Why Every Trader Should Pay Attention to the Economic Calendar

You are enjoying an average EUR/USD trend when all of a sudden, the market crashes without warning. Your stop-loss is hit, and hours of careful work are wiped away. What just happened? The ECB just informed everyone that it was going to cut interest rates in an unexpected manner, and you had no idea there was one coming.

This scenario happens every day on trading floors and home offices around the globe. The economic calendar is your early warning system. It is an exhaustive schedule of every important economic event, data release, or policy announcement that has a chance of reverberating the markets.

It is a little like knowing when a storm is coming. You would not leave your windows open for a hurricane, so why would you trade in the blind of a major economic event? If the Federal Reserve ideates interest rate decisions, the dollar may move in excess of 100+ pips in a matter of minutes. Not knowing about these events is not only dangerous; it can cause you to lose your account.

Students do not walk onto finals week unexplored, traders cannot walk into the markets without regard to what has not come without prior notice (this is not possible). The economic calendar does not allow you to predict anything, rather it provides you the knowledge to make more informed decisions under volatile conditions.

What is an economic calendar?

An economic calendar serves as a guide for navigating the financial markets and is a detailed timeline of upcoming data releases, central bank meetings, and policy announcements that will influence the price movements of currencies.

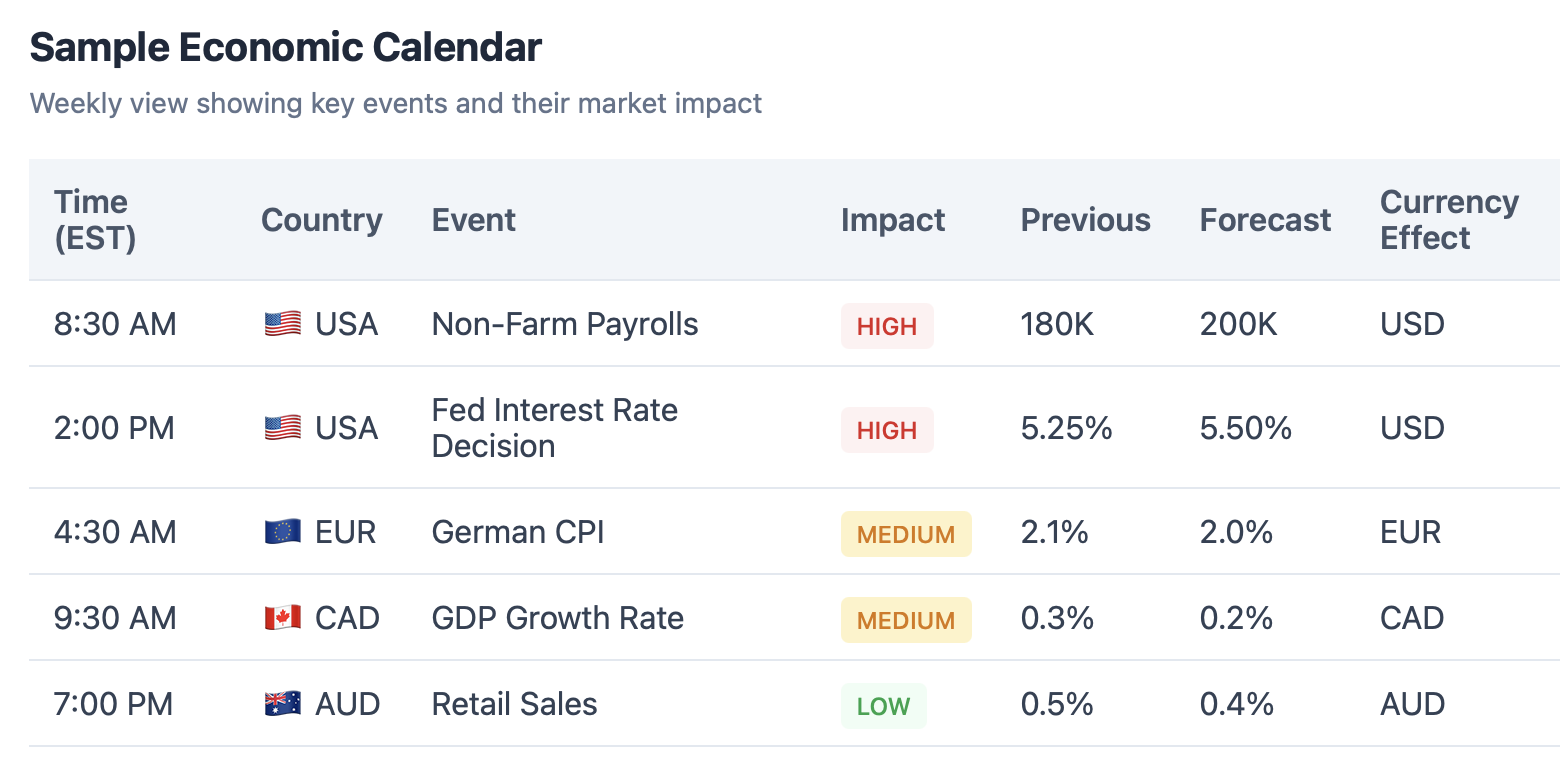

