection of quote currency can dramatically influence your trading strategy. While major currency quotes afford steadiness and predictability, emerging market quotes come with the rewards of higher potential returns at the same time with higher risks.

How to Read a Forex Quote

In order to be successful at trading, you need to be able to read forex quotes correctly. The formatting is standard all around the industry but most beginners fail to understand what the numbers really mean.

Typically, a forex quote looks something like this: EUR/USD = 1.1050. The quotation tells you that one euro equals 1.1050 US dollars. The number that follows the equals sign is always representing the amount of quote currency (USD) it takes to buy one unit of base currency (EUR).

Trading in 'pips' adds another layer of precision to the forex quote. A pip is generally measured as the fourth decimal place in most currency pairs. For example, if EUR/USD goes from 1.1050 to 1.1051, this is a one-pip movement. For currency pairs involving Japanese yen, a pip is measured by the second decimal place due to the lower relative value of the yen.

When you see GBP/JPY = 150.25. The GBP (British pound) has an exchange rate, based on the current price, of 150.25 JPY (Japanese yen). If you are planning to exchange 1,000 British pounds, you will receive 150,250 JPY (1,000 × 150.25). The yen is your quote currency in this case and tells you exactly the price of one British pound in yen.

In a simpler analogy, think of ordering coffee. If you ordered a cappuccino on your trip in China, the price might be 45 CNY (Chinese yuan). You could write this transaction as CAPPUCCINO/CNY 45; in this case, the price of cappuccino is tied to the yuan, meaning the quote currency indicates the price of the item. This same concept of price being tied to the quote currency applies to all pairs in the forex market.

Understanding quote currency precision is relevant for calculating your profit and loss. A change in price from 1.1050 to 1.1051 represents a 1 pip move in the EUR/USD price. This would equate to a $10 gain or loss on a standard 100,000-unit size. Your quote currency affects how the pip values convert to real amounts for you (or your trading account).

Role of Quote Currency in Trading Strategies

The quote currency also plays an integral part of your trading strategy. Different quote currencies behave differently, and part of successful trading is recognizing this and adjusting what the quote currencies are telling you.

High-frequency traders tend to favor major currency quote currencies, as they often have tight spreads and good liquidity. If you are trading EUR/USD or GBP/USD, execution of your trade is usually quick with little slippage. These currencies are tied to stable major economic powers, decreasing unexpected volatility that may conflict with the algorithms put in place to trade.

Longer-term position traders are more willing to trade quote currencies from emerging markets, as this may yield greater volatility and thus greater returns. Trading EUR/ZAR or USD/MXN can be quite lucrative, but it requires great patience and better risk management. However, the economic fundamentals and developments in those currencies will be much more important longer-term for your trading success.

Think about the difference in trading EUR/USD and EUR/JPY from the quote currency perspective. When trading EUR/USD, you are trading the most liquid market in the world. Any news from the Federal Reserve, US economic releases, or the strength or weakness of the US dollar can quickly influence your trades. On the other hand, if you are trading EUR/JPY, then the economic releases from the Bank of Japan, other Japanese economic releases or even the aspects relating to the Yen can influence your trades just as much.

The 2016 Brexit referendum is a great example of quote currency measures. GBP/USD got crushed overnight going from 1.50 to 1.33. Traders holding a position where USD is the quote currency suffered huge losses because the pound (base currency) got crushed against the dollar. Traders who understood the quote currency concept could have hedged their exposure or could have avoided the pair entirely.

Risk management considerations must account for quote currency characteristics. Position sizing, stop-loss placement, and profit targets are all reliant on understanding how your chosen quote currency acts and when it acts in different market conditions.

Everyday Analogies for Beginners

When you can relate forex concepts to examples in your day to day life, the concepts become clearer. The structure of base/quote currency is analogous to many transactions you perform every day without a second thought.

