- Introduction

Why Emotion Matters in Crypto Trading

In the world of crypto trading psychology, emotion is not a detail; it is the leading cause of trading losses. Even though traders think about technical indicators or fundamental news, they pay little attention to crypto trading emotion when it comes to deciding.

As Mark Douglas argues in Trading in the Zone, trading successfully is less about predicting markets than it is mastering your mind. In crypto, when prices gyrate, and they do gyrate, your mind can be clouded by emotions, leading to decisions based on FOMO (Fear of Missing Out), greed, or fear instead of rational and logical planning.

For example, during the 2021 Dogecoin mania, and retail traders, many with very little experience, started purchasing Dogecoin when the price surged above $0.70, convinced that this "meme coin" would never go back.

Within weeks, Dogecoin crashed below $0.20, leaving many bag-holders holding heavy losses. Similarly, many Bitcoin investors, during the run-up to $69,000 at the end of 2021, bought into Bitcoin late, only to be hit with a brutal 70%+ drawdown in 2022.

These real-world examples illustrate that emotion is not a "soft" issue, but a hard factor in the complete equation that makes a determination.

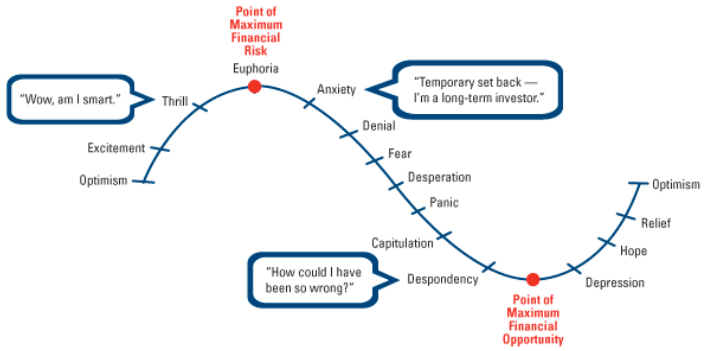

Figure 1: Investor sentiment cycle diagram

- Common Emotional Traps in Crypto Trading

The first step to avoiding emotional trading traps is identifying them. Some of the most dangerous ones are:

FOMO (Fear of Missing Out)

FOMO leads traders to get into trades at poor prices after seeing others make money, often in a speculative manner. In 2021, for example, Dogecoin and many other meme coins blasted off on hype and social media before collapsing as soon as the buying spree ended.

FUD (Fear, Uncertainty, Doubt)

This is FOMO's opposite. Bad news, real or imagined, causes traders to panic sell. For example, crypto was gripped by severe FUD after the collapse of the FTX exchange in 2022, leading to significant market sell-offs of even fundamentally sound assets.

Revenge Trading

This trap triggers when traders feel an urge to immediately get back losses, often doubling down on risk. This is akin to buying two more lottery tickets when you have already lost the prior ones, thinking you are "due" for a win.

Overtrading

Taking more than one position without any allocation logic is called overtrading, and many traders do this, chasing boredom, anxiety, or to feel like they are in control of wanting to trade more, for example, rebalancing through the expensive add volume of fees and slippage while Ethereum is pulling back.

Emotional decisions are both common and avoidable; the first part of improved trading discipline is recognizing them.

Table 1: Emotion Trap Comparison

|

Trap |

Definition |

Simple Analogy |

Professional Example |

|

FOMO |

Fear of Missing Out drives impulsive buying. |

Rushing to buy a hot new gadget that everyone wants. |

Buying crypto during a hype-driven pump near the top. |

|

FUD |

Fear, Uncertainty, and Doubt lead to panic selling. |

Selling a car because of a rumor that it will break down. |

Panic-selling BTC after scary regulatory headlines. |

|

Revenge Trading |

Overleveraging or doubling down to win back losses. |

Buying more lottery tickets after losing. |

Aggressively rebalancing during an ETH pullback, worsening slippage. |

|

Overtrading |

Taking too many trades without a clear plan. |

Constantly switching jobs for quick money. |

Frequent position changes during low-volatility ranges add fees. |

Case Study: In early 2025, Bitcoin dropped 28% from its January high of $109,350 to $78,000 by February. The influencer, spooked by whale-driven bear raids and negative sentiment, began panic selling. They liquidated positions at a loss, ignored stop-loss strategies, and publicly advised followers to exit the market.