An economic calendar indicates when the market will be influenced by the release of GDP growth rates, inflation data, employment data, central bank announcements or speeches, etc. These events will be categorized by country, impact rating (low, medium, high), and the type of economic indicator that is released.

Think of the U.S. Non-Farm Payrolls (NFP) Report. This report is released on a monthly basis and this data point can either make the dollar rally or plummet depending on whether or not job creation's actual number beats or misses expectations. Often, if 200,000 new jobs are anticipated, then traders assume the economy is continuing to strengthen irrespective of the overall data and if only 150,000 jobs were created, traders opt for the dollar to tumble as they reassess the value of the economy.

It is just like having a forecast for the markets. A meteorologist can't predict rain, but the date of a storm with certainty- they can tell you when the conditions are likely to be right for a storm to occur. The economic calendar indicates to traders when the markets could become volatile. If traders are aware of the economic calendar, they can prepare accordingly, rather than becoming surprised when the storm hits.

Professional traders can plan their week around the high-impact releases and know that trying to trade through a major ECB announcement without planning (i.e. like driving with a blindfold) is risky business, if not negligent.

Economic Indicators That Move Markets

Not all economic indicators create the same impact. If you are aware of which indicators have the largest impact, it can be the difference in pursuing successful trade opportunities and getting crushed by potential volatility.

