Position sizing is often the key differentiator between trading success and failure. However, the truth is that most traders only ever scratch the surface when they are looking for entries and exits and totally ignore this vital aspect of risk control. Whether you trade CFDs, forex or any other financial instrument, knowing how to size your trades correctly can ultimately determine the difference between surviving in the markets — or not.

What is Position Sizing?

Position Size is the amount of capital that you allocate to each individual trade. It’s the formula you’re using to figure out how many shares, lots, contracts is best for you to buy or sell based on your account size, your risk tolerance, and the unique elements of each trade setup.

Position sizing is the intersection between money management and risk management and is where most traders go wrong and blow out their accounts. It is a key factor in risk management which not only defines how much you can potentially make, however it also defines how much you can actually afford to lose on any single trade.

In the forex market, position sizing is further emphasized because of CFD leverage. Leverage magnifies gains and losses, so proper position sizing is critical in avoiding blowout account losses. Leverage can lead you to taking a significantly larger position than you are able to with cash alone, and when you’re trading with 50:1 or 100:1 leverage, even a small amount of miscalculation in position size can lead to catastrophic losses.

Example for Newbies: How Position Size Can Affect Your Trading It is important for traders to understand the relationship between risk and position size.

Take Xiao Ming, who is new to trading and has a $1,000 account. Excés: Excited by the profit potential, he decides to put $500 into trades a pop a huge 50% of his account per trade. Here’s what happens:

– Trade 1: -$500 (Account balance: $500)

- Trade 2: Lost $500 (Account value: $0)

Xiao Ming, after just two losing trades, is totally bust. This is an example of how devastating position sizing risk can be – you can have a great trading system, but your position sizing causes you to blow up your trading account first.

Professional Example: 2% Rule in Practice (20 Instances)

Now let’s take a professional trader with a $100,000 account using the 2% rule as is generally accepted. This means they would never lose more than 2% of their account ($2,000) on any one trade no matter how safe they think the setup is.

With proper position sizing:

– Max loss per trade: 2% of $100,000 = $2,000

- Consecutive loss count for account destruction: 50 trades

- Psychological benefit: Less stress begets better judgment

Even the professional trader does not go bankrupt until he loses 50 times in a row, yet Xiao Ming can only lose 2 times. This extreme comparison is why some people say that position sizing is the most important part of trading.

Why Does Position Sizing Define Whether You Survive or Not?

It is position sizing which literally dictates your exposure to risk; and how long you stay on the market. It impacts three key components of trading success: your profit-loss ratio, the sustainability of your win rate and your maximum drawdown.

The mathematics of position size and exposure are cruel and rigid. Position sizing, in contrast to picking entry points or reading market trends, is about how much to risk, not when to trade. It is to make certain that never will a trade kill your account in any direction the market can run.

Everyone has losing streaks even with the best trading strategies. Survival first, profits second; that’s what professional traders both know and acknowledge. You may have a great technical system, and/or you may be a fantastic market timer – BUT you are always mathematically certain to go bust if you are not sizing your bets correctly.

The Science of Learning Big Position Sizes

It’s one of the large position sizes that leads to emotional volatility that affects judgment. Commonly cited practices: When Traders are Over-leveraged When traders are taking on too much risk (i.e., using too much leverage), traders commonly:

- Exit winning trades too soon out of fear

- Let losses run with the hope of a turnaround.

- Act impulsively after a single-trade outcome

- Deviate from their trading approach in draw down phases

Real Life Example: Two Traders, Different Results

Trader A – The Safe Professional:

- Account size: $50,000

- Risk per trade: 1% ($500)

- Average monthly trades: 40

- Win rate: 55%

- Average win: +2R (Risk-Reward Ration)

- Average loser: -1R

After 12 months: Even with a pretty average 55% win rate, Trader A was able to consistently make profits and grow the account by 25% because of his disciplined position sizing system and favorable risk reward ratios.

Trader B – The Reckless Beginner:

- Account size: $50,000

- Risk Per trade: 10% ($5,000)

- Average monthly trades: 10

- Win rate: 70%

- Average winner: +1.5R

- Average loser: -1R

12-month results: Trader B had a very shocking 70% win rate, however, went down -60% at one point after 4 losing trades in a row and ended up quitting trading because of psychological pressure.

This comparison shows one of the most important trading concepts: good risk management, including setting stop-loss orders and adjusting the size of one’s positions based on market conditions, often matters more than win rate or even choice of strategy.

How Large or Small Should Your Position Be?

