Introduction: Why Are Stablecoins Now in the Global Spotlight?

Stablecoins have gone from being just a small part of crypto to a big deal in the financial world. Recent stablecoin news captures why:

-

Circle’s IPO and its bid for a U.S. trust charter

-

Hong Kong’s new law licensing stablecoin issuers

-

U.S. stablecoin legislation requires one-to-one backing and public disclosures.

These developments show stablecoins are bridging traditional finance and crypto.

Stablecoin transfer volume reached $27.6 trillion in 2024, surpassing Visa and MasterCard combined. Major issuers like USDT and USDC now hold hundreds of billions in circulation.

Stablecoins are no longer “just crypto playthings”. They work like digital dollars on blockchain, making quick global payments possible. For traders and investors, stablecoins have become a key part of the financial system.

As USDT market trends continue to evolve, stablecoins play a larger role in crypto finance. Next up, we'll break down what stablecoins are, how traders use them, and the risks and rules coming up.

What Is a Stablecoin? A Beginner’s Guide to Stablecoins

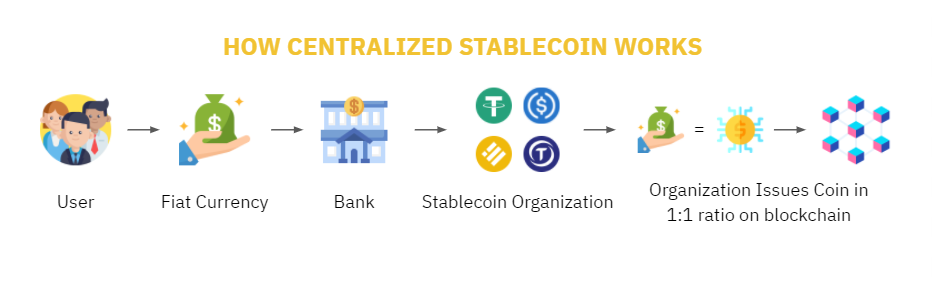

A stablecoin is a type of cryptocurrency that aims to keep its value steady. Usually, each stablecoin is linked to another asset (usually a fiat currency like the U.S. dollar). For example, each USDT (Tether) or USDC is meant to stay worth one dollar. They do this by keeping reserves of real assets to support each token. Basically, think of a stablecoin like a prepaid digital gift card filled with dollars: when you use it, it stays at $1.

Several stablecoin types:

-

Fiat-collateralized: These hold cash or bank deposits as reserves. (Example: USDT, USDC are backed 1:1 by U.S. dollars.)

-

Crypto-collateralized: These use other crypto assets as reserves. (Example: DAI is backed by Ethereum on the MakerDAO platform.)

-

Algorithmic (non-collateralized): No real reserves. Instead, they use rules/programs to balance supply and demand. (Example: the TerraUSD (UST) token, which used an algorithm linked to its sister coin LUNA.)

Fiat-backed coins like USDT and USDC are usually the most stable. They keep dollars in bank accounts and often show audits to prove it. Crypto-backed coins can lose value if the crypto they’re tied to drops in price. Algorithmic coins can be dangerous.

Not all stablecoins are equally stable. Fiat-backed ones generally do a better job of holding their $1 value, while algorithmic ones can crash hard. For example, TerraUSD tried to maintain its value through math, but it didn’t work out so well.

Why Do Stablecoins Matter for Forex and CFD Traders?

Stablecoins are popular among traders and brokers worldwide because they allow for instant and cheap money transfers across borders without going through traditional banks. Platforms like Binance or BTCDana often let users deposit and withdraw using stablecoins. Traders in countries with weak currencies use stablecoins as digital “dollar wallets” to keep their value safe and access global markets.

-

Borderless Settlements: Traditional international payments can be slow and pricey. Stablecoins eliminate the middleman, allowing funds sent in USDT or USDC to arrive in minutes with almost no fees on crypto networks.

-

Emerging Market Uses: In many developing economies, stablecoins act as proxies for the dollar. Even globally distributed tech firms pay employees in USD stablecoins to bypass volatile local currencies.