- Cognitive Biases and Trading Errors

Even seasoned traders are influenced by trading psychology biases that warp their decision making. Let's examine a few common examples:

- Confirmation bias

Traders like to find information that is consistent with their own belief system. A bullish trader might only read news outlets that are showing positive news about bitcoin and ignore technical sell signals or macro indicators showing bearish sentiment.

- Anchoring bias

This bias refers to being overly fixated on a specific price or piece of news. A classic example is refusing to sell a coin at a loss because they are "anchored" to a price, even when all signs and indicators show a clear downtrend.

- Overconfidence

Sometimes traders believe that their system or their intuition is "foolproof", leading to overconfidence. A professional example is when a trader "curve fits" backtest results to show a perfect performance record, only to later blow up in live conditions when the market changes.

- Survivorship bias

A lot of traders only look at the true success stories, while ignoring the failures. The crypto space is filled with influencers who hyped multiple leveraged longs during a bull market, only to have many of them go silent or confess to large losses in a bear market in 2022.

Understanding these biases is crucial, as the crypto trader mindset is not based solely on rational thinking. Understanding these traps allows traders to challenge those mental traps and make better decisions.

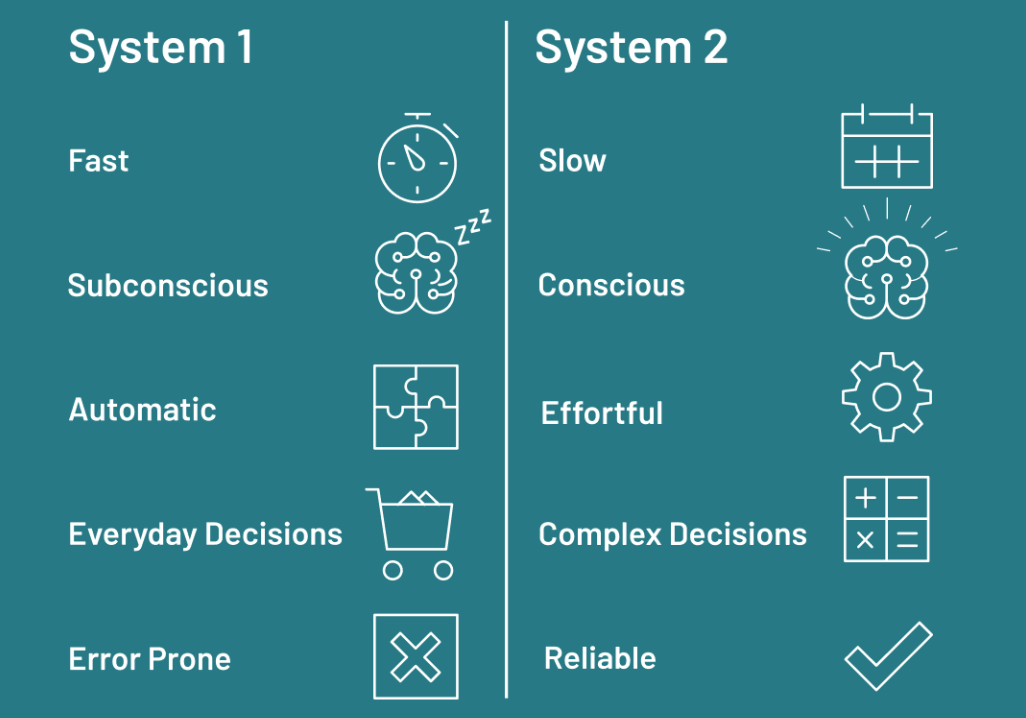

Figure 2:Kahneman’s System 1/System 2 thinking model from Thinking, Fast and Slow

How They Interact

- System 1 generates impressions and impulses; System 2 monitors and corrects them when necessary

- Most of our daily decisions are made by System 1, with System 2 stepping in only when stakes are high or errors are likely

- Kahneman calls this dynamic the “Law of Least Effort”; we default to the easiest cognitive path unless motivated otherwise

Relevance to Crypto and Panic Trading

In bear markets, traders often fall prey to System 1 thinking:

- Reacting emotionally to price drops

- Following herd behavior without analysis

- Ignoring long-term fundamentals

System 2, if engaged, would encourage:

- Strategic portfolio reviews

- Risk management

- Patience and discipline

- How to Handle Emotions During Market Extremes

Emotional extremes induced by market extremes, both bull markets and crashes, create emotional instability, which leads to bad trading decisions:

During bull markets, traders experience waves of greed and unjustified optimism, forgetting to manage risk and stop-loss orders completely since they believe only rising prices could happen.

