Whether you are a high school student interested in forex trading or an experienced trader looking to improve your approach, understanding long position is one of the foundations of forex trading. This guide takes you from the basic understanding of long position to the practical examples of real trades.

1. What is a "Long Position"?

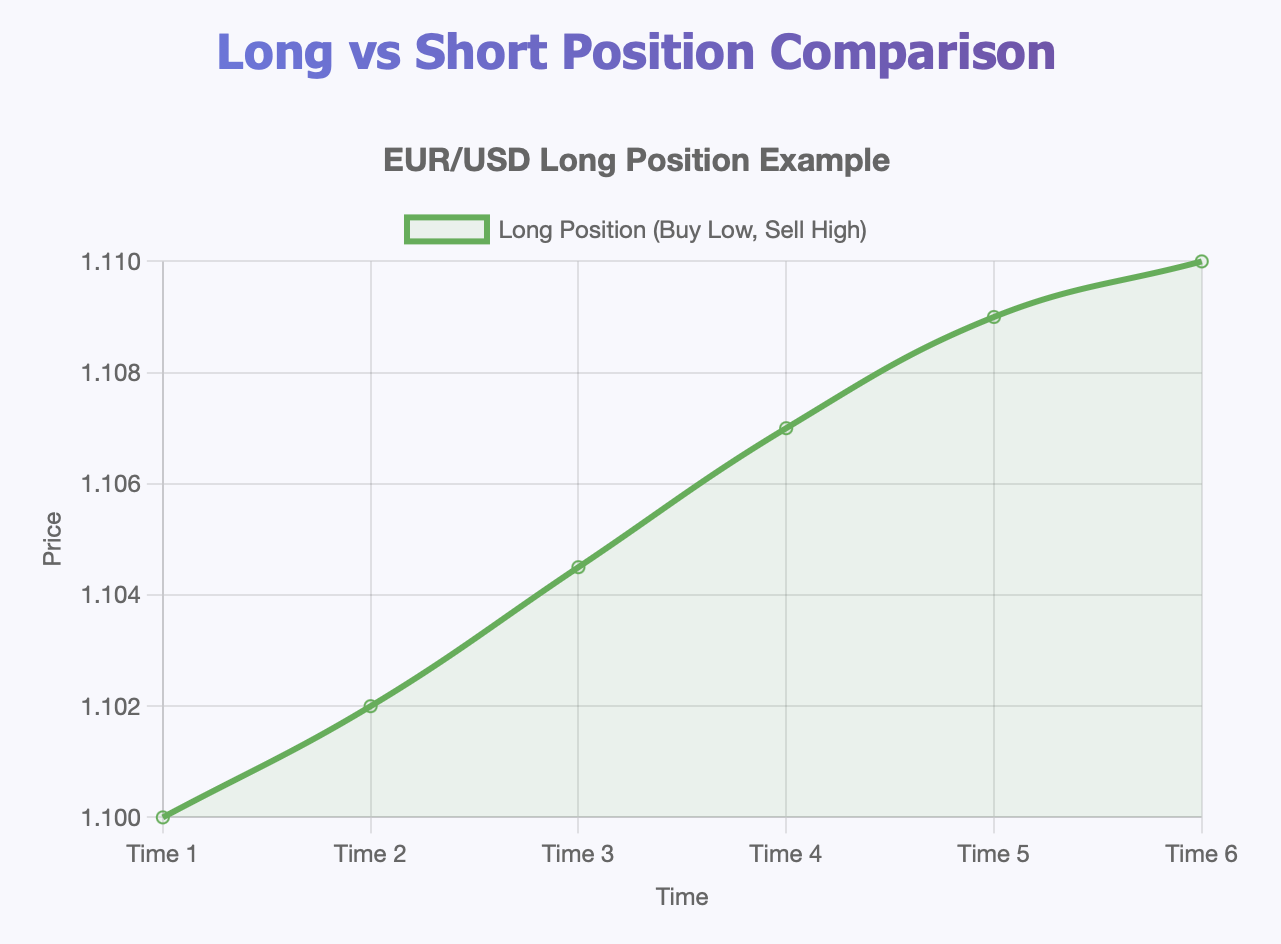

A long position in forex trading is when you buy a currency pair that you believe is going to rise in value so that you can sell it later at a profit. In other words, you are taking a classic "buy low, sell high" approach to currency trading.

Simple everyday example: You will be travelling to the US and think the US dollar will gain strength against your local currency, so you buy USD now, and plan on exchanging it for your local currency later at a better exchange rate. In essence, you are going long on USD.

Professional example: A trader is long EUR/USD at 1.0850, targeting 1.0950. Once the price reaches 1.0950, the trader makes an additional 100 pips. A standard lot size comes to $10 a pip - therefore, the trader's profit is $1,000.

The key relationship is simple: Long = Buy = Bullish view. When you go long, you're betting that the base currency (the first currency in the pair) will strengthen against the quote currency (the second currency).

A long position is the opposite of a short position, where you sell a currency pair expecting its value to decrease. Long positions reflect optimism about the currency's future performance.