-

CFD Stablecoin Funding: Many CFD/forex brokers allow traders to use USDT/USDC as funding. By depositing stablecoins, traders can quickly jump into leveraged trades or FX positions.

-

Forex Stablecoin Use: Stablecoins provide forex traders with a straightforward and fast way to move money across borders.

Stablecoins make it easier to access funds. Traders can move money in and out of crypto/CFD markets globally at any time, trading with USDT to capitalize on opportunities without delay.

Regulatory Landscape: What’s Changing for Stablecoins in 2025?

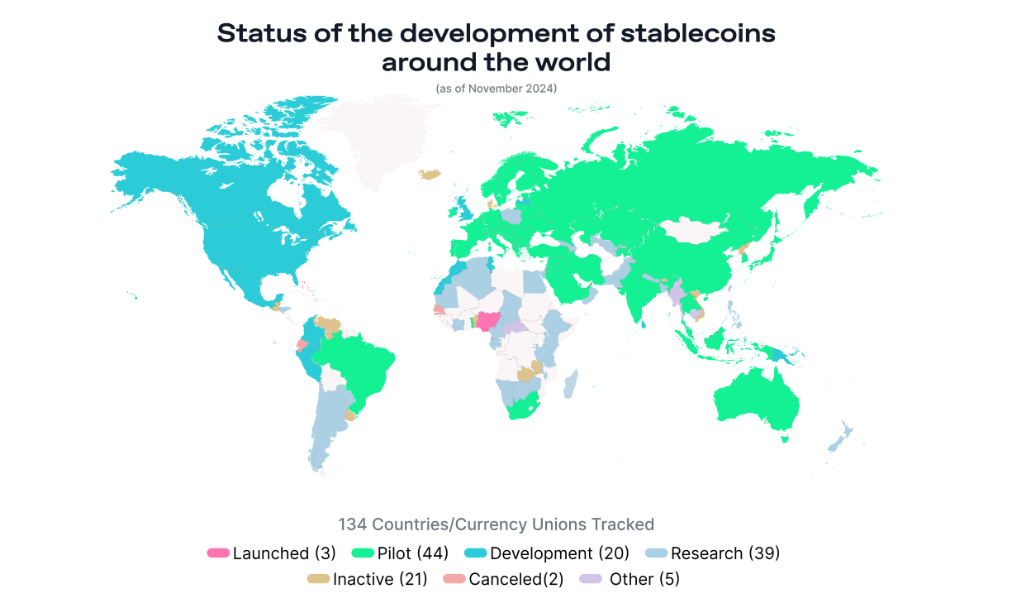

Regulators all around the world are racing to set rules for stablecoins in 2025. Each major area is working on its own stablecoin regulation, which will determine which stablecoins make it and which don’t.

-

United States – The U.S. Senate has passed a stablecoin framework called the “Clarity for Payment Stablecoins Act”. This bill would require any fiat-pegged stablecoin used for payments to be backed one-to-one with cash or U.S. Treasuries, and issuers must publish monthly reserve disclosures. In practice, this means Circle’s USDC (which already holds reserves in audited funds) would comply easily, while Tether (USDT) may face hard choices.

-

European Union – The EU’s Markets in Crypto-Assets (MiCA) regulation includes a stablecoin rulebook. It classifies major stablecoins as “e-money tokens” and mandates strict reserves, limiting how reserve assets can be invested. Notably, MiCA requires most stablecoin reserves to be held in eurozone banks, and allows regulated issuers to be interchangeable across member states.

-

Circle in Hong Kong is implementing a new stablecoin law (effective Aug 1, 2025), licensing issuers of fiat-pegged tokens. Authorities expect only a few issuers to meet the strict requirements.

Why Traders Should Care: The rules will decide which coins succeed and which get left behind. A stablecoin that meets U.S. standards will be trusted globally, while others might get banned or ignored. Circle’s focus on compliance could give USDC an advantage, whereas USDT compliance may focus on markets where rules are lighter.

Are Stablecoins Really Stable? Lessons from the UST Crash

Stablecoins are supposed to stay at $1, but history shows that not all designs are safe. TerraUSD was an algorithmic stablecoin: it kept its peg by minting or burning its sister token LUNA. In May 2022, a crypto market shock led to a UST crash. People holding UST quickly swapped it for LUNA, causing LUNA’s price to plummet to nearly zero and UST to drop way below $1. This chain reaction wiped out over $40 billion in just a few days.

