Introduction: Crypto Investment Potential in 2025

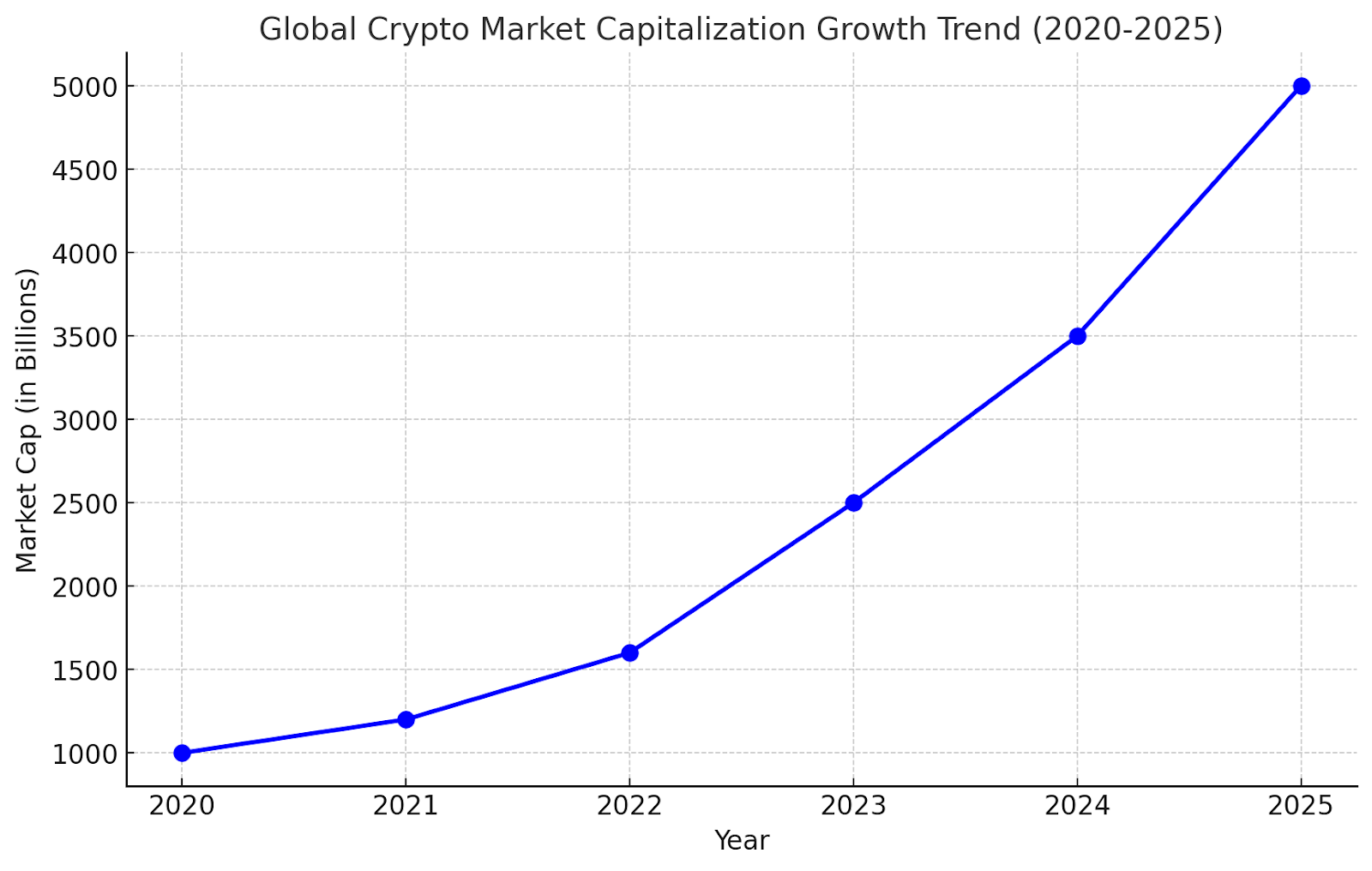

The cryptocurrency market continues to evolve despite macro trends and shifting regulations in 2025. Although cryptocurrencies have gone through stages of high volatility in the last few years, they still remain one of the best investment options for higher returns.

