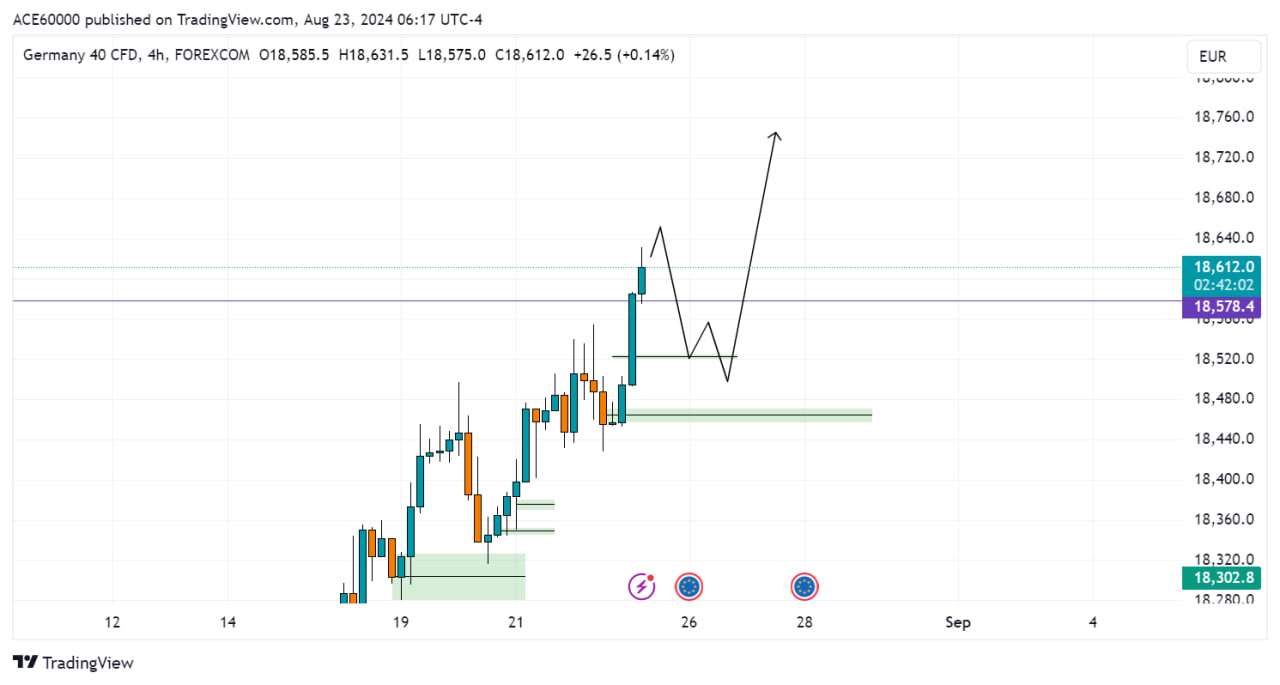

Technical Analysis:

DAX40 is currently in a good bullish trend and price have already crossed its resistance areas, if during New York session we get a retracement below we can look for buying opportunities around 18560 or 18360 if price give MSS to us around these areas we can look for longs.

Fundamentals:

European shares were largely flat on Friday, navigating through mildly turbulent trading, as investors were cautious ahead of Federal Reserve Chair Jerome Powell's eagerly-awaited speech later in the day.

The pan-European STOXX 600 index SXXP rose 0.1% to 516.37 at 0820 GMT.

ALL EYES ON POWELL'S SPEECH

The "fear gauge" Euro STOXX volatility index (.V2TX) saw an uptick this week and was last at 15.88 points.

Despite three Fed speakers on Thursday alluding to a rate cut in September, and voicing support for a "slow and methodical" approach, investors were jittery, wary of any unexpected twists at Powell's speech at the Jackson Hole symposium in Wyoming, due at 1400 GMT.

Overnight, Wall Street also lost ground, with all three major indexes losing between 0.4% and 1.67%.

Disclaimer: Trading carries risk. Practice effective risk management and consider your risk tolerance before trading.