Introduction

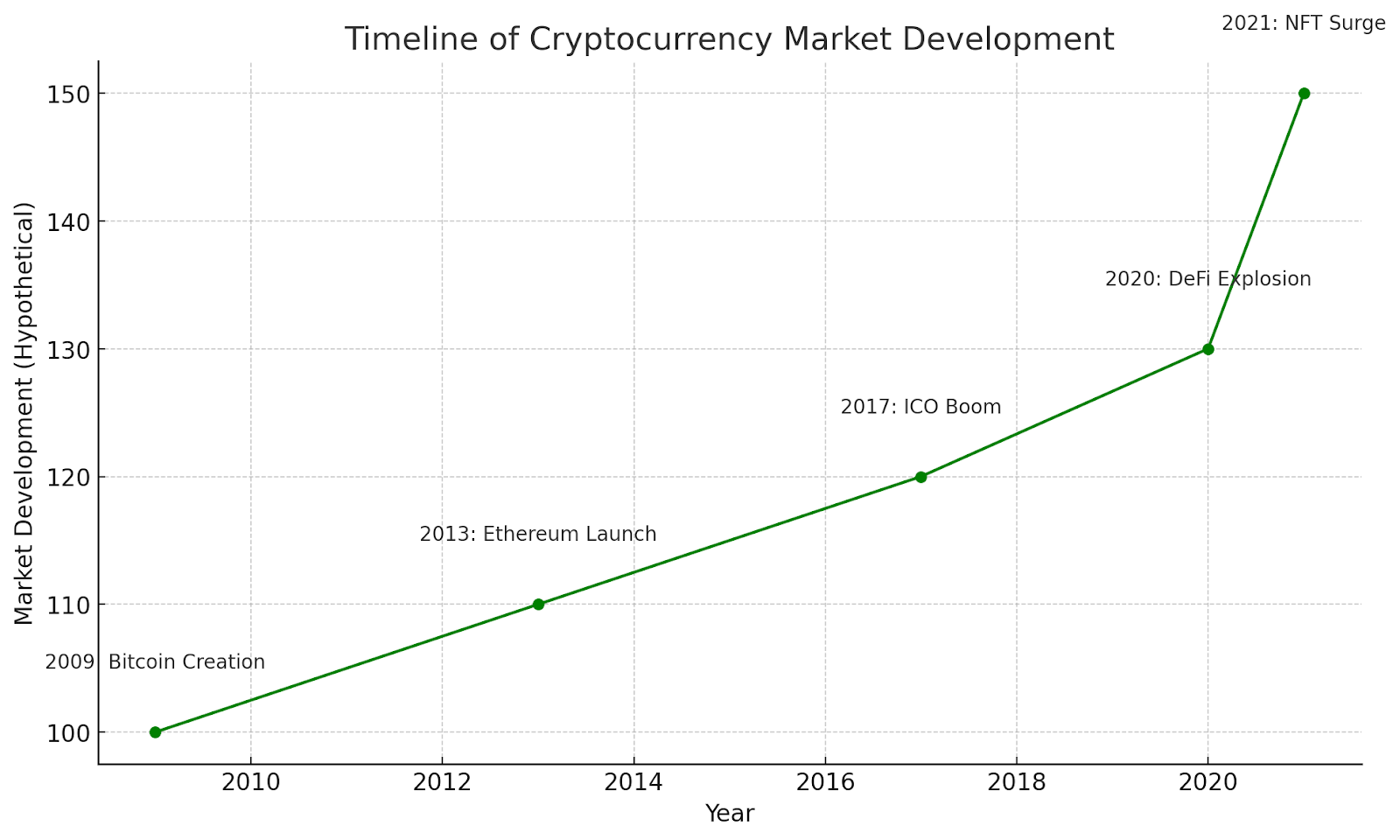

The cryptocurrency market has transformed over the last ten years from a specialized idea to a significant financial ecosystem that has caught the interest of institutional investors, retail traders, and even governments. Since the invention of Bitcoin in 2009, the world has expanded to include thousands of digital assets and cutting-edge blockchain technologies.

As the original and most well-known digital currency, Bitcoin investment continues to take center stage in news reports and portfolios. Bitcoin is a crucial component of many cryptocurrency schemes, as it is decentralized and has a limited supply. People also call it "digital gold."

