On Wednesday, Euro fell to $1.1263, the lowest level since last July. Eurozone inflation hit 4.1%, the highest level in several years. The fall of US dollar eased the decline of Euro. Thanks to the strong US retail sales data, America’s hawkish stance and Euro’s dovish stance becomes a sharp contrast.

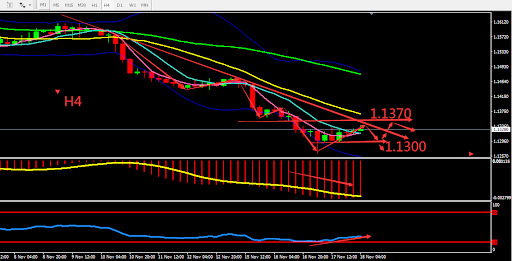

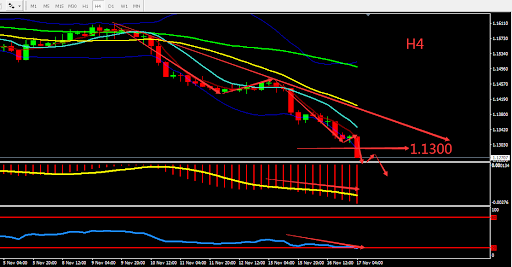

From a technical perspective, Euro’s daily candle reached bottom position and formed a doji pattern. The moving average moved downwards. MACD accelerated downward and shows bearish sign. On the 4- hours chart, EURUSD shows formation of the ladder bottom pattern. RSI stopped falling and there was a certain signs of rebound. Overall, prioritise operation within the fluctuation zone. The chart below is showing the key point and the estimated trend, the deciding point is near 1.1300.

Resistance:1.1340-1.1370-1.1400

Support:1.1300-1.1260-1.1220

This material is from Quant Tech Limited and is being posted with permission from Quant Tech Limited. The views expressed in this material are solely those of the author and/or Quant Tech Limited and BTCDana is not endorsing or recommending any investment or trading discussed in the material. Before acting on this material, you should consider whether it is suitable for your circumstances and as necessary, seek professional advice.