Proper position sizing should be a methodical process using tested formulas. One of the foundational formulas in use by professional traders globally:

Position Size = (Account Equity × Risk %) ÷ (Stop Loss Distance × Pip Value)

Let’s break down each component:

- Account Equity: Total balance that you can put in a trade.

- Risk Percentage: The percentage of your account you are comfortable with and willing to lose (usually 1-3%)

- Stop Loss Distance = how many pips from entry to stop-loss

- Value Of Pip: The money value of a pip for the selected instrument, you can also enable it if it's a fractional pip.

Practical Example: EUR/USD Trade Calculation

Xiao Ming’s Improved Approach:

- Account balance: $1,000

- Risk: 2.0% per trade ($20 max risk)

- Trading position: long EUR/USD

- Entry price: 1.1050

- Stop loss: 1.1000 (50 pips of risk at entry)

- Pip cost for standard lot: $10/pip

Calculation:

Size of Position = ($1,000 × 2%) ÷ (50 pips × $10 per pip)

Position Size = $20 / $500 = 0.04 lots equivalent to 4 micro lots

This implies that Xiao Ming should not exceed 4,000 units of EUR/USD (0.04 standard lots) to ensure his maximum loss never goes beyond $20.

Example: How a Professional Rather Sizes His Gold CFD Positions

Professional trader scenario:

- Account balance: $100,000

– Per trade risk: 1.5% ($1,500)

- Instrument: XAU/USD (Gold)

- Entry price: $2,050

– Stop loss: $2,020 (30 points stop)

- Contract size: $1 per point

Calculation:

Position Size = ($100,000 × 1.5%) ÷ (30 points × $1 per point)

Position Size = $1,500 / $30 = 50 contracts

The pro will enter with 50 contracts and he should not mind risking $1,500 on that trade.