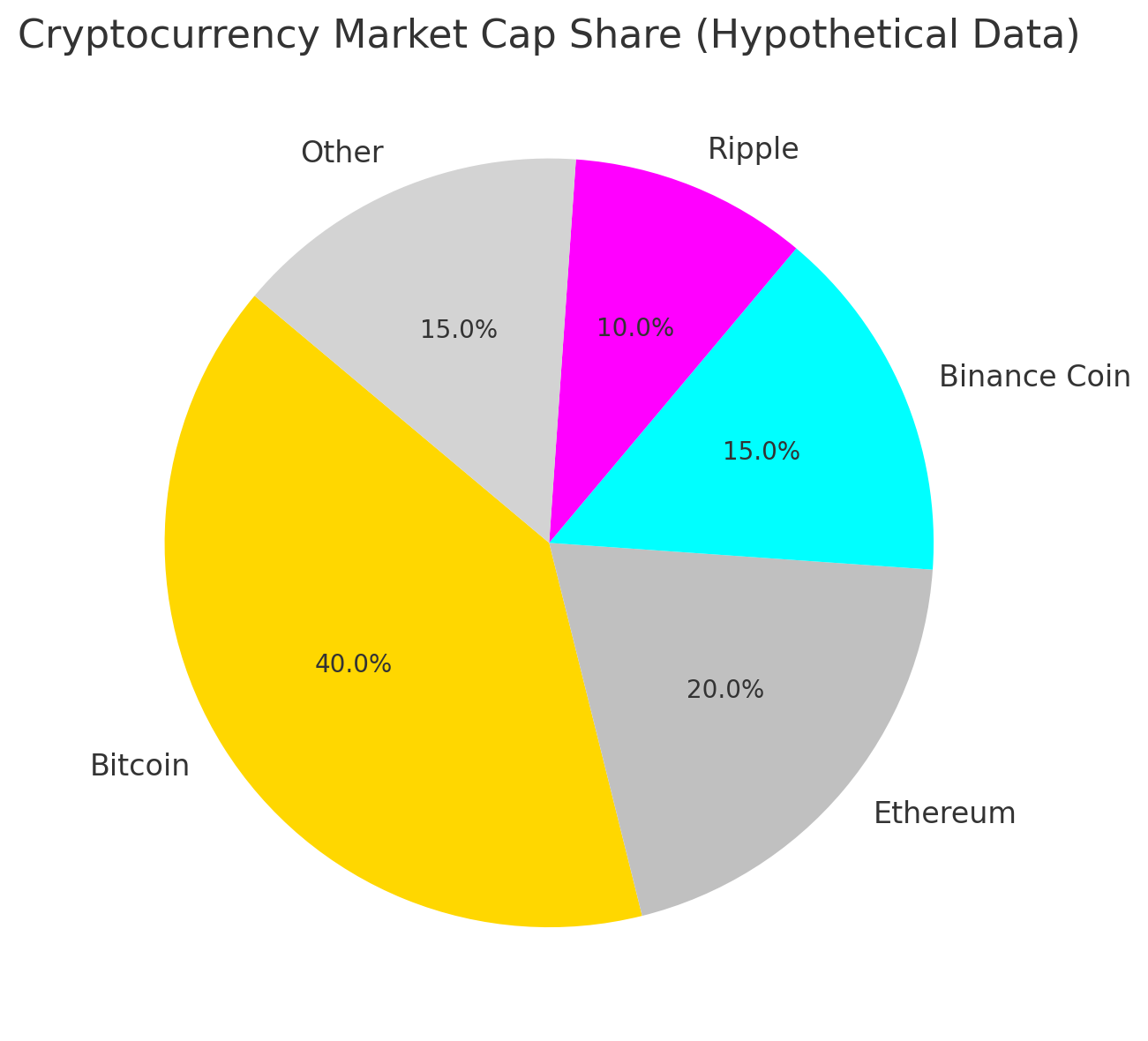

However, as Bitcoin has grown, other popular cryptocurrencies, such as Ethereum, Binance Coin, and Ripple (XRP), have also gained popularity. Smart contracts, decentralized programs that can evolve, and payments that can be done across borders are just a few of the things that each of these cryptocurrencies can do.

The fact that there is an increasing number of cryptocurrencies presents both advantages and challenges for investors. Making wise investment choices requires a deeper understanding of how these assets compare and where they may be headed in the crypto asset future in light of market volatility, changing regulations, and quickly developing technologies.

In this article, we will discuss how Bitcoin's dominance has evolved over time, the role of prominent altcoins, and strategies for investors to adjust and diversify their holdings.

Bitcoin’s Unique Advantages and Challenges

As the first cryptocurrency, Bitcoin continues to maintain its market leadership thanks to a number of well-known Bitcoin advantages. The first is its artificial scarcity, which many investors compare to digital gold because there will only ever be 21 million coins.