With new technologies like DeFi, Web3, and the Metaverse, it is evident that digital currencies will continue to be integrated into the global financial ecosystem. These new technologies are driving growth and innovations, as well as shaping the landscape of the crypto market.

There are many new policies that are being introduced, which can bring both risks and opportunities for investors; however, the market dynamics need to be carefully assessed. In this article, we will discuss 2025 cryptocurrency trends and offer future coin recommendations with the potential to become market leaders.

In the following section, we will look at specific cryptocurrencies that you should look out for in 2025. The goal is to help investors spot good opportunities amidst the ever-evolving market trends.

Market Background Analysis for 2025

Many investors are trying to explore digital assets as a way to avoid the volatility of the traditional market. However, external factors such as inflation and rising interest rates have a direct impact on the crypto market, leading to market fluctuations. This is because changes in the economy have a big effect on the crypto market.

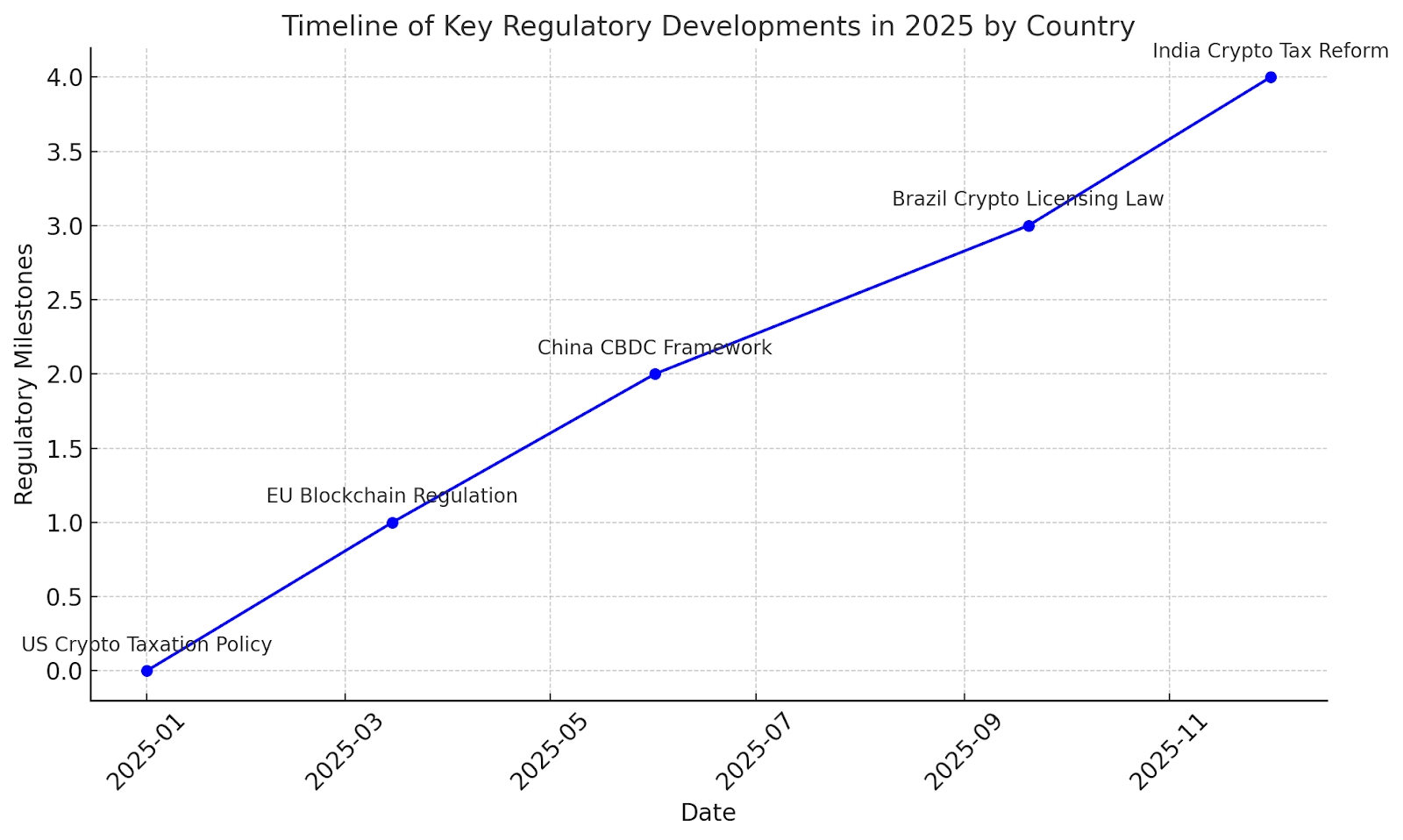

The regulatory climate is another important thing that will affect the crypto market in 2025. The United States, the European Union, and China, among others, have all taken the trouble to come up with detailed rules for cryptocurrencies. For example, the US has made it clear how taxes and securities rules apply to digital currencies.

These rules can change how the market works and how confident investors are. In 2025, though, more people are projected to get involved in the market, especially institutional investors who are new to cryptocurrencies.

This can make the market more liquid and help keep prices stable. As institutional crypto investment increases, the market will become more structured.

For Example: In late 2024, when BlackRock launched a spot Bitcoin ETF, over $3 billion in institutional capital flowed into the market within weeks, which boosted overall liquidity and price stability.

With support from greater institutions, the crypto market will become more viable. Additionally, blockchain technology continues to evolve with advancements in Layer 2 scaling solutions, cross-chain interoperability, and privacy enhancements.

These innovations are vital to improving users' experience, dealing with scalability issues, and driving a new wave of blockchain technology trends. Newer investors are drawn to emerging trends like NFTs, the Metaverse, and Decentralized Autonomous Organizations (DAOs), which makes the market sentiment remain volatile.

The backdrop of these developments enables us to assess the potential of specific cryptocurrencies in 2025, ensuring that investments align with crypto regulations and technological advancements.

