In the Asian session on Wednesday, the U.S. index once again set a new 16-month high, and Euro was under pressure. U.S. retail sales in October recorded the largest increase in seven months. Lagarde expects that GDP will still exceed the level before the epidemic at the end of the year, and still believes that inflation will slow down next year.

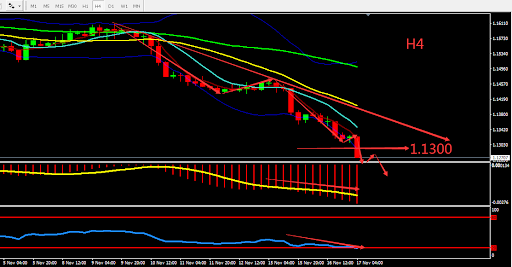

From a technical perspective, Euro has fallen for five consecutive days. When Euro make a downward break through 1.6000, it is a sign of the beginning of a bearish market. H4 graph shows that EURUSD forms a downward gap and there are no signs of stabilisation. The indicators were bearish across the board. Overall, prioritise SELL within the fluctuation zone. The chart below is showing the key point and the estimated trend, the deciding point is near 1.1300.

Resistance:1.1300-1.1330-1.1360

Support:1.1250-1.1220-1.1200

This material is from Quant Tech Limited and is being posted with permission from Quant Tech Limited. The views expressed in this material are solely those of the author and/or Quant Tech Limited and BTCDana is not endorsing or recommending any investment or trading discussed in the material. Before acting on this material, you should consider whether it is suitable for your circumstances and as necessary, seek professional advice.