Market Analysis of Gold on Friday 26 November 2021

On Thursday the price of gold fluctuated slower due to Thanksgiving celebrations. Core personal consumption spending of the US inflation measure rose 4.1% year-on-year in October, the highest level since 1991, supporting gold prices. Markets expect the Fed to accelerate monetary policy tightening to curb rising commodity prices.

Technically, gold's daily graph closed with Doji pattern. Gold fluctuated near the 60-MA, and the market lost its directions. On the 4-hour chart, the gold candle forms a head and shoulder pattern, the RSI strengthens, and the MA forms the Golden Cross. Overall prioritize buying at low prices in the fluctuation zone. Consider the support zone and resistance zone, short term intraday trading split the bull bear point around 1804.

Resistance:1804-1813-1820

Support:1792-1788-1778

Market Analysis of Crude Oil on Friday 26 November 2021

On Friday Asia session, crude oil fell sharply. The current price is at US$76.17/ barrel. OPEC said that the planned coordinated release of reserves may intensify, and it is expected that there will be a surplus of crude oil early next year. Trading will be light during Thanksgiving, and the market will wait for the guidance of the OPEC+ meeting next week.

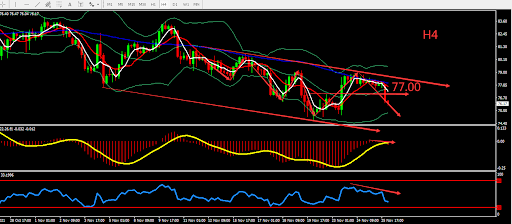

From a technical perspective, the daily graph still fell and wasn't able to stabilise at MA5. The market lacked direction. The indicator showed bearish signal. On H4 graph, there was a downward channel. Crude oil fell and broke through middle BOLL Band. Overall, prioritise Sell. The chart below is showing the key point and the estimated trend, the deciding point whether to buy or sell is near 77.00.

Resistance:77.00-77.60-78.30

Support:75.60-74.60-73.00

This material is from Quant Tech Limited and is being posted with permission from Quant Tech Limited. The views expressed in this material are solely those of the author and/or Quant Tech Limited and BTCDana is not endorsing or recommending any investment or trading discussed in the material. Before acting on this material, you should consider whether it is suitable for your circumstances and as necessary, seek professional advice.