As an example, consider shopping at the supermarket. When you look at a tag that says, "Milk - $3.99," you are looking at the milk is your base currency (what you want) and dollars are your quote currency (what you pay). You now don't understand the value of the milk without both parts of the equation. The forex pairs work the same way.

Take traveling abroad as another useful example. When you convert 1,000 Chinese yuans into US dollars at CNY/USD = 0.14 or 140 US dollars you are exchanging (giving up) yuans (the base currency) and receiving USD (the quoted currency). Your exchange rate indicates the "price" of your yuan in terms of dollars.

Buying game tokens with 'real money' follows the same concept. If 100 game tokens cost 5 US dollars you could write this as TOKEN/USD = 0.05. In this case, dollars are the quoted (what you're giving you) and tokens are the base currency. Your exchange is 5 cents/token.

Even in a trading/barter systems base/quote structure exists. If one person offers to trade 1 orange for 3 apples you could write this as ORANGE/APPLE = 3. In this example the orange is the base currency (we are exchanging oranges), apples (the quoted currency) and the relationship 3:1.

You can see therefore that any exchange of "A for B" creates a natural base/quote relationship. It is this concept that will help you understand forex pairs more readily--the value of anything always requires a reference point and can use the quote currency as that reference.

Quote Currency in CFD Trading

When it comes to understanding quote currencies, CFD trading adds a new level of complexity. When you trade forex CFDs, your profits and losses are based on the quote currency, which directly affects your account balance and risks.

CFD trading is typically defined as speculating on the changes in price of the two corresponding currencies and does not include the actual exchange of currencies. However, the quote currency will determine how trades are settled and where your profits come from either way.

For example, let us say that you have $10,000 in an account for trading EUR/USD CFDs. You decided to buy 1 standard lot (100,000 units) of EUR/USD and entered a market order at the price of 1.1050. You then watch the price increase to 1.1100, and develop a profit of 50 pips.

Since USD is the quote currency in EUR/USD, every pip is worth $10 i.e., profit of $500 in US dollars. Again, the BTCDana platform makes this automatic, but knowing how these mechanics work will allow you to have a greater understanding and better risk management strategy.

If your account is in euros but you are trading USD-quoted pairs, their appreciation will mean the currency conversion of your returns is created with additional complexity.

Quote currency volatility is so important when trading CFDs due to leverage. A 1% move in an emerging market quote currency may cause margin calls if you are overleveraged. Major quote currencies like the USD, EUR, and JPY will provide more predictable risk profiles when trading in leveraged fashion.

Professional CFD traders often hedge their quote currency exposure especially if trading multiple pairs with the same quote currency. For example, if you are long EUR/USD and GBP/USD at the same time, you are also short USD twice, exposing yourself.