During bear markets, traders create a range of emotional distress and panic selling, often creating panic selling at depressed prices, liquidating quality stocks, and losing their positions at the bottom, only to watch the price recover.

Ways to manage these emotions practically include:

- 5-Minute Rule: Take a 5-minute pause before acting on any impulse, and whenever you feel any strong impulse. A 5-minute pause allows you to avoid kinetic trades: it allows time to feel thoughts and reduce main limbic panic.

- Emotional Triggers: Close trading for the day after three consecutive losses; this is the best way to avoid speculation and revenge trading.

- Pre-determined exit targets: Create exit targets before entering trades; this avoids making decisions in real-time when your judgement may be impaired.

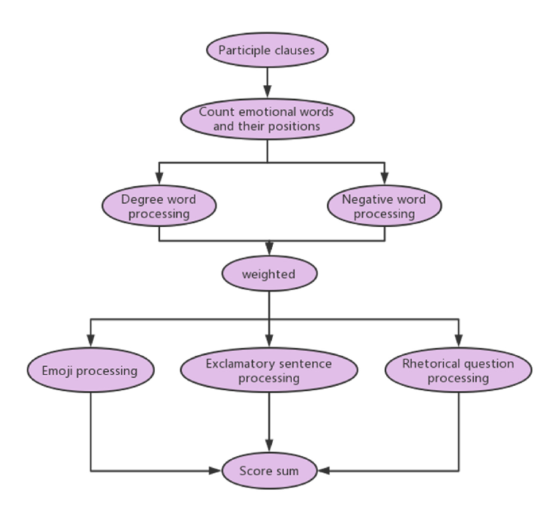

Figure 3: Emotion-handling flowchart

Bitcoin’s 2020–2021 Bull Market: A Snapshot

Figure 4: Bitcoin’s 2020–2021 Bull Market

- Start of Bull Run: Bitcoin began 2020 around $8,000 and surged past $64,000 by April 2021 — a 700%+ gain.

- Catalysts:

- Institutional adoption (e.g., Tesla, MicroStrategy)

- PayPal and Square are enabling crypto payments

- COVID-era monetary stimulus and inflation fears

- Halving cycle in May 2020, reducing BTC supply

Calm Traders vs. Emotional Speculators

|

Calm, Strategic Traders |

Emotional, Reactive Traders |

|

Set profit targets and exit plans. |

Bought at ATHs due to FOMO |

|

Used dollar-cost averaging (DCA) |

YOLO’d into meme coins |

|

Diversified across assets |

Overexposed to volatile tokens |

|

Took profits during parabolic moves |

Held through drawdowns, hoping for rebounds |

|

Stayed grounded in fundamentals |

Reacted to tweets and hype |

- How to Build Your Own Emotional Discipline System

Creating emotional risk control is not about supernatural willpower; it's about creating a reliable system. Here's how:

- Pre-Trade Checklist: Capture your bias, level of risk, stop-loss, and emotional state. Determine: "Am I calm and rational?"

- During Trade Monitoring: Recognize the impulses you have to deviate from your pre-trade analysis.

- Post-Trade Review: Determine if your actions adhered to your pre-trade analysis or were dictated by emotion.

Here are tools to help:

- Emotion journals (using apps like Notion or Edgewonk) to track your thoughts and feelings.

- Self-rating charts that you do on a daily basis to record your discipline and mood.

- Meditation apps (Headspace, Calm) and breathing techniques to lessen reactivity.

Even professionals unconsciously have those techniques ingrained in their systems. In fact, many retail traders at hedge funds or specialized private trading firms, perhaps, will journal not just about trades, but emotions, that highlight patterns which sabotage their performance.

Essentially, emotional control comes from routine habits, not from "trying harder."