Understanding Long Positions (When and Why to Go Long)

Going long on something doesn't come from blind optimism; it comes from research and knowledge about the market. The reasons traders decide to go long are:

Economic Fundamentals:

-

Positive economic data (GNP growth, employment numbers, inflation)

-

Change in stimulus policies by central banks (interest rate hikes often boost a currency).

-

Political stability with government policies that are beneficial.

-

Clear patterns of an upward trend (higher highs and higher lows)

-

Price staying firm at support

-

Bullish breakouts from order flows consolidations

Market Sentiment:

-

A more favorable risk appetite for growth currencies

-

Higher commodity prices that help the commodity-linked currencies

-

Safe haven flows during uncertainty (in currencies like USD, JPY, CHF, etc.)

For example, in 2022, USD/JPY had a tremendous rally and moved aggressively to the upside when the Federal Reserve was aggressively hiking interest rates while the Bank of Japan was holding interest rates ultra-low. It created a great argument for a long USD/JPY position because of the large interest rate differential, and some traders captured over 500 pips on the long USD/JPY position.

Remember, it's all about timing. You will be better off going long on a currency when the technical picture supports and confirms your fundamental view on the currency. Together, they will improve your chances of success.

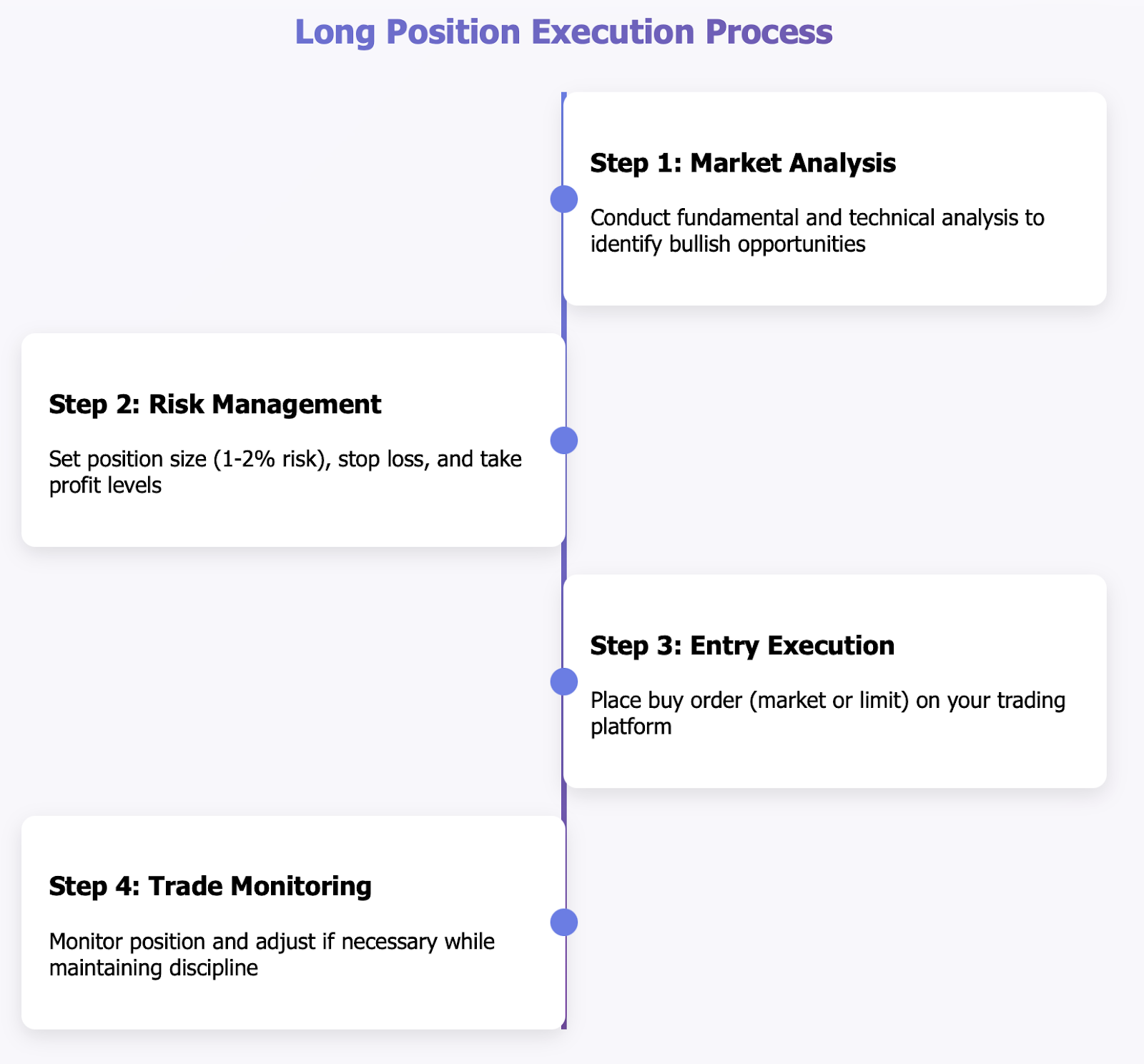

How to Open a Long Position

Opening a long position on BTCDana is simple. However, you need to be well prepared before you can do so. Follow this guide.

