Market Analysis of Gold on Wednesday 24 November 2021

On Tuesday, gold prices fell below the key 1800 level, and tested a low of $1,781.79. The US dollar hit a 16-month high of $96.61. US Treasury yields are steady. Expectations of an increase in US interest rates next year strengthened due to the re-election of Fed Chair Powell.

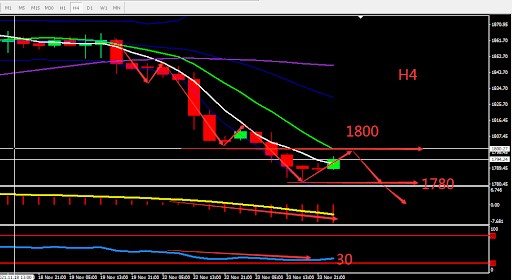

From a technical perspective, gold's daily graph shows a gap down and is bearish for the 4th day in a row. Gold has stopped weakening around the MA60, and the RSI is showing a sideways signal. On the 4-hour chart a ladder bottom pattern is formed. BOLL widened downwards. Overall prioritize selling at high prices in the fluctuation zone. Consider the support zone and resistance zone, short term intraday trading split the bull bear point around 1800.

Resistance:1800-1810-1819

Support:1788-1780-1770

Market Analysis of Crude Oil on Wednesday 24 November 2021

On Tuesday, the United States, Japan, and India all announced the release of strategic crude oil reserves. In particular, the United States will release 50 million barrels to stabilize inflation expectations caused by rising oil prices. However, crude oil price failed to fall and instead rebounded sharply from the low level.

From a technical perspective, the daily graph closed bearish and was under pressure of MA10. Pay attention to the pressure of middle BOLL band around $80. On H4 graph, crude oil was stable around the middle BOLL Band. RSI was at around 60. Overall, prioritise operation within the fluctuation zone. The chart below is showing the key point and the estimated trend, the deciding point whether to buy or sell is near 79.20.

Resistance:79.20-80.00-81.00

Support:77.80-77.00-76.30

This material is from Quant Tech Limited and is being posted with permission from Quant Tech Limited. The views expressed in this material are solely those of the author and/or Quant Tech Limited and BTCDana is not endorsing or recommending any investment or trading discussed in the material. Before acting on this material, you should consider whether it is suitable for your circumstances and as necessary, seek professional advice.