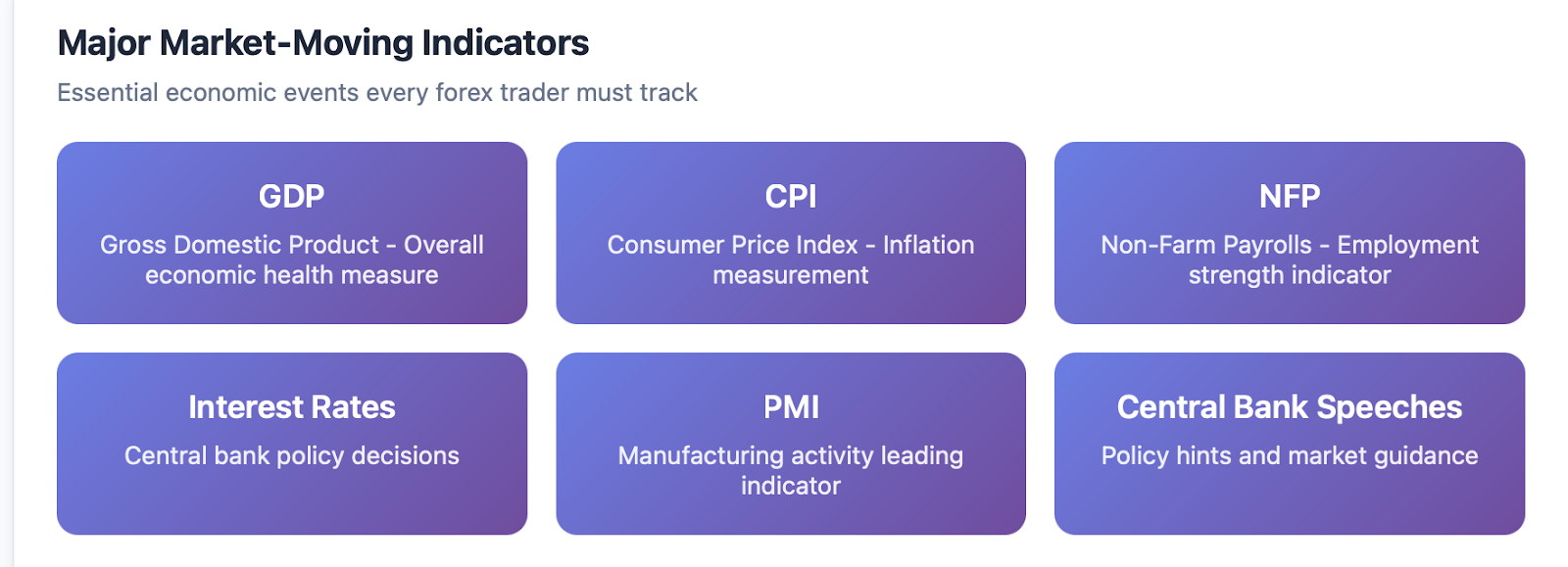

GDP (Gross Domestic Product) is representative of a country's total economic supply. When GDP growth exceeds expectations, this generally leads to stronger currencies because the market anticipates the economy will continue to expand. A surprise decrease in GDP would typically cause immediate sell-offs as traders prefer assets deemed safer.

CPI (Consumer Price Index), is a representation of inflation in which price fluctuations in basic goods or services that consumers utilize are tracked. Inflation rising generally anticipates interest rates will rise which usually strengthens values of currency. In early 2022 when the U.S. CPI rose to 7%, the uncharged dollar skyrocketed as traders anticipated the Fed would raise rates aggressively.

Outline for Interest Rate Decisions - interest rate decisions are the most significant markets moving events in the market calendar. Central banks enforce interest rates to control inflation through economic growth. A surprise interest rate hike usually sends currencies up, while unexpected cuts usually brings swift sell-offs.

Employment or Labor market date is the most important indicator to measure overall economic health. The monthly NFP report usually causes swings of 50+ pip in major dollar pairs. Strong employment numbers coming in typically signal strength in the economy. Weak employment numbers typically is a taint to possible concerns ahead.

PMI (Purchasing Managers' Index) acts as a crystal ball for future economic activity. PMI readings above 50 indicate expanding manufacturing activity, while readings below 50 suggest contraction. Smart traders watch PMI data for early signs of economic turning points.

In the midst of the 2008 financial crisis, U.S. employment data horrifically collapsed, and this caused massive dollar volatility when traders began to grasp how damaging the data would be on the economy.

Those traders who recognised the magnitude of the employment data collapse, and knew of the implications, were able to take positions; however, other traders found themselves caught up in the volatility.

The takeaway here? Pay attention to the high-impact news indicators. A slight revision to retail sales data is not going to move the markets, but a surprise Fed rate announcement can affect currency direction for months to come.

How to Read Your Economic Calendar Like a Pro

Economic calendars appear complex at first glance, but once you begin to work with them, it becomes second nature.