Example

Emotions v P&L – How A Trader Turned Mindset Into Money

Background: An experienced trader with 10+ years of experience in the forex and crypto space started to notice a worrisome trend: despite having solid technical setups, their results were inconsistent. The issue was emotional decision-making.

The Key Moment – Measuring Emotions Like a Metric

The trader began tracking his P&L results for each trade alongside the emotional context of each trade: confidence level, stress, fear, greed, and impulsivity.

In about three months, the trader was able to correlate their emotional states with P&L performance.

The key finding was that the trades he held under "emotional duress" (e.g., revenge trades, fear-of-missing-out entries, fear-based exits) had an overall negative expected value.

- Applying Psychology Models in Trading

Psychology models can facilitate going from emotional awareness to a course of actionable, practical steps:

System 1 and 2 Thinking

This model, which was popularized by Daniel Kahneman in Thinking, Fast and Slow, distinguishes:

- System 1: To act quickly, emotionally and instinctively.

- System 2: To act slowly, deliberately and logically.

Successful traders have to recognize they are emotionally reacting (System 1), and then have to purposefully switch to an analytical (System 2) process.

ABCDE Model Trading

This cognitive-behavioral model helps refrain from an emotional response:

- A (Activating Event): e.g., price drops dramatically and unexpectedly.

- B (Belief): “It's going to zero!”

- C (Consequence): Panic sell.

- D (Disputation): "Is that really true? What are you looking at for data?"

- E (New Belief): "This is just a normal pullback; my strategy says to hold."

Table 2: ABCDE Framework for 2025: Turning Panic into Strategic Reassessment

|

Step |

Meaning |

2025 Bear Market Application |

|

A – Adversity |

Identify the triggering event |

Bitcoin crashes 28% in Q1 2025 amid regulatory crackdowns and a major exchange hack. |

|

B – Belief |

Recognize your automatic thoughts. |

“This is the end of the bull cycle.” “I need to exit before it drops further.” |

|

C – Consequence |

Observe your emotional and behavioral response. |

Panic selling, abandoning long-term positions, and social media-induced anxiety |

|

D – Disputation |

Challenge those beliefs with facts and logic. |

“Bitcoin has survived worse drawdowns.” “This is a liquidity event, not a protocol failure.” “I have a plan — stick to it.” |

|

E – New Belief |

Reframe and take constructive action. |

Rebalance portfolio, deploy DCA into strong assets, review macro thesis, reduce screen time. |

Figure 5: ABCDE Model

- Quiz: Are You an Emotional Trader?

Try this simple self-test to help you think through your crypto trading emotion management. Answer Yes/No:

- Do I raise my position size because I lost money?

- Do I make trades without a clear trading plan?

- Do I find myself constantly checking prices after I have entered?

- Do I feel a bit anxious and uncomfortable about normal volatility?

- Do I avoid using a stop-loss?

- Do I make adjustments to targets at the last minute?

- Do I fail to journal when I was feeling emotional?

- Do I experience FOMO and buy coins during a price pump?

- Do I hold on to loser trades "hoping" that it will bounce?

- Do I get excited and overtrade after a big win?

Self-Assessment Scoring:

- <20: Powerfully controlling my emotions

- 20–40: Moderate level of emotion management but requires improvement in focus

- >40: High emotional risk - consider journaling and emotional alerts

Self-awareness is the first step to developing trading discipline.

Quiz Scoring Table

|

Score Range |

Interpretation |

Suggested Action |

|

< 20 |

Strong emotional control. |

Keep up your disciplined approach! |

|

20 – 40 |

Moderate control; signs of emotional trading appear. |

Focus on journaling emotions and tightening your plan. |

|

> 40 |

High emotional risk. |

Implement strict journaling, use alerts, and limit trades. |

- Conclusion

Emotional control is not an optional skill for crypto traders; it's the foundation of success. Even the best technical strategy will fall flat if it is applied emotionally.

Keep in mind the Golden Triangle:

- Emotion

- Strategy

- Discipline

If you’re committed to improving your trading results, then start forming better habits today. Journal your trades. Record and monitor your emotions. Use tried and tested psychology models.

If you’d like to hear more about remaining emotionally disciplined in crypto trading and having the tools for managing your trading psychology, subscribe to btcdana.com and keep your head above water in your trading journey.