Stablecoin risks: The stability of a stablecoin depends entirely on its design and collateral. Coins with 100% traditional reserves (like USDC, theoretically redeemable 1:1 for dollars) held up during stress, while purely algorithmic stablecoin schemes can fail. In reality, always check how a stablecoin is backed and audited before assuming it’s safe.

How Does Tether Make $1B+ From Interest? The Yield Model of Stablecoins

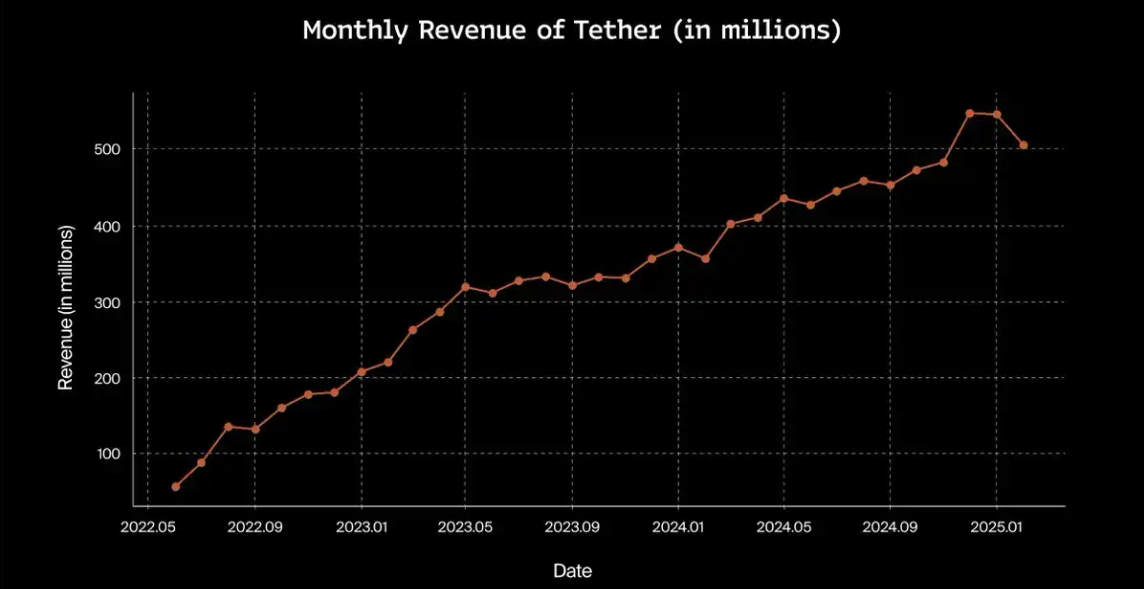

Stablecoins are profitable businesses. The biggest players, like Tether and Circle, make money by investing the dollars that back their tokens.

For example, a recent Reuters report found that about 80% of stablecoin reserves, including USDT reserves ($200 billion), are held in U.S. Treasury bills or repos. Tether earnings alone report about $120 billion in U.S. Treasuries. In Q1 2025, Tether recorded well over $1 billion in operating profit.

-

How it works: Users give dollars to the issuer and get stablecoins in return. The issuer then invests those dollars in easy-to-sell assets. The interest they earn becomes profit. Unlike regular banks, stablecoins have assets that match every token created.

-

Massive “shadow bank”: Collectively, stablecoins are now big players in Treasury markets. Their treasury holdings are similar to those of a mid-sized economy.

-

Risks: If U.S. interest rates drop, stablecoin yields will drop too. Plus, if too many tokens are cashed in at once, having assets locked up could cause liquidity risks.

In short, stablecoins borrow dollars and lend them out to the government, making money from the spread (aka Stablecoin interest). But it also means stablecoins sit at the intersection of crypto and traditional finance.

Do Stablecoins Undermine the U.S. Dollar?