An unparalleled network effect ensures this scarcity. Bitcoin's globally dispersed nodes virtually eliminate any single point of failure, and its hash rate frequently surpasses 600 hashes per second. As a long-term store of value, these characteristics together offer promising Bitcoin investment prospects.

However, security and decentralization don't eliminate all problems. On-chain transactions settle about every ten minutes; however, costs go up when there is a lot of traffic. Scalability solutions like the Lightning Network, which can already manage over US$500 million in locked value, are still in the early stages of adoption, but they show promise.

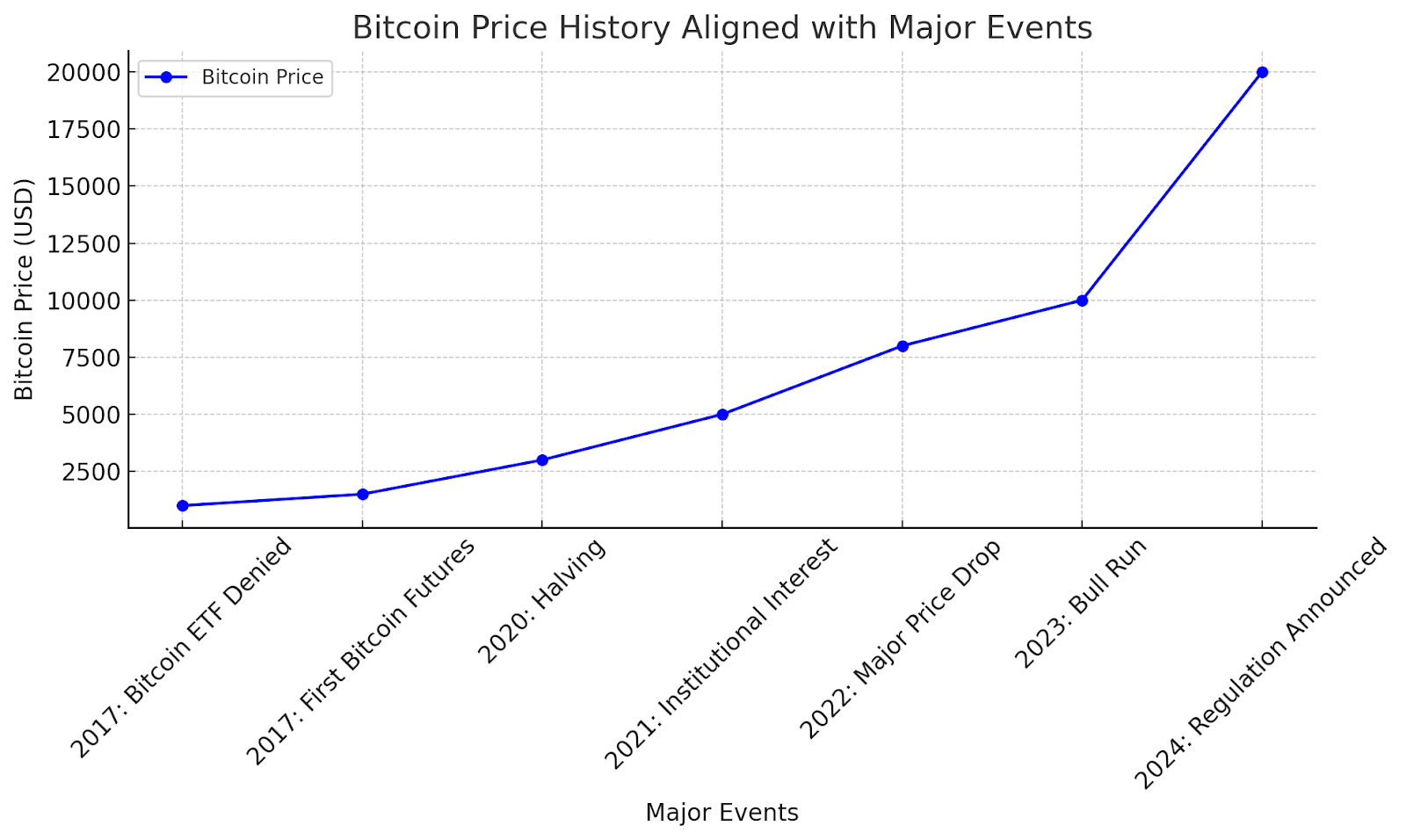

These structural problems may make it harder to use regular payments when compared to speedier blockchains. Bitcoin risks are compounded by regulation. Intraday price swings exceeding 10% have been sparked by headlines announcing stricter regulations in China (2021) or hints of U.S. spot ETF approval (2024). Still, institutional interest is growing.