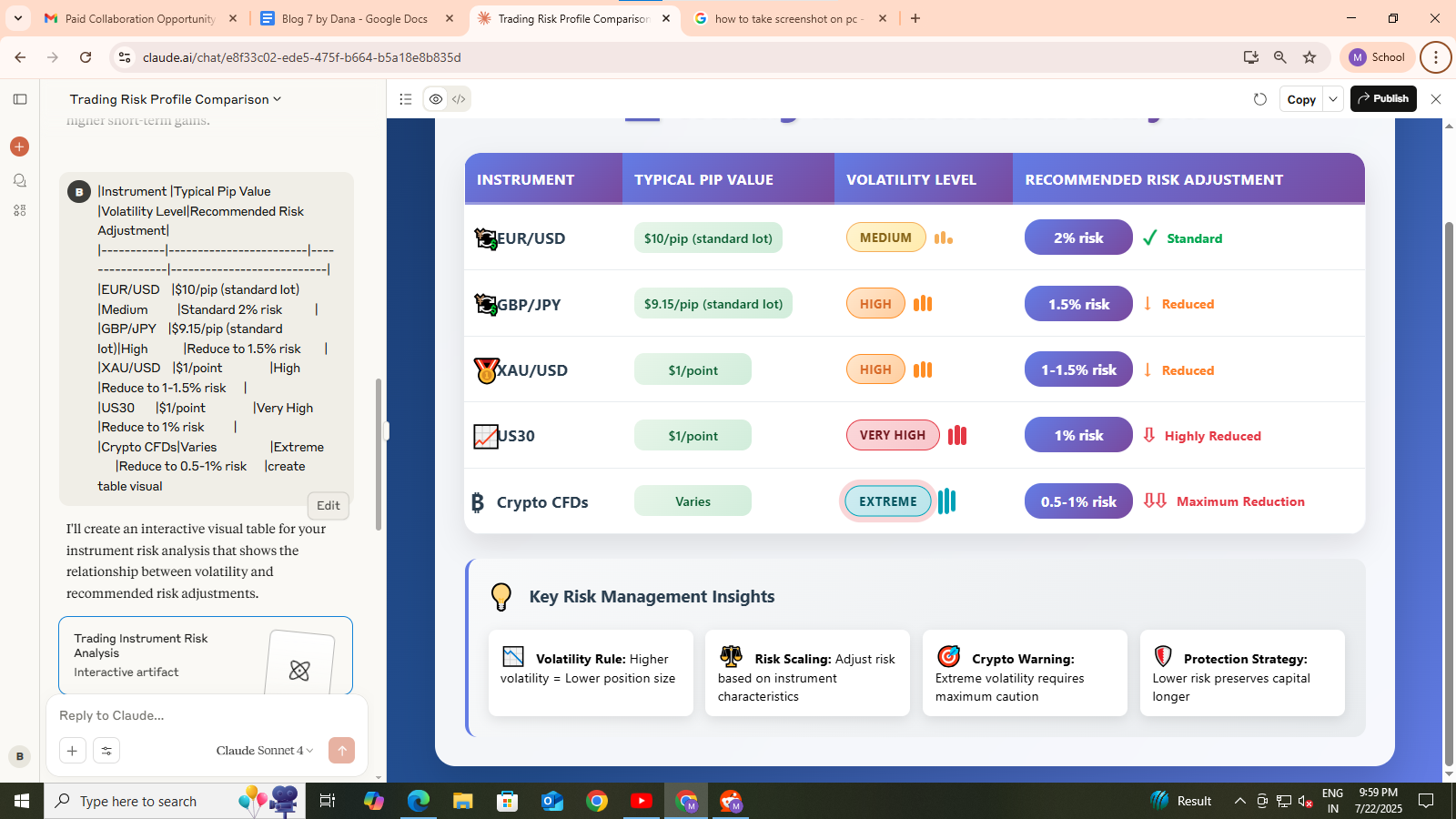

Adjusting for Different Instruments.

Different trading instruments have varying volatility and pip values, requiring position size adjustments:

