Introduction

The foreign exchange (forex) market is the largest and most liquid market in the world, with over $7 trillion traded daily. Its global, decentralized, and largely over-the-counter nature makes it incredibly attractive to traders. But this very openness also brings risk. Forex compliance isn’t a marketing checkbox; it’s a legal obligation that can determine whether your trading is profitable and sustainable or whether it ends in fines, frozen accounts, or worse.

Regulators around the world are paying increasing attention to forex regulation because the industry has become a magnet for illegal trading risks. Money laundering, tax evasion, cross-border capital flight, and fraud are all real threats. This is why many countries have tightened rules and are cracking down on unlicensed brokers and unregulated platforms.

Non-compliance is not some distant threat reserved for scammers; it can hit any trader. Ignoring jurisdictional rules can mean severe penalties, asset freezes, or even criminal charges. Consider these real-world cases:

-

In 2020, the U.S. CFTC fined multiple unregistered brokers millions of dollars for serving U.S. clients illegally.

-

Chinese investors lost millions to offshore forex platforms that disappeared overnight without regulatory recourse.

If you’re serious about trading, understand this truth: Compliance is not optional but the baseline for long-term, stable profitability.

Table 1:Compliance vs. Non-Compliance in Forex Trading

Global Forex Regulatory Frameworks: Key Institutions and Principles

Unlike centralized stock exchanges, forex is an over-the-counter (OTC) market with no global regulator. Instead, each country has its own frameworks, rules, and oversight agencies. Understanding these is essential for anyone navigating forex regulators.

Major Forex Regulatory Bodies

United States – CFTC & NFA

· The Commodity Futures Trading Commission (CFTC) regulates retail forex in the United States under the Dodd-Frank Law. To operate within the CFTC's regulations, brokers must register with the National Futures Association (NFA).

· Leverage regulations are 1:50 for major currency pairs, 1:20 for minor currency pairs, with a minimum funding requirement of $20 million in net capital for brokers. The CFTC also requires brokers to disclose risk in a detailed disclosure.

United Kingdom – FCA

· The Financial Conduct Authority (FCA) is the enforcer of strict regulations in the UK regarding client protections. The FCA requires that clients have segregated accounts, negative balance protection, and FSCS compensation up to £85,000.

· The FCA is also known for the diligent enforcement of its regulations by revoking brokers that are not compliant and taking action against the firm or individual.

European Union – ESMA under MiFID II

· The European Securities and Markets Authority (ESMA) regulates forex under MiFID II.

· ESMA enacts a leverage cap of 1:30 for retail clients, as well as an outright ban on binary options.

· ESMA requires standardized risk warnings and negative balance protection, as well as product intervention powers.

Australia – ASIC

The Australian Securities and Investments Commission (ASIC) requires:

· $1 million+ capital reserves

· segregated client funds

· leverage limitations (1:30 retail cap)

· ASIC receives significant respect for active enforcement, and investor education.

Singapore – MAS

· The Monetary Authority of Singapore (MAS) is considered one of the strictest regulators in Asia.

· MAS requires brokers to hold a Capital Markets Services License.

· MAS places much greater emphasis on AML/CFT compliance than ESMA, however, MAS, as seen in its active educational efforts in the retail forex sector, appreciates the importance of client funds segregation and investor education too.

Regulatory Approaches and Principles

Most top-tier regulators enforce:

-

Strict KYC and AML requirements.

-

Segregated client accounts.

-

Transparent disclosure of costs and risks.

-

Defined leverage limits to reduce excessive risk.

-

Ongoing audits and reporting.

Compare this to unregulated or offshore brokers with no capital requirements, no reporting, and no protection for your deposits.

Example: The FCA has revoked licenses of multiple firms for failing KYC checks. ESMA’s retail leverage cap is widely respected and copied in other regions.

There’s no single rulebook: Huge differences exist between regulators; traders must understand the regulatory background of their chosen platforms.

Key Elements of Compliance: KYC, AML, and Fund Security

At the heart of forex compliance are three critical pillars: forex KYC, AML in forex, and client fund segregation. These aren’t just bureaucratic hurdles; they’re systems designed to protect you as a trader.

KYC (Know Your Customer)

-

Verifies trader identity to prevent fraud.

-

Typically requires government ID, proof of address, and sometimes a source of funds.

-

Helps ensure only legitimate users can access services.

Forex KYC is legally mandated in most jurisdictions. Brokers use automated verification systems to make this process faster while meeting regulatory obligations.

AML (Anti-Money Laundering)

-

Brokers monitor transactions for suspicious activity.

-

AML programs report large or unusual trades.

-

IP tracking, withdrawal limits, and freezing suspicious accounts are common.

AML in forex is crucial for preventing illicit financial flows. Regulators impose heavy fines on brokers failing AML checks.

Client Fund Segregation

-

The broker must keep client deposits separate from operating capital.

-

Prevents misuse of trader funds if the broker faces financial trouble.

Client fund segregation ensures that even if a broker fails, your money is held safely in third-party trust accounts.

Example: The FCA regularly warns platforms about non-compliant forex KYC processes. FATF publishes blacklists of high-risk countries where AML checks are weak.