For Example: MicroStrategy has more than 200,000 Bitcoins on its balance sheet, and demand from enterprises has increased by US$1.5 billion since Tesla's investment in 2021. These well-known entries do make things more believable, but they also indicate how changes in macro policies affect the price of Bitcoin.

In brief, investors should consider how technology is evolving and how policies are changing before investing in Bitcoin. Even if it remains popular because it is uncommon, secure, and has a strong brand, they should consider this approach. You need to know how to deal with the ups and downs of the first cryptocurrency in history if you want to get the most out of it.

Differences and Potential of Other Major Cryptocurrencies

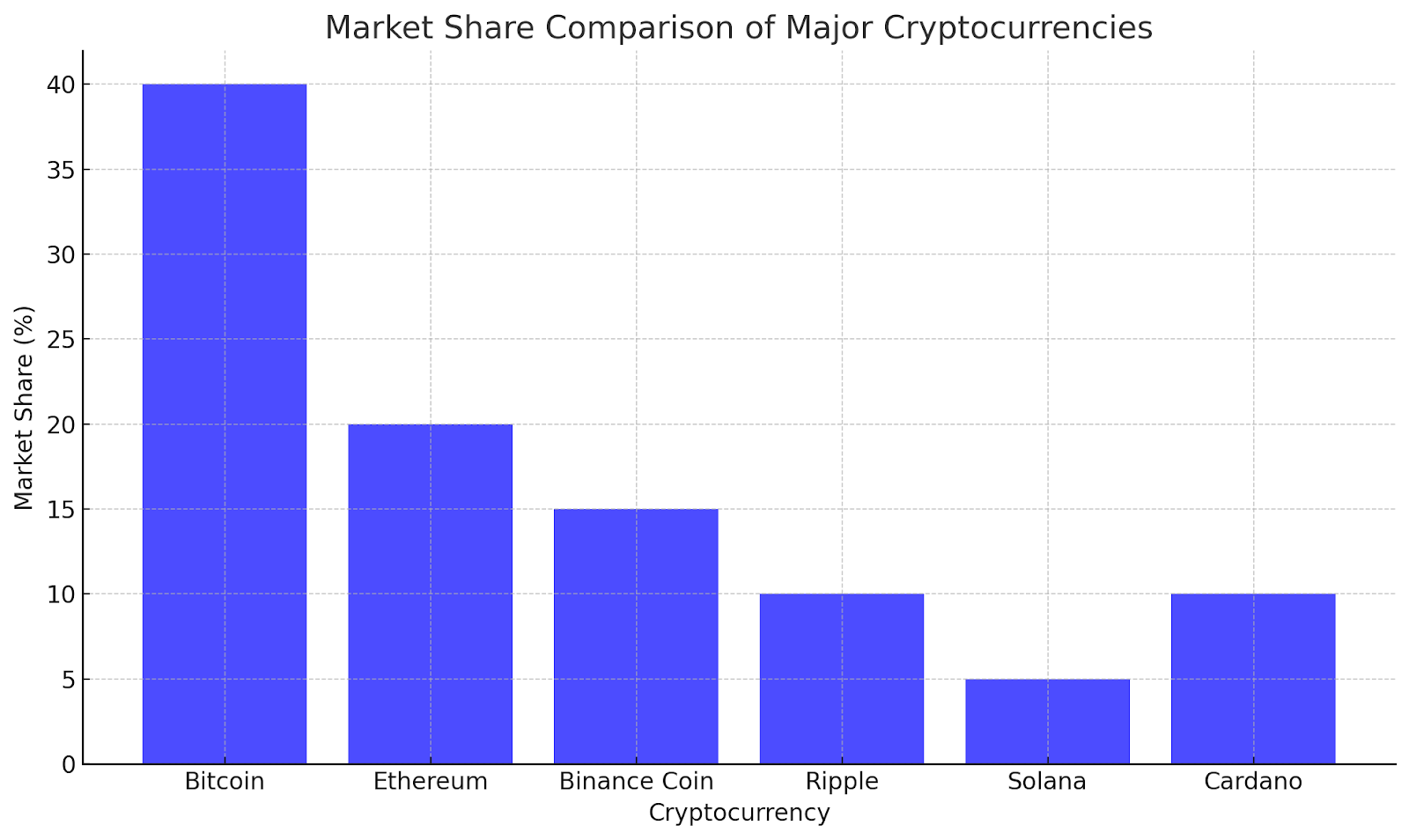

Even though Bitcoin still makes the most news, a more thorough major cryptocurrency analysis shows a rich and varied ecosystem of digital assets, each with its own distinct technical advantages and business prospects. Building a well-rounded cryptocurrency portfolio requires an understanding of these distinctions.