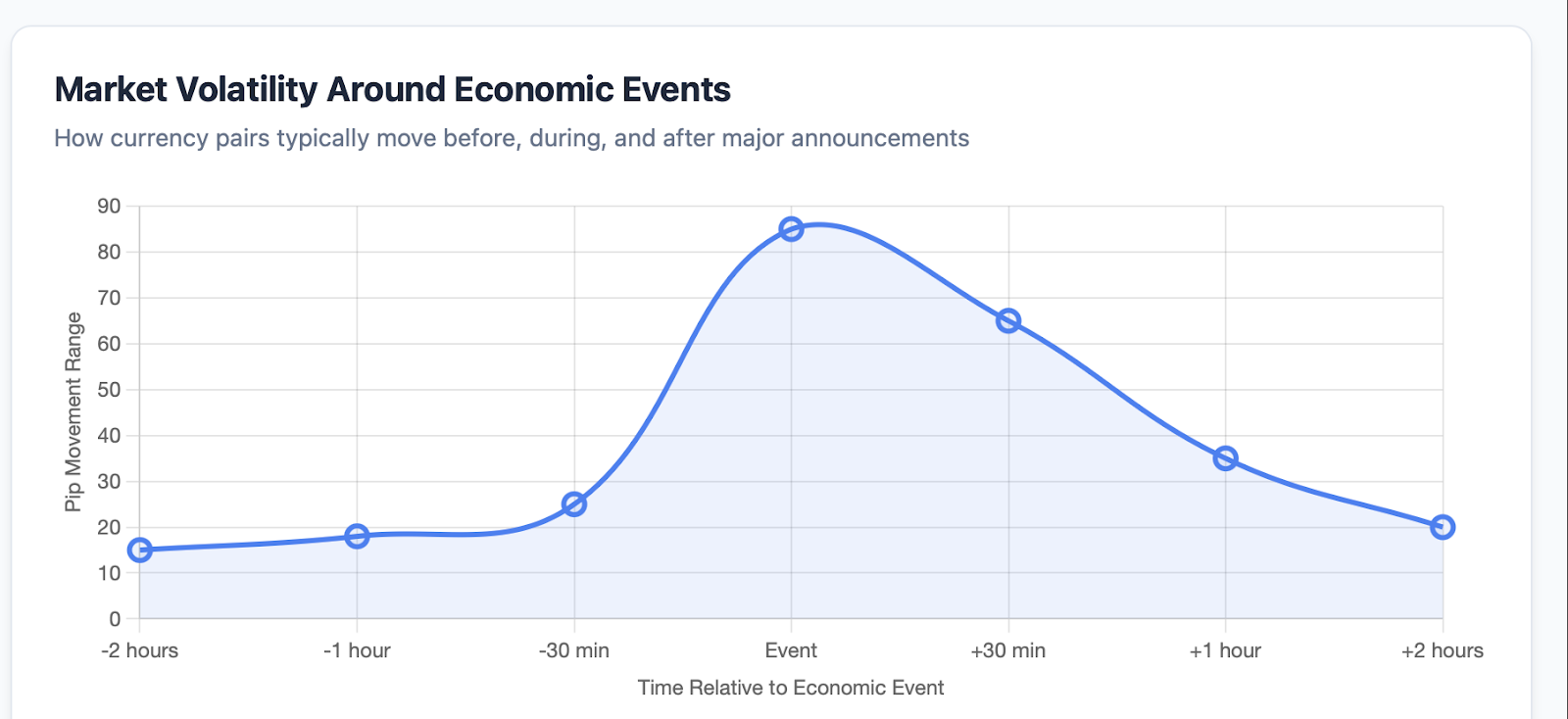

Timing is everything: Keep a watchful eye on the time releases, and as always different timezones could mean different things for trading volumes and volatility patterns.In even something as seemingly simple as a 2:30 pm EST release - that is 8:30 pm for traders in London, who may have paid to place a big trade event that will inevitably affect price action and their trades. Missing out on a major release because you mistook timezones is rookie mistake - one that even traders with experience sometimes make.

Nations and economic data: the nations counting economic data are not interchangeable; it follows that the economic data from each will primarily affect different currencies. German factory orders primarily impact the euro; the employment data from Australia will move the Aussie dollar etc. It's crucial to understand these economic relationships; when trading, you can narrow down just what economic data is relevant to your trading pairs.

Impact Ratings: Most calendars reference color coding or star systems to rate whether the event is significant or not. Red, or three-star events, are key, and your focus should be complete; yellow, or one-star releases, rarely move the market in a large way.

The Holy Trinity: Previous, Forecast, and Actual values comprise the nucleus of all economic releases. The market has already priced in the forecast; however, trades are made when actual values deviate from the forecast.

Here's where it gets interesting: assume NFP forecasts were to announce 180,000 new jobs, however, the actual number is 250,000. The dollar rallies; the market is happy, or has priced in the economic strength of the economy because they perceive the NFP as better than expected. However, if, for example, only 120,000 jobs were created, the dollar generally weakens since traders assess that the economy is weaker than perceived.