Step 1: Choose a Currency Pair. Choose a pair you are familiar with (liquidity, spread, and knowledge of the market). For example, you may choose EUR/USD, GBP/USD or USD/JPY.

Step 2: Can You Bullish? You will want to do both technical and fundamental analysis before you place any trades. You will want to find confluence from a variety of indicators that you may use to predict a bullish sentiment.

Step 3: Decide How You Will Trade.

Entry Price - Choose one or the other; Market order (instant execution) or Limit order (execution at a specific price).

Position Size - how much of the trade will be traded (generally 1-2% of your account size).

Take Profit (TP) - Where you plan to exit the trade for profit.

Stop Loss (SL) - Where you will allow that trade to run to when you've incurred enough "acceptable" risk.

Step 4: Execute Trade on BTCDana Platform. Go to the area where trading is conducted. Select your currency pair, select "buy" and identify that you are placing a long position. Be sure to enter your trade parameters and confirm your trade.

Now to discuss an example of risk management. Suppose you are going to go long GBP/USD at 1.2500, and you have an account in USD worth $10,000. We can assume that, somewhat generally you are willing to risk 2% maximum loss on a single trade, which is $200.

-

You can have a maximum Stop-Loss 50 pips from your entry, or 1.2450, which means you can risk a total of $200

-

You are risking 50 pips for $200 means you are leaving risk of $4 per pip (mini lot).

-

If go a 2:1 risk-reward scenario, set your take profit at 1.2600.

Important: Practice on a demo account before risking real money. This will allow you to know the platform and to test your strategies without any risk.

How to Calculate Profit and Loss From a Long Position

It is also important to understand how to calculate profit and loss for sound risk management and realistic expectations.

Basic P&L Logic:

-

Profit: Exit Price > Entry Price

-

Loss: Exit Price < Entry Price

Formula to Calculate Profit/Loss = (Exit Price - Entry Price) x Position Size x Pip Value

Full Example:

-

Currency Pair: EUR/USD

-

Entry Price: 1.1000

-

Exit Price: 1.1050

-

Position Size: 1 standard lotto (100,000 units)

-

Pip Value: $10 (for US-denominated accounts)

Calculation: (1.1050 - 1.1000) x 100,000 x 0.0001 = 50 pips Profit = 50 pips x $10 = $500.

P&L Influencing Factors:

Trade Size: If your position is larger, any potential profit or loss will be greater.

Leverage: Increased position size has even less capital outlay to achieve the same (or greater) outcome.

Spread: The difference between the bid and ask prices dampens your effective entry/exit price

Swap prices: Essentially the cost of overnight financing when trading a position that goes past the market close.