Outlook on Major Cryptocurrencies in 2025

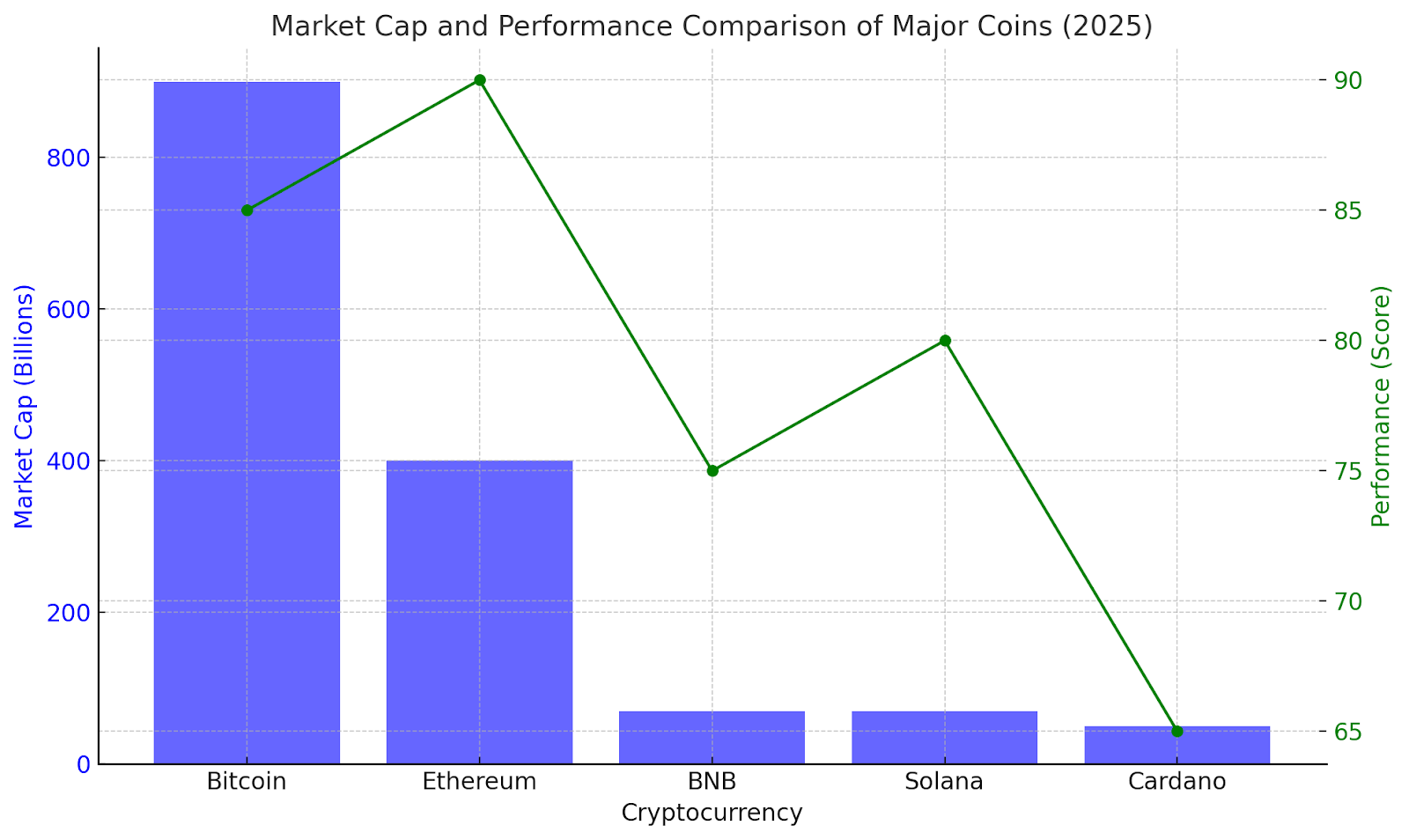

So far in 2025, the Bitcoin outlook remains strong as BTC continues to maintain its position as the leading digital currency and an effective inflation hedge. It has been able to stay at the top of the market and make it more volatile because it is the market leader.

More and more corporations and individual investors are interested in Bitcoin, which makes it evident that it is a smart asset to keep money in. Bitcoin is more stable now, but it can't grow as much as newer cryptocurrencies can. Ethereum, on the other hand, is changing to make it easier to scale and minimize the cost of transactions.

This Ethereum upgrade is expected to improve its market position and make it more attractive to developers.

For Example: Between 2021 and 2022, Ethereum gas fees dropped a lot after the tests for the Ethereum 2.0 upgrade. After the drop, the number of active decentralized apps (dApps) in Ethereum's ecosystem also went up by 35%. This shows how the Ethereum update could change how many developers work and how much it costs to make transactions.

BNB, Solana, and Cardano are some other cryptocurrencies that are worth looking at. There are many great aspects about these coins, such as low transaction fees and their potential for growth. For instance, it's known that Solana can handle a lot of transactions at once. Bitcoin and Ethereum are still the safest, easiest to trade, and most popular with the community.