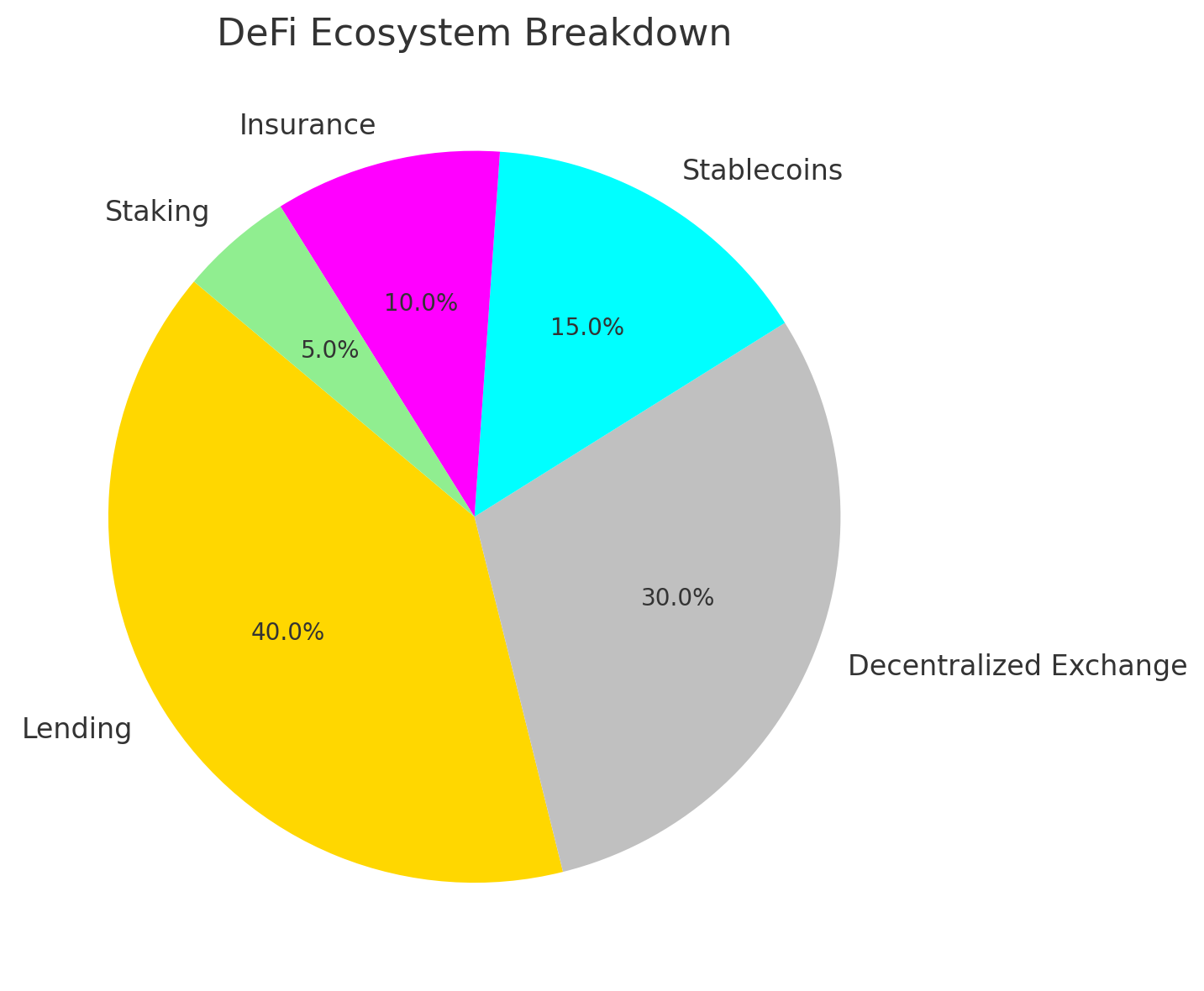

Due to its strong, smart contract capabilities, Ethereum's investment has increased significantly. Ethereum is at the heart of the decentralized finance (DeFi) movement. Its ERC 20 token standard makes it easy to construct apps that can be programmed, and it has also made it easier to launch thousands of tokens and platforms.

For Example: This incredible rise, notably during the DeFi boom of 2020–2021, sent ETH prices to all-time highs, turning Ethereum into more than just a cryptocurrency; it became the infrastructure layer for Web3.