Risks & Misconceptions

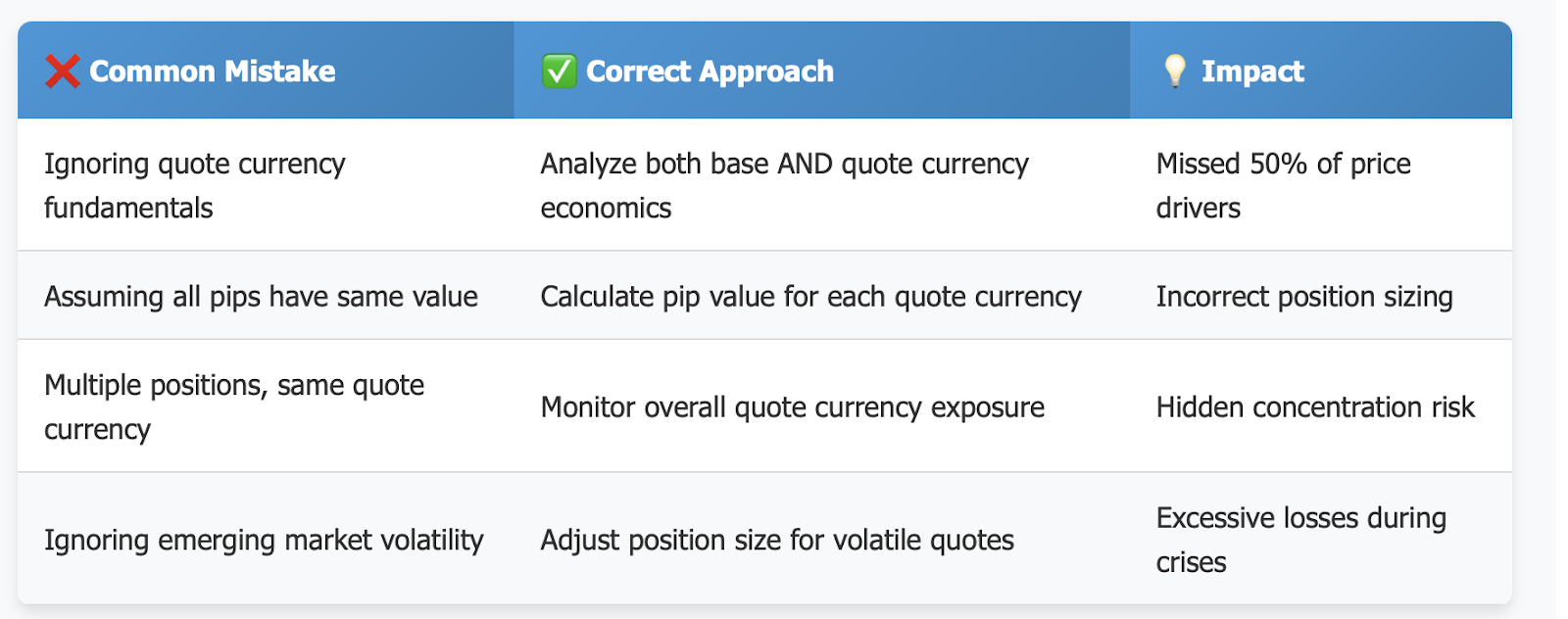

Beginner traders suffer from a variety of mistakes regarding quote currency. Understanding these specific mistakes can prevent loss of capital and improve overall trading performance.

Mistake 1: Ignoring Quote Currency fundamentals: Many traders only consider their base currency when analysising their trades while ignoring the quote currency which is equally important. If you trade EUR/AUD, Australian economic data, the Reserve Bank of Austrialia's monetary policy decisions and commodity prices (and commodities influence the AUD significantly) are just as important as the European economic fundamentals. The quote currency is half of every price movement.

Mistake 2: Not understanding pip values New traders will often just assume that pips are a monetary value that is the same across different currency pairs. The truth is pip value is dependent on the quote currency. So for example, a pip in EUR/USD is worth $10 for a standard lot but a pip in EUR/JPY is valued around $9 due to the difference in hedged exchange rates between those two pairs. By misunderstanding pip value, new traders can miscalculate position sizing and risk (reward) management.

Mistake 3: Discounting the risk of stated currency exposure of emerging markets. Trading currency pairs with emerging market quoted currencies such as Turkish Lira, Argentine Peso, or even the Venezuelan Bolívar, can be incredibly risky. For example, in 2021-2022 the Turkish Lira lost a staggering 80% of its value against the dollar. Traders with USD/TRY long positions would have sustained savage losses as the Lira burned to the ground in this example.

The COVID-19 pandemic demonstrated another aspect of quote currency risk; the evaporation of liquidity. In times of market stress, you can almost cancel certain emerging market quote currencies when liquidity evaporates and spreads widen. A trade that was originally profitable could have become unhedgable or exit-able very quickly.

Correlation risks continue to catch traders by surprise. The presence of multiple positions that share the same quote currency creates hidden concentration risk. If you are simultaneously long EUR/USD, GBP/USD and AUD/USD where do you think you are exposed to the movement of the USD? From a quote currency standpoint you now have triple the exposure to USD movement even when you think you are diversified across three separate base currencies.