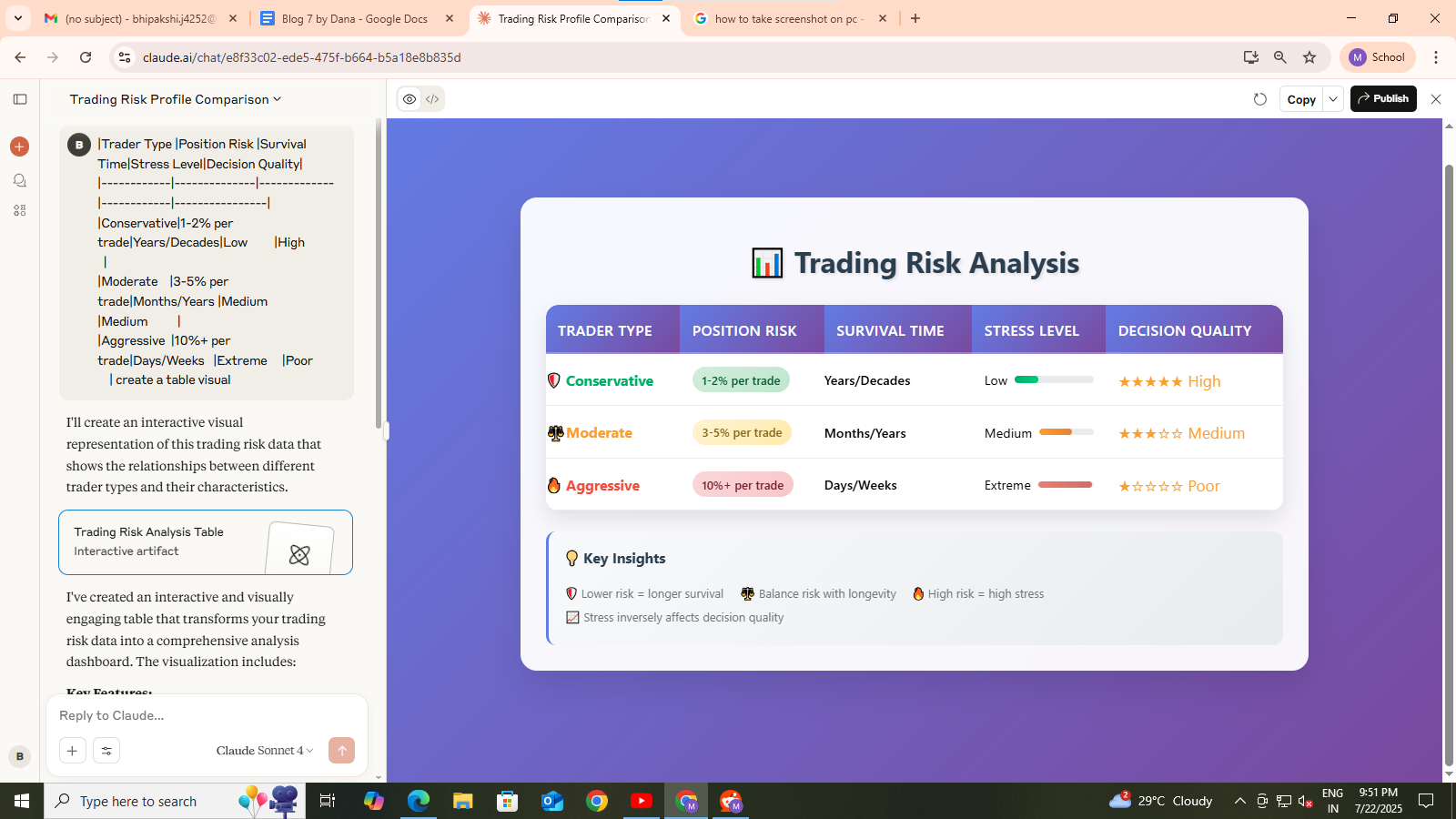

Common Position Sizing Strategies

Experienced traders use different position sizing techniques depending on their trading style, account size and market situation. Forex risk management strategies, formulas and techniques like Kelly Criterion, Optimal F and CPPI can help reduce trading risks and avoid trading biases.

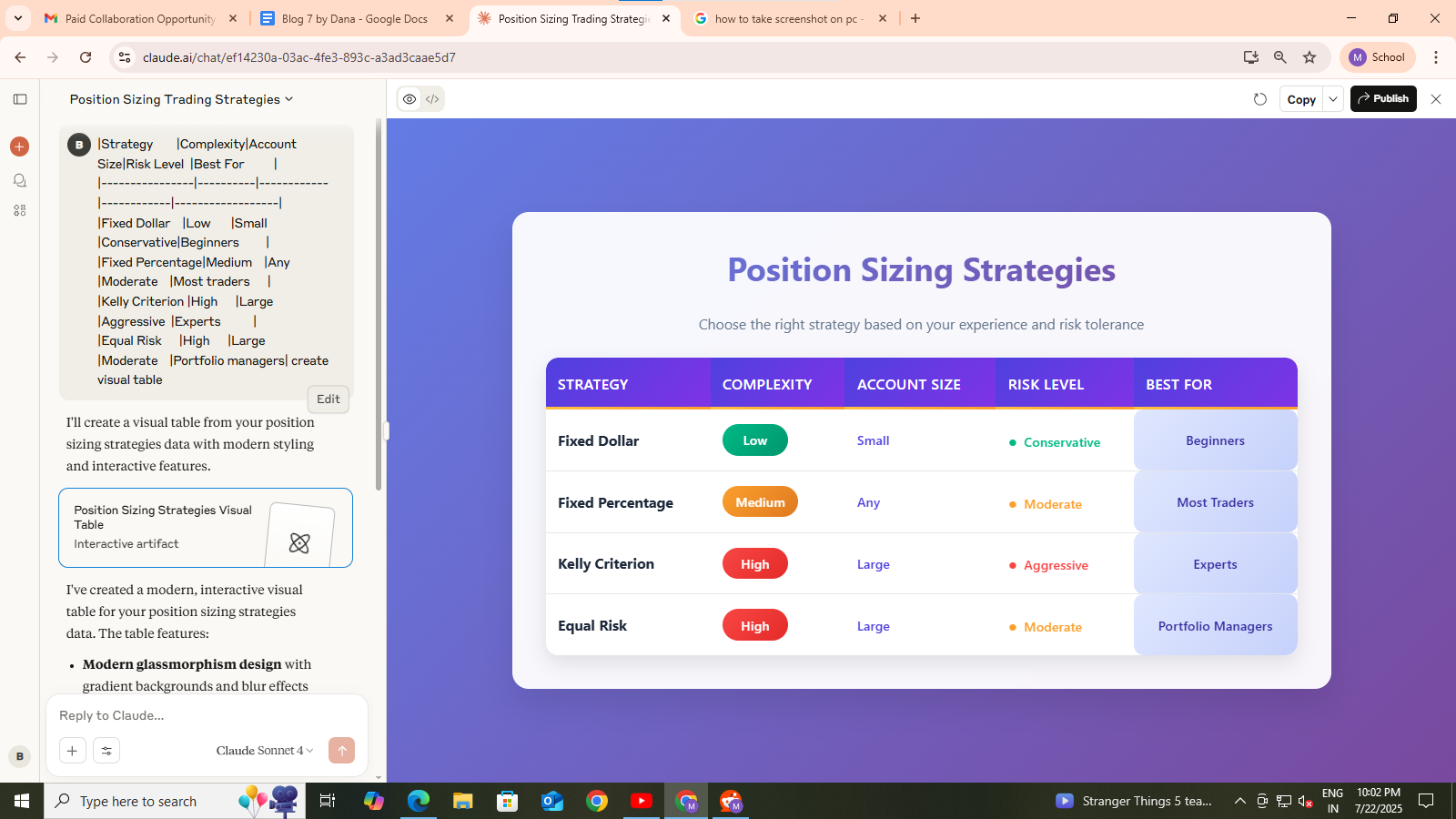

1. Fixed Dollar Risk Method

That's the worst method - that would be risking the same amount of money on every trade - no matter the setup or how the market is acting.