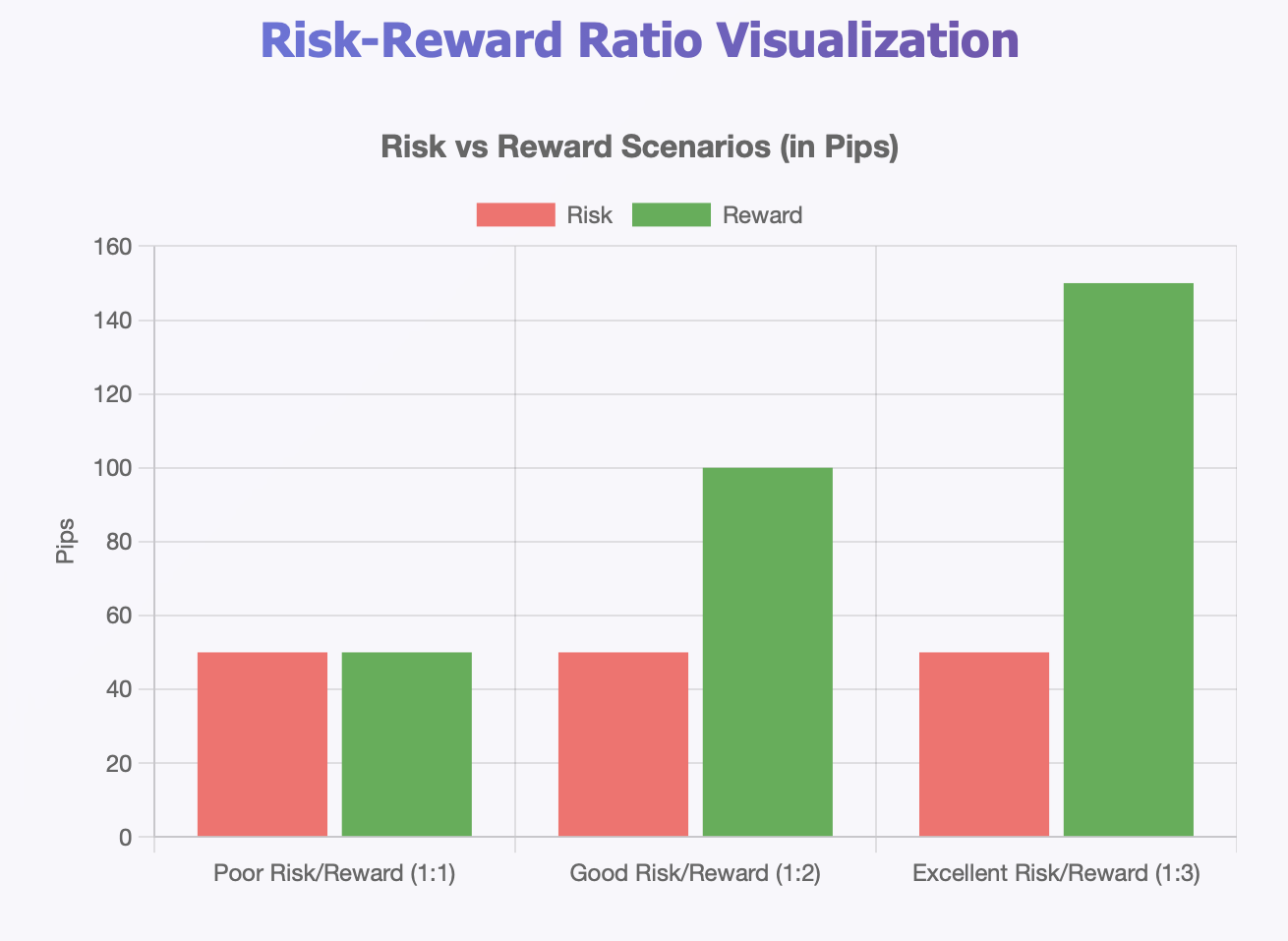

Risk Management through P&L: Always use realistic take profit and stop loss levels before entry. A common rule of thumb is to have a 2:1 risk reward level—for example, if you are prepared to risk 50 pips, you would want to lock in 100 pips of profit.

Pip Value Differences:

Major pairs (e.g. EUR/USD): $10 per pip with a standard lot

Cross pairs (e.g. EUR/GBP): depending on the currency quoted

Exotics: usually different pip values and higher spreads

Please remember: Understanding how to calculate P&L will firstly allow you to consistently control your risk, then help you to be a successful trader.

