Market Analysis of Gold on Monday 22 November 2021

On Monday, the financial market opened with a strong fluctuation. Gold fell sharply by US$8 in the short term, dropping below US$1,840 per ounce. US indexes are up and currently trading around 96.15. The hawkish remarks made by Fed officials last Friday had a positive impact on the US dollar and put pressure on gold prices.

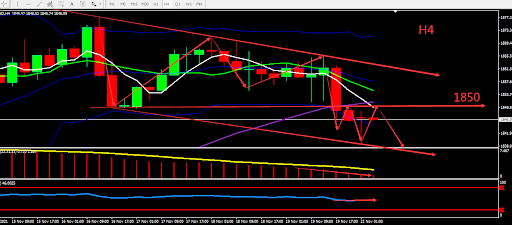

From a technical perspective, gold's weekly graph closed bearish with no upper shadow and fell below the upper BOLL band. The daily chart shows that gold fell below the key resistance point 1841. H4 graph shows signs of peaking, and the formation of a downward channel. MA formed Death Cross. Overall prioritize selling at high prices in the fluctuation zone. Consider the support zone and resistance zone, short term intraday trading split the bull bear point around 1868.

Resistance:1850-1856-1866

Support:1840-1833-1824

Market Analysis of Crude Oil on Monday 22 November 2021

Crude oil fell sharply on Friday to $74.99 per barrel, the lowest in the past seven weeks. The epidemic in Europe worsened, and Austria and Germany announced new lockdown measures, triggering concerns about shocks to oil demand. It is reported that Japan and the United States plan to release strategic oil reserves, which may put crude oil under pressure.

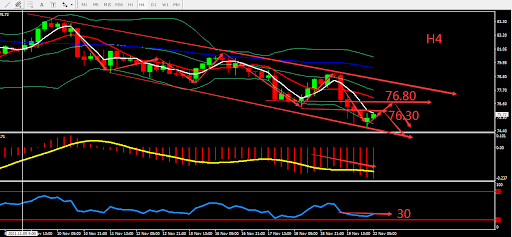

From a technical perspective, the weekly graph closed by four consecutive bearish candles. The daily graph turned downward. The indicators showed bearish sign. On H4 graph, there was a downward channel. BOLL widened downward, MA diverged, RSI was weak and moved around level 30. Overall, prioritise Sell. The chart below is showing the key point and the estimated trend, the deciding point whether to buy or sell is near 76.30.

Resistance:76.30-76.80-78.00

Support:75.00-74.50-73.50

This material is from Quant Tech Limited and is being posted with permission from Quant Tech Limited. The views expressed in this material are solely those of the author and/or Quant Tech Limited and BTCDana is not endorsing or recommending any investment or trading discussed in the material. Before acting on this material, you should consider whether it is suitable for your circumstances and as necessary, seek professional advice.