Emerging Cryptocurrencies in 2025

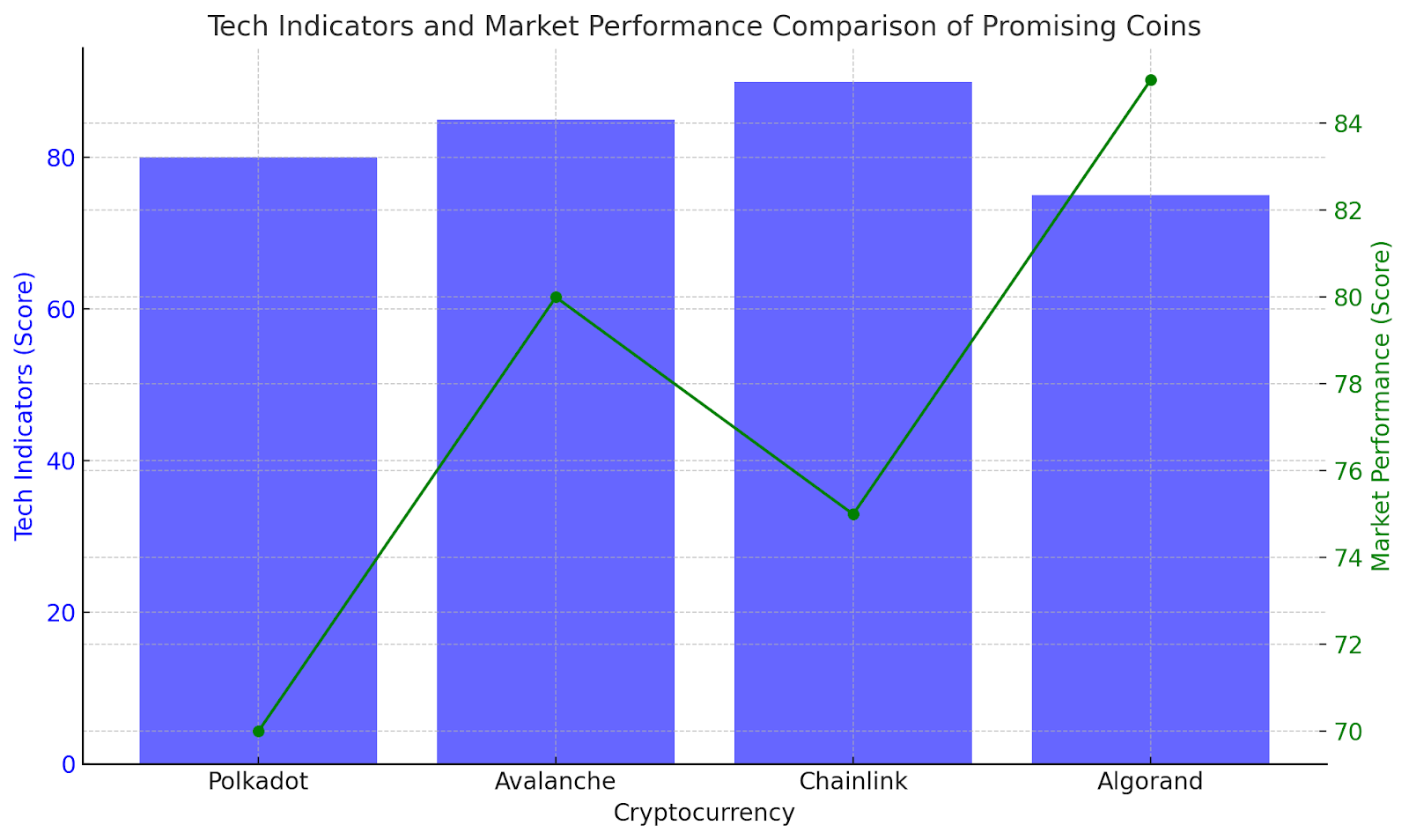

To properly identify promising cryptocurrencies, you must evaluate factors such as the development team, technological innovation, community activity, and market demand. Emerging cryptocurrencies that will survive the test of time usually have a well-rounded ecosystem, innovative technologies, and an engaged community.

There are many new coins on the market, but not all have unique features and strong market potential, like the ones listed below. Here are some promising coin recommendations to get started:

-

Polkadot:

The special feature of this coin is that it enables interoperability between different blockchains, addressing the scalability issue. It also facilitates the creation of custom blockchains due to its shared security model and cross-chain technology. It is the leading contender in the blockchain ecosystem because of its innovative technology.