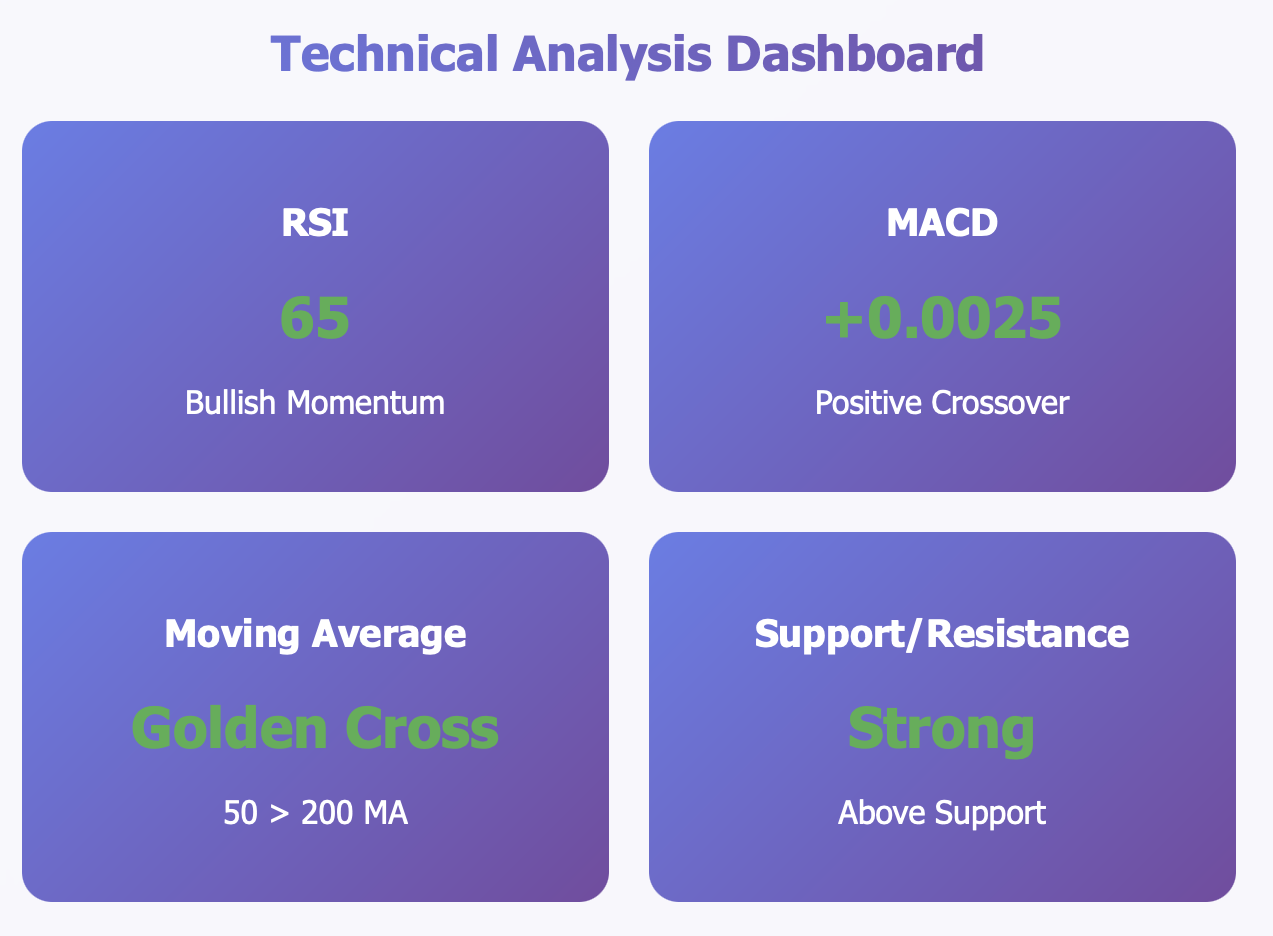

Common Technical Tools to Identify Long Positions

According to technical analysts and practitioners, Technical Analysis gives clear and objective signals to time long entries. Here are the best four technical analysis tools to utilize when looking for bullish opportunities.

Moving Averages (MA):

-

Golden Cross: A shorter MA (50 period) crosses above a longer MA (200 period) which is often a backdrop to repeated upward movement described as continuation.

-

Price Above MAs: Price being above two other MAs in most cases is bearish momentum and likely going to take price higher.

-

MAs as Support: MAs can sometimes act as dynamic support levels that the price can bounce off on pullbacks to the MA.

Relative Strength Index (RSI):

-

Oversold Bounce: RSI hovering below 30 and bouncing back above, usually means you have yourself a buying opportunity.

-

Bullish Divergence: Price pattern is making lower-lows however RSI pattern makes higher-lows. The bullish divergence suggest upward reversal in action.

-

RSI above 50: Considered bullish momentum.

MACD (Moving Average Convergence Divergence):

-

Bullish Crossover: MACD line crosses above the signal line, suggests buying momentum.

-

Positive Histogram Bars: Bars growing indicate greater bullish momentum or follow through price movement.

-

Zero Line Cross: MACD trail line crosses above zero line, suggesting trend strength.

Support and Resistance:

- Trendline Breaks: Price breaks above descending trendlines signify possible reversal

- Support Bounces: Strong reactions off of horizontal support levels provide low-risk entry

- Previous Resistance as Support: Resistance levels often become support levels

Practical Example - EUR/USD Setup: Suppose EUR/USD is in a downtrend, but shows:

- Price bounced from major support at 1.0800

- RSI showing bullish divergence

- 50-Period MA providing dynamic support

- MACD showing positive crossover

All of the above would create a condition to look at a long position around 1.0820, with a stop loss below support at 1.0780.

One thing to always remember: Technical analysis provides probabilities, not guarantees. Always use technical signals in conjunction with fundamental analysis, and risk management. You shouldn't allow any one indicator to drive your trading decision - indulge all indicators and notice where their signals create overlaps.