How it works:

- Pick a flat $ amount ($100, for example)

- Risk $ to $ on every trade

- Scale your position size up or down, depending on how far away the stop loss is

Pros:

- Very easy to compute and implement

- Consistent risk exposure

- Great for beginners who are learning discipline

Cons:

- Ignores account growth

- Too conservative for larger accounts

- Ignores trade quality differences

Best for: Beginner traders with small accounts ($1,000-$5,000)

2. Fixed Percentage Method

That is the most common approach with professional traders, that is you risk a % of your account balance on each trade.

Common percentages:

- Conservative: 0.5-1% per trade

- Moderate: 1-2% per trade

- Aggressive: 2-3% per trade (recommended maximum)

Pros:

- Scales with account size

- Offers steady risk compared to an equity

- Easy to compute buffer and psychologically comfortable

Cons:

- Doesn’t consider trade quality

- May favor the hot hand too much

- Quote sizes can get very low during drawdowns

Ideal for: Intermediate to advanced traders who have accounts of $5,000+

Kelly Criterion Method

Kelly criterion – formula employed by traders to define the appropriate position size for a trade. The fraction was conceived by John L. Kelly Jr., a researcher at Bell Labs, in the 1950s.

Kelly Formula:

f = (bp - q) / b

Where:

- f = fraction of your capital that you're willing to bet on a losing streak

- b = net received on the odds (profit/loss ratio)

- p = probability of winning

- q = the probability of losing (1-p)

Example calculation:

- Win rate: 60% (p = 0.6)

- Loss rate: 40% (q = 0.4)

- Average win: $300

- Average loss: $150

- Odds (b): $300/$150 = 2

f = (2 × 0.6 - 0.4) / 2 = (1.2 - 0.4) / 2 = 0.4 / 2 = 0.2 (20%)

According to the Kelly Criterion, you should risk 20% of capital on this trade setup.

Important note: In the world of money managers, slow and steady is the game. 0.10x-0. A rule of 15x times the Kelly-optimal investment size is a good one. The majority of pros use fractional Kelly (10-25% of the Kelly % you derive) to smooth out some volatility.

Pros:

- Mathematically best for long-term growth

- Cares for trade quality and past performance

- Maximises compound growth rate

Cons:

- Dependence on actual win rate and profit/loss numbers

- can suggest a very large position size.

Complex from the point of calculation and implementation

Best for: Traders who want a lot of backtesting data to work with

Equal Risk Method (Volatility-Adjusted)

The advanced position-sizing adjusts the size of the positions for the volatility of the individual instruments traded, which controls the risks in dollar terms.

Process:

Compute the Average True Range (ATR) for every single instrument

Then set the risk amount like $500

If volatility is higher or lower reduce the size you trade by the inverse factor of volatility

Example:

- EUR/USD ATR: 80 pips

- GBP/USD ATR: 120 pips

- Risk target: $500

For equal $500 risk:

- EUR/USD long from Huge size (less volatile)

- GBP/USD position: Further reduction: smaller position (lower volatility)

The best for: Portfolio traders with several instruments running at the same time.

Common Mistakes in Position Sizing

Even the best traders succumb to position sizing errors that destroy years of profit. Taking away some lessons learned from these mistakes is essential for long-term success in the markets.

Mistake 1: Trade Everything You’ve Got (All Your Eggs In One Basket)

Too much of his capital is concentrated in one, two, maybe three trades, especially among novices who have suddenly become convinced they have found the “sure thing.” This is in opposition to the fundamental principle of risk distribution.

For example: A counterparty has $10 000 on their deposit, and now is going to put $5 000 to one pair EUR/USD, since “For sure, it can only go up”. This 50% exposure of risk is equivalent to having just a two-trade losing streak as your full account wipeout.

Solution: Never risk more than 2-3% of your account on any trade (Regardless of high or low conviction).

Mistake 2: Trader Without Stops

Then there are traders who don’t follow stop losses because they mistakenly believe they can “manually manage the trade” or have “the price will come back”. This method is open-ended and it may result in significant losses.

Real-life example: The sad reality is that the majority of new Forex traders don’t have much money they can trade with. If for example, you entered a position at $1000 trading a 0.1 lots position of (171.28, see?) EUR/USD and the market went 100 pips against you, you would remain with $900 in your account.

Answer : You should always have a stop-loss in mind before you take a trade, and position size information should be derived from that stop-loss.

