On Wednesday Gold rose sharply to reach a maximum of $1868.57 per ounce, and US indexes shoots up. US CPI data in October jumped 6.2% year-on-year, far exceeding expectations of 5.8% and the previous value of 5.4%. The Fed faces greater pressure to accelerate monetary policy tightening.

From a technical perspective, gold's daily line broke through its strongest resistance level in recent months at $1835, and closed bullish above the BOLL's upper band, indicating a very strong trend. On the 4 hours chart the gold candle strengthened and weakened, testing support for the second time. MA is divergent, the RSI is relatively strong around 70. Overall, prioritise buy within the fluctuation zone. Consider the support zone and resistance zone, short term intraday trading split the bull bear point around 1840.

Resistance:1860-1870-1880

Support:1846-1840-1835

Market Analysis of Crude Oil on Thursday 11 November 2021

On Thursday in early morning, crude oil fell and broke through $80. On Wednesday, the EIA reported that commercial crude oil inventories, excluding strategic reserves, increased by 1.002 million barrels to 435.1 million barrels, an increase of 0.2%. European natural gas prices have fallen to their lowest level in more than a week, and Russia is gradually fulfilling President Vladimir Putin's promise to increase natural gas supply.

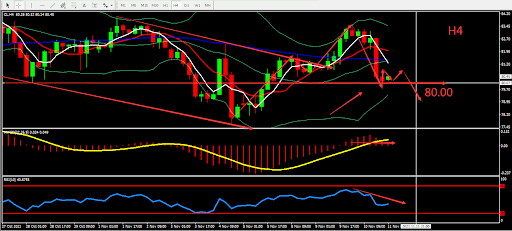

From a technical perspective, the daily graph closed bearish and form engulfing pattern. On H4 graph, crude oil fell and broke through middle BOLL band. MA formed Death Cross on high position. RSI was under pressure and fell. Overall, prioritise Sell. The chart below is showing the key point and the estimated trend, the deciding point whether to buy or sell is near 80.00.

Resistance:80.90-81.50-82.60

Support:80.00-79.20-77.50

This material is from Quant Tech Limited and is being posted with permission from Quant Tech Limited. The views expressed in this material are solely those of the author and/or Quant Tech Limited and BTCDana is not endorsing or recommending any investment or trading discussed in the material. Before acting on this material, you should consider whether it is suitable for your circumstances and as necessary, seek professional advice.