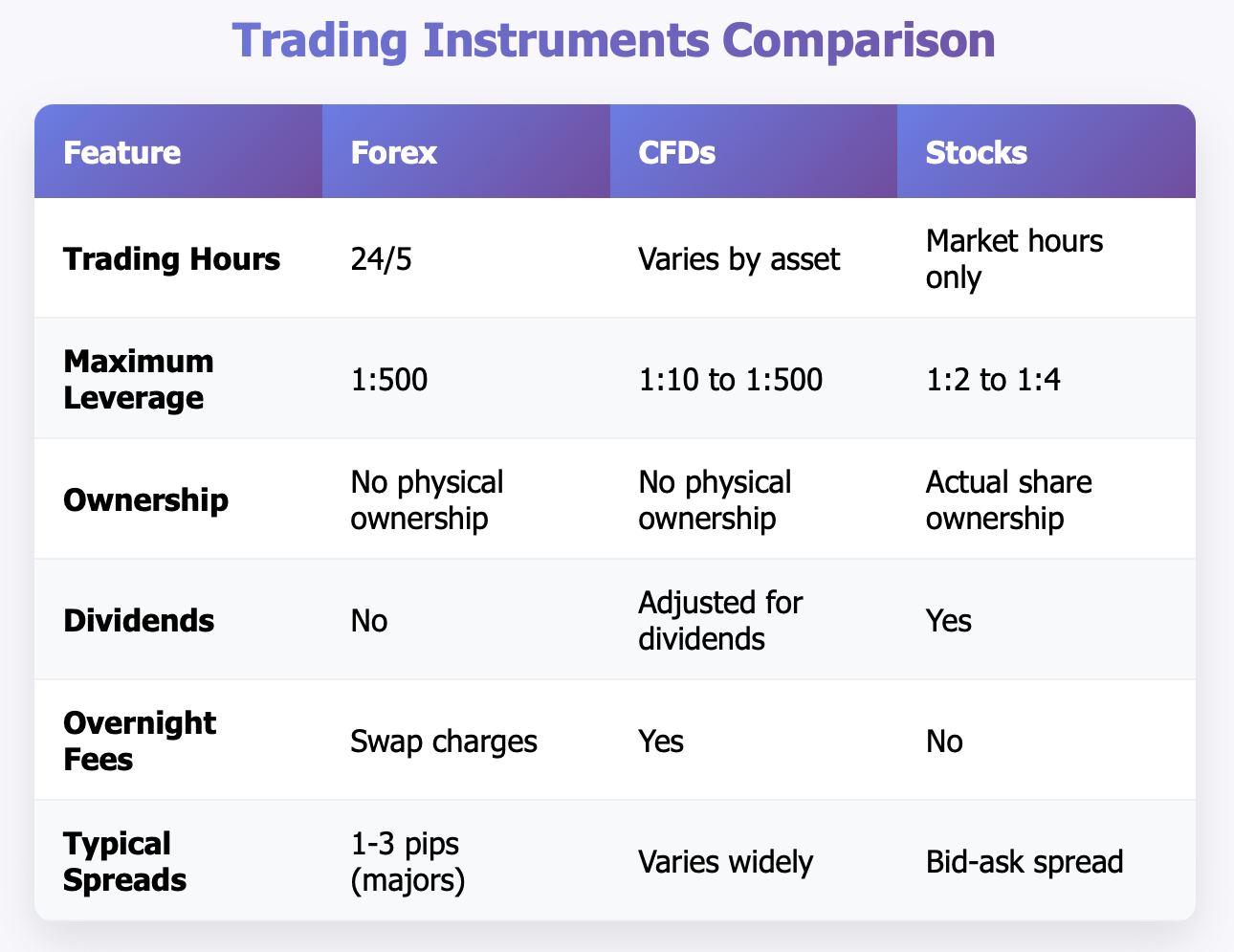

Comparison of Long Positions: Forex vs CFD vs Stocks

Knowing how long positions function across different markets will help you to select the correct instrument for your trading ambitions.

Forex Long Positions:

-

Two-way trading: You can go long and you can go short

-

High leverage: Up to 1:500 in many jurisdictions

-

24/5 market: trading hours around the clock unless the weekend

-

Currency pairs: always a two-currency pair

-

Tighter spreads- major currency pairs often have spreads of 1-3 pips

CFD Long Positions:

Different products: Stocks; Commodities; Indices; Cryptocurrencies

-

Flexible leverage: Each class of asset has different margin requirements (1:10 -1:500)

-

Contract for difference: You do not have ownership of the actual asset

-

Overnight fees: swap (interest) charges if you hold overnight

-

Market access: Trade global markets on one trading platform

Stock Long Positions:

-

Ownership: You purchase shares of the company that is subject to your ownership

-

Limited leverage: usually, 1:2 to 1:4 tops

-

Dividend: you have an opportunity to receive dividend payments from the Company

-

Can be long-term: you could hold for months if not years

-

Market access: Not trading always available, whens the exchange opens.

Your Choice

-

Select Forex for overnight trades, speclation on currency price and full-time trading

-

Select CFDs for a variety of instruments with a reasonable use of leverage

-

Select Stocks for longer than a year time-horizon, dividend payments and return on shares

-

Forex and CFDs allow for a more flexible trading time but require stricter compliance to risk management procedures since the leverage potential can be so high.

1. Common Errors When Going Long

You will learn much quicker and avoid numerous losses by oppurtunity if you undersood the common mistakes other traders never learn not to repeat. Here are some of the other common mistakes associated with shorted long positions.

Trading naked, meaning trading without stop losses. Many beginners will trade with real money and decide to try to escape with an existing loss, hoping that price will simply come back their way.

In reality, most would loss 80-100% of their account value when they would trade with losses on any other instrument with reasonable account management discipline.

-

Solution: Always put stop losses in place before entering trades.

-

Tip: Do not risk an account value of more than 1-2% for every trade.

2. Too Much Leverage: Leverage can increase both losses as well as profits. For example, with 1:100 leverage a 10% adverse move will entail a 100% account loss.

-

Resolution: Use conservative leverage especially at the beginning

-

Rule of Thumb: New traders should rarely exceed 1:10 leverage

3. Chasing Price: Opening long positions only after a significant upward move and buying peaks rather than buying valleys

-

Resolution: Wait for pull backs to support levels

-

Practice: When in a strong trend do not use market orders, use limit orders.

4. Emotional Trading: Emotional trading such as FOMO (Fear of Missing Out) or revenge trading after loss leads to poor trading decisions.

-

Resolution: Create and follow a written trading plan!

-

Policy: Take a break after each significant win and loss

5. Abandoning Risk - Reward Ratios There is a major violation of the primary rule of being a successful trader when you take small profits and allow for large losses.

-

Resolution: Take profit orders should target at least 2:1 reward to risk ratios.

-

Example: If you risk 50 pips then you should be targeting minimum 100 pips in profit.

6. Overtrading: Opening too many positions results in lack of focus, and your portfolio will suffer an increase in overall risk.

-

Solution: Quality over quantity -- look for high probability setups.

-

Rule: You should limit yourself to a maximum of 2-3 trades opened at once!