Binance Coin's prospects lie in its utility across the Binance ecosystem. BNB is in high demand, and its network is growing because individuals use it to pay trading fees, acquire access to token launches, and take part in DeFi protocols on the BNB Chain. It is a valuable tool for both developers and traders, as it is closely tied to the world's largest cryptocurrency market.

The emphasis on cross-border payments makes the Ripple application unique. Banks and other financial institutions are interested in XRP because it was created to enable inexpensive, almost instantaneous international transfers.

Ripple's long legal battle with the US SEC has led to fluctuating prices and has made investors less certain about the company's robust technology. People know Cardano for its research-based development and energy-efficient way of reaching an agreement.

Solana is another notable cryptocurrency that facilitates swift and inexpensive transactions. Because these currencies may work with one another, they typically do so. When comparing these assets, consider factors such as their intended use, the level of activity within the development team, the ease of selling them, and the team's level of recognition.

These altcoins don't have a unique selling point like Bitcoin does. Instead, their value as investments primarily depends on how useful they are, how many people use them, and new market trends.

How Investors Should Choose Cryptocurrencies

A well-thought-out cryptocurrency investment strategy is essential in this fast-paced, frequently unpredictable market. With thousands of digital assets available, investors must approach coin selection with logic, research, and a firm grasp of risk control rather than emotion or crowd-following.