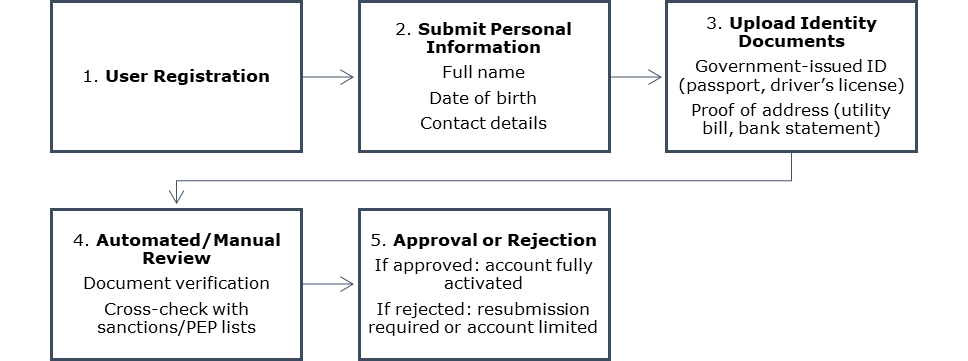

Table 2: KYC Verification Flowchart

Traders should always choose secure forex platforms with proven compliance. Strict compliance procedures are necessary to protect trader assets and legal identity.

Country-Specific Regulations and Their Impact on Traders

Where you live and where your broker operates both affect your legal obligations. Cross-border traders especially need to understand forex leverage limits, forex tax policies, CFD legality, and forex regulatory comparison across regions.

Leverage Limits by Country

-

USA: 1:50 maximum on majors.

-

EU: 1:30 due to ESMA rules.

-

Japan: Even stricter at 1:25.

These caps exist to reduce retail trader risk. High leverage can amplify both gains and catastrophic losses. For traders, these limits mean adjusting position sizes and strategies depending on their broker's jurisdiction.

Forex Tax Policies

-

US and UK: Traders must report gains, typically as capital gains or business income.

-

Singapore: Currently offers tax-exempt status for individual forex trading profits.

Understanding forex tax policies is essential to avoid surprises during filing season.

CFD Legality

-

CFDs are heavily restricted or banned in some markets. For example, Hong Kong limits retail CFD access.

-

Brokers must comply with local marketing rules, disclosure standards, and licensing requirements.

Other Compliance Factors

-

Crypto deposits: Some regulators ban or limit the use of crypto for funding forex accounts.

-

Fund transfers: Rules on foreign exchange controls and anti-money-laundering disclosures can impact withdrawals.

-

Cross-border issues: Home-country regulations may override broker jurisdiction requirements.

Example: The NFA in the U.S. has aggressively cracked down on high-leverage offerings. Japan's FSA reduced leverage limits to protect retail traders.

How to Choose a Compliant Forex Broker

Your choice of broker is the most important compliance decision you’ll make. Here’s how to apply the principles of choosing forex brokers, regulated forex brokers, licensed forex brokers, and identifying forex scams.

Check Regulatory Licenses

-

Verify license numbers on official regulator sites.

-

Confirm brokers are approved by bodies like the FCA, ASIC, or CFTC.

Regulated forex brokers proudly display licensing info. Licensed forex brokers make verification easy.

Review KYC/AML Transparency

-

Do they explain their KYC requirements?

-

Do they detail AML policies?

-

Non-transparent brokers may be hiding non-compliance.

Client Fund Segregation

-

Look for clear policies on fund separation.

-

Ask about third-party trust accounts or insurance.

Read User Agreements

-

Review all risk disclosures.

-

Look for clarity on costs, margin calls, and dispute resolution.

Evaluate Customer Support

-

Fast, clear answers to compliance questions.

-

Access to support in your language or region.

Use Broker Verification Tools

-

FCA’s online license checker.

-

NFA’s Background Affiliation Status Information Center (BASIC).

Example: A platform operating without licensing was shut down, leaving investors with no recourse. Use tools to verify real regulatory info.

Future Trends in Forex Compliance and How Traders Can Prepare

Forex isn’t static; compliance is evolving. Staying ahead of forex regulatory trends, future forex compliance, global forex regulations, and trading tax transparency is essential.

Key Trends to Watch

-

Automatic Information Exchange: CRS systems and OECD guidelines push brokers to share tax data internationally.

-

Crypto Regulation: Many countries are adding crypto KYC/AML rules for forex platforms accepting crypto deposits.

-

AI-Powered AML Systems: Automating suspicious transaction detection will reduce fraud but increase costs for non-compliant brokers.

-

Tax Transparency: OECD initiatives push for sharing CFD and forex account data with tax agencies.

-

Regulatory Arbitrage Shrinking: Countries harmonize standards to close loopholes.

Example: The EU is drafting a unified CFD regulation for retail traders. Singapore’s MAS coordinates crypto forex oversight.

Conclusion

Forex compliance isn’t a barrier to trading; it’s your moat. Traders who treat compliance as a core part of their strategy don’t just avoid fines, they protect their funds, their legal standing, and their long-term profitability.

Every serious trader should:

-

Study both the home country and platform jurisdiction laws.

-

Choose regulated forex brokers and licensed forex brokers.

-

Stay updated on forex regulatory trends.

btcdana.com can help with advice on forex trading compliance. We offer:

· Forex broker compliance guide articles.

· Tools for checking broker licenses.

· Access to btcdana compliance services to help assess your trading setup.