Mistake 3: Not adjusting for account changes

Accounts muscle up and down in the size, while traders trade the same position size and risk, which leads to an uneven risk in trading.

Growing account error: A trader starts with $5,000, grows it into $20,000 increases the position sizes (now risking only 0.5% instead of 2%), preventing the account from achieving more profits.

Shrinking account error: Following losses, an account goes from $20,000 to $10,000, but the trader remains committed to a big position size, so now it’s putting 4% at risk, not 2%, and fast-forwards the wreckage.

Solution: Update your trade size relative to your account balance – ideally once a week or at least once a month.

Quick Self-Check Questions

Before you place a trade, you should be asking yourself:

-

Can I really sleep comfortably with it being this large? If not, it’s too large.

-

So what will I do if this trade does not work? Be sure you make a solid plan for a stop loss and for an exit.

-

Is my position size relative to account size? Use current equity – not past peak values.

-

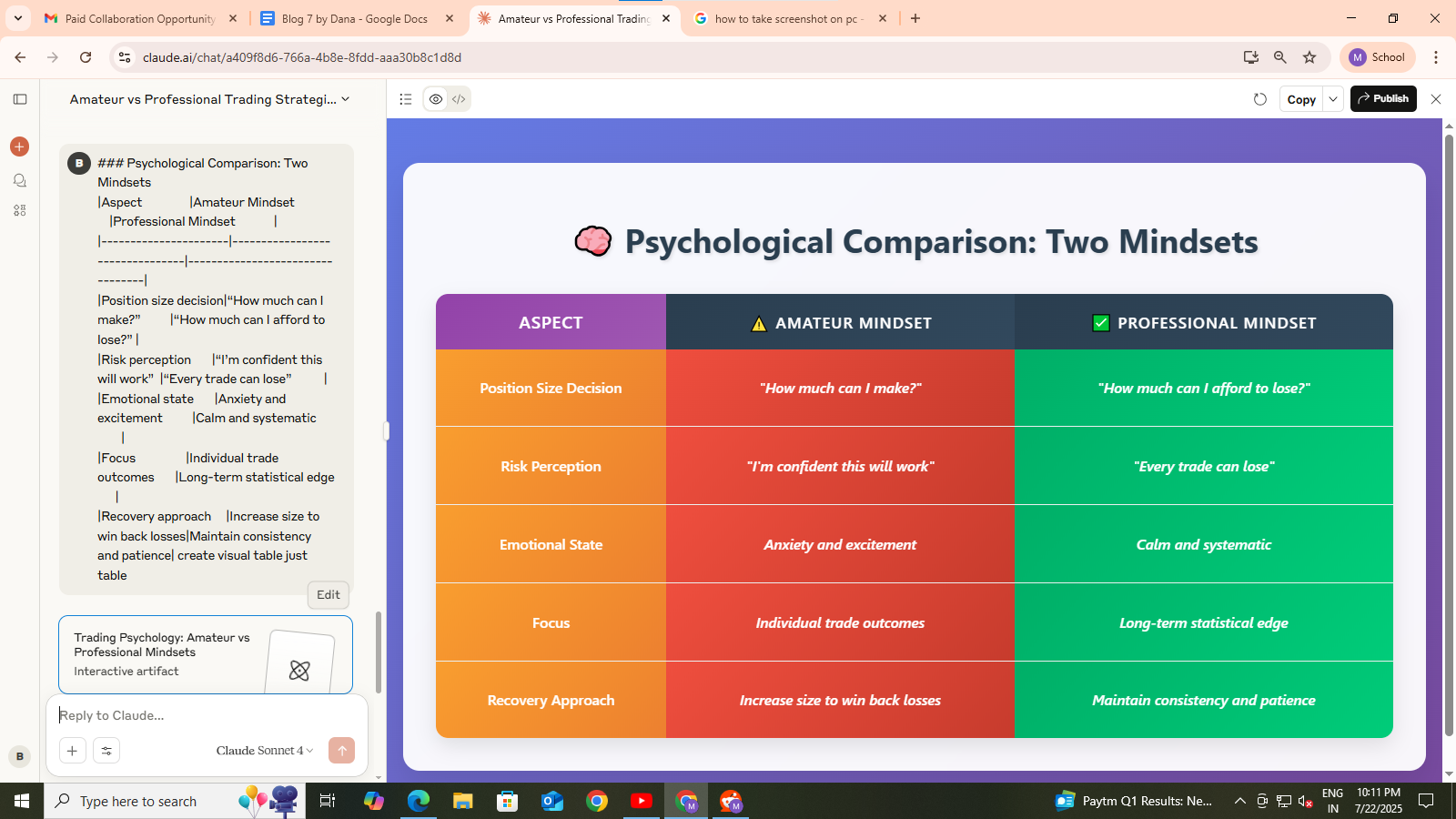

Behavior Comparison: Average Guy vs Professional.