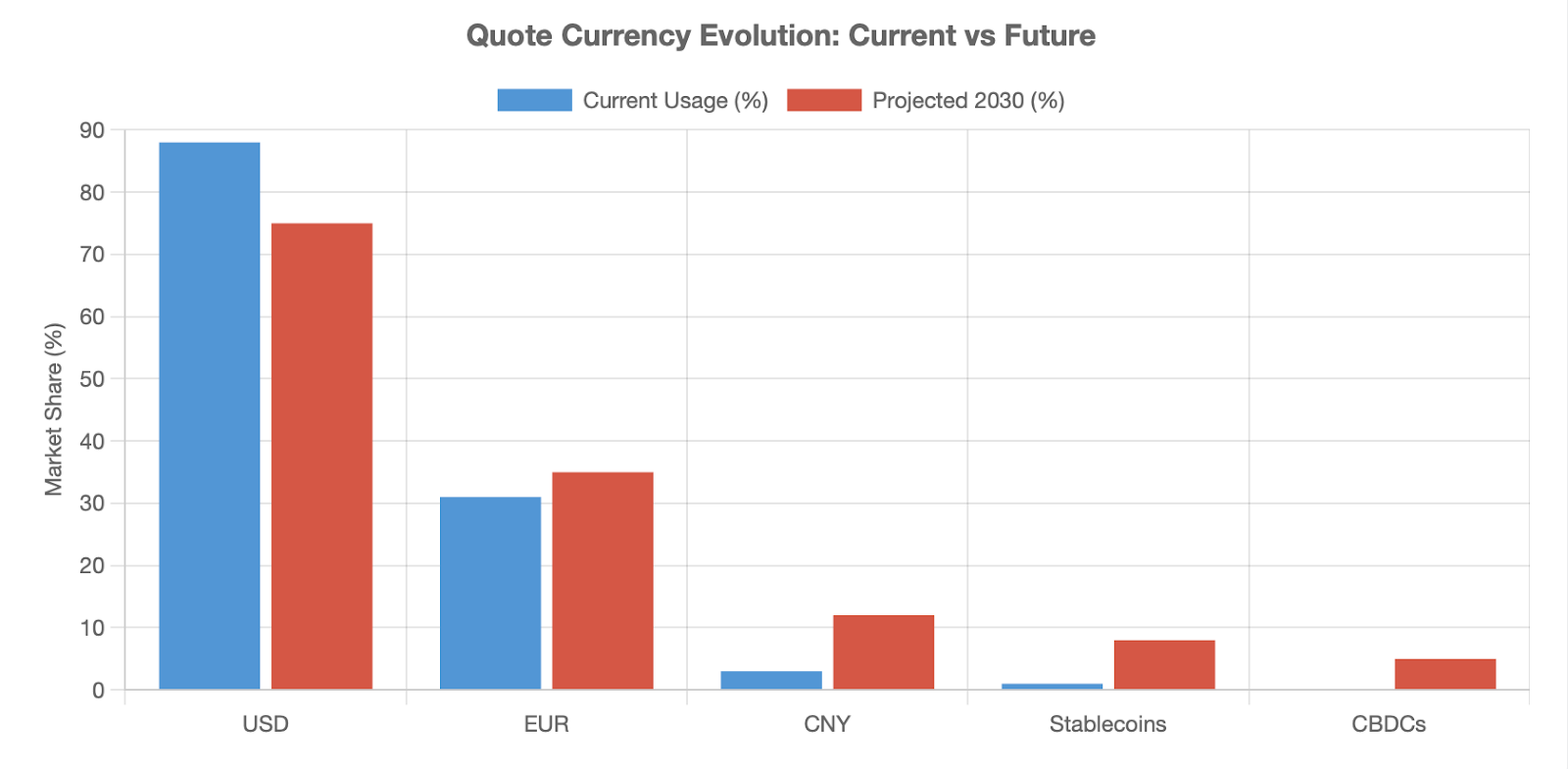

The Future of Quote Currency in Forex and the Forex Market

The Forex market is always evolving, and there are changes in quote currency both technologically and geopolitically. Understanding the overall behavior of forex market can help you prepare for any potential future impact on foreign currency trading individuals may encounter.