7. Poor Market Analysis: Opening positions that are based on tips, instinct, or not spending sufficient time in analysis.

-

Solution: Do your technical analysis and your fundamental analysis every time you open a position.

-

Requirement: Have a clear reason why you are placing each trade.

Risk vs Leverage Reality Check: With 1:100 leverage a 1% adverse move of price is 100% loss of your account. It takes a math major to understand that position sizing and risk management is not a nice to have, but an essential to your survival.

Finally: Remember that discipline always overpowers accuracy of predictions. Focus on the process not the profits, and the profits will follow without question.

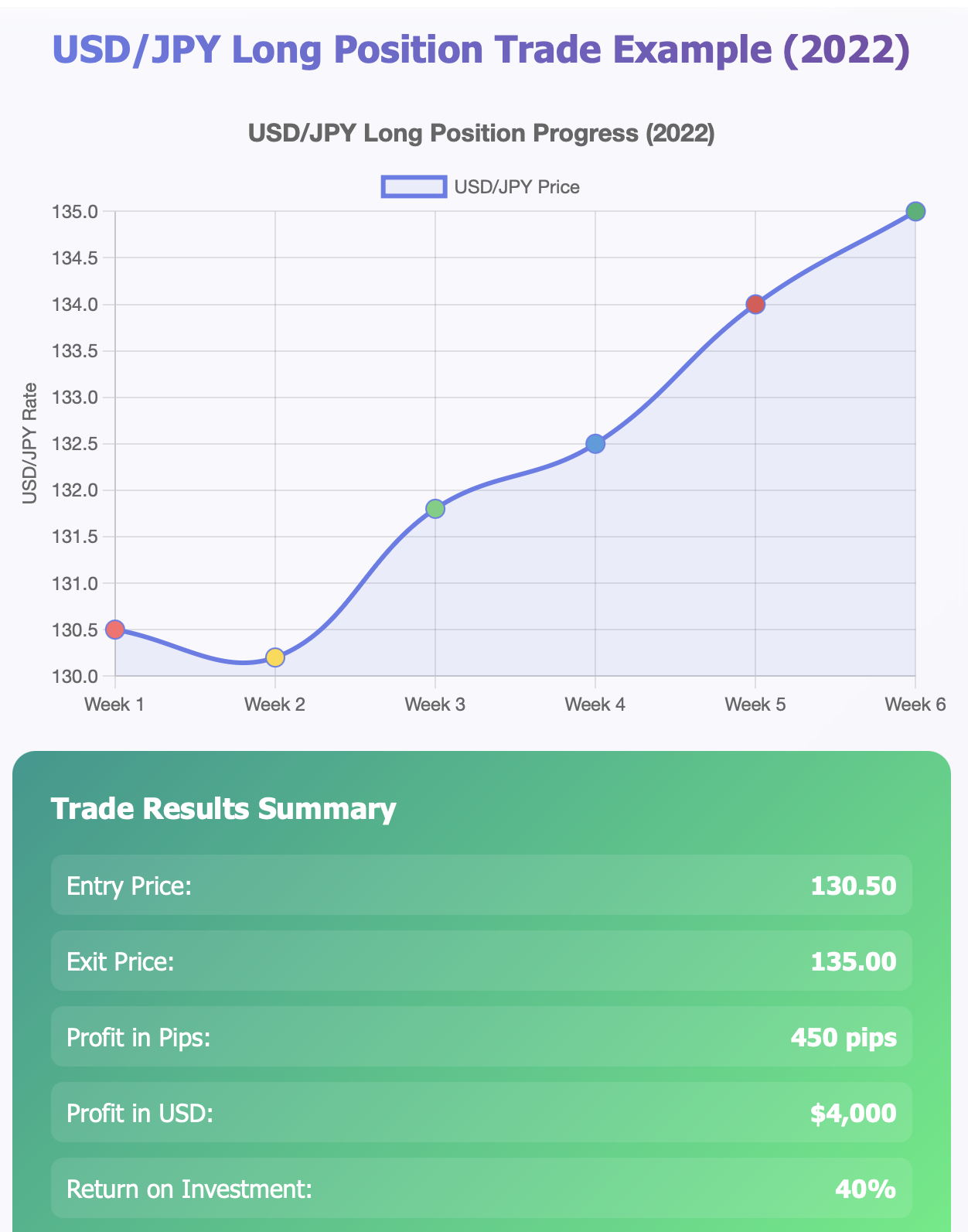

Real-World Example of a Long Position

Now let's look at a real-life long position trade to see how theoretical analysis is applied in practice.

Case Study: USD/JPY Long Position During Fed Rate Hike Cycle (2022)

Market Context: In mid-2022 the Fed was aggressively hiking interest rates to tame inflated prices while the Bank of Japan was running an ultra-accommodative monetary policy stance. As a result, the interest rate differential was very large, and hence a massive advantage for the US dollar over the Japanese yen.

Fundamental Analysis:

-

US inflation above 8% annually

-

Fed interested in raising rates from near zero percent to 4% +

-

Japan maintaining a negative interest rate and yield curve management

-

Rate differential widening in favor of US currency

Technical Setup:

-

USD/JPY broke through multi-decade resistance to the downside around price 125.00

-

Identifying a clear uptrend with series of higher highs and higher lows

-

50-day moving average providing dynamic support on any pullback

-

RSI was showing strong momentum, with no overbought closing price potential.

