On Tuesday, USD index rose sharply, and Euro showed a downward trend reaching a highest price of 1.1784 and the lowest price of 1.1708. The decline in US retail sales announced on Tuesday was much larger than expected, inhibiting dollar’s gains, but its impact was overwhelmed by higher-than-expected increases in industrial production, which accelerated the dollar’s rise. The U.S. dollar continued its gains against all major developed and emerging market currencies affected by the rebalancing of investment flows in the middle of the month.

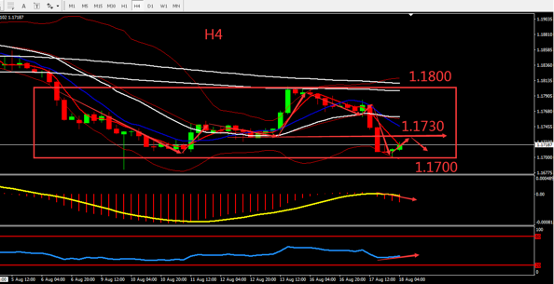

From a technical point of view, Euro’s daily graph shows morubozu bearish candle, and bearish sentiments are relatively strong. 1.1700 are the deciding point for bull and bear in the short term. H4 graph shows that EURUSD maintains a range of 1.1700-1.1800, and the indicators tend to be bearish. Overall prioritize operate on the fluctuation zone. Consider the support zone and resistance zone, the deciding point whether to buy or sell is near 1.1700.

Resistance:1.1730-1.1760-1.1800

Support:1.1700-1.1680-1.1650

This material is from Quant Tech Limited and is being posted with permission from Quant Tech Limited. The views expressed in this material are solely those of the author and/or Quant Tech Limited and BTCDana is not endorsing or recommending any investment or trading discussed in the material. Before acting on this material, you should consider whether it is suitable for your circumstances and as necessary, seek professional advice