Stablecoins may be the biggest potential disruptor of either normal or conventional quote currencies. Cryptocurrencies have made some level of impact in the forex trading market, and stablecoins like Tether (USDT), USD Coin (USDC), and various other dollar-pegged cryptocurrencies facilitate billions in daily trading volume already. There are some exchanges that offer crypto/stablecoin pairs, and they function similarly to forex pairs, but use stablecoins as the quote currency.

The Chinese yuan's internationalization is a direct challenge to USD as the world's most recognized dominant currency. The People's Bank of China (PBOC) is actively promoting its use in international trade. Although the global number of yuan-denominated payments has grown steadily according to SWIFT data, it still comprises not less than 3% of global payments collectively with USD being counted as 40%.

The potential for countries to de-dollarize could change which quote currency is preferred an individual trader. Countries such as Russia, China, India, and Brazil have looked at ways to lessen their reliance on the USD in their bilateral trade relations with one another, and should they succeed, this may provide a greater demand for EUR, CNY, or also for digital currencies some of which could be backed by gold, as a replacement for quote currency.

Central Bank Digital Currencies (CBDCs) further complicate the potential evolution of quote currencies. The digital euro from the European Central Bank, China's digital yuan, and other CBDC initiatives may ultimately emerge as quote currencies in digital forex markets that promote the reliability of fiat currencies, while adding the efficiency of digital assets.

Climate-based currencies are also an evolving trend where the values of currencies are shaped by environmental conditions. Some schemes are set out about creating carbon-based quote currencies where the environmental costs are reflected somehow in the exchange rates. Although at this stage theoretical, there are ways to revamp our understanding of currency valuations by testing multiple options.

Conclusion & Calls-to-Action

The quote currency underpins the forex and trading process. Trading without the understanding of this idea means you are trading blind and are unable to effectively assess risk, determine profits or derive reasonable trading strategies. Any aspiring trader or successful trader needs to get through the process of dissolution of how to understand quote currency dynamics before moving onto the other more complex exploration of trading.

Keep in mind that the quote currency is more than just a technical specification – it is effectively half of every trade you make. Though you may primarily trade and manage the exposure of major currencies like the USD and EUR, or even emerging currencies such as BRL and ZAR, the quote currency dictates the price, settlement, and valuation of your trades.

Moreover, this knowledge becomes relevant when trading products which are leveraged, such as CFD products, in which you can even see your losses and gains from the movements and values of the quote currency being magnified.

The forex market is constantly evolving. New solutions such as stablecoins and digital currencies are now being offered, and geopolitical relationships are becoming more tenuous. With these changes to the market, quote currencies may ultimately change into another currency. To be able to see where the market may go, staying on top of these recent developments in cryptocurrency and the forex market, and mastering current market mechanics holds a better position than most traders who disregard these facets of the market.

Of course, there are benefits to understanding all about quote currencies, such as managing risk and returns. You may make competent decisions based upon traditional research methods that account for both currencies and avoid making mistakes by leveraging your knowledge of these variables as sophisticated traders will do.

Are you ready to start trading with a better understanding of quote currencies? Join BTCDana today and start your risk-free demo account. BTCDana has very good spreads across all major and emerging market currency pairs, and the demo platform is a perfect environment to work on developing your fundamentals within the world of forex trading.

Open your BTCDana account now and discover why thousands of traders trust our advanced platform for their forex CFD trading needs.

Start your trading journey with BTCDana – where professional tools meet user-friendly design.