Also, consider the definite examination grading system. Let's assume everyone anticipated a class average of 75% but the actual class average was 85%; parents (the market) would have a positive response. Conversely, if the actual average was only 65%, the parent response would be hence disappointment.

The Brexit referendum succinctly proved this point in looking at actual versus forecast. Polls anticipated a close race; however, the actual "Leave" victory shocked the market, which precipitated a fall in the pound as traders rushed to reprice British banks and assets.

Market responses determine whether a reaction is "good" or "bad." Responses can depend on the actual price change but more often depend on the gap between price change and expectation.

Utilizing the Economic Calendar in your Trading

The Economic Calendar is not just for keeping track of upcoming events, it is tactical, and used for thoughtful, informed decision making in your trading process from start to finish.

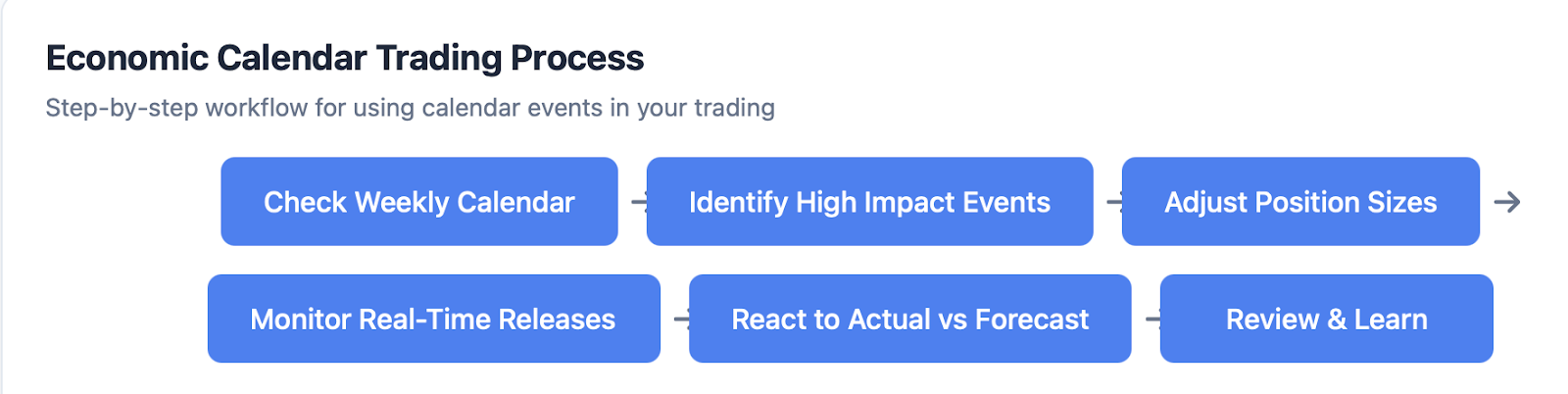

Pre-Trading Analysis: Each week begins with a review of the incoming high impact events. If the Fed is going into a meeting on Wednesday and the NFP is dropped on Friday, you are assured volatility is coming. Professional traders will often preemptively reduce position sizes or avoid taking on new positions at this time as they choose to preserve capital over gamblng on uncertain outcomes.

Real Time Analysis: When the economic data hits you will have seconds to decide. If the NFP numbers are strong you may want to tighten your stop-losses if you are short the dollar and possibly add to the dollar long position if in a profitable position. If inflation numbers are weak your trading thesis may be signalled to cut loser positions based on rate hike plays.

Post-Release Analysis: After initial volatility settles down, review how the markets reacted compared to your expectations. Did you know the dollar rallied about what you expected to see after the jobs data? Did you notice how some currency pairs rallied more than others? This analysis will help you build the experience required to anticipate how the market will react in the future.

Here's a real world example: A trader is holding long EUR/USD positions going into the ECB President Lagarde's speech. The calendar shows a medium impact, but the trader knows recent inflation issues could lead to hawkish statements. Rather than leave the position at risk, they shut half their position before the speech. When Lagarde acknowledges faster rate hikes, the euro moves sharply higher and the remaining position has a good return while keeping a handle on risk.