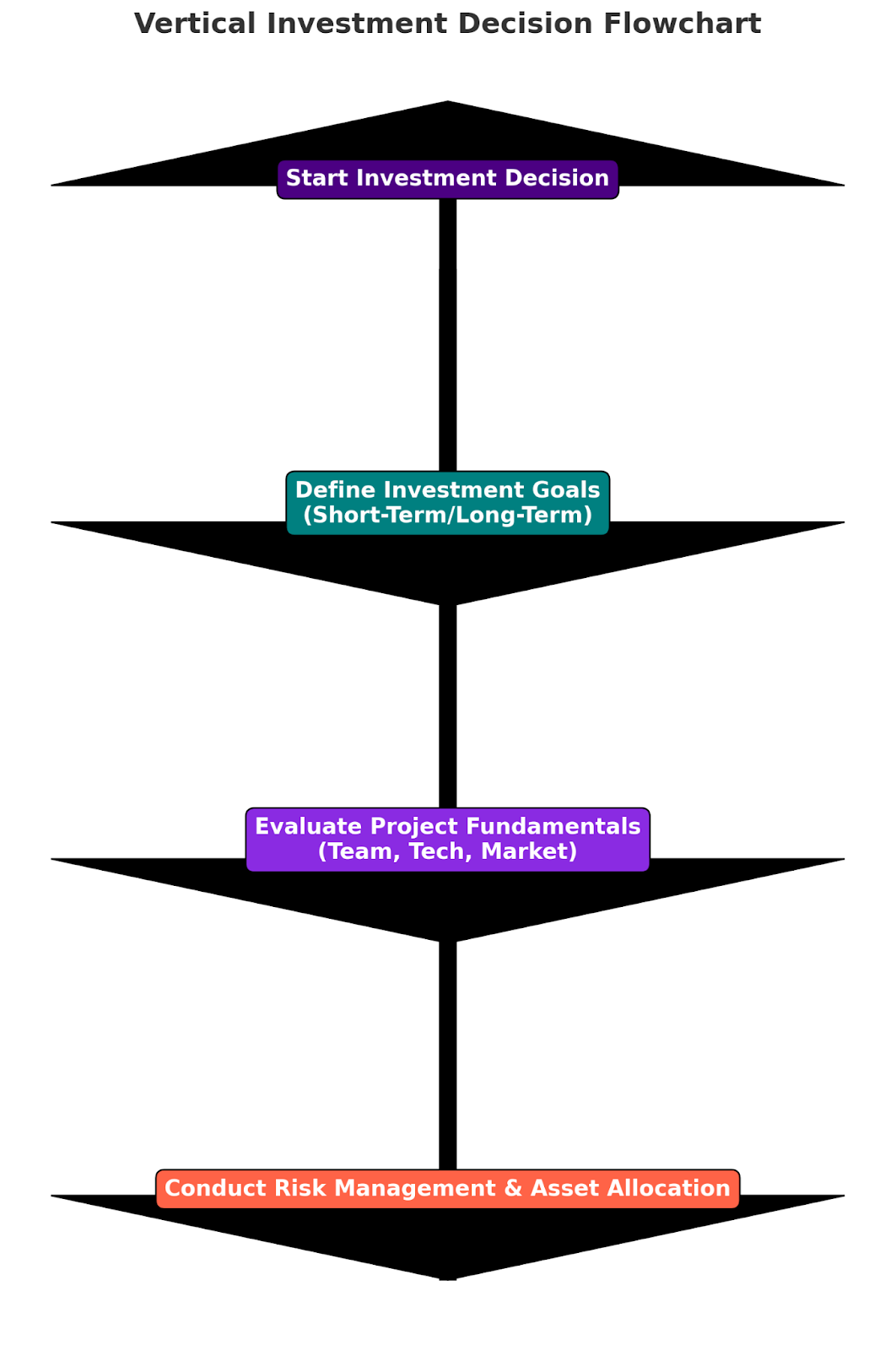

First, write down what you want to get out of your investments: Are you looking for short-term profits through speculative trading or long-term wealth building based on the fundamentals of the project? Your plan should fit with how long you plan to stay in the market and how much risk you're willing to take.

Next, look at the most important parts of any project: the development team's experience, new technologies, real-world use cases, community activity, and the health of the ecosystem. Projects that get regular updates have good developer support, and solve real problems usually lead to better investment decisions.

For Example: Early Ethereum investors who read its whitepaper and understood how smart contracts could be used made a lot of money during the DeFi boom. On the other hand, a lot of people who bought hype-driven tokens without doing their homework, like some meme coins, lost a lot of money during market corrections.

These real-life examples show how important it is to do your homework. Without sound crypto risk management, even good setups can result in losses. Technical indicators and chart patterns can help you spot entry and exit points. Set stop-losses, control the size of your positions, and get ready for market swings.

Smart asset allocation can help you spread your risk so that you aren't too reliant on the success of any one asset. Don't put all of your money into one coin or sector. Instead, create a portfolio that includes a variety of categories and change it as the market changes.

Also, keep an eye on changes in the law and use reliable platforms that offer risk management tools, analytics, and help. The most important thing to remember is that a logical, research-based approach leads to success.

Don't try to make quick money. Instead, learn from both successful investors and those who lost money because they didn't plan well or traded based on their feelings.

Future Trends and Market Outlook

Investors hoping to stay ahead of the curve must comprehend cryptocurrency's future trends as the digital asset space continues to change. Both innovation and policy are influencing the industry's transition from a frontier of speculation to a more developed, regulated, and utility-driven financial ecosystem.

