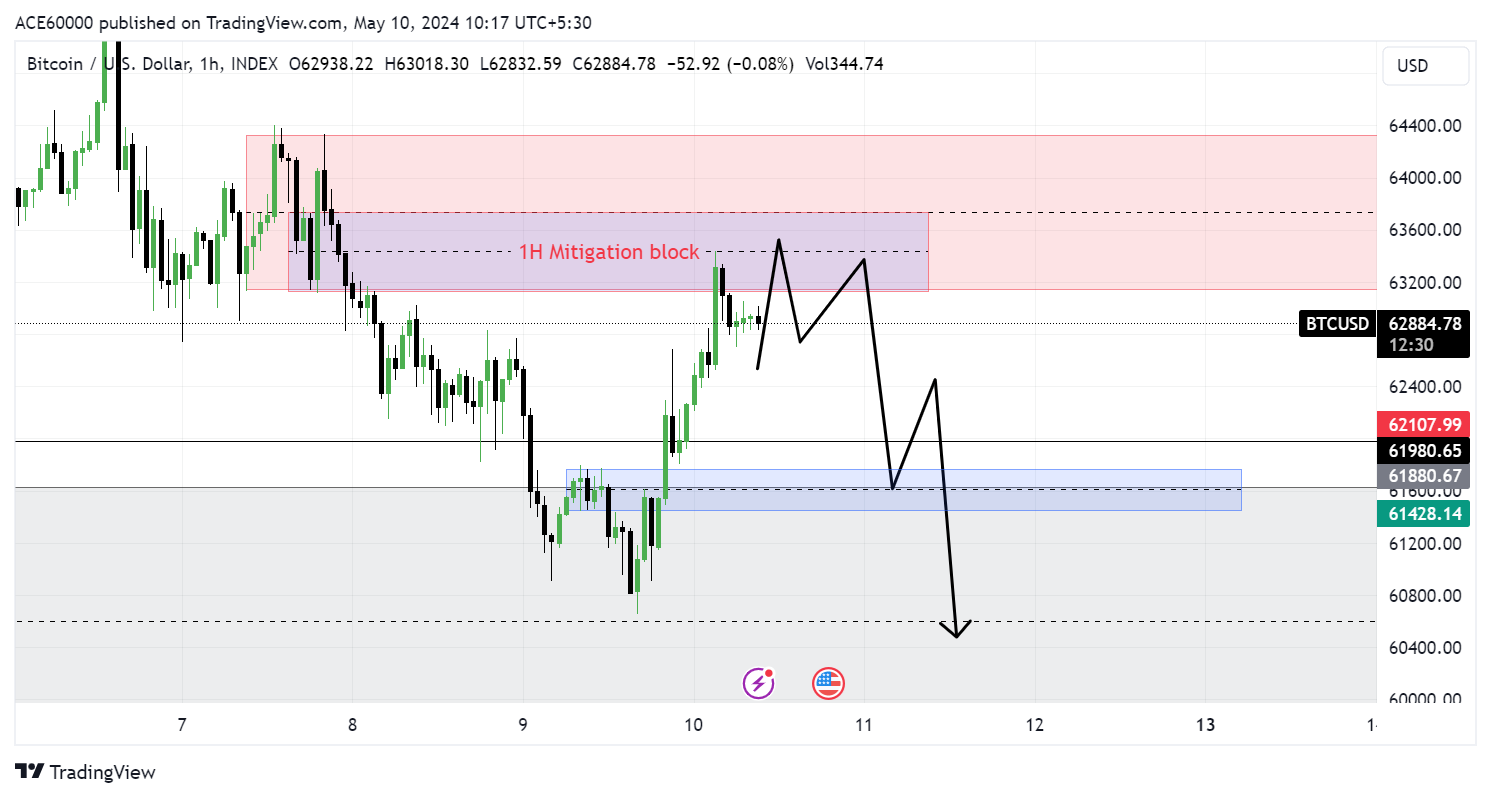

Technical Analysis:

BITCOIN is trading around our selling Point of interest current price is 62900. As soon as we get a market structure shift on 15 min time frame we can go for selling with the SL of last swing. This is just a retracement to the upside till 4H order block and we also have a bearish mitigation block in 1H, multiple confluences.

Fundamentals:

Bitcoin ETF flows turn negative again

Investors’ de-risking behavior was also visible across the spot Bitcoin exchange-traded funds (ETFs), where traders have resumed withdrawing their capital.

After recording positive net flows for two consecutive days, data from Farside Investors shows U.S.-based spot Bitcoin ETFs recorded outflows totaling $15.7 million on May 7.

Grayscale’s GBTC fund, which witnessed its first netflows after 78 days on May 3, was the primary driver behind May 7 ETF withdrawals with a total of $15.7 million outflows.

At the same time, inflows into other Bitcoin ETFs continued to slow down. Flows into BlackRock's iShares Bitcoin Trust (IBIT) have been at a standstill since April 24, only seeing inflows on May 3 and May 6.

“Yesterday’s ETF Flows came in at -$15.7M,” noted independent market analyst Daan Crypto Trades, adding that flows were “mostly flat on the day, which was also clear in the #Bitcoin price action.”

Disclaimer: Trading carries risk. Practice effective risk management and consider your risk tolerance before trading.