Common Mistakes and Pitfalls Guide

Mistakes when computing 328 R. Spears / Journal of Behavioral and Experi- out new trades and a new position size, but only some of these mistakes are actually made on the basis of biased decisions. These mental traps are important to recognize as you're getting to build "the disciplined trader" in yourself.

Psychological Bias 1: Overconfidence and Hypovisionary Memory: The first of these is the hypovisionary memory and the overconfidence factor.

Since success is always more vibrant and losses are too easily forgotten, the human tendency is to overestimate the success rate and to trade too much.

The trap: Having made some profitable trades, a trader feels, “I’m on a hot streak, I should risk more to make more money.”

Reality check: The most effective trading methods may be good only 60-70% of the time, and losing streaks are par for the course.

Solution: Keep a detailed trading diary and review your actual win rate against the deceptive success rate you think you have.

Revenge Trading After Losses This is another psychological bias that you should be aware of.

Never try to avenge a big loss by adding to your position and then violating your rules.

Dangerous progression example:

– Typical trade: $100 at risk, $100 lost

– Revenge trade 1 – Risking $200 because you want the $100 back and you believe you are sure of what you doing – Lose $200

– Revenge trade #2: $400 risk chasing the $300 loss and turns into a $400 loss

– Total loss: $700 (original loss: $100)

Professional mind-set: Follow position-sizing rules after any loss. We need to recover by remaining committed to execution, not to risk.

Leverage Misunderstanding

Leaveraged instruments as they call it. CFD traders in general are not very aware of this concept. High as in a leverage can be high like my profits but also is higher as in the risk.

“Misunderstanding 100:1 leverage means you can make 100x as much money!”

Fact: It cuts both ways: Profits ARE multiplied, but losses are also multiplied. Cause with 100:1 leverage, the 1% movement against you has taken away 100% of your money.

(And remember: Use leverage as a tool for accessing the correct sized contracts for your capital — not to INCREASE risk.

The “All-In” Mentality

Some traders feel like they need to be risking a high percentage to achieve any sort of large profit – this feels especially true for those with smaller accounts.

(some) Faulty logic: I only have $1,000 so I gotta risk at least $500 per trade to even bother.

Do the math Reality: with small accounts, at 2% risk you can EARN having the POWER of compound returns:

- Start: $1,000

- Monthly profit target (It is achievable with a good risk management) : 8%

- After 1 year: $2,518

- After 2 years: $6,341

Rinse and Repeat (Part 1): The Recovery Plan and Road Back to Profit

So if sizing mistakes have led to massive losses, here’s how you can go about systematically recovering.

And now for reporting – stop everything – check out, think over and plan.

• Halve exposure – Small enough as you mop up on the right side of markets, small enough exposure.

• Process trumps profits -- It's how closely they follow the rules, not what's on the P&L.

• Journal - Be alert by documenting every step and uncover a pattern of behaviour.

• Lulls bigger Share position - Slowing down of share adding journey showing discipline.

Best position size calculator – ideal for beginners Can do quick calculations Programs entry, stop loss, target and risk in one set.

These days, position size can be calculated relatively easily and accurately with online calculators and trading platforms. Here are the best tools and basics for everyone from weekend doodlers to professional sketch artists.

Built-in Platform Tools

Some other trading software out there that includes position sizing calculators:

MetaTrader 4/5:

- Stock position size calculator added to help section of order window

- Lot size is calculated based on risk amount and stop loss automatically.

- All of the forex pairs and CFDs voted for in the crowdinvesting platform

TradingView:

- Limit order and risk tools in the chart interface.

- On chart pip value calculator (position size calculator)

- Custom risk/reward ratio visualizations

Online Position Size Calculators

MyFxBook Position Size Calculator:

- Free web-based tool

- support for commodity, forex and index

- Supports various account currencies

- Mobile-friendly interface

BabyPips Position Size Calculator:

- Beginner-friendly interface

- Meaningful assistance to learning for different entry fields

- Get coverage on all Major and Minor currency pairs

- Includes leverage impact calculations

Step-by-Step Calculator Usage Example

2% of $2,000 trade on EUR/USD What would be your optimal stop loss?