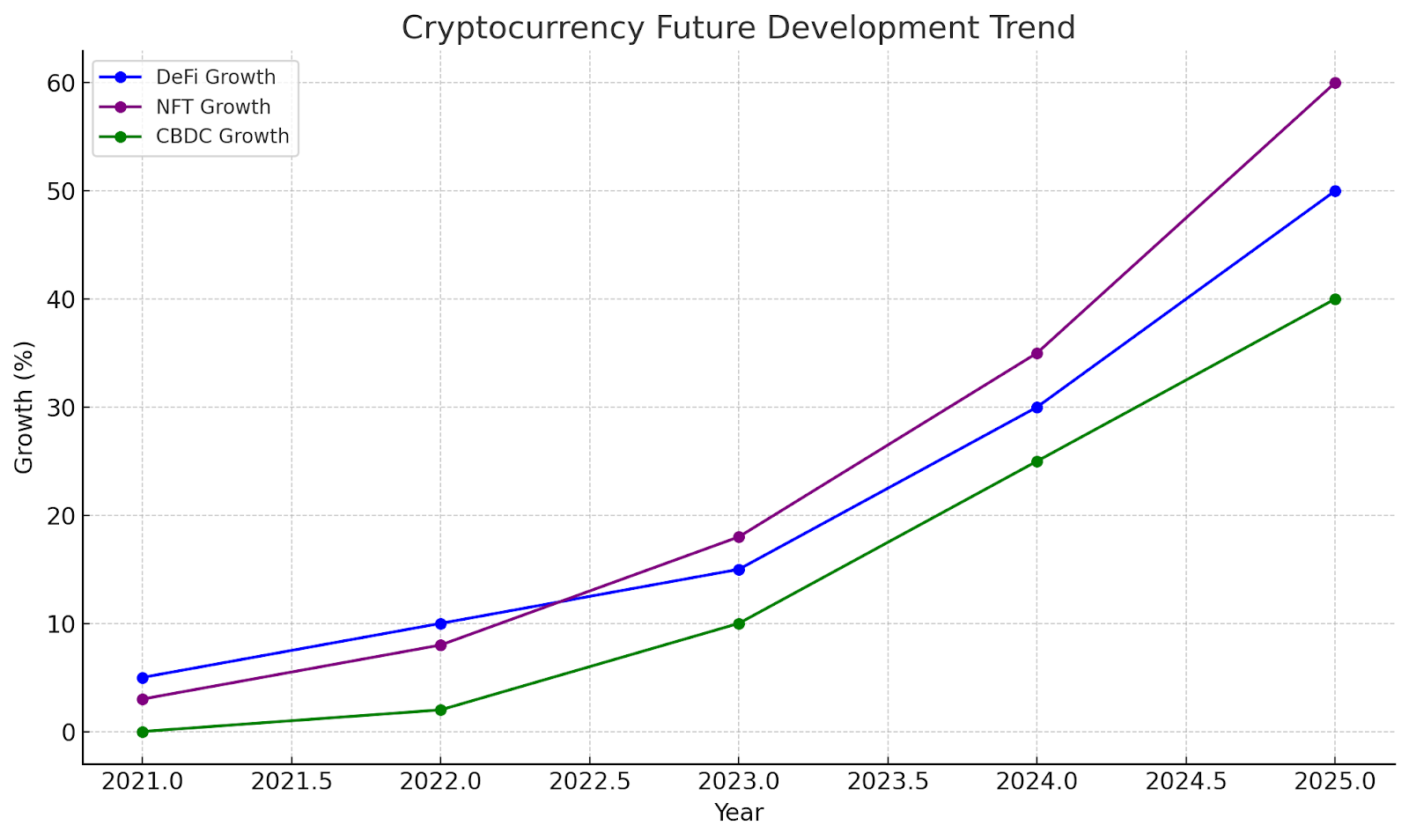

The ongoing DeFi development is a major factor in future growth. Applications of decentralized finance have already transformed asset trading, lending, and borrowing without the need for middlemen. DeFi is establishing the foundation for an alternative financial infrastructure, with smart contracts driving everything from synthetic assets to yield farming.

For Example: Recent improvements to Ethereum, such as the switch to proof-of-stake in Ethereum 2.0, have increased scalability and decreased energy consumption, which has benefited price and developer activity.

The emergence of Central Bank Digital Currencies (CBDCs) is another important theme. CBDCs are being piloted by nations like China (with the digital yuan) and Nigeria (with the eNaira), and other governments are looking into similar projects.

Fiat-crypto interactions may change as a result of the CBDC impact, leading to new regulatory frameworks and changes in investor behavior. The market is also being shaped by environmental concerns.

As sustainability becomes a global priority, green cryptocurrencies that utilize environmentally friendly consensus mechanisms, such as proof-of-stake, are gaining increasing popularity. Networks like Cardano and Ethereum are promoting themselves as greener substitutes for chains that use a lot of energy.

Stronger digital asset compliance is being pushed for globally on the regulatory front. Tighter regulation is anticipated to promote market stability and safeguard individual investors, as evidenced by the EU's MiCA framework and the U.S. SEC's changing position.

Institutional players like Fidelity and BlackRock are also introducing crypto-related products, indicating ongoing institutional involvement. In conclusion, the cryptocurrency market is about to enter a more developed stage characterized by advancements in technology, environmental consciousness, and regulatory clarity.

Investors will be better positioned to navigate the next phase of cryptocurrency development if they align their strategies with these trends, emphasizing innovation, compliance, and real-world use cases.

Frequently Asked Questions

The technology, market patterns, regulatory risks, and your investing goals (short-term vs. long-term) are factors you should consider.

Ethereum is ideal for DeFi and smart contracts, while Binance Coin is helpful for the ecosystem. Bitcoin is safe, but it doesn't scale well.

DeFi is a financial service that doesn't need an intermediary to enable you to borrow, lend, and trade.

Conclusion

The digital asset market has enormous potential, but it's also complicated, as this cryptocurrency investment summary demonstrates. While other well-known coins like Ethereum, Binance Coin, and Ripple offer distinctive features and developing ecosystems, Bitcoin remains the leader due to its scarcity and decentralization.

However, these advantages also come with several significant drawbacks, including market volatility, technical limitations, and regulatory risks. It takes more than just speculation to be a successful cryptocurrency investor.

It necessitates making rational investment decisions supported by research, risk management, and a thorough comprehension of trends and technology. Continual learning and meticulous analysis are crucial for traders of all skill levels.

Follow the latest crypto news and insights at btcdana.com to stay informed and make better investment decisions. Btcdana provides useful tools to help you confidently and clearly navigate the future of digital finance, including market updates and educational materials. Begin with a demo account on our platform now to implement all you have learned in this article.