Big questions are being raised about stablecoin and USD’s global role. They extend the dollar’s reach by allowing people and businesses to use “the dollar” instantly worldwide, often without going through banks.

For example, in countries like Argentina or Turkey, where inflation is high, people are turning to USDT adoption. They’re getting paid and saving in USDT just like they would with real dollars. In this way, stablecoins can help reinforce the dollar’s strength by meeting demand through crypto.

Many developing countries see stablecoins as substitutes for dollars, rather than replacements. They still operate based on USD value. U.S. regulators see stablecoins as a way to keep digital payments linked to the dollar. Over time, stablecoins could change how currencies are used. But digital dollar threats depend on policies. For traders, the takeaway is that stablecoins are political as well as financial instruments.

How to Arbitrage Stablecoins: From On-Chain to OTC

Traders can and do stablecoin arbitrage, but it’s not free money. The principle is simple: when the price of a stablecoin drops below $1 on one market, buy low and sell on another for a tiny profit. Common methods include:

-

Between Exchanges: Compare prices of stablecoins on different CEXs. For example, if USDT trades at $0.998 on Binance but $1.002 on another exchange, a fast trader could buy on Binance and sell on the other.

-

Cross-Chain Arbitrage: Stablecoins exist on multiple blockchains. Sometimes USDT trading strategy on Tron (TRC20) results in a slight discount compared to USDT on Ethereum (ERC20) due to liquidity differences. An arbitrageur might swap tokens across chains to profit from even a 0.2% gap.

-

CEX vs DEX: Liquidity pools on decentralized exchanges can show different stablecoin rates than centralized platforms. Advanced traders watch large pools on Uniswap or Curve and execute flash-loan-backed trades to exploit any deviation.

-

OTC/Retail: In some countries, peer-to-peer or OTC prices differ. Traders may buy stablecoins cheaply via local networks and sell internationally where demand is higher.

But beware the risks. These spreads are often very small. So you need a big volume to make it worth the effort. Fees and delays can wipe out profit: gas fees, withdrawal minimums, and slippage all cut into arbitrage gains. For example, moving USDT from Ethereum to Binance might cost tens of dollars and take minutes, but by then the price gap can vanish.

CBDCs vs Stablecoins: Friend or Foe?

Central Bank Digital Currencies (CBDCs) and private stablecoins aim for quick digital payments, but are pretty different. CBDCs are issued by central banks and are legal tender with state backing, which gives control over policy, privacy, and interest rates. On the other hand, stablecoins come from private companies, relying on reserve backing and user trust in audits. Both usually use blockchain, but CBDCs might operate on permissioned systems, while stablecoins generally use public networks.

Their coexistence depends on market design. CBDCs could be distributed via licensed fintechs as regulated stablecoins. Conversely, stablecoins may serve roles like cross-border payments that CBDCs avoid. For instance, China’s e-CNY CBDC and Hong Kong’s yuan-pegged stablecoin highlight this evolving dynamic. USDT’s popularity across Asia illustrates private dominance. Central banks are responding by launching or regulating digital currencies. Future competition or complementarity will hinge on regulatory choices, technological design, and user needs.

A real-world example: China is testing out its e-CNY (digital yuan CBDC), while Hong Kong is looking into a yuan-pegged stablecoin. At the same time, USDT is a go-to in Asia for accessing US dollars. Traders should keep an eye on this area because the different rules and features will shape whether CBDCs and stablecoins work together or go head-to-head in each market.

The Road Ahead for Stablecoins

Stablecoins have come a long way from being just crypto curiosities to becoming an essential part of the financial system. They are bridging traditional finance and decentralized finance, letting traders move money quickly and giving consumers access to a "digital dollar" from just about anywhere. But this new landscape is still being figured out.

For traders and finance pros, mastering stablecoins is now a core skill. You need to know which coin you’re using and how it’s backed. Understand that stablecoin future depends on design, and value on the global stage depends on laws and geopolitical shifts.

With BTCDana, you can confidently integrate stablecoins into your trading routine:

-

Instantly deposit and withdraw USDT to access global CFD and forex markets.

-

Trade over 300 CFDs (forex, crypto, stocks, commodities) on desktop or mobile with tight spreads and fast execution.