For Example: In 2024, Polkadot received significant institutional backing from the Web3 Foundation, which further enhanced its position in the market and its recognition among institutional investors.

-

Avalanche:

Avalanche is largely recognized for its high throughput, which is possible because it uses a fast consensus algorithm that lets it handle thousands of transactions per second with low latency. This is why it is the greatest choice for DeFi apps and other blockchain solutions that are made to order.

-

Chainlink:

This is a decentralized Oracle network that connects smart contracts to real-world data. This is a big step forward in the blockchain world. It provides safe and dependable off-chain data, which makes it an important part in the development of decentralized apps (dApps).

-

Algorand:

Through its Pure Proof of Stake (PPoS) consensus mechanism, Algorand is able to offer scalability, security, and decentralization. It is also capable of supporting a wide range of global financial applications due to its high-performance blockchain, making it a top contender for mainstream adoption.

The increasing demand for decentralized financial services, scalability, and enhanced technological innovations is the primary reason behind the growth of these emerging coins. However, investing in these coins still carries potential risks, such as liquidity risks, regulatory risks, and the potential for project failure.

Although these coins offer incredible opportunities, investors must carry out careful fundamental analysis of each crypto project to asses its long-term potential.

Industry Trends and Future Tech Drivers

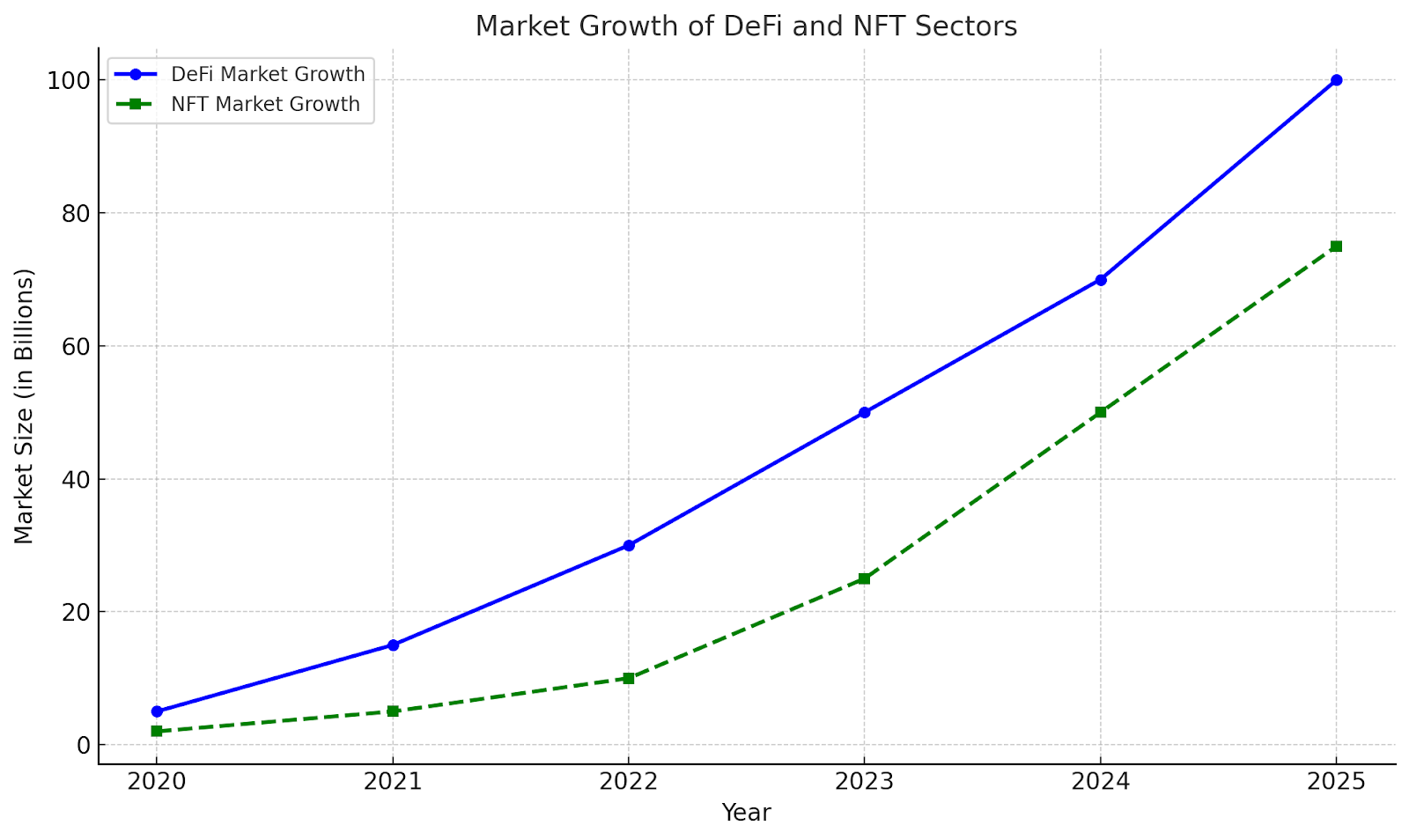

A lot of important technical and business factors are affecting the cryptocurrency market in 2025. These changes help the industry thrive and realize its full market potential. One of the most important trends is that Decentralised Finance (DeFi) is getting better. It is still growing as an important aspect of the crypto economy.

DeFi trends in 2025 are mainly being influenced by regulatory developments, which help create a more secure environment for users and investors alike. The metaverse growth has also been incredible, along with NFTs, which have also remained strong over the years.

As more industries explore virtual worlds and digital assets, the potential of the Metaverse and NFTs will become immense. Another critical technological advancement is the development of Layer 2 scaling solutions and cross-chain interoperability, which are crucial for addressing scalability challenges in blockchain networks.