Trade Execution:

-

Entry Price: 130.50 (entry point long after a pullback and using the dynamic support of the 50-day MA)

-

Stop Loss Price: 128.00 (below the entry point and below the recent swing low approximately 250 pips below the entry point)

-

Take Profit Price: 135.00 (450 pips above the entry point, after the expected pullback, and around psychological resistance)

-

Position Size: 1 Standard Lot.

-

Risk to Reward Ratio: approximately 1.8:1 (450 pips profit target, and risking 250 pips)

Trade Management: The trade was held for approximately six weeks. During this time:

-

The price moved sideways for approximately two weeks, testing the trader's patience.

-

Action was sparked by the employment data releasing strong readings in the US, that resulted in a breakout above 132.00.

-

The position was closed, in part, at 134.00 ( taking the 350 pips profit).

-

The balance of the position reached the full target at 135.00.

Final Summary:

-

Total Profit: 450 pips on 50% of your position + 350 pips on 50% = 400 pip average

-

Dollar Profit: 400 pips x $10 per pip = $4,000 on a $10,000 account

-

Return: +40% over six weeks

-

Holding Period: 42 days

Key Success Factors:

-

Confluence: There were many fundamental and technical factors that aligned.

-

Patience: Waited for a proper setup to enter the trade rather than chase it.

-

Risk Management: clear stop loss and position size.

-

Discipline: Followed the plan even though the price went sideways for some time.

Lessons Learned:

-

Rate of change differences can lead to massive trends

-

Patience with consolidations often gets rewarded

-

Partial profit-taking allows for risk reduction and upside exposure

-

Strong fundamental themes can outweigh the noise of short-term technicals

This example demonstrates that sound analysis combined with good risk management and disciplined execution can lead you to make some very nice profits from being long, but not all trades will be winners - consistent profit is the result of managing losses and maximizing gains over many trades.

Frequently Asked Questions (FAQ)

Q: What is a long position in forex? The meaning of a long position in forex means that you buy a currency pair with the anticipation that the price will increase. You will profit once you are able to sell the currency pair at a higher price than you bought it at. In simple terms, a long position is a bet that the base currency will strengthen in value relative against the quote currency.

Q: Is going long the same as buying? Yes, in forex trading going long is simply referred to as buying. When you "go long" on the EUR/USD pair, you are simultaneously buying euros and selling dollars with the expectation that the euro will appreciate in value against the dollar.

Q: Do all long position trades make money? Just like any investing, long pegged positions present a risk. You also lose money from a long position the price of the pair trades below the entry point. This is why having stop losses and using proper risk management techniques are important to preserve your capital - you never really protect till you know your trading up big targets against other traders long or short positions.

Q: How do I know when I should go long? You can look for confluence in your analysis. Confluence can include: (1) price action is in an uptrend, (2) there's positive economic news, (3) the underlying central bank policy is supportive of your currency, and (4) technical indicators are showing bullish momentum. Always avoid relying on one single signal!

Q: What currency pairs are available for going long using BTCDana?

BTCDana has major pairs (EUR/USD, GBP/USD, USD/JPY), minor pairs (EUR/GBP, AUD/CAD), and exotic pairs (USD/TRY, EUR/ZAR). You can go long in any currency pair meaning you can buy any base currency against any quote currency available on the platform.

Q: What is the minimum amount of money I need to trade long positions?

With BTCDana, you can start anywhere from $100-$500, but good risk management practice would suggest having at least $1,000-$2,000 to trade, so you have a meaningful position size and can keep your risk low per trade. Don't forget, your account size affects your ability to sustain the normal up- and-down movements of the market.

Q: Can I hold a long position overnight?

Yes, forex is open 24/5 which means you can hold onto a position for days, weeks or months, but while holding overnight, you could incur swap charges (positive or negative) based on the interest rates charged by each currency in your currency pair.

Q: What is the difference between a long position and buy order?

These two terms are often used interchangeably but according to technical specification, a buy order is the instruction to initiate a long position. Once the buy order has been successful, you "hold a long position" in that currency pair.

Ready to Master Long Positions?

Understanding long positions is the first step on your journey into forex trading. The real key is being able to add in real-world experience and properly managing risk.

Where To Go Next:

Practice For Free: Create a demo account with BTCDana and practice placing long positions using fake money

Start Small: When you feel comfortable trading with real funds use micro lots and conservative leverage

Keep Learning: Be sure to check out our next article "Short Position - Trading Strategies When You Predict a Decrease", and keep practicing the other side of the market

Stay Disciplined: Find your trading plan and stick with it, no matter what your emotions tell you

Are you ready to apply what you've learned? Sign up at BTCDana and start practicing long positions with no risk! Demo accounts provide you a place to practice and build your confidence before you invest real capital.

Remember: The first long position of every professional trader began exactly where you are, with education, practice, and a solid risk management strategy you will be on the path to becoming a trader.