Market Analysis of Gold on Thursday 18 November 2021

On Wednesday, gold prices rebounded to recent highs and are currently trading around $1,865. Concerns about inflation prompted the market to buy gold as a safe-haven asset. Expectations of rising inflation may prompt the central bank to raise interest rates and have also strengthened the US dollar and limited the rise in gold prices.

From a technical perspective, the daily chart of gold closed with a bullish engulfing and stabilized around the MA5. The indicator is bullish overall. On the 4-hour chart, the gold candle broke through the strengthening pattern and formed the Golden Cross. MACD is relatively strong, and RSI is also relatively strong at 60. Overall, prioritize buying at low prices in the fluctuation zone. Consider the support zone and resistance zone, short term intraday trading split the bull bear point around 1860.

Resistance:1870-1877-1888

Support:1860-1852-1841

Market Analysis of Crude Oil on Thursday 18 November 2021

Crude oil fell on Wednesday. US EIA crude oil inventories unexpectedly fell, and the growth was not as good as the previous market expectation. Refined oil inventories and gasoline inventories fell. The International Energy Agency and OPEC stated that supply may increase substantially in the next few months, and OPEC+ has maintained an agreement to increase production by 400,000 barrels per day per month.

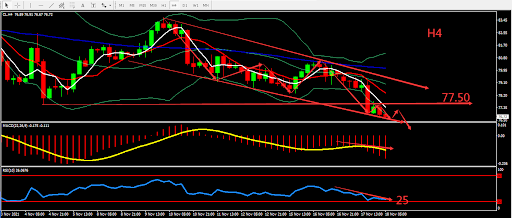

From a technical perspective, the daily and weekly graph show a high probability of further drop. The indicators showed bearish signal. On H4 graph, crude oil formed bottom ladder, MACD strengthened. RSI was weak around level 25. Overall, prioritise Sell on the high position. The chart below is showing the key point and the estimated trend, the deciding point whether to buy or sell is near 77.50.

Resistance:77.00-77.50-88.30

Support:76.50-75.80-74.70

This material is from Quant Tech Limited and is being posted with permission from Quant Tech Limited. The views expressed in this material are solely those of the author and/or Quant Tech Limited and BTCDana is not endorsing or recommending any investment or trading discussed in the material. Before acting on this material, you should consider whether it is suitable for your circumstances and as necessary, seek professional advice.