Smart traders treat the economic calendar like how students treat exam schedules; they prepare thoroughly, they stay focused when the critical moment arrives and they learn from each result to improve future results.

Gold traders can learn a lot from calendar awareness. With CPI releases, gold usually rallies sharply in response to additional inflation fears of which investors often rush to buy gold as a safe haven. If traders understand the importance of CPI releases and position accordingly while managing stop-losses, they would experience significant moves down the road without too much risk of loss.

When you engage the economic calendar properly into your trading plan it can go from just being a schedule to an advantage.

Even the most experienced traders can succumb to some of the common traps of economic calendars. Recognizing the mistakes before they happen can save your trading account risks from unnecessary damage.

Disregarding Market Expectations: Price is dependent on market expectations. Fortunately, many traders fail to consider market expectations and solely concern themselves with whether economic data is "good" or "bad". Strong GDP growth sounds bullish. But if market participants were expecting higher GDP growth then the currency could decrease based on the "disappointment" of the actual results.

Timezone Error: Missing significant releases because of timing errors is surprisingly common. More than a few London traders have missed U.S. market-moving data after confusing GMT and EST, and Asian traders have also miscalculated release times relative to Europe.

Calendar Dependence: As some traders become so focused on calendar events that they fail to consider any technical analysis. Price action and chart patterns are relevant, a calendar should complement your existing methods, not replace them.

"Buy the Rumor, Sell the Fact" Trap: The market can anticipate significant moves with regard to important events, and this move could reverse upon the news release. For example, the Fed may decide to raise rates as was already performed a number of times prior to the announcement. Yet the dollar would be expected to increase during this new rate hike.

During the COVID-19 pandemic, this scenario occurred with regularly terrible economic data, only to be released as "priced in" by the market. This created some odd outcomes which calendar traders were unable to respond to.

Over-Trading Around Events - It's easy to fall into the trap of desiring to trade every high-impact release, but over-exposure and poor decision-making are potential hazards. Not every economic event needs to be acted upon; sometimes the best course of action is to sit in a position until something is clearer.

You must remember the economic calendar is a supporting tool, not a crystal ball. The markets are unpredictable, and perfect fundamental analysis doesn't guarantee profitable trades. Use the economic calendar to support your decision and risk management, but do not expect to eliminate risks of trading.

Transform Your Trading with Proper Economic Calendar Utilization

The economic calendar is one of the most powerful tools a trader has, and yet many traders only scratch the surface of its full potential. Knowing when major economic events hit the market is what distinguishes the prepared trader from the trader who is blindly taking the plunge.

The principle remains the same: the markets move according to the deviation of expected outcomes vs actual outcomes. When the actual economic data differs from forecasted data, the currencies will react. Your job is to position yourself for those moves and hedge against potential adverse outcomes.

Do you have an economic calendar? If you're one of the few traders who don't (or you're not sure what it is), I'm going to help you out.

Traders who trade successfully build their trading routine around an economic calendar. Every week they identify structural events with high impact throughout the week. They adjust their position size based on that information and position themselves accordingly for economic releases. Economic event releases also require traders to be on alert at those times.

On a side note, using an economic calendar does not guarantee that you will earn a profit, but it does give you a much better chance of being profitable consistently into the future.

An economic calendar also teaches you patience: rather than trying to force a trade during periods of weakness you can await the high probability setups that occur around important economic releases. Trading is about quality not quantity, and the economic calendar gives you the events that provide quality in your trading.

Even more importantly, get in the habit of checking an economic calendar at least once a day. Especially in Forex trading, you would not walk out of your house without checking the weather for the day - don't trade without checking the economic events that are due for the day that might be effecting your positions.

To sum it all up - the structure of the economic calendar is your preparation for trading. When you learn how to recognize the events on the economic calendar and place your trades with insight, you are taking a big step to achieving consistency as a trader.

Are you ready to use your economic calendar? Join BTCDana today, and you can track your trading activity with insight and tools to keep ahead of events that help shape the market. Trade better not harder.