For Example: Aave started employing Polygon, a Layer 2 scaling solution, in 2024. This made trading easier and transactions cheaper. This made Ethereum's DeFi activities go up.

These technologies have made transactions a lot faster and cheaper, which is ideal for dApps and DeFi platforms that need to grow. New innovations like zero-knowledge proofs are also propelling privacy technology forward. These make transactions more private and keep blockchain networks safe at the same time.

This new function is really important for people who are worried about privacy in a decentralized world. Many cryptocurrency trading platforms, like BtcDana, have also added AI and machine learning to their systems to assist investors in lowering their risk, making forecasts, and improving their trading tactics.

These tech trends are likely to impact the cryptocurrency market in the future. When making investment decisions, consider how these new technologies could help the market grow over time.

Frequently Asked Questions (FAQs)

1. What is driving the growth of DeFi in 2025?

DeFi is growing because there are clearer rules, new technologies, and Layer 2 scaling solutions that make it easier to use and lower transaction fees.

2. How does Ethereum 2.0 impact the crypto market?

Ethereum 2.0 makes it much easier to scale and lowers gas fees, which makes it more popular for smart contracts and decentralized apps.

3. How will AI and machine learning affect crypto trading in 2025?

AI and machine learning will change the way people trade cryptocurrencies by automating risk management, making market predictions more accurate, and improving trading techniques.

Conclusion and Crypto Investment Tips 2025

There are a lot of risks in the cryptocurrency market, but there are also a lot of opportunities. But the rise of DeFi, the Metaverse, and new technologies like Layer 2 scalability and privacy tech show that the future is bright. To succeed in crypto investment in 2025, investors must have a solid crypto risk management strategy.

This is because there are enormous risks, such as changes in the market, new rules, and the likelihood that a project will fail. Diversifying is another wonderful way to invest in the crypto market. Putting your money into a mix of assets and industries will help minimize your risks and keep your money safe.

Choosing the best crypto platforms, such as btcdana.com, ensures secure and informed trading. This platform will help you implement crypto risk management strategies, such as setting appropriate stop-losses and limiting exposure to any single asset. Get started today and open either a demo or trading account for free now.