Introduction

Why Crypto Taxes Matter

Cryptocurrency has exploded from a niche experiment to a global multi-trillion-dollar market. With this meteoric growth has come increased regulatory scrutiny. Governments worldwide are racing to ensure that crypto doesn’t become a haven for tax evasion. Crypto tax compliance is no longer optional; it’s essential for anyone holding or trading digital assets.

Why? Because more countries are implementing crypto tax laws designed to capture revenue from capital gains, income from mining and staking, and even NFT sales. Authorities are stepping up enforcement, with high-profile cases proving the risks of ignoring these rules. For example:

-

Coinbase had to disclose user data to the IRS, leading to thousands of U.S. crypto traders receiving audit letters.

-

South Korean authorities seized crypto holdings from tax evaders who tried to hide assets in private wallets.

Non-compliance can lead to audits, crypto tax penalties, frozen assets, and even criminal charges. As crypto trading matures, so does the tax environment around

How Crypto Assets Are Taxed: Income, Capital Gains, or Both?

Unlike fiat currency, crypto isn’t always treated as “money.” Most jurisdictions classify it as property or an asset, triggering crypto capital gains tax when sold or traded. But different activities have different tax obligations.

Breakdown by Activity

Table 1: How Different Crypto Activities Are Taxed

-

Trading usually means paying crypto capital gains on profits.

-

Mining rewards are treated as crypto income tax.

-

Staking and airdrops often count as staking tax or passive income.

-

NFT sales can be either capital gains or income, depending on your country's rules.

Many traders wonder if losses can be written off. In many jurisdictions, losses can offset gains, reducing your tax bill.

Example: The IRS treats mined coins as income and tracks cost basis for gains. The Australian ATO has clear rules on NFTs for crypto tax guide purposes.

Around the globe, crypto tax enforcement is becoming more coordinated and unavoidable. The OECD's Crypto-Asset Reporting Framework (CARF) is being adopted by over 40 jurisdictions requiring exchanges to share user transaction data cross border from 2026. These developments will dramatically change the way traders can hide unreported gains, and reinforce the importance of duly recording every trade, transfer, and exchange.

Meanwhile, in the United States, the IRS is expanding its reporting rules with exchanges soon required to issue Form 1099-DA to show users' sales proceeds - essentially the same as the brokerage reports for stocks - meaning capital gains calculations could soon become necessary resources and vastly more visible to the IRS.

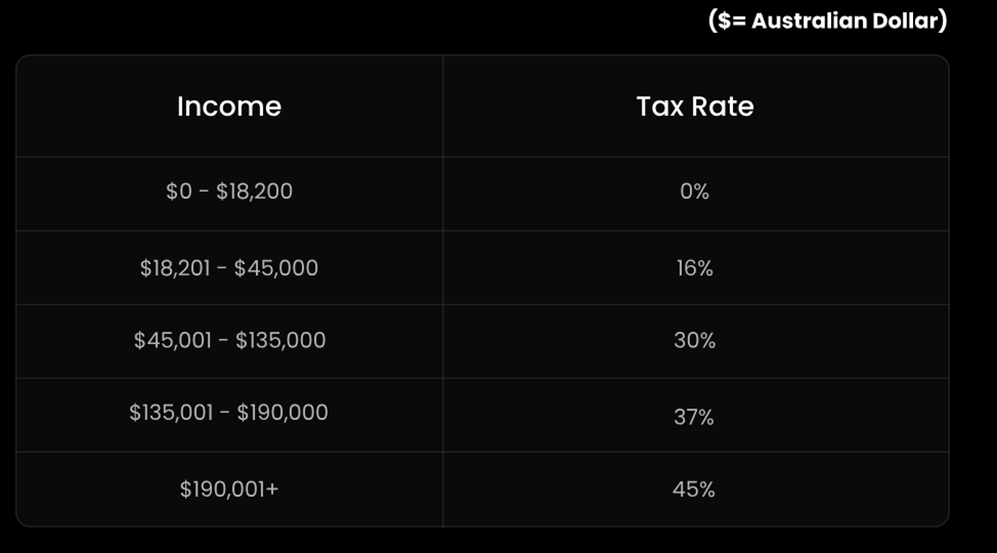

Figure 1: Australian Income Tax Rates (AUD)

Global Comparison: Crypto Tax Policies Around the World

Crypto tax by country laws vary significantly, making it essential to know your local rules and even your citizenship-based obligations.

Strictly Regulated

-

United States: Reports on Form 8949 and Schedule D. Trades are capital gains; staking/mining is income.

-

Germany: No crypto capital gains tax if held over one year.

-

Japan/Australia: Comprehensive rules, regular reporting.

Tax-Friendly

-

Portugal: Personal crypto gains are tax-free.

-

UAE: No personal crypto tax laws on gains.

-

Singapore: No capital gains tax, but businesses may owe income tax.

Grey Zones

-

India: New 30% tax with unclear offset rules.

