Market Analysis of Gold on Wednesday 10 November 2021

The price of gold welcomed the fourth consecutive increase on Wednesday. This is mainly due to the weak trend of the US dollar and US stocks which supported the price of gold. In addition, the high PPI index also kept inflation expectations high, leading to the favor of gold which has anti-inflationary property. However, Brad's hawkish speech limits the rise in gold prices.

From a technical perspective, the daily graph of gold continuously closed bullish and broke through the upper BOLL band. Gold shows a slow increase. MA on H4 graph shows divergence, BOLL opened upwards and MACD volume increases. Overall, prioritise Buy on Low prices, pay attention to CPI data. Consider the support zone and resistance zone, short term intraday trading split the bull bear point around 1821.

Resistance:1833-1840-1855

Support:1825-1821-1813

Market Analysis of Crude Oil on Wednesday 10 November 2021

On Tuesday, crude oil continued its upward trend, boosted by morning API data that shows reduction in inventory. The White House said today that it would not announce plans to release the Strategic Petroleum Reserve (SPR). The energy report predicts an increase in crude oil supply next year, leading the market to speculate that the Biden administration may shelve plans to release the country’s emergency reserves.

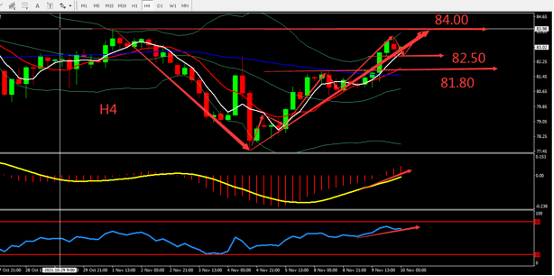

From a technical perspective, the daily graph closed bullish and stable at middle BOLL Band. On H4 graph, crude oil formed reversal V pattern. MA formed Golden Cross and strengthened. Indicators showed bullish signs. Overall, prioritise Buy. The chart below is showing the key point and the estimated trend, the deciding point whether to buy or sell is near 84.00.

Resistance:83.60-84.00-85.00

Support:82.50-81.80-81.00

This material is from Quant Tech Limited and is being posted with permission from Quant Tech Limited. The views expressed in this material are solely those of the author and/or Quant Tech Limited and BTCDana is not endorsing or recommending any investment or trading discussed in the material. Before acting on this material, you should consider whether it is suitable for your circumstances and as necessary, seek professional advice.