Input parameters:

• Account balance: $2,000

• Risk percentage: 2% ($40)

• Currency pair: EUR/USD

• Entry price: 1.1050

• Stop loss price: 1.1000

• Account currency: USD

Calculator output:

- Pip risk: 50 pips

– Pip value: 1$ a pip (for 10 000 units)

- Recommended Lot Size: 8,000 units (0.08 lot)

- Maximum loss: $40

Important Tool Limitations

But despite their utility, keep in mind:

-Leverage consideration: Make sure the tool makes it clear that the stochastic is not taking leverage into account.

Accuracy of pip value: Some tools will not use the same pip value as your broker

-Currency conversion:Tools should handle different account base currencies right.

- Real-time:Markets move fast, continuously re-calculate

Pro tip: Always verify calculator results with manual math on crucial trades, especially when getting started.

Trading Psychology & Position Sizing

Profits are celebrated without overconfidence

Large positions create emotional chaos:

– Judgment and decision-making are impeded by stress.

- Fear dominates during drawdowns

- Greed dominates winners

- Single trades can either profit or lose you entire month’s gains

Psychological Position Size Guidelines

The “Sleep Test”: If you can sleep soundly with the position you are in, then you are good. If you are taking another drink, checking prices every 90 seconds or losing sleep over a trade, your position is too big no matter what your math would tell you.

The “Restaurant Test”: If losing this trade would make you think twice about whether to order appetizers at dinner, your position size is impacting your well-being and thus too large.

The ‘Explanation Test’: if you had to justify your position size to a seasoned trader, would you be able to do so with confidence? If the reason you did was “it felt right” or “I had really high level of confidence,” then you’re trading emotionally, not systemically.

Building Psychological Discipline

Start with position sizes that feel “too small.” Most beginners initially think proper position sizing seems overly conservative, but this reaction indicates they’re approaching trading with a gambling mindset rather than a business approach.

Progressive discipline building:

Week 1-2: Use 0.5% risk to build comfort with the process

Week 3-4: Increase to 1% risk while maintaining emotional control

Month 2-3: Graduate to 1.5-2% risk only after proving consistency

Ongoing: Maintain maximum 2-3% risk even with years of experience

Handling Different Market Conditions

During winning streaks: Resist the urge to increase position sizes dramatically. Small increases (from 2% to 2.5% risk) are acceptable, but avoid jumping from 2% to 5% risk based on recent success.

During losing streaks: Many traders feel compelled to reduce position sizes during drawdowns, but this can limit recovery potential. Instead, maintain consistent position sizing but consider taking fewer trades to reduce overall portfolio risk.

During high volatility periods: Reduce position sizes to account for increased market uncertainty, typically by 25-50% during major news events or market disruptions.

The bridge from amateur to pro mindset generally takes 6-12 months of regular practice with appropriate position sizing.

Summary & Action Plan

Sizing your positions is the cornerstone of successful trading; it will not only determine your earning potential but also your probability of surviving in the markets. The most important takeaways from this guide are:

Core principles to remember:

- The size of a position matters more than the timing of entry or exit

- Risk control is part of every trade.currentTimeMillis() private val riskLimit = math.

–Mathematical formulas take the emotion out of tough decisions

-Consistency of application is more important than perfection in calculation.

- Your mental comfort with the position size is going to have an effect on how well you execute the trade.

Immediate action steps:

-

Determine your current position sizing risk per trade level (start with 1-2% of account equity).

-

Select proper tools from the guide provided in Section 7, for correct calculations.

-

Write down your position sizing rules and follow them consistently.

-

Start out with a smaller size and work your way up.

-

Monitor your level of compliance with the position sizing rules as a critical performance measure.

Long-term development path:

Start with basic, static percentage approaches and later include more advanced formations such as volatility-based sizing as your experience and trade amount increases. It’s not about finding the “best” position sizing method, but rather finding one that you’re able to execute consistently over say the next 100 trades.

Platform recommendation: You should try to trade on a demo account with BTCDana.com to try out position sizing calculations in a trading simulator without any risk. With a demo account you can try different systems and approaches without putting your hard-earned money on the line, and begin developing your psychological discipline when it comes to real trading.

Just remember, every professional trader started with small positions and simple calculations. More than finding the perfect optimisation strategies, it will be your discipline in using and applying these principles that will determine your success as a trader. Begin small, be consistent, and let compound growth work in your favor with time.

The one thing that makes a difference between traders who make it and those who blow up their accounts typically comes down to the same thing: respect for position sizing rules. Turn this to your advantage and have your trading decisions driven by mathematics rather than by feelings.

Final metric to track : Do not track your progress by the amount of money you make, it’s about how well you adhere to your position sizing rules. Profits will automatically flow from controlled risk, but risk must be controlled in the first place.