-

Thailand/Argentina: Rapidly changing, inconsistently enforced.

Example: U.S. traders must use Form 8949, while Germany offers a one-year holding exemption for crypto tax-free countries. U.S. crypto tax rules can be stricter than many expect, especially on staking and airdrops.

Table 2: Crypto Tax Rate Comparison

Regulatory authorities around the world are tightening crypto tax rules. More than 40 countries will start timely sharing of user data via the OECD's CARF by 2026. The EU’s DAC8 is rolling out legislation requiring exchanges and other intermediaries to report all transactions to national revenue authorities. India is clamping down on P2P and DeFi tax loopholes.

Australia has started taxing staking and many NFT sales as income, and fees paid to miners as personal services. Even Germany is reviewing its one-year tax-free rule. Users should prepare for more transparency, much stricter reporting obligations, and fewer grey areas going forward.

Crypto Tax Filing: A Step-by-Step Compliance Guide

Filing your taxes starts with good record-keeping and planning for crypto tax reporting.

Step 1: Collect All Records

-

On-chain wallet activity

-

Exchange/CEX/DEX reports

-

NFT sales

-

Mining and staking income

Many exchanges now offer the best crypto tax software integrations for easier data pulls.

Step 2: Choose Tax Software

Recommended tools:

These services help ensure crypto tax reporting accuracy, generating forms like IRS Form 8949.

Step 3: File Properly

-

Include crypto on relevant tax forms.

-

Respect local deadlines.

Step 4: Hire a Professional

If you have high volume, cross-border complexities, or large gains, consider an expert who knows how to file crypto taxes.

Example: A trader using Koinly synced wallets and exchanges, reviewed errors, and filed accurately with the IRS.

Risks and Grey Areas in Crypto Taxation

Many believe certain crypto activities are invisible to tax authorities. That’s risky thinking. Crypto tax loopholes rarely hold up under scrutiny.

Key Grey Areas

-

DEX use still creates taxable events; DEX tax risk is real.

-

Privacy coins like Monero don’t eliminate privacy coin taxes.

-

Cross-border transfers risk double taxation if not properly documented.

-

DAO governance rewards may count as taxable income.

-

NFT gaming and Play-to-Earn rewards are increasingly scrutinized.

Audit Flags

-

Misclassifying income as capital gains.

-

Failing to report DEX transactions.

-

Hiding staking income.

-

Using mixers to obscure transfers.

Top 5 Crypto Tax Mistakes to Avoid

1. Overlooking Small Transactions

Many traders forego tracking smaller trades, such as swaps and fees. Yet many tax authorities expect every single transaction to be tracked, recorded, and reported. You can’t afford to ignore any trades because even small moves affect your cost basis and perhaps realizing capital gains tax.

For example: South Korea's tax authority performed unexpected tax raids in 2024, discovering that hundreds of wallet holders weren’t accurately reporting small DeFi swaps and transfers of altcoin.

2. Miscategorizing Income vs. Capital Gain

Staking, mining, and airdrops are typically taxable income when you received them, not capital gains. Mixing these up can lead to inadvertently underreporting income in the future, and ultimately penalties.

3. Not Tracking DeFi and NFT Investments

DeFi trades and sales of NFTs can often be forgotten about. But many will be taxable events. Be sure to record wallet addresses, transaction dates, and fair market values every single time.

4. Assumed Tax-Free Jurisdiction (a “friendly” jurisdiction)

Countries with low or no capital gains tax (for instance Portugal or the UAE) are under greater international pressure to tighten, monitor, and restrict their international crypto user good fortune, habits, and ultimately policies. When governments shift these policies, local traders will remain unprepared and at risk of large financial impacts.

5. Failing to Use Tax Software or Professional

The complexity of crypto tax is a great reason to use software. Manual record keeping often leads to mistakes, and using crypto tax software and/or hiring a professional tax advisor protects you from large unintentional negative impacts.

Future Trends: Where Crypto Tax Is Headed

Crypto is moving toward global transparency. OECD crypto reporting initiatives aim to standardize data sharing.

Key Trends

-

OECD’s CARF (Crypto-Asset Reporting Framework): Exchanges will share user data across borders.

-

G20 Support: Push for global crypto tax law harmonization.

-

Expansion of CRS-style reporting to crypto accounts.

-

Smart contract systems could enable real-time auto-tax calculations.

-

Tax agencies are testing AI-powered auditing to detect evasion.

Table 3: Comparative Snapshot of Top Marginal Capital Gains or Income Tax Rates (2025)

Conclusion: Key Takeaways and What to Do Next

Crypto taxation is complex, but the fundamentals are clear: different activities trigger different taxes. And crypto tax laws globally are tightening.

· Start tracking your activity.

· Use crypto tax tools like Koinly or TokenTax.

· Seek crypto tax help if your situation is complex.

At btcdana.com, we’re committed to keeping you informed with guides on tax compliance for crypto so you can trade confidently and legally.