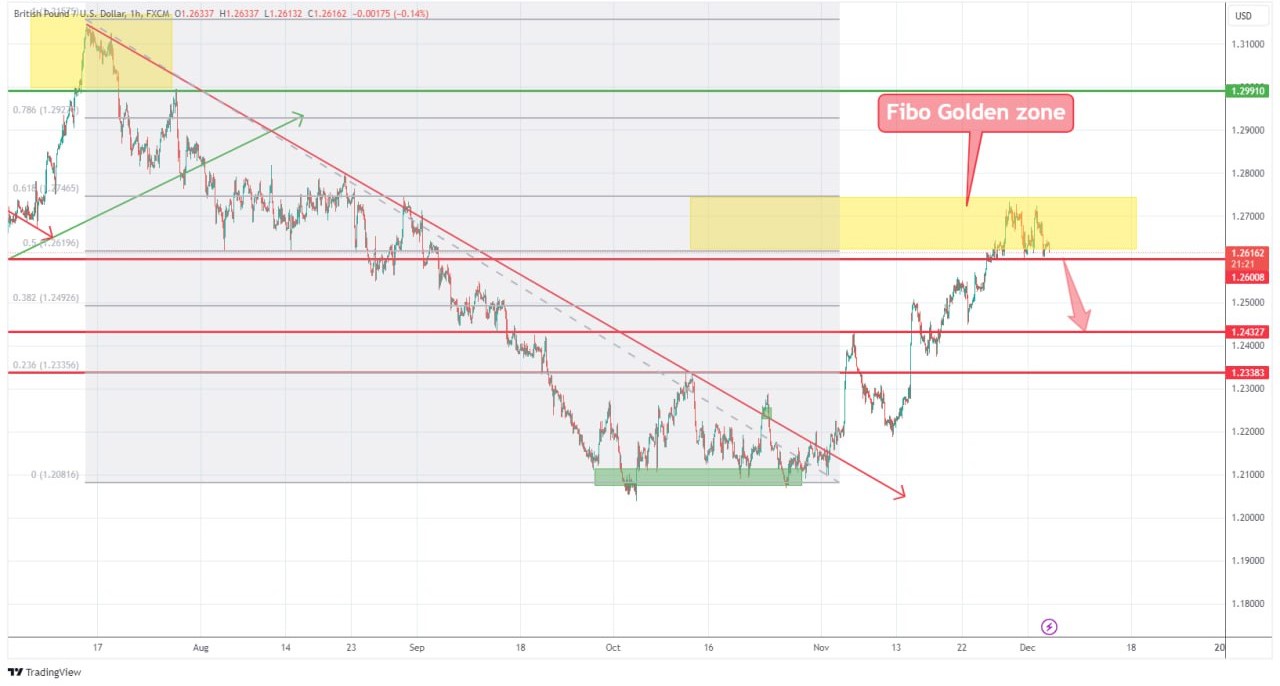

📊TECHNICAL ANALYSIS ON 1-HOUR TIMEFRAME

I've been bullish on GBPUSD and expected it to reach 1.26. Indeed, the target was not only reached but also surpassed with a high of 1.2720. However, after reaching the 1.27 zone, GBPUSD started to show signs of fatigue and failed twice at this level. With the rise since mid-November contained in a rising wedge pattern and a potential double top forming (confirmation required with a drop under 1.26), the pair could decline to the next level of support around 1.24. That being said, I'm bearish on GBPUSD, and I'm looking to sell rallies, with a negation in the event of a new local high.

📊QUICK FUNDAMENTAL LOOK

Dollar rose in European trade on Monday against a basket of major rivals, on track for the third profit in four days on active short-covering. The gains come despite strong prospects of early interest rate cuts by the Federal Reserve in 2024, potentially even in March

⚠️Warning: Trading contains elements of risk, please be careful when Making Orders, Market Recommendations are only for consideration.